Marine Enzymes Market Size 2024-2028

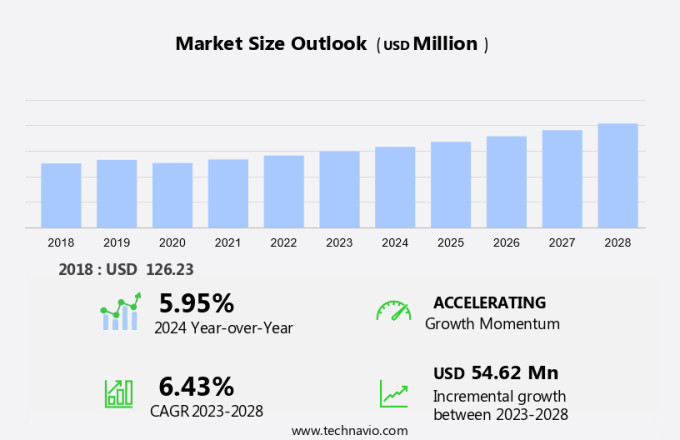

The marine enzymes market size is forecast to increase by USD 54.62 billion at a CAGR of 6.43% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for food enzymes in various industries, particularly in bakery items and dairy products. Bakery goods, such as flour lipids, crackers, and bread, utilize proteases, a type of marine enzyme, to improve dough fermentation and texture. In the dairy sector, marine enzymes are employed in the production of cheese, butter, and margarine to enhance their taste, texture, and nutritional value. The complex production process of marine enzymes, which involves the extraction from marine sources, poses challenges for market growth. However, recent advances in enzyme technology have facilitated the large-scale production and commercialization of these valuable enzymes.

Marine enzymes derived from marine organisms have gained significant attention in recent years due to their unique attributes and potential applications in various industries. These enzymes, which include proteases, lipases, and others, offer numerous benefits that make them an attractive alternative to traditional enzymes. One industry that stands to gain the most from marine enzymes is the cosmetics industry. Marine enzymes have been found to improve the texture and quality of cosmetic products, making them more desirable to consumers. They also offer sustainable production methods, aligning with the growing trend towards eco-friendly and natural products.

In the food processing industry, marine enzymes have been used to produce flour lipids, which are essential in the production of cheese, butter, and margarine. These enzymes help improve the texture, flavor, and shelf life of these products. Additionally, marine enzymes have been used in the production of structured lipids, which are used in the manufacturing of baked goods, crackers, and waffles. Environmental remediation and biocatalysis are other areas where marine enzymes have shown great promise. These enzymes are capable of functioning under extreme conditions and can be used to break down complex pollutants, making them valuable tools in environmental cleanup efforts.

Furthermore, marine enzymes have been used in drug discovery and molecular biology research, providing new insights into the development of novel therapeutics. The future of marine enzymes is bright, with potential applications in bioremediation, biotechnology, and other emerging industries. The unique properties of marine enzymes, such as their ability to function under extreme conditions and their high specificity, make them a valuable resource for researchers and industries seeking to develop innovative solutions. Marine biodiversity is a rich source of these enzymes, and efforts to discover and isolate new marine enzymes are ongoing. As research in this area continues to advance, it is expected that new applications and industries will emerge, further expanding the market for marine enzymes.

In conclusion, marine enzymes offer a sustainable and innovative solution for various industries, from cosmetics to food processing and beyond. Their unique attributes, including their ability to function under extreme conditions and their high specificity, make them a valuable resource for researchers and industries seeking to develop new and innovative products and solutions. As research in this area continues to advance, it is expected that the market for marine enzymes will continue to grow, providing new opportunities for businesses and researchers alike. Keywords: marine enzymes, cosmetics industry, food processing, environmental remediation, biocatalysis, drug discovery, molecular biology, bioremediation, extreme conditions, enzyme performance, marine biodiversity, sustainable products.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Medicine

- Nutraceutical

- Cosmetics

- Others

- Type

- Proteases

- Xylanases

- Pectinase

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- Italy

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

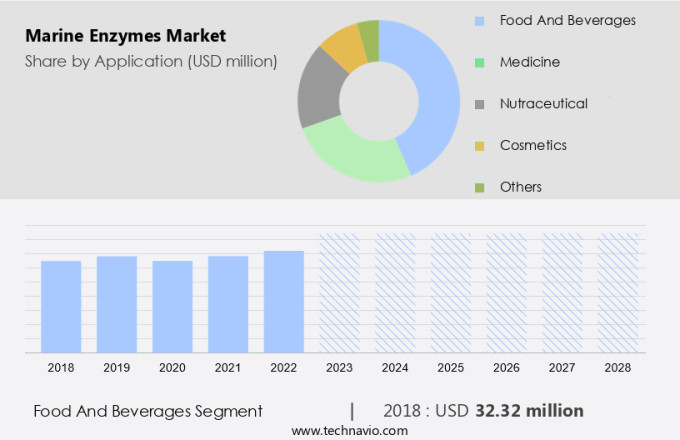

The food and beverages segment is estimated to witness significant growth during the forecast period. Marine-derived enzymes, particularly carbohydrases such as alpha- and beta-amylases, glucoamylases, cellulases, lactases, hemicellulases, glucose isomerases, pectinases, and others, have gained significant attention in the food and beverage industry due to their ability to break down complex carbohydrates into simpler units. These enzymes are sourced from microbes found in marine environments and are used in various applications, including food processing, nutraceuticals, and infant formula. Structured lipids, derived from vegetable oils, are another area of interest for marine enzymes. These enzymes are used to modify the lipid structure, improving their functionality and nutritional value. The food industry outlook remains positive for marine enzymes, with increasing demand for enzymes in the brewery and dairy industries.

Regulatory guidelines and institutional regulations play a crucial role in the market growth of marine enzymes. Compliance with these regulations ensures the safety and efficacy of marine enzyme products. The nutraceutical industry is a significant consumer of marine enzymes, with a growing trend towards functional foods and supplements. In the context of food processing applications, marine enzymes offer advantages such as improved taste, texture, and shelf life. The market for marine enzymes is expected to grow steadily, driven by increasing consumer awareness of health and wellness and the demand for clean-label products. Keywords: Marine enzymes, Carbohydrases, Structured lipids, Food processing applications, Nutraceuticals, Regulatory guidelines, Institutional regulations, Infant formula, Vegetable oils.

Get a glance at the market share of various segments Request Free Sample

The food and beverages segment accounted for USD 32.32 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing continuous expansion, presenting lucrative prospects for industry participants. The United States dominates the regional market share. The expansion in the pharmaceutical and diagnostics sector is fueling the utilization of marine enzymes in this region. Furthermore, increasing knowledge about enzyme applications and growing health-conscious consumer trends are fueling the demand for enzyme-infused consumer goods. This trend is anticipated to persist throughout the forecast period. The market growth in North America is driven by the rising consumption of proteases and lipases in the US. Textiles and wastewater treatment are the primary industries driving the demand for marine enzymes in North America.

Despite production challenges in cultivating marine organisms in laboratory settings and commercial demands for large-scale production, the market is expected to thrive due to its unique benefits. Marine enzymes offer superior efficiency and stability compared to their terrestrial counterparts, making them a valuable addition to various industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for food enzymes is the key driver of the market. Marine enzymes derived from marine sources have gained significant attention in various industries, including the cosmetics sector, in recent years. These enzymes possess unique attributes that make them ideal for use in sustainable products. The agriculture industry also benefits from marine enzymes due to their ability to enhance the efficiency of agricultural processes. In the cosmetics industry, marine enzymes offer numerous advantages, such as improving the texture and effectiveness of skincare and haircare products. The future of marine enzymes looks promising as they continue to be explored for their potential uses in diverse applications. The global market for marine enzymes is experiencing growth due to the increasing demand for eco-friendly and effective ingredients in consumer products.

Food enzymes extracted from marine sources play a crucial role in the food industry by maintaining the nutritional content and extending the shelf-life of various food products, including meat, bakery, dairy, frozen food, oils and fats, and confectioneries. The trend toward processed and packaged food products continues to drive the demand for food enzymes, as they help ensure food security and safety.

Market Trends

Recent advances in enzyme technology is the upcoming trend in the market. Marine enzymes have gained significant traction in various industries due to advancements in genetics and process technology. Genetic engineering facilitates the selection of suitable host organisms and safe cultivation conditions, ensuring the production of high-quality enzymes. Uncertainty regarding enzymes with unsuitable properties or association with toxin-producing organisms can be mitigated by transferring the enzyme gene to a safe host using protein-engineering tools. Genetic engineering enables the creation of enzymes with enhanced stability, specificity, and productivity, allowing the production of naturally occurring enzymes in large quantities through fermentation. In the food industry, marine enzymes find extensive applications in bakery items, such as improving the functionality of flour lipids, enhancing the texture of baked goods, and increasing the shelf life of crackers. Cheese, butter, and margarine production also benefit from marine enzymes, which contribute to improved taste, texture, and functionality.

Market Challenge

The complex production process of marine enzymes is a key challenge affecting market growth. Marine enzymes, derived from various marine sources, have gained significant attention in the industry due to their cost-effective production and unique properties. These enzymes exhibit both anti-inflammatory and anti-cancer properties, making them valuable in numerous applications. The production process involves the selection of an appropriate marine source, such as animals, plants, microbes, or fungi. Biologically active enzymes are then extracted from these organisms using advanced techniques in microbiology, genetics, and biochemistry. Technological advancements in metagenomics and synthetic biology facilitate the discovery and production of marine enzymes. The increasing demand for marine collagen and other marine-derived products further fuels the growth of the market. The complexity of the production process necessitates a deep understanding of the involved biology and technology.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Liquide SA: The company offers marine enzymes that activate ingredients by biotechmarine under the brand SEPPIC.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Enzyme Technologies Ltd.

- Antozyme Biotech Pvt. Ltd.

- ArcticZymes Technologies ASA

- BASF SE

- BioLume Inc.

- Creative Enzymes

- Dash Corp.

- Enzymatica AB

- Enzyme Supplies Ltd.

- Kemin Industries Inc.

- Koninklijke DSM NV

- Lallemand Inc.

- Nagase and Co. Ltd.

- Novo Nordisk AS

- Novozymes AS

- Revelations Biotech Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Marine enzymes have gained significant attention in various industries in recent years due to their unique attributes and sustainable origins. These enzymes, derived from marine organisms, offer numerous benefits in the cosmetics industry for creating natural and eco-friendly products. Marine enzymes possess anti-inflammatory and anti-cancer properties, making them valuable additions to skincare and personal care formulations. Beyond cosmetics, marine enzymes find applications in the agriculture industry, biotechnology, and food processing. In food processing, marine enzymes are used to improve the production of bakery items, flour lipids, cheese, butter, margarine, and structured lipids. They are also used in the production of nutraceuticals, infant formula, and vegetable oils.

Further, regulatory guidelines and institutional regulations play a crucial role in the commercialization of marine enzymes. Biocatalysis, drug discovery, molecular biology, and bioremediation are some of the areas where marine enzymes are being explored for their potential in metabolic disorders, cancer, infectious diseases, and metabolic disorders. Marine enzymes' extreme performance in various conditions makes them ideal for use in textiles, wastewater treatment, and other industrial applications. Despite the growing demand for marine enzymes, scalability and production challenges remain, limiting their commercialization in laboratory settings. The future of marine enzymes lies in their ability to provide sustainable solutions to various industries while meeting commercial demands and regulatory requirements. Marine habitats continue to be a rich source of novel therapeutic agents and enzyme-based products, driving research and development in this field.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.43% |

|

Market growth 2024-2028 |

USD 54.62 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.95 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

US, Canada, China, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advanced Enzyme Technologies Ltd., Air Liquide SA, Antozyme Biotech Pvt. Ltd., ArcticZymes Technologies ASA, BASF SE, BioLume Inc., Creative Enzymes, Dash Corp., Enzymatica AB, Enzyme Supplies Ltd., Kemin Industries Inc., Koninklijke DSM NV, Lallemand Inc., Nagase and Co. Ltd., Novo Nordisk AS, Novozymes AS, and Revelations Biotech Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch