Mineral Cosmetics Market Size 2024-2028

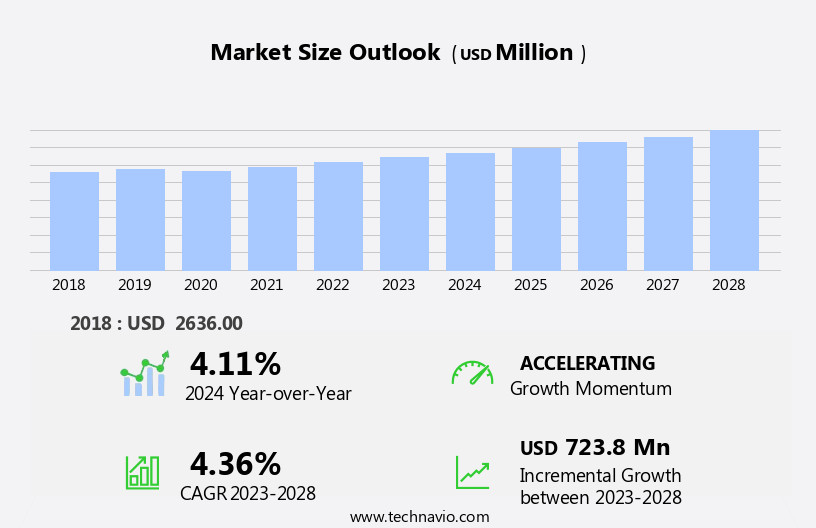

The mineral cosmetics market size is forecast to increase by USD 723.8 million at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Mineral Cosmetics Market During the Forecast Period?

How is this Mineral Cosmetics Industry segmented and which is the largest segment?

The mineral cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Makeup

- Skincare

- Haircare

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- Japan

- Middle East and Africa

- South America

- North America

By Product Insights

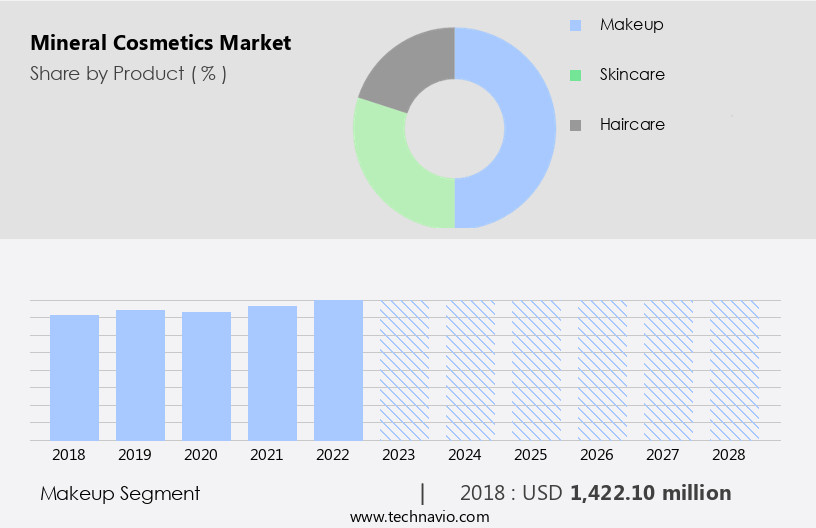

- The makeup segment is estimated to witness significant growth during the forecast period.

The market primarily focuses on the makeup segment, which generates significant revenue due to the widespread availability of mineral-based face, eye, and lip products. Factors driving growth in this segment include increasing disposable income levels in developing countries, expanding consumer bases, and the convenience of online retail platforms. Social media promotion further enhances consumer awareness and sales. Mineral cosmetics, made from natural ingredients such as mica, iron oxide, and zinc oxide, offer long-lasting wear and are free from synthetic chemicals, artificial colors, parabens, dyes, preservatives, and synthetic fragrances. These skin-friendly, versatile, and multi-functional beauty products cater to various consumer needs, including wrinkles, fine lines, chapped lips, acne, and protection against ultraviolet radiation.

Market leaders, including Caudalie, Juice Beauty, and One Thing, offer organic and clean, cruelty-free brands, expanding their global presence and production capacities. The e-commerce sector, driven by internet penetration and mobile phones, plays a crucial role In the market's growth, reaching a diverse consumer base, including millennials and young consumers. The market potential is substantial, with advancements in face-care products, non-comedogenic offerings, and various color options catering to consumers' appearance preferences and facial features.

Get a glance at the Mineral Cosmetics Industry report of share of various segments Request Free Sample

The Makeup segment was valued at USD 1422.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

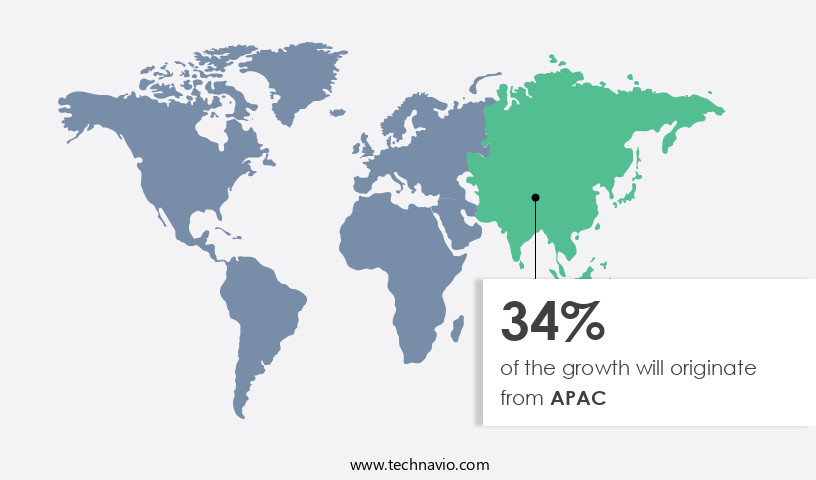

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In 2023, North America held the largest market share In the global mineral cosmetics industry, driven by the significant sales volume through offline distribution channels, including salons, spas, medical clinics, and specialty stores. The US, being a leading importer and exporter of beauty and skincare products, is a major contributor to the market's growth. The increasing preference for high-quality, natural, vegan, and organic cosmetics propels the market forward. The US market dominates the region, with Canada following closely. Mineral cosmetics, characterized by their long-lasting wear and natural, versatile ingredients, are gaining popularity among consumers. These include mica, iron, and zinc oxide, titanium dioxide, and other minerals.

Consumers seek skin-friendly, multi-functional beauty products that cater to various facial features and address concerns such as wrinkles, fine lines, chapped lips, acne, and ultraviolet radiation. Brands offering primers, mascaras, loose powder foundations, sunscreen lotions, and other mineral cosmetics are in demand. Consumers also prefer natural variants over synthetic chemical-based cosmetics, leading to the rise of organic and clean, cruelty-free brands. The e-commerce sector, fueled by internet penetration and mobile phone usage, offers significant opportunities for market expansion. Millennials and young consumers, particularly working women, are the prominent consumer base for mineral cosmetics. Market advancements include non-comedogenic products, color cosmetics, and face-care products.

The market's valuation is expected to increase, driven by the growing health consciousness and the availability of various product types, including lip care, face makeup, eye cosmetics, and mineral powders.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Mineral Cosmetics Industry?

Growing awareness about benefits of natural cosmetics is the key driver of the market.

What are the market trends shaping the Mineral Cosmetics Industry?

Multichannel marketing is the upcoming market trend.

What challenges does the Mineral Cosmetics Industry face during its growth?

High price of products is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The mineral cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mineral cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mineral cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Altana AG - Eckart, a division of the company, specializes in mineral cosmetics. Mineral cosmetics, a segment of the cosmetics industry, has gained popularity due to its natural and non-chemical composition. These products, made primarily from minerals, offer broad-spectrum coverage and are free of synthetic additives. The market has witnessed significant growth, driven by consumer demand for healthier and more natural beauty solutions. The market's expansion is further fueled by the increasing awareness of skin health and the desire for cruelty-free and vegan cosmetics. Eckart's mineral cosmetics cater to this trend, providing a range of high-performance, natural, and cruelty-free products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altana AG

- Angel Face Mineral Cosmetics Ltd

- Aroma Dead Sea spa and Cosmetics Ltd.

- AS Beauty LLC

- Astral Brands Inc

- BWX Ltd.

- EL Erman Cosmetic Manufacturing Ltd.

- Fosun International Ltd.

- Glo Skin Beauty

- Iredale Cosmetics Inc.

- Kawar Dead Sea Products

- LOreal SA

- Merck KGaA

- Mineralissima

- Natura and Co Holding SA

- Neelikon Food Dyes and Chemicals Ltd.

- Pure Colors Cosmetics Inc.

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Companies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mineral cosmetics have gained significant traction In the global beauty market due to their unique properties and consumer preferences for sustainable and natural variants. These cosmetics are known for their long-lasting wear and versatility, offering a wide range of benefits for various skin types and concerns. Mineral cosmetics primarily consist of minerals such as mica, iron, zinc oxide, and titanium dioxide. These natural ingredients provide excellent coverage, are lightweight, and offer a natural, flawless finish. In contrast to other cosmetics, mineral cosmetics do not contain synthetic chemicals, artificial colors, dyes, preservatives, or synthetic fragrances. The demand for mineral cosmetics is driven by several factors, including health consciousness, increasing awareness of allergies, and the desire for eco-friendly and sustainable beauty products.

The popularity of mineral cosmetics has led to the emergence of numerous brands, both global and domestic, catering to this growing market. The flexibility of mineral cosmetics is another significant factor contributing to their popularity. These products offer multiple functions, such as serving as primers, sunscreens, and foundations, making them a convenient choice for consumers. Mineral cosmetics are suitable for various facial features, including wrinkles, fine lines, chapped lips, acne, and protection against ultraviolet radiation. The market for mineral cosmetics is diverse and expansive, with various product categories, including loose powder foundations, sunscreen lotions, mascara, blush, bronzer, concealer, face powder, and foundation.

These products cater to the needs of different consumer segments, such as working women, millennials, and young consumers. The e-commerce sector has played a crucial role In the growth of the market. With increasing internet penetration and the widespread use of mobile phones, consumers have easy access to a vast array of mineral cosmetics from various brands. Social media platforms have also become significant marketing channels for mineral cosmetics, enabling brands to reach a broader audience and engage with consumers directly. Advancements in mineral cosmetics technology have led to the development of new products and innovations. For instance, non-comedogenic mineral cosmetics are gaining popularity due to their ability to prevent clogged pores.

Additionally, the market for mineral cosmetics is expanding beyond face makeup to include eye cosmetics and lip care products. The market is expected to continue growing, driven by increasing consumer awareness, health consciousness, and the availability of a wide range of products catering to diverse consumer needs. The market potential for mineral cosmetics is significant, with numerous opportunities for new market initiatives and global presence. In conclusion, mineral cosmetics offer a natural, sustainable, and versatile alternative to traditional cosmetics. With their long-lasting wear, multiple functions, and eco-friendly properties, mineral cosmetics have become a popular choice among consumers. The market for mineral cosmetics is diverse, dynamic, and expanding, driven by various factors, including consumer preferences, health consciousness, and technological advancements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 723.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, UK, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mineral Cosmetics Market Research and Growth Report?

- CAGR of the Mineral Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mineral cosmetics market growth of industry companies

We can help! Our analysts can customize this mineral cosmetics market research report to meet your requirements.