Mining Truck Market Forecast 2023-2027

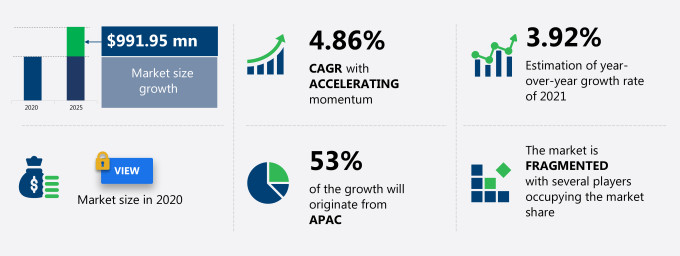

The mining truck market share is expected to increase by USD 991.95 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.86%.

This mining truck market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers market segmentation by product (90-150 tons, 154-255 tons, and 290-363 tons) and geography (APAC, Europe, North America, South America, and MEA).

What will the Mining Truck Market Size be During the Forecast Period?

Download the Free Report Sample to Know More

Mining Truck Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The growth of the mining industry is notably driving the mining truck market growth, although factors such as the shortage of a skilled workforce may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the mining truck industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Mining Truck Market Driver

The growth of the mining industry is one of the key factors expected to propel the market’s growth in the forthcoming years. Owing to the recovery of commodity prices and cost-cutting measures adopted by the mining companies, the mining sector has been able to grow significantly in 2017 post the financial crisis of 2008. Also, several infrastructure projects in the emerging economies, including India and China, are fuelling the growth of the global mining industry. The increasing investments in mining activities being conducted in economies, including Brazil, Chile, China, Argentina, and Australia, will further accelerate the growth of the mining trucks market. Such rising investments in the mining industry will drive the mining truck market to grow during the forecast period.

Key Mining Truck Market Trend

Several companies are automating their mining operations to improve productivity and reduce the number of accidents. Hence, the vendors are also making significant investments in offering automated solutions. The market has witnessed recent developments related to automated trucks in the mining industry. Therefore, the rising adoption of automation will drive the growth of the global mining truck market during the forecast period.

Key Mining Truck Market Challenge

The efficiency and life of mining trucks depend on the skills of operators. There is a shortage of skilled and unskilled workforce in the mining industry. Mining is also not considered a lucrative employment opportunity by the workforce due to the hostile working environment and long hours. Regulatory support for renewable sources of energy has also made coal mining a less preferred work opportunity by the workforce. The aging of the workforce is also a key reason for the shortage. The rising adoption of automation in the mining industry also necessitates the need for training, which is expensive. Therefore, the shortage of a skilled workforce is a challenge for the growth of the global mining truck market during the forecast period.

This mining truck market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

What are the Revenue-generating Product Segments in the Mining Truck Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The mining truck market share growth by the 90-150 tons segment will be significant during the forecast period. 90-150-tons trucks are widely used in small mining sites. The downturn of the mining industry in the last few years resulted in mining companies investing in low-cost operations. Hence, the adoption of 90-150-tons mining trucks was high. The support for small-scale mining also drove the growth of the segment.

This report provides an accurate prediction of the contribution of all the segments to the growth of the mining truck market size and actionable market insights on post COVID-19 impact on each segment.

Which are the Key Regions for Mining Truck Market?

For more insights on the market share of various regions Request for a FREE sample now!

53% of the market’s growth will originate from APAC during the forecast period. China, Australia, and India are the key markets for mining trucks in APAC. Market growth in APAC will be faster than the growth of the market in other regions.

The increasing investments in coal-fired power generation projects will facilitate the mining truck market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

Who are the Major Mining Truck Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AB Volvo

- BAS Holding BV

- BEML Ltd.

- Caterpillar Inc.

- Epiroc AB

- Hitachi Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- SANY Group

- Tata Motors Ltd.

This statistical study of the mining truck market encompasses successful business strategies deployed by the key vendors. The mining truck market is fragmented and the vendors are deploying growth strategies such as offering technologically advanced products to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The mining truck market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

|

Mining Truck Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.86% |

|

Market growth 2021-2025 |

USD 991.95 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.92 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 53% |

|

Key consumer countries |

China, US, Russian Federation, Australia, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AB Volvo, BAS Holding BV, BEML Ltd., Caterpillar Inc., Epiroc AB, Hitachi Ltd., Komatsu Ltd., Liebherr-International AG, SANY Group, and Tata Motors Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Mining Truck Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive mining truck market growth during the next five years

- Precise estimation of the mining truck market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the mining truck industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of mining truck market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch