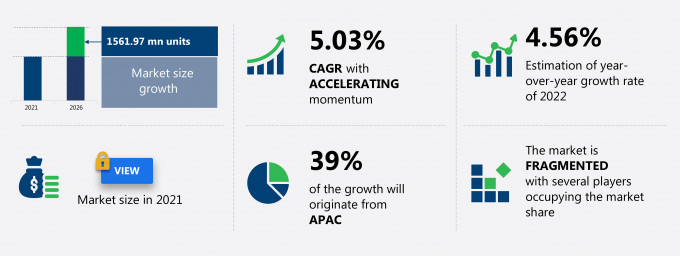

The lumber pallet market share is expected to increase by 1561.97 million units from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 5.03%.

This lumber pallet market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers lumber pallet market segmentation by end-user (food and beverage, chemicals and pharmaceuticals, retail, construction, and others) and geography (APAC, North America, Europe, the Middle East and Africa, and South America). The lumber pallet market report also offers information on several market vendors, including Brambles Ltd., Coxco Inc., Faber Group B.V, FALKENHAHN AG, Greif Inc., John Rock Inc, Kamps Pallets Inc., Leap India Food and Logistics, Millwood Inc., Nefab AB, Pacific Pallets PVT. Ltd, Palcon LLC, PalletOne Inc., PECO Pallet, PGS Group, Rowlinson Packaging Ltd., Shur-way Group Inc., UFP Industries Inc., United Pallet Services Inc., and Yellow Pallet B.V., among others.

What will the Lumber Pallet Market Size be During the Forecast Period?

Download Report Sample to Unlock the Lumber Pallet Market Size for the Forecast Period and Other Important Statistics

Lumber Pallet Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post-COVID-19 era. The rise in containerization is notably driving the lumber pallet market growth, although factors such as fluctuating lumber prices and shortage of raw materials may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the lumber pallet industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Lumber Pallet Market Driver

The rise in containerization is one of the major drivers impacting the lumber pallet market growth. The growth in containerization is increasing the use of lumber pallets because shipping containers have smooth, level surfaces that permit the quick movement of pallets of different sizes using forklifts. The use of lumber pallets makes it easier to move heavy stacks in containers. Before being moved to containers, the individual items are stacked on a lumber pallet to create a unit load. This can be moved easily and loaded onto containers using a pallet jack, forklift, crane, or any other material handling equipment. Therefore, the growth in containerization is expected to lead to a higher demand for lumber pallets during the forecast period.

Key Lumber Pallet Market Trend

The emergence of pallet pooling is one of the major trends influencing the lumber pallet market growth. The emergence of pallet pooling services has enabled end-users to rent pallets at nominal rates for their entire supply chains, thus eliminating the need to buy crates. Renting a pallet from a shared pool offers substantial savings and significant returns on investments to end-users. Also, the reverse supply chain for end-users is handled by the pallet pooling companies. For instance, the pallet pooling companies deliver the pallet in the quantities ordered by end-users and deal with those pallets once they reach the end of the supply chain. Some pallet vendors, such as LEAP India, Brambles, Northwest, and others, also provide pallets on a rental basis. For instance, LEAP India offers pallets for rent to end-users in the e-commerce, automotive, dairy, beverages, pharmaceuticals, and other industries. There is a significant rise in the leasing or renting of pallets by end-users. This, in turn, is likely to increase the trend of lumber pallet pooling during the forecast period.

Key Lumber Pallet Market Challenge

Fluctuating lumber prices and shortage of raw materials are one of the major challenges impeding the lumber pallet market growth. Volatility in the prices of lumber is mainly attributed to a reduction in the availability of wood and lumber in many countries, such as Nigeria, Pakistan, Colombia, and Brazil, as a result of widespread deforestation and the decline in the number of new tree plantations. The increasing capacity expansion in lumber processing plants across India, the UK, and Canada, without taking into consideration the need for the sustainable procurement of raw materials, is increasing the disparities between the demand for and supply of lumber. Owing to such factors, end-users, such as pallet manufacturers, are expected to experience a shortage of timber. As a result of the shortage of timber in the market, pallet manufacturers will find it difficult to complete their orders. Thus, the shortage of lumber and wood products is expected to slow down the growth of the global lumber pallet market during the forecast period.

This lumber pallet market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global lumber pallet market as a part of the global metal and glass containers market within the overall global containers and packaging market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the lumber pallet market during the forecast period.

Who are the Major Lumber Pallet Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Brambles Ltd.

- Coxco Inc.

- Faber Group B.V

- FALKENHAHN AG

- Greif Inc.

- John Rock Inc

- Kamps Pallets Inc.

- Leap India Food and Logistics

- Millwood Inc.

- Nefab AB

- Pacific Pallets PVT. Ltd

- Palcon LLC

- PalletOne Inc.

- PECO Pallet

- PGS Group

- Rowlinson Packaging Ltd.

- Shur-way Group Inc.

- UFP Industries Inc.

- United Pallet Services Inc.

- Yellow Pallet B.V.

This statistical study of the lumber pallet market encompasses successful business strategies deployed by the key vendors. The lumber pallet market is fragmented, and the vendors are deploying organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments while maintaining their positions in the slow-growing segments.

The lumber pallet market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Lumber Pallet Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the lumber pallet market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Lumber Pallet Market?

For more insights on the market share of various regions Request PDF Sample now!

39% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for lumber pallets in the region. The market growth rate in this region will be faster than that of the other geographies during the forecast period.

The presence of large automotive, manufacturing and other end-user industries will facilitate the lumber pallet market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID-19 Impact and Recovery Analysis

The lumber pallet market in APAC witnessed certain challenges due to the outbreak of COVID-19 in 2020. The COVID-19 pandemic affected many countries in the region, including China, India, South Korea, and Japan. The outbreak affected the overall economy as well as supply chains and the industrial sector across the region. The imposition of stringent nationwide lockdowns resulted in the temporary closure of all non-essential industries, including the automotive industry. This led to a decline in the use of lumber pallets in 2020. Also, a halt in all manufacturing operations negatively impacted the demand for lumber pallets in the first half of 2020.

What are the Revenue-generating End-user Segments in the Lumber Pallet Market?

To gain further insights on the market contribution of various segments Request a PDF Sample

The food and beverage industry uses lumber pallets to transport large quantities of products economically. Benefits such as the reduced risk of damage to products and injury to workers and the higher efficiency of lumber pallets in warehouse storage are fueling the use of lumber pallets in the food and beverage industry.

However, the lumber pallet market growth in the food and beverage segment is expected to be slower compared with the other market segments over the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the lumber pallet market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Lumber Pallet Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.03% |

|

Market growth 2022-2026 |

1561.97 mn units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.56 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 39% |

|

Key consumer countries |

US, Canada, China, UK, Germany, and Sweden |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Brambles Ltd., Coxco Inc., Faber Group B.V, FALKENHAHN AG, Greif Inc., John Rock Inc, Kamps Pallets Inc., Leap India Food and Logistics, Millwood Inc., Nefab AB, Pacific Pallets PVT. Ltd, Palcon LLC, PalletOne Inc., PECO Pallet, PGS Group, Rowlinson Packaging Ltd., Shur-way Group Inc., UFP Industries Inc., United Pallet Services Inc., and Yellow Pallet B.V. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Lumber Pallet Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive lumber pallet market growth during the next five years

- Precise estimation of the lumber pallet market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the lumber pallet industry across APAC, North America, Europe, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of lumber pallet market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch