Micro Electric Vehicle Market Size 2023-2027

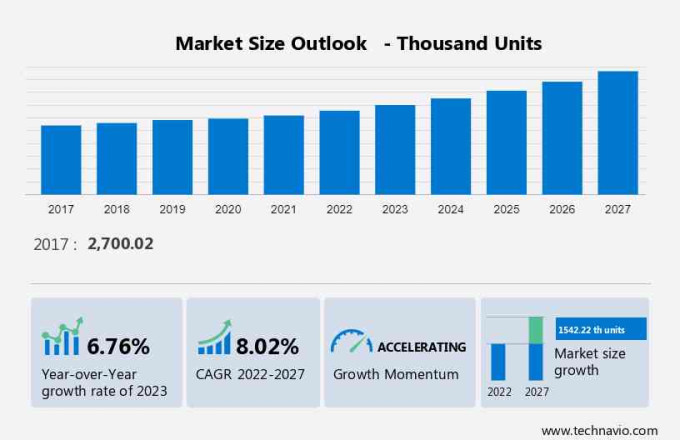

The micro electric vehicle market size is forecast to increase by USD1.54 th units at a CAGR of 8.02% between 2022 and 2027.

- The market is experiencing significant growth, driven by several key trends. One major factor fueling market expansion is the establishment of dedicated consortiums for the development of micro electric vehicles, leading to innovative designs and vehicle platforms that cater to the unique needs of consumers. Additionally, advancements in Li-ion batteries, lighter construction materials, and increasing automation are enhancing the drivability and maneuverability of these vehicles. However, it is essential to note that the power grids serving as a source for charging these electric vehicles can indirectly contribute to environmental pollution. Despite this challenge, the market is poised for continued growth, with consumers increasingly seeking sustainable and eco-friendly transportation solutions.

What will be the Size of the Micro Electric Vehicle Market During the Forecast Period?

- The market is experiencing significant growth in the United States, driven by the demand for green transportation solutions in the context of smart cities. With increasing focus on emission reduction and the adoption of renewable energy, alternative fuels such as electric vehicles (EVs) are gaining popularity. Micro electric vehicles, including one-seater EVs and compact cars, offer sustainable transportation alternatives for urban mobility and last-mile delivery. Battery technology advancements and charging solutions have made EVs more accessible and convenient for consumers. Electric vehicle infrastructure, including charging stations, is being integrated into transportation infrastructure to support the growing demand for emission-free driving.

Regulations and incentives are also playing a crucial role in the adoption of micro electric vehicles, with many cities and states implementing policies to promote the use of eco-friendly vehicles. Moreover, the integration of autonomous vehicles and mobility data analytics into the mobility ecosystem is expected to further drive the growth of the market. Urban planning initiatives are also focusing on traffic congestion solutions and emission reduction strategies, making micro electric vehicles an attractive alternative to traditional transportation methods. Overall, the market is poised for continued growth as a key component of the sustainable transportation landscape.

How is this Micro Electric Vehicle Industry segmented and which is the largest segment?

The micro electric vehicle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD th units" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Type

- Golf and micro cars

- Quadricycle

- Application

- Commercial

- Personal

- Public utilities

- Geography

- North America

- Canada

- US

- APAC

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

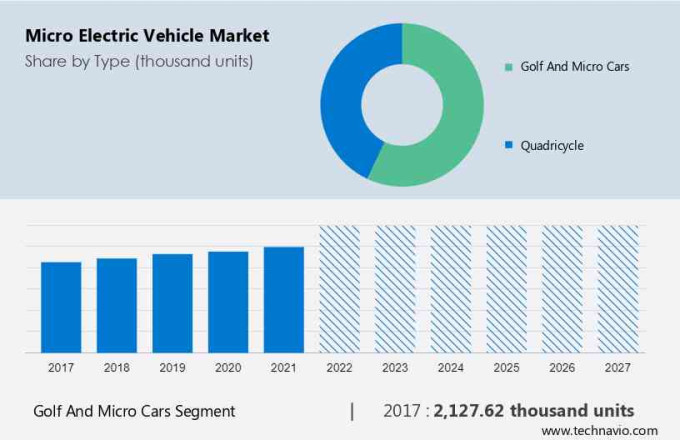

- The Golf and micro cars segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the golf carts and micro cars segments, accounting for approximately 80% of the market share. This dominance is attributed to the rising sales of electric golf carts and personal utility vehicles in regions like North America and Europe. Additionally, micro cars with a maximum power rating of up to 15 kW are gaining popularity due to their low carbon footprint and cost-effectiveness for personal use. In commercial applications, such vehicles are increasingly utilized for cargo transportation, particularly in industries with large campuses or distribution centers. The electrification trend in the transportation sector is further propelling the market growth.

Intelligent charging programs and electrification technologies are being integrated into these vehicles to enhance their functionality and efficiency. The market is expected to continue expanding as more businesses and consumers adopt sustainable and cost-effective transportation solutions.

Get a glance at the micro electric vehicle industry share of various segments Request Free Sample

The Golf and micro cars segment accounted for USD 2127.62 th units in 2017 and showed a gradual increase during the forecast period.

Regional Insights

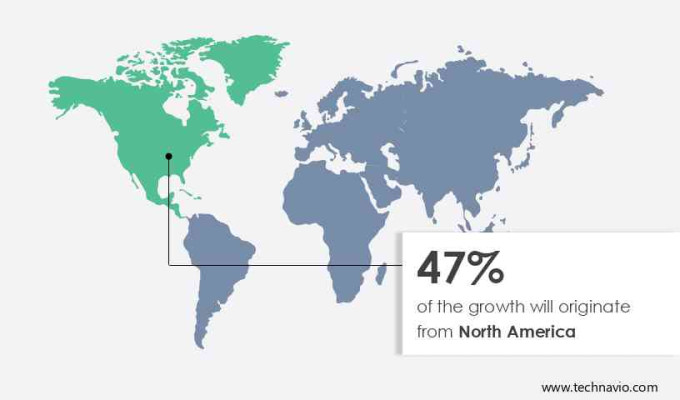

- North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to increasing demand for personal, affordable, and environmentally responsible transportation options. This trend is particularly noticeable in the sale of electric golf carts and club cars in the US and Canada. Government initiatives to reduce carbon emissions are also driving market expansion. Despite the dominance of gasoline-powered SUVs and pick-up trucks in the North American automotive market, the micro electric vehicle segment is rapidly expanding. Lithium-ion battery technology is a key enabler, providing the necessary power and range for these small, maneuverable vehicles. As the market continues to grow, it offers commercial opportunities for manufacturers and investors alike.

Market Dynamics

Our micro electric vehicle market researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Micro Electric Vehicle Industry?

Dedicated consortium for development of micro electric vehicles: All-new designs and vehicle platforms drive demand is the key driver of the market.

- The market is an emerging segment within the electric mobility industry, gaining traction as an eco-friendly and economical alternative to traditional fossil-fueled vehicles. Micro electric vehicles, also known as quadricycles or mini-electric vehicles, are compact, low-emission vehicles with a short range and a low-powered drivetrain. They are ideal for personal use in urban areas, offering great maneuverability and ease of usage, particularly in traffic jams and transportation difficulties. Lithium-ion batteries power these vehicles, providing a range that caters to short-distance travel needs. The electric propulsion system offers zero-emission transportation, reducing the carbon footprint and contributing to the electrification trend.

Commercial use of micro electric vehicles is also increasing, particularly in cargo transportation and last-mile delivery services. Government incentives, such as subsidies and policies, are driving the growth of the market. However, the market faces challenges due to insufficient charging infrastructure and government rules regarding the classification and certification of these vehicles. The electric quadricycle market is expected to expand rapidly, with diverse range offerings, longer ranges, and smart grid capabilities becoming increasingly popular. The market is also witnessing the development of intelligent charging programs and fast charging stations, making electric mobility more accessible and convenient for urban commuters.

The market offers ecologically sustainable solutions for personal and commercial transportation needs, with two-seater vehicles and compact battery packs providing minimal parking space requirements. The market is expected to continue its growth trajectory as more and more people seek affordable, environmentally responsible transportation options.

What are the market trends shaping the Micro Electric Vehicle Industry?

Improved Li-ion batteries, lighter construction, and increasing automation for improved drivability and maneuverability is the upcoming trend in the market.

- The market in the US is witnessing significant growth due to the increasing demand for zero-emission vehicles and the electrification trend. These vehicles, which include electric quadricycles and mini-electric vehicles, offer great maneuverability and ease of usage, making them ideal for personal use in urban areas. The electric mobility industry is expanding rapidly, with electric propulsion systems becoming more economical and affordable for commercial use. The use of compact battery packs and intelligent charging programs is facilitating the electrification of cargo transportation and mobility services. The electric mobility industry is also addressing transportation difficulties in urban populations by providing eco-friendly transportation solutions with low carbon footprints.

The diverse range of electric vehicles, from two-seater vehicles to four-wheelers, cater to various transportation demands. The US government is offering incentives and subsidies to promote the adoption of electric vehicles, which is further boosting the market growth. However, the insufficient charging infrastructure and government rules regarding charging infrastructures are challenges that need to be addressed. The market is also focusing on the development of smart grid capabilities and standard charging to overcome these challenges. The electric quadricycle and micro electric vehicle segments offer specific advantages such as short-range, low-powered drivetrains, and ease of parking in urban areas.

These vehicles are also becoming increasingly popular for last-mile delivery services due to their maneuverability and faster charging capabilities. The market is expected to continue expanding as the demand for more sustainable and affordable transportation solutions grows.

What challenges does Micro Electric Vehicle Industry face during the growth?

Power grids serving as a source to electric vehicles are indirectly polluting environment is a key challenge affecting the market growth.

- The market in the US is experiencing rapid expansion as more consumers and businesses seek economical, eco-friendly, and low-emission transportation solutions. Zero-emission electric quadricycles and mini-electric vehicles are gaining popularity for their short-range capabilities, great maneuverability, and ease of usage, particularly in urban areas where traffic jams and parking difficulties are common. These vehicles, which include two-seater electric cars and two-wheelers, use lithium-ion batteries for electric propulsion and intelligent charging programs to optimize energy consumption. The electric mobility industry is driving the electrification trend, with policies and incentives encouraging the adoption of electric vehicles for both personal and commercial use.

However, insufficient charging infrastructure and inadequate government subsidies remain challenges to the widespread adoption of these vehicles. The diverse range of electric vehicles, from compact battery packs to longer-range battery electric vehicles, cater to various transportation demands and use cases, including cargo transportation and last-mile delivery. Electric mobility offers numerous benefits, including reduced carbon footprints, lower operating costs, and minimal parking space requirements. As the transportation sector continues to grapple with environmental concerns and emissions regulations, electric vehicles are becoming an increasingly attractive alternative to fossil-fueled vehicles. The smart grid capabilities of electric vehicles enable efficient charging and energy management, contributing to a more sustainable and connected transportation system.

The compact size and affordable price points of micro electric vehicles make them an accessible and economical solution for urban commuters and eco-conscious consumers. As the market continues to evolve, advancements in battery technology and charging infrastructure are expected to address current challenges and further boost the growth of the market.

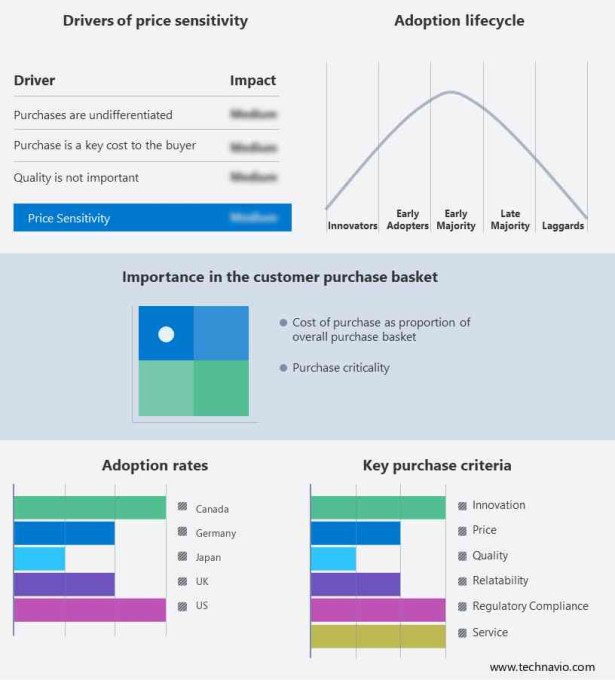

Exclusive Customer Landscape

The micro electric vehicle market market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alta Zero Emissions Solutions Inc. - The company specializes in transporting temperature-sensitive goods through organized refrigerated shipping solutions within the market in the United States. Our services ensure the preservation of perishable items during transit, maintaining optimal temperature conditions to guarantee their quality and freshness.

The market research and growth report includes detailed analyses of the competitive landscape of the micro electric vehicle market industry and information about key companies, including:

- Alta Zero Emissions Solutions Inc.

- AYRO Inc.

- Bayerische Motoren Werke AG

- Bintelli Electric Vehicles

- BYD Electronic Co. Ltd.

- Electrameccanica Vehicles Corp.

- Elio Motors Inc.

- G H Varley Pty Ltd.

- Hyundai Motor Co.

- Italcar Industrial Srl

- Mahindra and Mahindra Ltd.

- Mercedes Benz Group AG

- Microlino AG

- PMV Electric Pvt. Ltd.

- Polaris Inc.

- Renault SAS

- Shandong Baoya

- Shifeng Group Co. Ltd.

- Textron Inc.

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing rapid expansion as the trend towards electrification continues to gain momentum. These compact, zero-emission vehicles offer an affordable and eco-friendly alternative to traditional fossil-fueled vehicles. With a focus on short-range mobility, micro electric vehicles are ideal for urban commuters and last-mile delivery services. Micro electric vehicles, also known as quadricycles or mini-electric vehicles, are characterized by their low-powered drivetrains and compact battery packs. They offer great maneuverability, making them an excellent solution for navigating traffic jams and transportation difficulties in densely populated areas. Their small size also means minimal parking space is required, adding to their appeal for personal and commercial use.

The electric mobility industry is witnessing a surge in demand as governments and consumers alike seek to reduce carbon footprints and promote ecologically sustainable solutions. Policies and incentives, such as subsidies and tax credits, are being implemented to encourage the adoption of electric vehicles, including micro electric vehicles. Despite the advantages of micro electric vehicles, challenges remain. Insufficient charging infrastructure and government rules regarding their use and registration can hinder their widespread adoption. However, efforts are being made to address these issues through the development of intelligent charging programs and the expansion of charging infrastructure. Micro electric vehicles come in a diverse range of designs, from two-seater vehicles to cargo transportation solutions.

They offer low emissions, making them an environmentally responsible choice for both personal and commercial use. Their short-distance travel capabilities make them an excellent fit for urban populations, and their smart grid capabilities allow for integration with the electrical grid for efficient energy management. Battery technology plays a crucial role in the performance and affordability of micro electric vehicles. Lithium-ion batteries are currently the most common choice due to their high energy density and long life cycle. However, research and development efforts are ongoing to improve battery technology and reduce the cost of batteries. The market is expected to continue growing as the trend towards electrification and the need for affordable, eco-friendly transportation solutions become increasingly important.

With their ease of usage, great maneuverability, and low carbon footprint, micro electric vehicles are poised to play a significant role in the future of transportation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.02% |

|

Market growth 2023-2027 |

1542.22 th units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

6.76 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 47% |

|

Key countries |

US, Canada, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alta Zero Emissions Solutions Inc., AYRO Inc., Bayerische Motoren Werke AG, Bintelli Electric Vehicles, BYD Electronic Co. Ltd., Electrameccanica Vehicles Corp., Elio Motors Inc., G H Varley Pty Ltd., Hyundai Motor Co., Italcar Industrial Srl, Mahindra and Mahindra Ltd., Mercedes Benz Group AG, Microlino AG, PMV Electric Pvt. Ltd., Polaris Inc., Renault SAS, Shandong Baoya, Shifeng Group Co. Ltd., Textron Inc., and Yamaha Motor Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the micro electric vehicle market industry growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch