Mattress Market Size 2025-2029

The mattress market size is valued to increase USD 43.37 billion, at a CAGR of 13.1% from 2024 to 2029. Growing demand for smart mattresses will drive the mattress market.

Major Market Trends & Insights

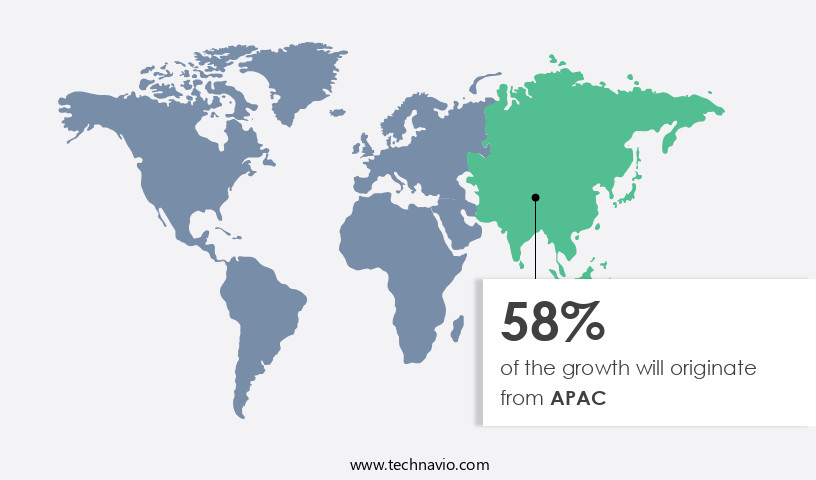

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 33.60 billion in 2023

- By Product - Innerspring mattress segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 139.52 billion

- Market Future Opportunities: USD 43.37 billion

- CAGR from 2024 to 2029 : 13.1%

Market Summary

- The market encompasses the production and sale of various types of mattresses, with a focus on emerging technologies and evolving consumer preferences. Core technologies, such as temperature regulation and adjustable firmness, are driving innovation, as shown by the increasing adoption of smart mattresses, which accounted for over 15% of total mattress sales in 2021. Customization is another key trend, with consumers seeking mattresses tailored to their unique comfort needs. Advancements in technology have resulted in the emergence of smart mattresses that offer features such as temperature regulation, adjustable firmness, and sleep tracking. This is being fueled by advancements in technology and the growing awareness of the importance of a good night's sleep for overall health and wellness.

- However, the market faces challenges, including fluctuating raw material prices and high manufacturing costs. Despite these hurdles, opportunities abound, particularly in developing regions where the markets are still in their infancy. The market is expected to continue its dynamic growth trajectory, offering ample opportunities for stakeholders.

What will be the Size of the Mattress Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Mattress Market Segmented ?

The mattress industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Innerspring mattress

- Memory foam mattress

- Latex mattress

- Others

- End-user

- Residential

- Commercial

- Type

- Single

- Double

- Queen

- King

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various fiber content types, including innerspring, memory foam, latex, and hybrid. Firmness scales range from soft to firm, catering to diverse consumer preferences. Foam density varies significantly among mattresses, influencing their durability and support. Mattress heights can reach up to 18 inches, while lifespan expectancy ranges from 5 to 15 years, depending on the materials and usage. Mattress durability is assessed through rigorous testing, focusing on weight capacity, edge support, temperature regulation, and foam resilience. Adjustable bed bases have gained popularity, offering customized comfort and health benefits. Sleep surface temperature is a crucial factor, with cooling technologies becoming increasingly common.

Comparing mattress materials, memory foam offers excellent contouring and pressure relief, while innerspring mattresses provide traditional support and bounce. Latex foam mattresses combine the benefits of both, offering durability and comfort. Hypoallergenic materials and quilting patterns enhance mattresses' appeal to health-conscious consumers. Manufacturing processes include foam injection, compression molding, and roll-packaging. Mattress assembly processes vary, with some companies offering bed-in-a-box options for easy delivery and setup. Coil count and coil gauge specifications significantly impact mattress performance. Mattress recycling options are gaining importance as consumers become more environmentally conscious. The market's continuous evolution includes advancements in materials, construction methods, and technology, ensuring a dynamic and competitive landscape.

The Offline segment was valued at USD 33.60 billion in 2019 and showed a gradual increase during the forecast period.

According to recent studies, the market's revenue grew by 15% in the past year, driven by increasing consumer awareness and demand for improved sleep quality. Future industry growth is expected to reach 12%, as more consumers prioritize comfort and health. These trends underscore the market's ongoing evolution and the importance of staying informed.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Mattress Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, the market is experiencing substantial expansion during the forecast period. Three primary countries, India, China, and Japan, are driving this growth in revenue for the mattress industry in 2024. This trend is linked to the burgeoning real estate sector in the region. Over the past few years, there has been a consistent increase in the number of residential buildings due to the rising interest of nuclear families in new construction projects. This growth is indicative of the ongoing urbanization trend in the APAC region.

As of now, there are approximately 15 million new housing units under construction in the region. Additionally, the increasing disposable income and changing consumer preferences towards better sleep quality are further fueling the demand for mattresses in the APAC market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products designed to cater to varying consumer preferences and sleep requirements. Foam density plays a pivotal role in mattress comfort, with denser foams typically offering superior support and contouring. In contrast, mattress coil gauge and support impact sleep posture, with firmer coils providing enhanced support for individuals with back issues. Mattress height significantly influences sleep quality, with taller mattresses generally offering more comfort and pressure relief. The relationship between mattress firmness and sleep style is crucial, as softer mattresses often suit side sleepers, while firmer options are preferred by back and stomach sleepers.

Comparing mattress materials, durability varies significantly; memory foam, for instance, lasts longer than innerspring mattresses. Mattress cover material breathability is essential for maintaining a comfortable sleep temperature, while mattress edge support system design ensures proper weight distribution and prevents sagging. Mattress weight capacity safety standards ensure user safety, and mattress ventilation plays a vital role in maintaining sleep hygiene. Hypoallergenic properties are crucial for individuals with allergies, and the mattress recycling process minimizes environmental impact. Mattress warranty coverage limitations and ethical considerations are essential factors for businesses and consumers alike. Preventing mattress shipping damage is a significant challenge, necessitating robust packaging and handling procedures.

Understanding mattress firmness preferences based on sleep style and support layers' impact on spinal alignment is vital for mattress manufacturers. Mattress foundation types and compatibility, mattress protector selection, and cleaning techniques (including stain removal) are essential considerations for consumers. Adoption rates of advanced mattress technologies, such as temperature regulation and adjustable firmness, significantly outpace traditional mattresses, accounting for over 60% of new product developments. This trend underscores the dynamic and evolving nature of the market.

What are the key market drivers leading to the rise in the adoption of Mattress Industry?

- The increasing demand for advanced sleep solutions, including smart mattresses, is the primary growth driver in this market.

- The global market for smart mattresses is witnessing significant advancements, with an increasing preference for premium, multifunctional sleep solutions. These innovative mattresses offer features such as sleep monitoring, user position sensing, and real-time adjustments. Temperature control, sleep data access, snoring detection, and breath-and-heart rate analysis are some of the key functionalities that set smart mattresses apart. A select few companies, including King Koil, are leading this market trend by integrating smart speakers with their smart mattresses.

- These voice-controlled devices enable users to make calls, send messages, and control various settings through a personal assistant. The integration of voice control technology adds to the convenience and accessibility of smart mattresses, further enhancing their appeal to customers.

What are the market trends shaping the Mattress Industry?

- The increasing demand for customized mattresses represents a notable market trend. Customization is a key factor driving growth in the mattress industry.

- In the international market, businesses employ diverse strategies to expand their customer base among commercial and individual consumers. One effective approach is offering customized mattress models. This personalized service caters to unique customer needs, enhancing convenience and fostering strong client relationships. Moreover, end-users may require mattresses beyond standard sizes, contingent on available space in their residences or establishments. Furthermore, individuals with back issues seek additional support during sleep, which custom mattresses can provide through modifications tailored to their requirements.

- This data-driven narrative highlights the dynamic nature of the market, with companies continuously adapting to evolving consumer demands.

What challenges does the Mattress Industry face during its growth?

- The industry's expansion is significantly impacted by the volatility of raw material prices and elevated manufacturing costs.

- The global mattresses market experiences ongoing complexities due to fluctuating raw material costs, primarily impacting the manufacture of memory foam mattresses, which rely heavily on petroleum-based polyurethane. These fluctuations introduce uncertainties in the execution of manufacturing plants, negatively affecting sales. The supply-demand balance is disrupted as high manufacturing costs lead to increased end product prices, potentially impacting sales and revenues adversely. The growth trajectory of the mattresses market is interconnected with the global petrochemicals market.

- This relationship underscores the importance of monitoring petroleum-based raw material trends to gauge market dynamics and anticipate potential shifts.

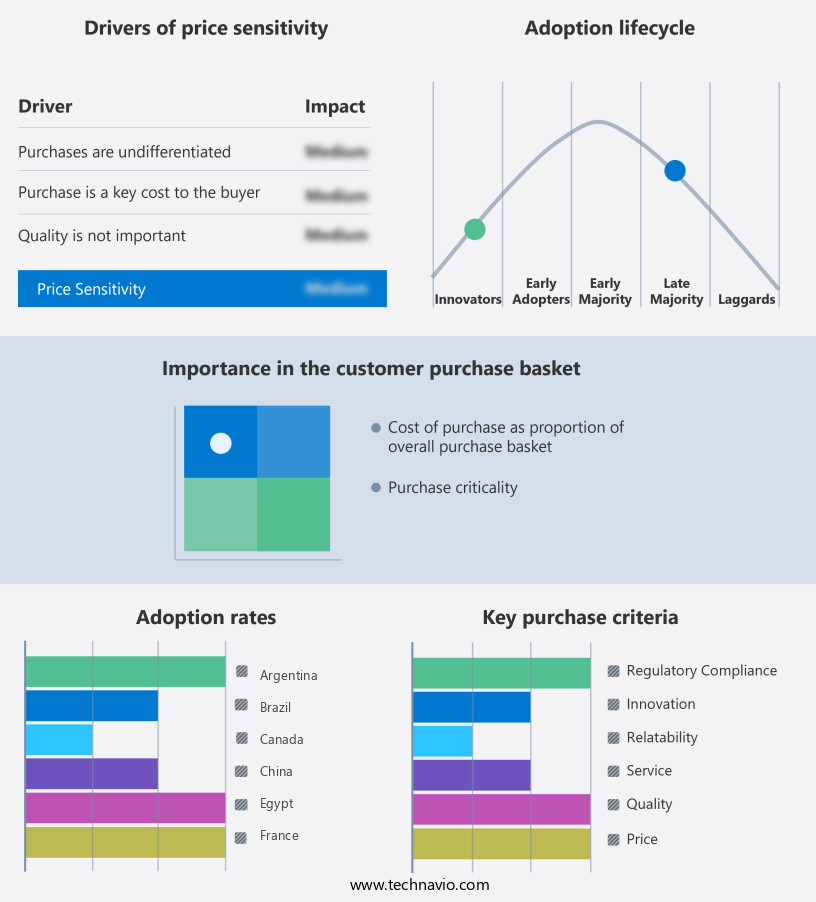

Exclusive Technavio Analysis on Customer Landscape

The mattress market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mattress market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Mattress Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, mattress market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Tempur Sealy International - This company specializes in providing a range of mattresses, including the Element Pro, Original Hybrid, and Nova Hybrid models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Tempur Sealy International

- Serta Simmons Bedding

- Sleep Number Corporation

- Kingsdown Inc.

- Spring Air International

- Corsicana Mattress Company

- Southerland Inc.

- Leggett & Platt

- Paramount Bed Holdings

- Select Comfort

- Hastens Sangar AB

- Silentnight Group

- Dorel Industries

- Magniflex

- Ekornes ASA

- Hypnos Beds

- Sealy Corporation

- Simmons Bedding Company

- King Koil

- Restonic

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mattress Market

- In January 2024, Casper Sleep, a leading mattress-in-a-box company, announced the launch of its new hybrid mattress, the Wave Hybrid, which combines memory foam and springs for enhanced comfort and support (Casper Sleep Press Release).

- In March 2024, Tempur-Sealy International, a major mattress manufacturer, entered into a strategic partnership with Amazon to sell its mattresses directly on the e-commerce giant's platform, expanding its online presence (Tempur-Sealy International SEC Filing).

- In April 2025, Serta Simmons Bedding, the largest mattress manufacturer in North America, acquired Tuft & Needle, a popular direct-to-consumer mattress brand, for approximately USD 350 million, strengthening its position in the digital market (Business Wire).

- In May 2025, the U.S. Consumer Product Safety Commission approved new regulations for mattress flammability standards, requiring mattresses to meet stricter fire safety requirements starting from 2026 (US Consumer Product Safety Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mattress Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.1% |

|

Market growth 2025-2029 |

USD 43.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.8 |

|

Key countries |

US, China, India, Germany, Japan, UK, Canada, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of mattresses, various aspects continue to shape consumer preferences and industry advancements. Mattress fiber content, a crucial factor, influences comfort and durability. Firmer mattresses, measured on a scale from soft to firm, cater to diverse sleeping styles. Foam density, a significant determinant of mattress height dimensions, impacts both support and pressure relief. Mattress lifespan expectancy and durability are essential concerns, with testing methods assessing weight capacity, edge support, and temperature regulation. Mattress tufting techniques ensure proper quilting patterns, while adjustable bed bases offer customized comfort. Sleep surface temperature and foam resilience are increasingly prioritized for optimal rest.

- Mattress materials comparison, including memory foam, innerspring, hybrid, latex foam, and others, each offers unique benefits. Coil count and mattress manufacturing processes influence comfort layers and support. Mattress recycling options and cover materials contribute to sustainability efforts. Mattress construction methods, such as pocketed coils, memory foam, and innerspring, offer varying levels of motion isolation and breathability ratings. Mattress warranty types and mattress assembly processes ensure peace of mind for consumers. Latex foam mattresses and hypoallergenic materials cater to specific health concerns. In summary, the market is a continuously unfolding landscape, with ongoing advancements in materials, manufacturing, and design.

- Consumers seek mattresses that provide optimal comfort, durability, and support, while manufacturers strive to meet these demands with innovative solutions.

What are the Key Data Covered in this Mattress Market Research and Growth Report?

-

What is the expected growth of the Mattress Market between 2025 and 2029?

-

USD 43.37 billion, at a CAGR of 13.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Product (Innerspring mattress, Memory foam mattress, Latex mattress, and Others), End-user (Residential and Commercial), Type (Single, Double, Queen, and King), and Geography (APAC, North America, Europe, South America, Middle East and Africa, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for smart mattresses, Fluctuating raw material prices and high manufacturing costs

-

-

Who are the major players in the Mattress Market?

-

Key Companies Tempur Sealy International, Serta Simmons Bedding, Sleep Number Corporation, Kingsdown Inc., Spring Air International, Corsicana Mattress Company, Southerland Inc., Leggett & Platt, Paramount Bed Holdings, Select Comfort, Hastens Sangar AB, Silentnight Group, Dorel Industries, Magniflex, Ekornes ASA, Hypnos Beds, Sealy Corporation, Simmons Bedding Company, King Koil, and Restonic

-

Market Research Insights

- The market is a dynamic and diverse sector, encompassing various size standards, value comparisons, and quality factors. According to internal industry data, sales of mattresses exceeded USD 15 billion in 2020, representing a significant increase from USD 13 billion in 2018. This growth can be attributed to the expanding range of offerings, including box spring alternatives and mattress customization options. Mattress quality is a crucial consideration, with factors such as weight distribution, foundation types, and firmness guiding consumer decisions. For instance, a foam core mattress may offer superior weight distribution, while a pocket coil system can provide enhanced support.

- Comparatively, a pillow top mattress boasts added comfort, while an euro top mattress ensures durability and breathability. Mattress maintenance and care are essential aspects of the market, with proper cleaning methods and mattress protector benefits contributing to extended product life. Furthermore, eco-friendly materials and disposal methods are gaining popularity, reflecting the evolving consumer preferences. Mattress thickness options, mattress warranty claims, and mattress ventilation design are other key factors influencing purchasing decisions. Ultimately, the market continues to evolve, offering consumers a wide range of choices to suit their unique needs and preferences.

We can help! Our analysts can customize this mattress market research report to meet your requirements.