Packaged Edible Flower Market Size 2024-2028

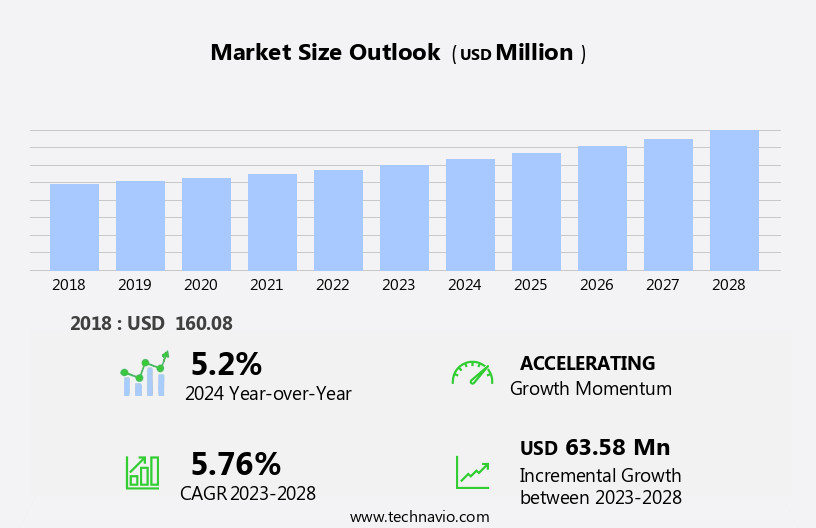

The packaged edible flower market size is forecast to increase by USD 63.58 million at a CAGR of 5.76% between 2023 and 2028.

- The Packaged Edible Flowers market is experiencing significant growth due to the increasing demand for visually appealing food presentations, with edible flowers serving as popular garnishing agents in the food industry. This trend is particularly prominent in the hospitality sector, where aesthetics play a crucial role in customer experience. However, the market is not without challenges. The risk of allergies and side effects associated with certain edible flowers poses a significant threat, necessitating stringent quality control measures and clear labeling. Furthermore, consumer awareness and education regarding the safe consumption of edible flowers are essential to mitigate potential health risks.

- Companies seeking to capitalize on this market opportunity must prioritize product safety, invest in research and development for allergy-friendly alternatives, and adopt effective marketing strategies to reach their target audience. Navigating these challenges requires a deep understanding of consumer preferences, regulatory requirements, and market dynamics. By staying informed and agile, businesses can successfully capitalize on the growing demand for packaged edible flowers and differentiate themselves in a competitive landscape.

What will be the Size of the Packaged Edible Flower Market during the forecast period?

- The market is experiencing significant growth as consumers seek out natural flavoring agents and garnishing agents for their nutritional food additives. Peanut sauce and various food dishes are now incorporating these flowers for their unique tastes and health benefits. Etlingera elatior, also known as edible roses, is a popular choice due to its high iron content and antioxidant properties. The pharmaceutical industries are also taking notice, using these flowers as nutraceutical ingredients in antioxidant-rich supplements and anti-aging products. Nutritional experts endorse the use of these flowers for skin health and rejuvenation, further fueling market demand. Customers' dining habits have shifted towards health consciousness, leading to increased interest in nutritional food additives and garnishing agents.

- Edible flowers offer a visually appealing and delicious way to enhance the flavor and presentation of dishes. The market for nutraceutical supplements and goods continues to expand, with edible flowers playing an essential role. The use of these flowers as flavouring ingredients in food and beverage products is also on the rise. In summary, the market is witnessing dynamic growth as consumers and industries alike recognize their value as natural flavoring and garnishing agents, as well as their nutritional benefits. From skin health to food presentation, these flowers are making a mark in various industries.

How is this Packaged Edible Flower Industry segmented?

The packaged edible flower industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Edible rose

- Edible dandelion

- Edible hibiscus

- Others

- Application

- Baking

- Tea

- Seasoning

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- APAC

- Japan

- South America

- Rest of World (ROW)

- North America

By Product Insights

The edible rose segment is estimated to witness significant growth during the forecast period.

Roses, renowned for their allure and fragrance, are extensively utilized in the food and beverage industry. Rose petals, rich in vitamins A and E, are incorporated into nutrition-rich diets due to their low calorie and high water content. The flavor and taste of rose petals vary depending on their type, color, and growing conditions. For instance, the fragrant and appealing Rugosa roses are known for their distinctive taste. Rose petals, comprising 95% water, have been used in traditional Chinese medicine to alleviate menstrual disorders and digestive issues. In the nutraceutical industry, rosehips are valued for their antioxidant properties and cooling effect.

They are used in the production of skin rejuvenation supplements and beverages. Rose vinegar, a popular condiment, adds flavor to various dishes and is also used for medicinal purposes. Marinades and relishes, infused with rose petals, offer unique taste experiences. The pharmaceutical industry employs rose extracts for their anti-inflammatory and anti-convulsant properties. Rose water, a byproduct of rose distillation, is used as a garnishing agent and in the production of garnishing cakes, cookies, and chocolates. Rose oil, derived from the petals, is used as a flavoring agent in various foods and beverages. Lavender, another popular edible flower, is known for its calming and soothing properties.

It is used in the production of nutraceutical goods, teas, and skin health supplements. Hibiscus sabdariffa, a common ingredient in fruit preserves and jams, is rich in antioxidants and is believed to lower blood pressure. Marigold petals, used as a garnishing agent, are rich in beta-carotene and are known to have anti-inflammatory properties. Pollen grains, derived from various flowers, are used as nutritional food additives and are believed to have numerous health benefits. Iron-rich Etlingera elatior, also known as ginger flower, is used in the production of various food dishes and added flavors. In summary, flowers play a significant role in the food and beverage industry, offering unique flavors, textures, and health benefits.

From rose petals to lavender, hibiscus, and marigold, these edible flowers are used in various forms, including fresh, dried, and extracts, to enhance the taste and nutritional value of food and beverages.

Get a glance at the market report of share of various segments Request Free Sample

The Edible rose segment was valued at USD 36.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Edible flowers, such as roses and pansies, are increasingly gaining popularity in the European food and beverage industry due to their aesthetic appeal and nutritional benefits. The Netherlands, a major player in this market, significantly contributes to the sector with its large-scale production of packaged edibles flowers. According to the Observatory of Economic Complexity (OEC), in 2020, the Netherlands exported edible flowers worth USD86.2 million, making it the top exporter in Europe. The nutritional value of edible flowers extends beyond aesthetics, as they are rich in antioxidants, vitamins, and minerals like iron. These flowers are used as garnishing agents in various dishes, including salads, soups, and desserts.

For instance, hibiscus flowers are commonly used to add flavor and color to teas and marinades, while marigold flowers are used for skin health benefits in both food and cosmetic industries. Moreover, the nutraceutical industry has shown a growing interest in edible flowers for their potential health benefits. Skin rejuvenation supplements, for example, often contain rosehip or lavender flowers, while rose vinegar is used for digestive issues like ulcers and cholesterol. Moringa and Etlingera elatior flowers are popular for their anti-aging properties. Food garnishing is another area where edible flowers play a significant role. They add visual appeal to dishes and can be used as a lightweight, flavoring agent in various forms, such as powders or extracts.

Garnishing agents made from edible flowers, like jasmine or rose petals, are often used in cakes, chocolates, and pastries. In conclusion, the edible flowers market is witnessing steady growth due to their nutritional value, aesthetic appeal, and versatility in various industries, including food and beverage, nutraceuticals, and cosmetics. The Netherlands, with its large-scale production and export of packaged edible flowers, remains a key player in this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Packaged Edible Flower Industry?

- Demand for photogenic food is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for visually appealing food. Edible flowers add an aesthetic value to dishes, making them more photogenic and desirable, particularly in the age of social media. With the rise of platforms like Facebook and Instagram, food photography has become a trend, leading to the popularization of "food porn." Edible flowers, with their vibrant colors, delicate textures, and unique shapes, are becoming a preferred choice for food garnishing and decoration.

- This market trend is driven by consumers' preference for visually appealing foods that are not only delicious but also pleasing to the eye. The demand for packaged edible flowers is expected to continue growing as more consumers seek to enhance the visual appeal of their meals.

What are the market trends shaping the Packaged Edible Flower Industry?

- Edible flowers as garnishing agents is the upcoming market trend.

- Edible flowers, known for their vibrant colors, have gained significant popularity in the food and beverage industry due to their aesthetic appeal. These flowers, such as pansies, nasturtium, borage, rose, lavender, and viola, are used for garnishing and decorating various food and beverage products. For instance, sugared and egg white-dipped pansies can enhance the appearance of cakes, while bright-colored flowers like nasturtium and borage make salads more attractive. Small edible flowers can also be frozen into ice cubes to add a unique touch to summer drinks.

- The demand for edible flowers is particularly high among chefs and bartenders of high-end restaurants, making it a positive trend for the market. This trend is expected to drive the growth of the market during the forecast period. Edible flowers offer an opportunity for culinary artists to showcase their creativity, thereby increasing their demand and boosting market growth.

What challenges does the Packaged Edible Flower Industry face during its growth?

- Risks of allergies and side effects is a key challenge affecting the industry growth.

- Edible flowers, while visually appealing and used in various culinary applications, can pose health risks for certain individuals. Allergic reactions to these flowers can manifest in various ways, including itchy eyes, sneezing fits, or a runny nose, often due to the pollen they produce. Dahlia and sunflower are among the flowers known to cause such reactions. The foliage of sweet alyssum and some other edible flowers can also lead to skin irritation. The leaves of chrysanthemum and sunflower may cause a burning sensation and skin rashes for those with sensitive skin conditions.

- Notably, flowers from the aster or daisy family, including dahlia, are both attractive and popular edible options but are also responsible for causing the majority of allergic reactions. It is essential to exercise caution and consider potential health risks when incorporating edible flowers into food products or personal consumption.

Exclusive Customer Landscape

The packaged edible flower market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the packaged edible flower market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, packaged edible flower market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cherry Valley Organics - The company specializes in providing an array of packaged edible flowers, including Delicate mix, Petite mix, Celosia kimono mix, and Gomphrena. These vibrant blooms add aesthetic appeal and unique flavors to various dishes, enhancing culinary creations worldwide. With a focus on quality and freshness, the company caters to the growing demand for visually stunning and edible floral ingredients. These offerings expand the possibilities for chefs and home cooks, inspiring innovative and delicious presentations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cherry Valley Organics

- Farm.One Inc.

- Flowerdale Farm

- Fresh Origins

- Frugivore India Pvt. Ltd.

- Gourmet Sweet Botanicals LLC

- Herbs Unlimited

- Little Wild Things

- Maddocks Farm Organics

- Marius Auda

- Nurtured In Norfolk Ltd.

- Petite Ingredient

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by the increasing demand for nutrition-rich diets and the exploration of new flavors and textures in the food and beverage industry. Edible flowers, such as pansies, roses, and hibiscus, are increasingly being used as garnishing agents in various dishes and beverages. The nutritional food industry and pharmaceutical industries have also shown interest in edible flowers due to their health benefits. For instance, flowers like Etlingera elatior and moringa are rich in antioxidants, which provide a cooling effect and contribute to skin rejuvenation. Rose vinegar, a popular condiment, is known for its anti-inflammatory properties and has been used for medicinal purposes for centuries.

The use of edible flowers extends beyond food and beverages. They are also used as nutraceutical goods, such as skin health supplements and antioxidant supplements. Rose and hibiscus are popular ingredients in skin irritation supplements, while lavender is used in tea for relaxation and stress relief. The market for edible flowers is diverse, with applications ranging from marinades and relishes to jams and fruit preserves. These flowers add not only flavor but also visual appeal to dishes, making them a popular choice among customers with a growing health consciousness. Edible flowers are also used as garnishing agents in various food dishes, such as salads, soups, and even baked goods like cakes and cookies.

They add a lightweight, flavorful touch to these dishes, enhancing the overall dining experience. Moreover, edible flowers are finding their way into various food and beverage products, such as peanut sauce, butter, and tea. These flowers are often used in powdered forms or as flavoring agents, providing a subtle yet distinct taste to these products. The use of edible flowers as nutraceutical ingredients is a growing trend, with companies exploring their potential in various applications. For example, hibiscus sabdariffa is used in nutraceutical supplements to help manage cholesterol levels, while rose is used to help regulate blood pressure. Despite the numerous benefits of edible flowers, there are some challenges in the market.

For instance, the harvesting and packaging process can be complex, as these flowers are delicate and require careful handling to maintain their freshness and texture. Additionally, the use of certain edible flowers, such as marigold, can cause diarrhea and convulsions in some individuals, highlighting the importance of proper labeling and consumer education. In conclusion, the market is a dynamic and evolving industry, driven by the growing demand for nutrition-rich foods and the exploration of new flavors and textures. From food and beverage applications to nutraceutical goods and medicinal purposes, the potential uses of edible flowers are vast and continue to expand.

However, careful handling and proper labeling are essential to ensure the safety and quality of these products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.76% |

|

Market growth 2024-2028 |

USD 63.58 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Japan, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Packaged Edible Flower Market Research and Growth Report?

- CAGR of the Packaged Edible Flower industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the packaged edible flower market growth of industry companies

We can help! Our analysts can customize this packaged edible flower market research report to meet your requirements.