Military Robots Market Size 2024-2028

The military robots market size is forecast to increase by USD 8.62 billion, at a CAGR of 8.51% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends and factors. One major trend is the strengthening of border surveillance and patrolling, leading to increased demand for unmanned ground vehicles (UGVs) and unmanned aerial vehicles (UAVs) for border security applications. Another trend is the development of multi-mission robots, which can perform various tasks such as bomb disposal, reconnaissance, and combat support, making them valuable assets for military operations. However, there is also a growing skepticism toward automated weapons systems and ethical concerns regarding the use of military robots, which may pose challenges to market growth. Despite these challenges, the market is expected to continue expanding due to the increasing demand for autonomous systems and advanced technologies in military applications.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth due to the integration of advanced technology such as Artificial Intelligence (AI), LiDAR, Fiber optics, and Electric propulsion. These technologies enable Military robots to perform various functions including Search and rescue, Combat support, Modern warfare Reconnaissance, Surveillance, Bomb disposal, and Combat. Hybrid robots are increasingly being used in missions due to their ability to combine the advantages of both autonomous and remotely operated systems. The market for Military robots is driven by Defense budgets and National security concerns. Mission success rates are emphasized in modern warfare, leading to the automation of various tasks previously performed by Human soldiers. Autonomous robots are being used for CBRN attacks detection and Mine countermeasures. Unmanned Aerial Vehicles (UAVs) and Mine clearing robots are essential components of Ground vehicle strategy. Electronic jamming and Electronic warfare are also critical applications of Military robots. The market is expected to grow at a steady pace due to the increasing adoption of these robots for various military applications. The use of UAVs for reconnaissance and surveillance is a significant trend in the market. The integration of AI and advanced technology is expected to further boost the market growth.

Key Market Driver

The strengthening of border surveillance and patrolling is notably driving market growth. Military robots have emerged as a significant component of modern ground vehicle strategies, offering enhanced combat capabilities and electronic warfare systems. Unmanned Ground Vehicles (UGVs) are increasingly being utilized for undersea surveillance and anti-submarine warfare, employing advanced recovery technology to ensure mission success. Electronic jamming is integrated into these robots to disrupt enemy communications and sensors, providing a strategic advantage. The integration of military robots into undersea operations and anti-submarine warfare is revolutionizing defense tactics, enabling more effective and efficient surveillance and response. These advanced technologies offer a new dimension to military capabilities, ensuring superiority in various operational scenarios. Thus, such factors are driving the growth of the market during the forecast period.

Key Market Trends

Development of multi-mission robots is the key trend in the market. Military robots are increasingly being integrated into ground and underwater strategies for enhancing combat capabilities and electronic warfare. Unmanned Ground Vehicles (UGVs) are being employed for reconnaissance, bomb disposal, and transportation tasks, while undersea robots are utilized for surveillance and anti-submarine warfare. Electronic jamming is employed to disrupt enemy communications and sensors, and military robots are being developed with advanced recovery technology to ensure their safe return from missions. Ground vehicle strategy involves the deployment of autonomous vehicles for logistics and reconnaissance, while undersea robots are essential for maintaining situational awareness in anti-submarine warfare. These advancements in military robotics are revolutionizing the battlefield and expanding the scope of electronic warfare applications. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Increased skepticism toward automated weapons systems is the major challenge that affects the growth of the market. Military robots are increasingly being integrated into ground and underwater warfare strategies due to their advanced capabilities. Unmanned Ground Vehicles (UGVs) are being used for combat missions, reconnaissance, and electronic warfare, including electronic jamming. In underwater environments, military robots play a crucial role in anti-submarine warfare and undersea surveillance. These robots are equipped with advanced technology to detect and neutralize threats, making them indispensable in modern warfare. Recovery technology is also a significant application area for military robots, enabling efficient and safe recovery of valuable assets in hazardous conditions. Military robotics is a dynamic and evolving field, with continuous advancements in technology driving new applications and capabilities. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AeroVironment Inc. - The company offers military robots such as Vapor.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applied Research Associates Inc.

- BAE Systems Plc

- Bayonet Ocean Vehicles

- Cobham Ltd.

- Ekso Bionics Holdings Inc.

- Elbit Systems Ltd.

- General Dynamics Corp.

- General Robotics Ltd.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- Milanion Ltd

- M-Tecks Robotics

- Northrop Grumman Corp.

- QinetiQ Ltd.

- Robo-Team Defense Ltd.

- Saab AB

- Teledyne Technologies Inc.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

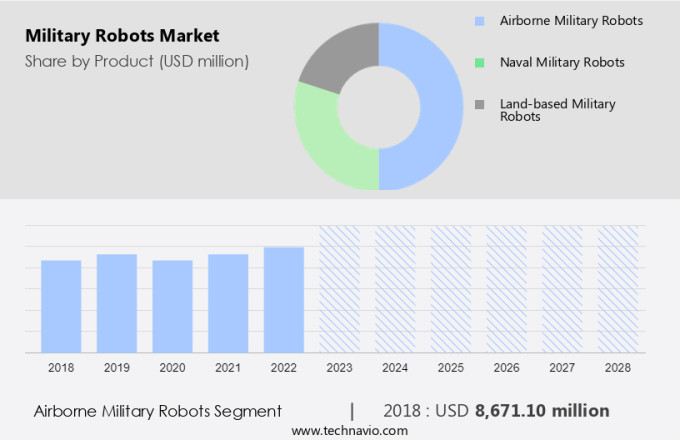

By Product

The airborne military robots segment is estimated to witness significant growth during the forecast period. In the realm of military applications, artificial intelligence (AI) and advanced technology continue to revolutionize the landscape of modern warfare. Integration of AI and machine learning (ML) in military robots is a significant trend, enhancing situational awareness and decision-making capabilities. LiDAR technology and fiber optics enable superior sensing and navigation, while electric propulsion ensures silent and efficient operation. Hybrid robots, combining the strengths of human soldiers and automation, are increasingly used for combat support, transportation, reconnaissance, and surveillance.

Get a glance at the market share of various regions Download the PDF Sample

The airborne military robots segment was the largest and was valued at USD 8.67 billion in 2018. Autonomous navigation and bomb disposal robots ensure mission success rates and minimize risks for human personnel. Versatile military robots find applications in aerial, naval, and land-based platforms, including UAVs for reconnaissance and mine clearing, and PackBot robots for search & rescue and explosive ordnance disposal. Operational challenges in military and defense applications, such as border security and mine countermeasures, are addressed through the development of autonomous military robots. Defense budgets and national security concerns continue to fuel the demand for these advanced technologies. AI integration and advanced autonomy enable military robots to operate effectively in various environments, contributing to the success of modern military operations.

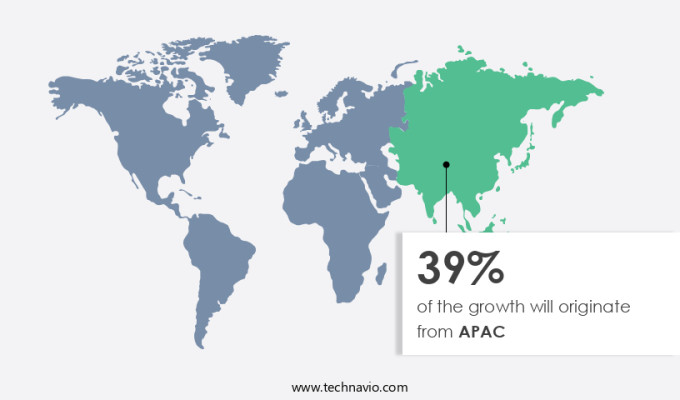

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In the realm of military applications, artificial intelligence (AI) and advanced technology are revolutionizing the landscape of defense and security. LiDAR and fiber optics technologies are integral to military robots, enhancing their situational awareness and decision-making capabilities. Electric propulsion and hybrid robots are essential for combat support, enabling modern warfare to transcend operational challenges. AI integration and autonomous navigation are critical components of military robots, increasing mission success rates in combat, reconnaissance, surveillance, bomb disposal, and transportation. Versatile robots are employed in aerial, naval, and land-based applications, including patrol, search & rescue, explosive ordnance disposal, border security, and mine countermeasures. Defense budgets continue to prioritize national security, driving the growth of autonomous military and defense applications. UAVs and mine clearing robots are prominent examples of military robots that utilize AI and ML for autonomous navigation and situational awareness. Human soldiers are increasingly working alongside these robots to enhance their capabilities and improve overall effectiveness. The integration of AI and advanced technology in military robots is transforming the way modern warfare is conducted, ensuring superior performance and improved safety for troops.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Outlook

- Airborne military robots

- Naval military robots

- Land-based military robots

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Wearable Robots And Exoskeletons Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, Germany, China, UK, France - Size and Forecast

- Commercial Robotics Market Analysis APAC, North America, Europe, South America, Middle East and Africa - China, US, Japan, Germany, South Korea - Size and Forecast

- Security and Law Enforcement Robots Market Analysis North America, APAC, Europe, Middle East and Africa, South America - China, US, South Korea, Japan, Germany - Size and Forecast

Market Analyst Overview

The market is witnessing significant growth due to the integration of Artificial Intelligence (AI) and Machine Learning (ML) in military and defense applications. AI and ML are crucial for situational awareness and decision-making in modern warfare. Military robots come in various forms, including Aerial, Naval, and Land-based. These robots are designed for Combat support, Reconnaissance, Surveillance, Bomb disposal, and Combat. The use of Hybrid robots, which combine electric propulsion and Fiber optics, offers versatility for Patrolling, Search & rescue, and Explosive Ordnance Disposal. UAVs (Unmanned Aerial Vehicles) are increasingly being used for aerial reconnaissance and surveillance.

In addition, autonomous navigation and AI integration enable these UAVs to operate effectively in modern warfare. Military robots play a vital role in Mission success rates by automating tasks previously performed by Human soldiers. Operational challenges in modern warfare, such as hazardous environments and long-range missions, are being addressed through the use of these robots. The Military & defense applications of robots extend to Air travel, Border security, Mine countermeasures, and Mine clearing. Defense budgets and National security concerns continue to drive the growth of this market. In conclusion, the market is transforming modern warfare through advanced technology, autonomous navigation, and AI integration. These robots are essential for Combat, Human soldiers' support, and Mission success rates in various Military & defense applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 8.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 39% |

|

Key countries |

US, China, Russia, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AeroVironment Inc., Applied Research Associates Inc., BAE Systems Plc, Bayonet Ocean Vehicles, Cobham Ltd., Ekso Bionics Holdings Inc., Elbit Systems Ltd., General Dynamics Corp., General Robotics Ltd., Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Lockheed Martin Corp., Milanion Ltd, M-Tecks Robotics, Northrop Grumman Corp., QinetiQ Ltd., Robo-Team Defense Ltd., Saab AB, Teledyne Technologies Inc., and Thales Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies