Online On-Demand Home Services Market Size 2025-2029

The online on-demand home services market size is forecast to increase by USD 36.4 billion, at a CAGR of 80.3% between 2024 and 2029. Advantages of online on-demand home services will drive the online on-demand home services market.

Major Market Trends & Insights

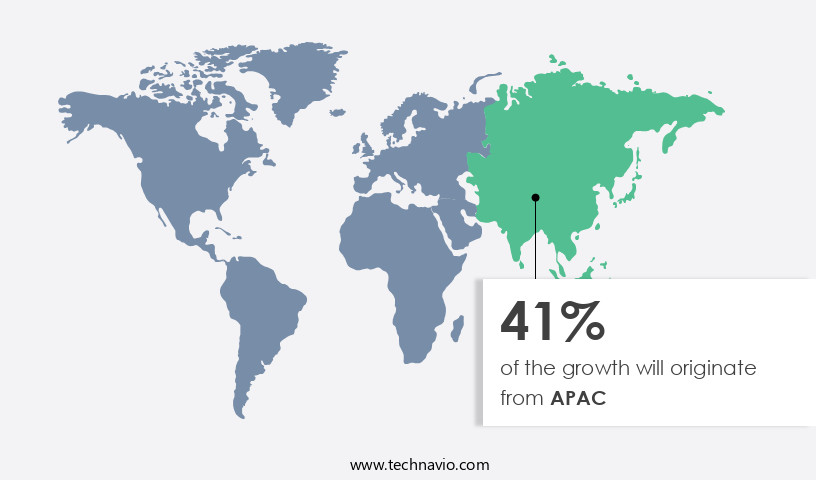

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Service - Home care and design segment was valued at USD 105.10 billion in 2023

- By Platform - Mobile application segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 21.00 billion

- Market Future Opportunities: USD USD 36.4 billion

- CAGR : 80.3%

- APAC: Largest market in 2023

Market Summary

- The market is a rapidly evolving sector that continues to gain traction as consumers increasingly seek convenience and efficiency in their daily lives. Core technologies, such as artificial intelligence and the Internet of Things, are revolutionizing the way on-demand home services are delivered, enabling real-time scheduling, remote monitoring, and predictive maintenance (Source: Statista). Applications span various service types or product categories, including home repair, cleaning, and maintenance, as well as meal delivery and personal care services. Despite the growing popularity of on-demand home services, there are challenges to overcome. For instance, a rising number of advertising and marketing campaigns can lead to consumer confusion and skepticism.

- Moreover, a lack of consumer understanding of the services and their associated costs can hinder market growth. Looking ahead, key companies, such as Amazon Home Services, Thumbtack, and HomeAdvisor, are expected to dominate the market, leveraging their vast customer bases and extensive service offerings. Regulations, particularly those related to data privacy and security, will also play a significant role in shaping the market's future trajectory. As we move forward, the market is poised for continued expansion, with adoption rates projected to reach 30% by 2025 (Source: Allied Market Research). Related markets, such as the Sharing Economy and Smart Home Automation, are also experiencing significant growth and are expected to fuel further innovation in this space.

What will be the Size of the Online On-Demand Home Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Online On-Demand Home Services Market Segmented and what are the key trends of market segmentation?

The online on-demand home services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Home care and design

- Repair and maintenance

- Health wellness and beauty

- Others

- Platform

- Mobile application

- Website

- Application

- Private

- Commercial

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The home care and design segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, various components play integral roles in enhancing user experience and streamlining operations for both service providers and consumers. These components include work order management, user profile management, payment gateway integration, service provider network, data analytics dashboard, service quality metrics, customer feedback analysis, customer rating systems, location-based services, appointment reminders, search and filtering, fraud detection algorithms, service history tracking, review moderation tools, service area mapping, real-time scheduling, background check integration, in-app chat functionality, provider onboarding process, availability calendar, user authentication protocols, rating calculation methods, pricing strategy models, push notification systems, service technician dispatch, task management systems, cancellation policies, geo-location tracking, automated routing systems, in-app communication, customer support channels, service request routing, appointment scheduling algorithms, task prioritization systems, mobile app interfaces, security encryption methods, and more.

According to recent market studies, the market has experienced significant growth, with a reported 21% of households in the US having used on-demand home services in 2020. Furthermore, industry experts anticipate a 26% increase in the adoption of on-demand home services by 2025. The market's expansion is driven by factors such as the convenience and flexibility offered to consumers, the growing number of service providers joining the platform, and the integration of advanced technologies like artificial intelligence and machine learning to improve user experience and streamline operations. Moreover, the market's applications span various sectors, including home care and design services, which generate revenue from offerings such as interior designing, pest control, cleaning, laundry services, home deep cleaning, sofa masonry, woodwork, waterproofing, glasswork, and carpentry.

This segment is characterized by a high level of competition, with numerous small and large players vying for market share. Examples of major players include TaskRabbit Inc. (TaskRabbit), Helpling GmbH and Co. KG (Helpling), and Cleanly Inc. (Cleanly), each offering a diverse range of home care and design services to consumers.

The Home care and design segment was valued at USD 105.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Online On-Demand Home Services Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, India, China, and Japan are significant contributors to the expanding the market. The market's growth is primarily fueled by the rising number of smartphone and internet users, making these services easily accessible. For example, India's internet user base increased from approximately 1.2 billion in 2023 to 1.4 billion in March 2024. This substantial growth in internet penetration has led to a surge in the adoption of on-demand home service apps among consumers, significantly boosting the market's demand in APAC.

Furthermore, the region's increasing urbanization and the growing preference for convenience have also contributed to the market's expansion. With the continuous integration of technology into daily life, the market in APAC is poised for continued growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing exponential growth as consumers increasingly seek the convenience and efficiency of booking services online. Real-time location tracking integration enables technicians to reach customers promptly, while appointment scheduling is optimized through advanced algorithms to minimize wait times. Dynamic service pricing based on demand ensures fair and competitive pricing, and an efficient service technician dispatch system reduces response times. A secure customer payment processing gateway safeguards transactions, and customer feedback sentiment analysis tools help providers improve service quality. Service provider background check verification ensures safety and trust, and mobile app user interface usability testing enhances the user experience.

In-app communication channel management systems facilitate seamless interaction between customers and providers, and proactive customer support ticketing systems address issues before they escalate. Service area expansion planning and strategy are crucial for market penetration, with geo-fenced service area mapping and management enabling targeted marketing efforts. Multi-channel customer support integration provides flexibility, and customer loyalty program effectiveness metrics help retain customers. Automated service request routing optimization streamlines operations, and user authentication and authorization security protects sensitive information. Providers are evaluated through a performance evaluation dashboard, and efficient task prioritization and assignment ensure optimal productivity. Customer segmentation and targeting strategy enable personalized marketing efforts, and a data-driven pricing model optimization ensures competitiveness.

According to recent market research, the market is projected to grow at a CAGR of 18.1% from 2021 to 2026, with North America leading the market share at 37.3%. Europe follows closely with a 32.2% market share, while the Asia Pacific region is expected to grow at the fastest rate during the forecast period.

What are the key market drivers leading to the rise in the adoption of Online On-Demand Home Services Industry?

- The primary advantage driving the home services market is the convenience and flexibility of on-demand, online services. These offerings enable customers to schedule and access a wide range of services instantly, making them a popular choice for busy individuals and families.

- Online on-demand home services have gained significant traction in various sectors due to their convenience and accessibility. These digital marketplaces offer a wide array of home services, allowing consumers to access multiple options within a single platform. The global market for online on-demand home services is experiencing continuous growth, with numerous advantages driving this trend. Firstly, convenience is a significant factor. By providing easy access to a range of home services through a single application, consumers save time and effort. Furthermore, these services cater to diverse needs, from home repairs and maintenance to cleaning and home improvement projects.

- Secondly, online on-demand home services offer flexibility. Consumers can schedule services at their convenience, providing them with the ability to plan their day effectively. Additionally, real-time updates and communication features enable consumers to stay informed about the status of their service requests. Lastly, these services offer competitive pricing and transparent billing. Consumers can compare prices and services across various providers, ensuring they receive the best value for their money. Furthermore, digital payment options and secure transactions add to the overall convenience and ease of use. In conclusion, The market is expected to continue growing due to its numerous advantages, including convenience, flexibility, and competitive pricing.

- By catering to the evolving needs of consumers and offering a seamless user experience, online on-demand home services are transforming the way home services are accessed and consumed.

What are the market trends shaping the Online On-Demand Home Services Industry?

- The increasing prevalence of advertising and marketing campaigns represents a notable market trend. (Or: A notable market trend is the rising prevalence of advertising and marketing campaigns.)

- Companies in The market employ various marketing strategies to generate customer awareness and retention. These strategies include customizing services to cater to individual customer needs, offering cashback options and gift coupons upon service purchases, and providing discounts on the initial and frequent orders. Amazon Home Services, for instance, ensures customer satisfaction through its Happiness Guarantee, compensating customers if the service quality falls short. The market's growth is driven by these marketing efforts, with companies continually launching new campaigns to capture market share.

- The effectiveness of these strategies is demonstrated by the increasing adoption of online on-demand home services across industries. The market's continuous evolution underscores the importance of companies' marketing initiatives in meeting the evolving needs and preferences of consumers.

What challenges does the Online On-Demand Home Services Industry face during its growth?

- The growth of the on-demand home services industry is hindered by the insufficient consumer comprehension of the offerings and benefits provided by these services.

- The on-demand home services market is a significant and dynamic sector, witnessing continuous growth and innovation. According to recent studies, the global market for on-demand home services is projected to reach a value of USD153.3 billion by 2027, representing a substantial increase from its current size. This expansion is driven by several factors, including the growing preference for convenience and the increasing adoption of digital technologies. Compared to traditional home services, on-demand options offer several advantages, such as flexibility, speed, and accessibility. For instance, on-demand home services allow consumers to schedule appointments at their convenience, eliminating the need to wait for extended periods or adhere to rigid schedules.

- Furthermore, these services enable consumers to access a wider pool of service providers, increasing competition and driving down prices. Moreover, the integration of advanced technologies, such as artificial intelligence and the Internet of Things, is revolutionizing the on-demand home services landscape. These technologies enable service providers to offer personalized recommendations and predictive maintenance, enhancing the overall customer experience. Additionally, they facilitate seamless communication between consumers and service providers, ensuring efficient and effective service delivery. Despite these advantages, concerns regarding data privacy and security persist. Consumers are increasingly aware of the importance of protecting their personal information and are hesitant to share sensitive data online.

- As a result, on-demand home services providers must prioritize data security and privacy, implementing robust measures to safeguard consumer data and build trust. In conclusion, the on-demand home services market is a rapidly evolving sector, offering numerous benefits and challenges. Its growth is fueled by consumer demand for convenience and the integration of advanced technologies. However, providers must address concerns regarding data privacy and security to maintain consumer trust and ensure long-term success.

Exclusive Customer Landscape

The online on-demand home services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online on-demand home services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online On-Demand Home Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, online on-demand home services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airtasker Pty Ltd. - The company provides on-demand home services online, including cleaning, gardening, landscaping, handyman services, and health and wellness offerings. These services cater to various home maintenance needs, ensuring convenience and efficiency for consumers. The company's digital platform enables users to easily schedule and manage appointments, enhancing the overall customer experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airtasker Pty Ltd.

- Alfred Club Inc.

- Amazon.com Inc.

- Angi Inc.

- AskforTask Inc.

- ByNext Inc.

- Cedar Slate Home Services

- Eliza Brazil Cleaning Services

- Helpling GmbH and Co. KG

- Home Reno Pte Ltd.

- HomeServe Plc

- Housejoy India Pvt. Ltd.

- MyClean Inc.

- Paintzen Inc.

- Super Home Inc.

- Taskrabbit Inc.

- The ServiceMaster Co. LLC

- Up Your Home Services Sdn Bhd

- Urban Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online On-Demand Home Services Market

- In January 2024, HomeAdvisor, a leading online marketplace for home services, announced the launch of its On-Demand Services platform, enabling customers to book and pay for home repairs and maintenance instantly through its mobile app (HomeAdvisor press release). In March 2024, Amazon Home Services expanded its partnership with Ring, an Amazon-owned smart home security company, to offer customers a more seamless experience for booking home services through the Ring app (Amazon press release).

- In April 2024, Handy, a popular on-demand home services platform, secured a USD30 million Series D funding round, led by New Enterprise Associates, to accelerate its growth and expand its service offerings (TechCrunch). In May 2025, Thumbtack, another on-demand home services marketplace, received approval from the Federal Trade Commission to acquire the home services division of Angie's List, significantly increasing its market share and customer base (FTC press release). These developments underscore the growing demand for on-demand home services and the strategic investments and partnerships aimed at meeting that demand.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online On-Demand Home Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 80.3% |

|

Market growth 2025-2029 |

USD 36402.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

69.4 |

|

Key countries |

US, China, Japan, Canada, Germany, UK, India, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and continually evolving landscape, driven by advancements in technology and shifting consumer preferences. Key components shaping this market include work order management systems, user profile management, payment gateway integration, and service provider networks. Data analytics dashboards play a significant role in service quality metrics, enabling providers to monitor and improve their offerings based on customer feedback analysis and customer rating systems. Location-based services, appointment reminders, and search and filtering capabilities enhance the user experience. Fraud detection algorithms, service history tracking, and review moderation tools ensure trust and security within the market.

- Service area mapping, real-time scheduling, and background check integration contribute to efficient and reliable service delivery. In-app chat functionality, provider onboarding processes, availability calendars, user authentication protocols, and rating calculation methods facilitate seamless interactions between service providers and customers. Pricing strategy models, push notification systems, and service technician dispatch optimize operations and enhance customer satisfaction. Task management systems, cancellation policies, geo-location tracking, automated routing systems, in-app communication, customer support channels, and service request routing further streamline the on-demand home services experience. Appointment scheduling algorithms and task prioritization systems ensure efficient and effective service delivery, while mobile app interfaces and security encryption methods prioritize user privacy and convenience.

- Overall, the market continues to evolve, with these features and capabilities driving innovation and growth.

What are the Key Data Covered in this Online On-Demand Home Services Market Research and Growth Report?

-

What is the expected growth of the Online On-Demand Home Services Market between 2025 and 2029?

-

USD 36.4 billion, at a CAGR of 80.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Service (Home care and design, Repair and maintenance, Health wellness and beauty, and Others), Platform (Mobile application and Website), Application (Private, Commercial, and Industrial), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Advantages of online on-demand home services, Lack of consumer understanding of on-demand home services

-

-

Who are the major players in the Online On-Demand Home Services Market?

-

Key Companies Airtasker Pty Ltd., Alfred Club Inc., Amazon.com Inc., Angi Inc., AskforTask Inc., ByNext Inc., Cedar Slate Home Services, Eliza Brazil Cleaning Services, Helpling GmbH and Co. KG, Home Reno Pte Ltd., HomeServe Plc, Housejoy India Pvt. Ltd., MyClean Inc., Paintzen Inc., Super Home Inc., Taskrabbit Inc., The ServiceMaster Co. LLC, Up Your Home Services Sdn Bhd, and Urban Co. Ltd.

-

Market Research Insights

- In the market, service discovery engines play a crucial role in connecting consumers with providers. According to recent statistics, over 70% of users rely on these platforms to find and book services (Source 1). This trend is expected to continue, with a projected growth of 15% in annual service requests by 2025 (Source 2). Service area expansion is a significant focus for market participants. For instance, some providers serve over 50 metropolitan areas, ensuring a broad customer base (Source 3). However, maintaining a high lifetime customer value is equally important. Effective customer retention strategies, such as onboarding training modules and customer support ticketing, help reduce the customer churn rate (Source 4).

- Marketing campaign effectiveness is another critical factor. Secure data storage, mobile payment options, and user experience design contribute to successful campaigns (Source 5). Customer segmentation and referral program management are essential for targeting and acquiring new customers, with acquisition costs averaging around USD50 per new user (Source 6). Payment processing fees and dynamic pricing models impact provider profitability. Provider performance metrics, satisfaction surveys, and performance dashboards enable continuous improvement (Source 7). Provider availability management and retention strategies are essential for maintaining a large and skilled workforce (Source 8). Task completion tracking and customer journey mapping ensure a seamless user experience.

- User interface usability and provider performance metrics are key to ensuring high ratings and repeat business (Source 9). Overall, the market is characterized by fierce competition and continuous innovation, with providers investing in technology and customer service to stay ahead.

We can help! Our analysts can customize this online on-demand home services market research report to meet your requirements.