Motherboard Market Size 2024-2028

The motherboard market size is forecast to increase by USD 12.63 billion at a CAGR of 17.96% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing adoption of smartphones and continuous innovation in motherboard technology. With the global smartphone market projected to reach over 3.8 billion users by 2025, the demand for advanced motherboards to support these devices is on the rise. Additionally, the rapid pace of technological advancements in motherboard design, such as support for higher memory capacities, faster data transfer rates, and improved power efficiency, is fueling market growth. However, the market is not without challenges. The availability of substitutes, such as System on a Chip (SoC) solutions, is putting pressure on motherboard manufacturers to differentiate their offerings and provide added value to customers.

- Furthermore, the increasing complexity of motherboard designs and the need for continuous innovation to stay competitive are increasing development costs and time-to-market. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must focus on delivering innovative, high-performance, and cost-effective motherboard solutions to meet the evolving needs of their customers.

What will be the Size of the Motherboard Market during the forecast period?

- The market encompasses the production and sale of central components that connect various hardware elements in smartphones, computers, and other computing devices. This market exhibits significant activity, driven by the growing digitization of business operational needs and the integration of advanced technological breakthroughs. Chipset capabilities, such as PCIe 4.0 for GPUs and CPUs, play a crucial role in enhancing data processing speed and efficiency. The digital entertainment sector, including gaming and video games, contributes to market growth. Motherboards designed for non-traditional desktops, such as those for gaming and overclocking, are increasingly popular. The integration of BIOS configurations for customization and optimization further caters to user preferences.

- Moreover, the market extends beyond computers, with applications in smartphones, connected vehicles, and other digital devices. The convergence of computing and communication technologies continues to fuel market expansion, as the demand for faster, more powerful, and versatile motherboards grows. Overall, the market is poised for continued growth, driven by technological advancements and evolving business and consumer needs.

How is this Motherboard Industry segmented?

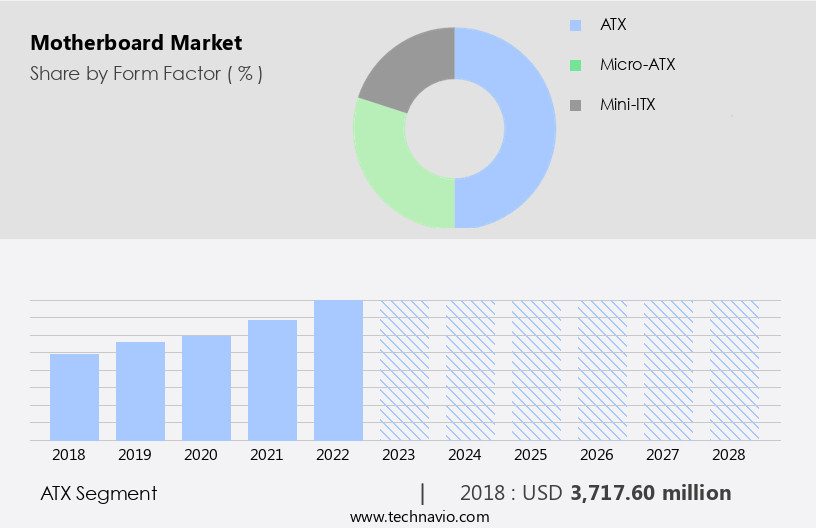

The motherboard industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Form Factor

- ATX

- Micro-ATX

- Mini-ITX

- End-user

- Industrial

- Commercial

- Geography

- APAC

- China

- Japan

- South Korea

- Taiwan

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Form Factor Insights

The atx segment is estimated to witness significant growth during the forecast period.

The market, specifically ATX boards, has experienced significant expansion and modernization since its inception by Intel in 1995. ATX boards, with their standardized dimensions and configurations, have replaced Baby-AT boards in various computing systems, including non-traditional desktops. The latest ATX 3.0 version, released in 2022, boasts advanced connectivity and high-performance components, catering to business operational needs and the digital transformation in industries. Sustainability and automation are key drivers in the industry expansion. ATX boards offer numerous expansion slots for semiconductors, networking possibilities, and I/O ports, enabling industrial automation and smart technologies. In the digital entertainment sector, gaming motherboards feature lightning gaming ports and support for next-generation GPUs, catering to the growing digitization and 5G networks.

Motherboards play a crucial role in the integration of smartphones, computers, and various IoT connected devices. With the increasing demand for advanced connectivity and data processing, ATX boards are customizable, offering BIOS configurations, memory slots, and PCIe 4 GPUs for data analytics and machine learning applications. The market's growth is fueled by the need for high-performance components and the development of infrastructure for automation applications, video streaming apps, and connected vehicles. The technological breakthroughs in ATX boards contribute to the digital transformation in various industries, enabling interoperability and data acquisition modules for industrial activities.

Get a glance at the market report of share of various segments Request Free Sample

The ATX segment was valued at USD 3.72 billion in 2018 and showed a gradual increase during the forecast period.

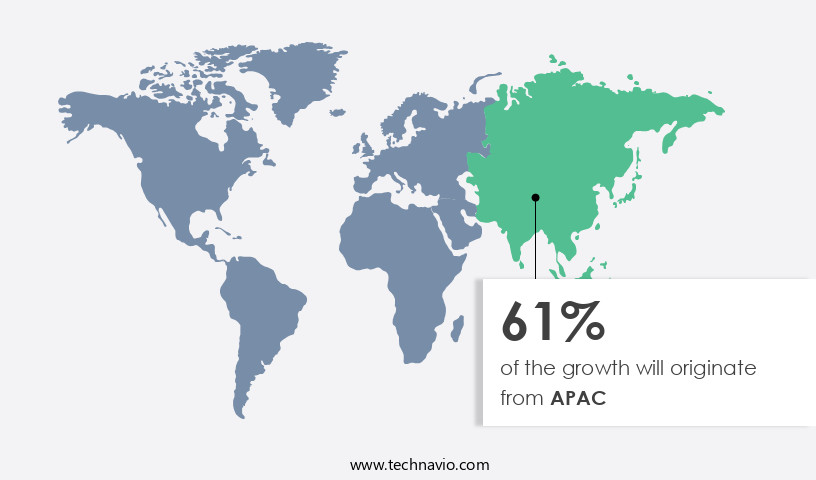

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant expansion, driven by the increasing demand for advanced computing systems in non-traditional desktop applications, such as industrial automation, digital entertainment, and the automotive industry. Sustainability is a key focus in electronics manufacturing, leading to the development of compact motherboards and the integration of smart technologies like machine learning and data acquisition modules. Industry expansion in sectors like automation, smartphones, and computers necessitates high-performance components, including next-generation GPUs, networking possibilities, and connectivity advancements like 5G networks and lightning gaming ports. Motherboards play a crucial role in device connection and interoperability, enabling the use of peripherals and the implementation of advanced connectivity solutions.

The market is expected to grow substantially due to the digitalization trend, population growth, and the increasing adoption of smart technologies in various industries. This growth is fueled by the need for customization, overclocking, and technological breakthroughs in chipset capabilities. Additionally, the digital transformation of businesses and the increasing popularity of video streaming apps, IoT connected devices, and computer on modules contribute to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motherboard Industry?

- Rising adoption of smartphones is the key driver of the market.

- The global smartphone market is experiencing significant growth due to the availability of affordable devices and increasing global Internet penetration. Developing countries like India and China are emerging as major markets for smartphones, driven by rising disposable income and large populations. The evolution of smartphones from 4G LTE to 5G technology has led to more complex RF front ends in 5G devices, necessitating a higher density and smaller form factor for motherboards and other electronic components.

- Additionally, the 5G system's increased data processing capabilities will result in larger battery capacity requirements. To address this challenge, technological advancements are required to compress components without compromising performance. This trend is expected to continue, shaping the future of the market.

What are the market trends shaping the Motherboard Industry?

- Continuous Innovation of motherboards is the upcoming market trend.

- The market is experiencing innovation and technological advancements, with companies introducing new products to cater to evolving consumer needs. For example, in May 2022, ASUS Republic of Gamers (ROG) unveiled a special edition motherboard and graphics card in collaboration with the anime series Evangelion. The ROG MAXIMUS Z690 HERO motherboard and ROG STRIX RTX 3090 graphics card feature distinctive designs, with the graphics card boasting bolted and grooved horizontal lines and emblems of NERV, EVA-01, and ROG on the fans.

- The motherboard displays a dynamic image of the Unit-01 mecha. This collaboration underscores the market's dynamic nature, with companies continually seeking to differentiate themselves through unique offerings.

What challenges does the Motherboard Industry face during its growth?

- Availability of substitutes is a key challenge affecting the industry growth.

- explores the potential of silicon-interconnected fabric (Si-IF) as a possible replacement for traditional motherboards. This innovation enables direct silicon-to-silicon connections, allowing wire linkages to bare chips. The latest Si-IF technology can aggregate a collection of closely integrated, smaller, and simpler chiplets. Processors, analog and RF chiplets, voltage-regulator modules, and even passive components like inductors and capacitors are interconnected via a silicon wafer that ranges from 500 nm to 1 mm in thickness.

- This approach could lead to high-performance computers with the computational capacity of numerous servers on a single wafer of silicon. However, it may pose a challenge to market expansion during the forecast period due to the potential disruption of existing motherboard companies.

Exclusive Customer Landscape

The motherboard market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motherboard market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motherboard market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - This company specializes in providing a range of motherboards, including MicroATX, Mini iTX, and UTX models, catering to various system build requirements. These motherboards support diverse form factors, ensuring compatibility with a broad spectrum of components and applications. By offering such a diverse selection, the company enhances its market reach and positions itself as a versatile solution provider in the technology industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Advantech Co. Ltd.

- Altium LLC

- AOPEN Inc.

- ASRock Inc.

- ASUSTeK Computer Inc.

- BIOSTAR Group.

- Chaintech Technology Corp.

- EVGA Corp.

- Gigabyte Technology Co. Ltd.

- Intel Corp.

- LEADTEK Research Inc.

- Micro Star International Co. Ltd.

- MiTAC Holdings Corp.

- NZXT Inc.

- PNY Technologies Inc.

- SAPPHIRE Technology Ltd.

- Shenzhen Seavo Technology Co. Ltd.

- Super Micro Computer Inc.

- Zotac Technology Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to expand, driven by the increasing demand for advanced computing systems in various industries. Traditional desktop computers have been surpassed by non-traditional computing systems, as sustainability and efficiency become key business operational needs. The industry's expansion is fueled by the capabilities of modern chipsets, enabling electronics manufacturing to automate and integrate various components. The manufacturing sector, in particular, has seen significant growth in the adoption of motherboards with high-performance components and advanced connectivity options. Motherboards play a crucial role in the digital transformation of industries, from smart technologies in the digital entertainment sector to automation applications in industrial automation.

The growing digitization trend has led to the development of compact boards, designed to meet the needs of various applications. The integration of smart technologies, such as machine learning and data acquisition modules, has expanded the capabilities of motherboards. These technologies enable data processing and analytics, making motherboards an essential component of the Internet of Things (IoT) and connected vehicles. The demand for high-performance components, such as CPUs and GPUs, has driven technological breakthroughs in motherboard design. Customization and overclocking options have become popular among enthusiasts, particularly in the gaming industry. The expansion of 5G networks and the development of next-generation GPUs have opened up new possibilities for motherboards.

Lightning gaming ports and advanced connectivity options have become essential features for gaming motherboards, enabling seamless device connection and video streaming apps. The digitalization of industries has led to the emergence of system integrators, who specialize in designing and building customized computing systems. These systems often require motherboards with specific I/O ports and BIOS configurations to meet the unique needs of their clients. The population growth and the increasing demand for digital services have led to the proliferation of smartphones and mobile service subscriptions. Motherboards have become an essential component of mobile devices, enabling advanced features and capabilities.

In , the market is experiencing significant expansion, driven by the increasing demand for advanced computing systems in various industries. Motherboards play a crucial role in the digital transformation of industries, enabling automation, integration, and advanced connectivity. The development of high-performance components and the integration of smart technologies have opened up new possibilities for motherboard design, making them an essential component of the digital age.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.96% |

|

Market growth 2024-2028 |

USD 12628.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.18 |

|

Key countries |

Taiwan, China, US, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motherboard Market Research and Growth Report?

- CAGR of the Motherboard industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motherboard market growth of industry companies

We can help! Our analysts can customize this motherboard market research report to meet your requirements.