Industrial Rack And Pinion Market Size 2024-2028

The industrial rack and pinion market size is forecast to increase by USD 998.6 million at a CAGR of 9.45% between 2023 and 2028. The market is driven by the growth of industrial manufacturing, leading to an increase in demand for machine tools. This sector's expansion is fueled by the rising production of automobiles, electronics, and heavy machinery. Additionally, the increasing demand for stairlifts in offices and public buildings is another growth factor. However, the availability of substitutes for rack and pinion systems, such as belt drives and ball screws, poses a challenge to market growth. Despite this, the market is expected to continue its upward trajectory due to the superior efficiency and precision offered by rack and pinion systems. These systems' ability to handle heavy loads and high power density makes them an ideal choice for various industrial applications.

The market is witnessing significant growth due to its applications in various sectors, including automobile sales, steering wheels, and stair lifts. Rack and pinion drives provide essential rotational motion for linear actuators, making them vital in industrial machinery, mining equipment, and agricultural machinery. The integration of high-performance gear rack and pinion systems enhances precision machining and CNC machining processes, particularly when utilizing high-strength alloys and advanced materials like composites. Furthermore, the demand for wind turbines and marine applications boosts the need for reliable mechanical components. As industries move towards digital manufacturing and integration with automation, the market for rack and pinions is set to expand rapidly, driving innovation and efficiency.

Market Segmentation

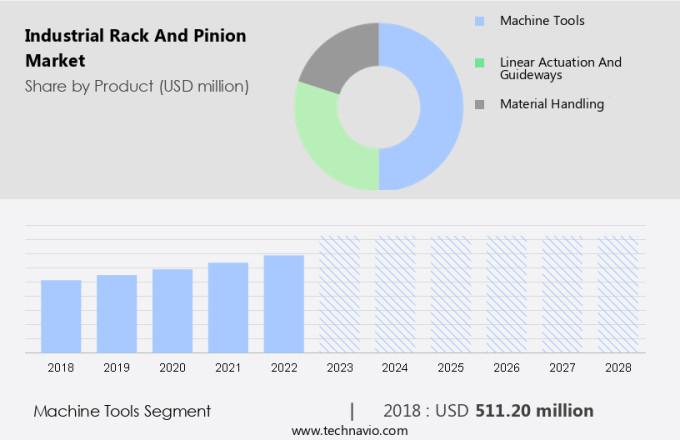

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product

- Machine tools

- Linear actuation and guideways

- Material handling

- Type

- Alloy steel

- Carbon steel

- Stainless steel

- Aluminum alloy

- Plastic

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

The machine tools segment is estimated to witness significant growth during the forecast period.The market is witnessing significant growth due to its extensive applications in various industries. Machine tools, actuators, and material handling systems are primary end-users of this market. In process industries, rack and pinion systems are utilized for rotary and linear motion in drive trains and motor technology. Stairlifts and offices also make use of this technology for smooth and precise movement. Zero backlash, a crucial feature of rack and pinion systems, ensures accurate positioning in IoT-enabled industrial applications. ZHY Gear, a leading player, offers customized solutions for industries such as wind turbine gearboxes, construction equipment, power plants, and oilfields. Condition monitoring systems integrated with rack and pinion technology enhance system efficiency and reliability. Industrial gears and drive trains benefit from the durability of rack and pinion systems, making them an indispensable component in numerous industries.

Get a glance at the market share of various segments Request Free Sample

The machine tools segment was valued at USD 511.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to its extensive applications in various industries. Machine tools, actuators, and material handling systems are major end-users of industrial rack and pinion systems. In process industries, these systems are employed for precise rotary and linear motion in applications such as wind turbine gearboxes, motor technology, and drive trains. Stairlifts and offices also utilize rack and pinion systems for smooth vertical motion. The integration of IoT and condition monitoring technologies enhances the efficiency and reliability of these systems. ZHY Gear, a key player in the industrial gear market, offers zero backlash rack and pinion gears for construction equipment, power plants, oilfields, and other heavy-duty applications. These gears ensure minimal play and accurate positioning, contributing to the overall performance and productivity of the equipment.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Industrial Rack And Pinion Market Driver

The growth of industrial manufacturing leading to an increase in demand for machine tools is the key driver of the market. In the realm of industrial manufacturing, particularly within discrete sectors, machine tools play a pivotal role in executing various machining processes such as cutting, milling, drilling, and boring on metal, wood, or plastic components. Machine tools employ both manual and automated systems, with the former utilizing handwheels for torque application and the latter, electric motors. To facilitate linear motion in these applications, rack and pinion assemblies are employed as a mechanism for converting rotary motion into linear motion. As the demand for machine tools escalates due to their widespread use in industries like process industries, material handling, offices, and even in specialized applications such as stairlifts and wind turbine gearboxes, the need for rack and pinion assemblies also the demand.

Moreover, these assemblies find application in diverse industries, including motor technology, drive trains, construction equipment, power plants, oilfields, and rotary or linear motion systems. With the advent of IoT and condition monitoring technologies, rack and pinion assemblies are increasingly being integrated with advanced features such as zero backlash and precision gearing, further enhancing their appeal and utility. ZHY Gear, a leading industrial gear manufacturer, offers a comprehensive range of rack and pinion assemblies, catering to various industries and applications.

Industrial Rack And Pinion Market Trends

Increasing demand for stairlifts in offices is the upcoming trend in the market. The market caters to various industries, including Machine Tools, Process industries, and Material handling, providing essential components for actuators and drive trains. These components are integral to motor technology, enabling rotary and linear motion in diverse applications. In Material handling, rack and pinion systems are employed in stairlifts, offering an alternative solution for individuals with mobility challenges due to arthritis, joint stiffness, or injuries. In industries such as Construction equipment, Power plants, Oilfields, and Wind turbine gearboxes, rack and pinion systems ensure zero-backlash and precise movement, contributing to overall efficiency and productivity. With the advent of IoT and condition monitoring, these systems are increasingly being integrated to enhance performance and reduce maintenance costs. ZHY Gear, a leading industrial gear manufacturer, offers high-quality rack and pinion systems, catering to the specific requirements of different industries and applications.

Industrial Rack And Pinion Market Challenge

The availability of substitutes for rack and pinion systems is a key challenge affecting the market growth. Rack and pinion systems are essential components in various industries, including machine tools, process industries, material handling, and construction equipment, for converting rotary motion into linear motion. Actuators that employ rack and pinion mechanisms are widely used in applications such as Stairlifts, Offices, and Zero backlash systems. In the realm of Industry 4.0, IoT and condition monitoring technologies are increasingly integrated into rack and pinion systems for enhanced performance and efficiency. ZHY Gear, a leading industrial gear manufacturer, offers advanced rack and pinion solutions for diverse applications. These include machine tool drives, motor technology, drive trains, and wind turbine gearboxes.

Moreover, in power plants and oilfields, rack and pinion systems are utilized for rotary and linear motion applications, ensuring optimal performance and reliability. Despite the availability of other linear actuation mechanisms like ball screws, lead screws, and linear motors, rack and pinion systems maintain a significant market presence due to their versatility and cost-effectiveness. However, it is crucial to consider the specific application requirements, such as length and speed, when selecting the appropriate linear actuation mechanism. For instance, while ball screw systems offer smooth and almost friction-free movement, they may vibrate or whip when the length of the axis is more, and the ball bearing rotates faster than the critical speed of rotation.

Thus, rack and pinion systems are an optimal choice for applications requiring smooth and friction-free actuation over long lengths or spans.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Apex Dynamics Inc: The company offers industrial racks and pinions such as Precision racks.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATLANTA Antriebssysteme GmbH

- B and B Manufacturing Inc.

- Commercial Gear and Sprocket Co. Inc.

- GAM Enterprises Inc.

- Gudel Group AG

- HMK Automation Group Ltd.

- Kohara Gear Industry Co. Ltd.

- Lomar Machine and Tool Co.

- MIJNO PRECISION GEARING SAS

- Nexen Group Inc.

- Nidec Corp.

- P R Components Pvt. Ltd.

- Pearl Engineers

- REDEX Group

- Reliance Precision Ltd.

- Sati SpA

- Shri Butbhavani Engineering

- Statewide Bearings

- Yuan Yi Chang Machinery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The linear actuator is a critical component in various applications, including steering wheels for electric vehicles and autonomous vehicles. These devices play a vital role in enhancing infrastructure and industrial automation by providing efficient motion control systems. With advancements in robotics, gear shaping, and precision engineering, modern CNC machines are designed to optimize load capacity and accuracy. In sectors like aerospace and renewable energy, electric actuators and servomotors equipped with advanced sensors and control systems ensure reliable operation. As industries continue to embrace automation systems, engineered materials like engineered plastics are increasingly utilized for their lightweight and durable properties, further driving innovation and efficiency across sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market Growth 2024-2028 |

USD 998.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.41 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 41% |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Apex Dynamics Inc., ATLANTA Antriebssysteme GmbH, B and B Manufacturing Inc., Commercial Gear and Sprocket Co. Inc., GAM Enterprises Inc., Gudel Group AG, HMK Automation Group Ltd., Kohara Gear Industry Co. Ltd., Lomar Machine and Tool Co., MIJNO PRECISION GEARING SAS, Nexen Group Inc., Nidec Corp., P R Components Pvt. Ltd., Pearl Engineers, REDEX Group, Reliance Precision Ltd., Sati SpA, Shri Butbhavani Engineering, Statewide Bearings, and Yuan Yi Chang Machinery Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch