US - Online Apparel, Footwear, and Accessories Market 2024-2028

The US - Online Apparel, Footwear, and Accessories Market size is forecast to increase by USD 131.73 billion, at a CAGR of 12.17% between 2023 and 2028. The accelerated growth of the market is due to various factors such as increasing penetration of the internet and smartphones, availability of multiple payment options for online transactions and free shipping and hassle-free return policies.

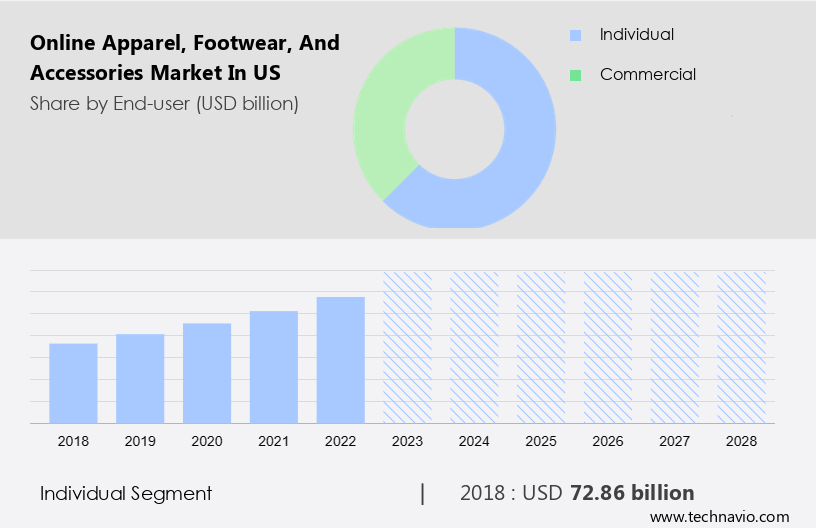

The report includes a comprehensive outlook on the US Online Apparel, Footwear, And Accessories Market, offering forecasts for the industry segmented by End-user, which comprises individual, and commercial. Additionally, it categorizes Gender into women and men and covers Product, including apparel, footwear and accessories. The report provides market size, historical data spanning from 2018 to 2022, and future projections, all presented in terms of value in USD billion for each of the mentioned segments.

What will be the size of the US Online Apparel, Footwear, And Accessories Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

US Online Apparel, Footwear, And Accessories Market: Key Drivers, Trends and Challenges

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key US Online Apparel, Footwear, And Accessories Market Driver

The availability of multiple payment options for online transactions is notably driving the market growth. The evolving online payment landscape is one of the significant factors that is driving the growth of the US - online apparel, footwear, and accessories market. As per the present market scenario, online retailers are opting for feature-rich and secure online payment solutions to facilitate the online sales of apparel, footwear, and accessories. Cards, e-wallets, bank transfers, direct debits, and mobile payments are some of the payment methods offered by online retailers. To remain competitive in the US - online apparel, footwear, and accessories market, vendors have been acquiring additional software or resources to customize the payment methods for secured transactions.

Moreover, the most used online payment methods in the US in 2020 were credit/debit cards and digital wallets, which represented 67% and 10% of all payment transactions, respectively. The other payment methods used are cash on delivery, bank transfers, and others. All these factors will drive the growth of the US online apparel, footwear, and accessories market during the forecast period.

Key US Online Apparel, Footwear, And Accessories Market Trends

Increasing adoption of omnichannel retailing is an emerging trend shaping market growth. Various domestic and international retailers have been incorporating omnichannel retailing across the supply chain in the US - online apparel, footwear, and accessories market. Omnichannel retailing provides an integrated shopping experience for consumers. Online shopping helps consumers save time when compared with physical purchases from stores. On the other hand, omnichannel retailing allows them to touch and feel products before purchasing. In the US, 64% of retailers are using the omnichannel retailing strategy.

For instance, J.C. Penny uses the omnichannel strategy that allows customers to buy online and pick up at stores. It has also created a cart function to provide a seamless shopping experience on multiple devices. Hence, the increasing adoption of omnichannel retailing is expected to be a positive trend for the growth of the US online apparel footwear and accessories market during the forecast period.

Major US Online Apparel, Footwear, And Accessories Market Challenge

Stringent government regulations on the manufacture of apparel, footwear, and accessories is a significant challenge hindering the market growth. The demand for leather as a premium raw material is high in the apparel, footwear, and accessories industry. In addition, the Consumer Product Safety Improvement Act (CPSIA) of the US regulates all children's products, including children's leather products, sold in the US. It includes apparel, footwear, toys, bags, wallets, and other leather goods for children. Third-party lab testing is mandatory for all children's products that are imported into the country. The importers also need to issue a Children's Product Certificate (CPC) for these products. CPC is a document that states the name of the company, applicable standards, address, and test results from the US Consumer Product Safety Commission (CPSC) approved testing company.

Additionally, the act impacted the retailers, manufacturers, and suppliers of leather products such as apparel, handbags, shoes, and belts. Such regulations and restrictions imposed on the leather industry increase the costs for the vendors of leather products and hinder their production processes. Currently, online retailers in the US need to collect tax from consumers if they have a physical presence in the consumer's state, thus hindering the growth of the US online apparel, footwear, and accessories market during the forecast period.

US Online Apparel, Footwear, And Accessories Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

US Online Apparel, Footwear, And Accessories Market Customer Landscape

Who are the Major US Online Apparel, Footwear, And Accessories Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Academy Sports and Outdoors Inc. - The company offers online, apparel, footwear, and accessories such as Magellan Outdoors Adults Snow II boots, Magellan Outdoors Men's waterproof, and Magellan Outdoors mens field boot III.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Amazon.com Inc.

- Backcountry.com LLC

- Berkshire Hathaway Inc.

- Costco Wholesale Corp.

- CustomInk LLC

- eBay Inc.

- Frasers Group plc

- Groupon Inc.

- H and M Hennes and Mauritz GBC AB

- Industria de Diseno Textil SA

- Kering SA

- Kohls Corp.

- LVMH Moet Hennessy Louis Vuitton SE

- Macys Inc.

- Next Plc

- Nordstrom Inc.

- Penney OpCo LLC

- PVH Corp.

- Ralph Lauren Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What are the Largest-Growing Segments in the US Online Apparel, Footwear, And Accessories Market?

The individual segment is estimated to witness significant growth during the forecast period. The growth of the individual end-user segment in the US - online apparel, footwear, and accessories market is influenced by various factors related to changing consumer behaviors, technological advancements, and evolving market trends. The growing trend of consumers preferring online shopping over traditional retail contributes significantly to the individual end-user segments' growth

Get a glance at the market contribution of various segments Download the PDF Sample

The individual segment was the largest and was valued at USD 72.86 billion in 2018. Further, the penetration of digitalization also stimulates the US - online apparel, footwear, and accessories market growth. For instance, Amazon.com, Inc. has virtual try-on technologies that leverage AR to allow users to try on clothing and accessories virtually before making a purchase. This immersive experience reduces uncertainties about fit and style, attracting more individual consumers to online platforms. Thus, as technology continues to advance and consumer preferences evolve, the individual end-user segment is expected to contribute to driving further growth in the US online apparel, footwear, and accessories market during the forecast period.

Segment Overview

The US Online Apparel, Footwear, And Accessories Market report forecasts market growth by revenue and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- End-user Outlook

- Individual

- Commercial

- Gender Outlook

- Women

- Men

- Product Outlook

- Apparel

- Footwear

- Accessories

|

US Online Apparel, Footwear, And Accessories Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.17% |

|

Market Growth 2024-2028 |

USD 131.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.72 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Academy Sports and Outdoors Inc., Amazon.com Inc., Backcountry.com LLC, Berkshire Hathaway Inc., Costco Wholesale Corp., CustomInk LLC, eBay Inc., Frasers Group plc, Groupon Inc., H and M Hennes and Mauritz GBC AB, Industria de Diseno Textil SA, Kering SA, Kohls Corp., LVMH Moet Hennessy Louis Vuitton SE, Macys Inc., Next Plc, Nordstrom Inc., Penney OpCo LLC, PVH Corp., Ralph Lauren Corp., Target Corp., The Gap Inc., Transform Holdco LLC, Under Armour Inc., Walmart Inc., and Zalando SE |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this US Online Apparel, Footwear, And Accessories Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.