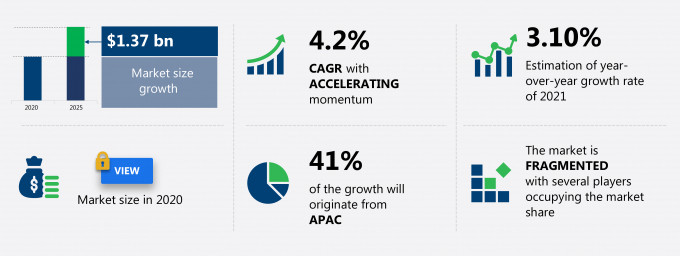

The induction cookware market share is expected to increase by USD 1.37 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.2%.

This induction cookware market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers induction cookware market segmentation by product (pan, skillet pan, pressure cooker, dutch oven, and stockpot), end-user (residential and commercial), and geography (North America, APAC, Europe, South America, and MEA). The induction cookware market report also offers information on several market vendors, including Chantal Corp., Groupe SEB, Meyer Corp., Newell Brands Inc., NuWave LLC, Stove Kraft Ltd., The Middleby Corp., Whirlpool Corp., Williams-Sonoma Inc., and ZWILLING J.A. Henckels AG among others.

What will the Induction Cookware Market Size be During the Forecast Period?

Download Report Sample to Unlock the Induction Cookware Market Size for the Forecast Period and Other Important Statistics

Induction Cookware Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post-COVID-19 era. The expansion of distribution networks is notably driving the induction cookware market growth, although factors such as volatility in raw material prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the induction cookware industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Induction Cookware Market Driver

One of the key factors driving the induction cookware market during the forecast period is the expansion of distribution networks. Vendors are adopting different strategies to promote their brands and broaden their customer base. One of the popular strategies that market players have adopted is the expansion of distribution channels. The omnichannel model of distribution is also becoming popular among induction cookware manufacturers as they are entering the online retail space to gain more customers and improve brand recognition. However, vendors are continuously emphasizing distributing and promoting their modern cooking appliances not only through physical retailers but also through online shopping portals. Furthermore, online retailing has provided opportunities for vendors in the global induction cookware market to increase their sales, expand their geographical presence, and improve customer relations and profitability. Newell Brands, Whirlpool (KitchenAid), Conair, and others sell their products through their own shopping websites. The expansion of their distribution channels will lead to higher revenue for the market during the forecast period.

Key Induction Cookware Market Trend

Growing innovations and adoption of advanced technology are other factors supporting the induction cookware market growth in the forecast period. One of the trending innovations in the field of induction cookware is smart connectivity using Wi-Fi and Bluetooth. Such smart induction cookware is controlled and monitored through mobile apps installed on smart gadgets. Manufacturers are also focusing on introducing smart connectivity features in their upcoming modern cooking appliances, such as multicookers and slow cookers, in order to gain customer attention and increase their market shares. For instance, Xiaomi offers an induction-based rice cooker called Mijia Smart Rice Cooker in India, which can be controlled via Xiaomi’s Mi Home app. It can be connected to Bluetooth and be controlled and monitored through smart gadgets. It combines the benefits of pressure cookers, porridge makers, steamers, slow cookers, rice cookers, yogurt makers, sautés pans, food warmers, and others. These products are convenient as they eliminate the need for separate kitchen appliances, thus making more space in the kitchen. Belkin, another vendor, offers smart connected slow cookers, which can be connected to the Internet. During the forecast period, many other vendors are expected to introduce smart electric container cook pots.

Key Induction Cookware Market Challenge

Volatility in raw material prices will be a major challenge for the induction cookware market during the forecast period. The prices of the raw materials used in the manufacturing of induction cookware such as steel, aluminum, and copper do not remain constant but fluctuate constantly based on their availability. Also, the growing gap between supply and demand in recent years has increased the cost of raw materials considerably. Any increase in the price of raw materials increases the manufacturing cost of induction cookware and leads to lower profit margins for vendors. Furthermore, to remain competitive in the market, manufacturers are experimenting with low-cost substitutes, which may compromise the quality of the product. Also, raw material suppliers can increase their prices based on demand, which increases the manufacturing cost. Furthermore, the price of an alloy of aluminum hit a four-year low in April 2020 on the London Metal Exchange due to the low demand amidst the outbreak of COVID-19. As the availability of these metals is vital for the production of induction cookware products, any surge in the prices of these raw materials could impact the profit margins for induction cookware manufacturers, which is a major challenge for the market during the forecast period.

This induction cookware market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global induction cookware market as a part of the global housewares and specialties market (specialties are small household products) within the global household durables market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the induction cookware market during the forecast period.

Who are the Major Induction Cookware Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Chantal Corp.

- Groupe SEB

- Meyer Corp.

- Newell Brands Inc.

- NuWave LLC

- Stove Kraft Ltd.

- The Middleby Corp.

- Whirlpool Corp.

- Williams-Sonoma Inc.

- ZWILLING J.A. Henckels AG

This statistical study of the induction cookware market encompasses successful business strategies deployed by the key vendors. The induction cookware market is fragmented and the vendors are deploying growth strategies such as organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Chantal Corp. - The company offers induction cookware such as fry pans, saucepans, and more.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The induction cookware market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Induction Cookware Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the induction cookware market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global housewares and specialties market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Induction Cookware Market?

For more insights on the market share of various regions Request PDF Sample now!

41% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for induction cookware market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Significant growth in urbanization and the increasing promotion of energy-efficient cooking methods will facilitate the induction cookware market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 in countries such as India, Pakistan, Bangladesh, and Japan affected the region’s economy and caused numerous fatalities in the region in 2020. The outbreak pandemic led to the temporary shutdown of production units of end-user industries for induction cookware in 2020. Hence, the regional market witnessed a supply-demand imbalance in 2020. This hampered the growth of the regional market during the year. However, the market in this region is expected to recover and grow during the forecast period, owing to the easing of restrictions, the reopening of manufacturing units, and the resumption of business activities.

What are the Revenue-generating Product Segments in the Induction Cookware Market?

To gain further insights on the market contribution of various segments Request PDF Sample

The induction cookware market share growth by the pan segments be significant during the forecast period. The demand for multi-cooktop-compatible pans, which can be used on both gas stoves as well as induction cooktops, is growing globally in recent times. For instance, Prestige Omega Deluxe Induction Base Non-Stick pan can be used for gas stove and induction top cooking while Whirlpool Corp’s (Whirlpool) KitchenAid KCAS10ER Aluminum Nonstick pan has a stainless steel base, which stays flat on all cooktop surfaces, including electric, gas, and induction stoves.

This report provides an accurate prediction of the contribution of all the segments to the growth of the induction cookware market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Induction Cookware Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2021-2025 |

USD 1.37 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.10 |

|

Regional analysis |

North America, APAC, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 41% |

|

Key consumer countries |

US, Germany, UK, China, and France |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Chantal Corp., Groupe SEB, Meyer Corp., Newell Brands Inc., NuWave LLC, Stove Kraft Ltd., The Middleby Corp., Whirlpool Corp., Williams-Sonoma Inc., and ZWILLING J.A. Henckels AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Induction Cookware Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive induction cookware market growth during the next five years

- Precise estimation of the induction cookware market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the induction cookware industry across North America, APAC, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of induction cookware market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch