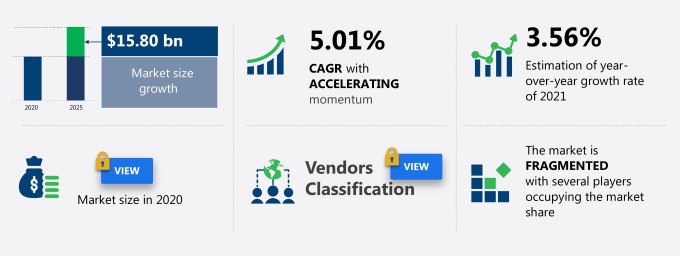

The packaging market share in India is expected to increase by USD 15.80 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 5.01%.

This packaging market research report of India provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers packaging market segmentation in India by product (rigid packaging and flexible packaging) and end-user (food and beverages, pharmaceuticals, consumer electronics, and others). The packaging market report of India also offers information on several market vendors, including Amcor Plc, Constantia Flexibles Group GmbH, Cosmo Films Ltd., Essel Propack Ltd., Jindal Poly Films Ltd., Oji Holdings Corp., Tetra Laval International SA, TPCL Packaging Ltd., UFlex Ltd., and Uma Group among others.

What will the Packaging Market Size in India be During the Forecast Period?

Download the Free Report Sample to Unlock the Packaging Market Size in India for the Forecast Period and Other Important Statistics

Packaging Market in India: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post COVID-19 era. The shift toward the use of flexible packaging is notably driving the packaging market growth in India, although factors such as government regulations on plastic recycling and the use of single-use plastics may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the packaging industry in India. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Packaging Market Driver in India

Flexible packaging makes use of the best characteristics of paper, aluminum foil, and plastic without compromising the freshness, durability, printability, and barrier protection of the packaged product. They are used as an effective packaging solution to improve the shelf life of products. The features of flexible packaging, such as lightweight, small size, and ease in deposal, have made it an effective option for packaging. Flexible packaging consumes less energy during the manufacturing, transportation, and disposal processes and is an economical packaging method. Flexible packaging also produces less packaging waste when compared to rigid packaging. Such factors have increased the demand for flexible packaging among food and beverage, consumer durable, and pharmaceutical manufacturing companies.

Key Packaging Market Trend in India

The growth of the organized retail sector in India, one of the critical packaging market trends in India, will significantly influence market growth. Retailers prefer flexible packaging as it helps in preserving the quality of products and lengthening their shelf life and can also influence buyers during the purchase decision-making process. Because of the increasing Internet penetration and the growing e-commerce industry in the country, the organized retail industry in India will witness considerable growth. The retail industry is developing in tier-2 and tier-3 cities in India, in addition to the major cities and metros. Factors such as changing demographic profiles, rising disposable incomes, growing urbanization, and changing consumer tastes and preferences are driving the growth of the organized retail market in India.

Key Packaging Market Challenge in India

Generally, some of the plastics used for packaging are non-degradable in nature, and their disposal generates landfill problems. The process of disposing of plastics incurs a high labor and equipment cost. Moreover, due to the rising focus on recyclability, by governments and environmental organizations, plastic manufacturers are focusing on adopting alternate packaging solutions to reduce plastic landfills. The Government of India announced a plan on October 2, 2019, to phase out single-use plastics by 2022. As a result of this, the government has asked e-commerce and manufacturing companies to reduce the use of single-use plastics for packaging. The government has also proposed a plan to curb single-use plastics, including plastic bags, small bottles, cups, plates, straws, and sachets. Such regulations are expected to directly impact the vendors in the market and force end-users to adopt biodegradable packaging materials during the forecast period.

This packaging market analysis report of India also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

The growth in the global metal and glass containers market will be driven by factors such as the growing packaging industry, high demand for plastic packaging, and growing use of glass packaging. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the packaging market in India during the forecast period.

Who are the Major Packaging Market Vendors in India?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Amcor Plc

- Constantia Flexibles Group GmbH

- Cosmo Films Ltd.

- Essel Propack Ltd.

- Jindal Poly Films Ltd.

- Oji Holdings Corp.

- Tetra Laval International SA

- TPCL Packaging Ltd.

- UFlex Ltd.

- Uma Group

This statistical study of the packaging market in India encompasses successful business strategies deployed by the key vendors. The packaging market in India is fragmented and the vendors are offering sustainable packaging and smart packaging solutions to compete in the market.

Product Insights and News

- Amcor Plc - The company offers flexible packaging solutions for beverage, food, healthcare, home care, personal care, pet care, and technical applications.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The packaging market forecast report of India offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Packaging Market Value Chain Analysis in India

Our report provides extensive information on the value chain analysis for the packaging market in India, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the metal and glass containers market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Industry innovation

The report has further elucidated on other innovative approaches being followed by vendors to ensure a sustainable market presence.

What are the Revenue-generating Product Segments in the Packaging Market in India?

To gain further insights on the market contribution of various segments Request for a FREE sample

The packaging market share growth in India by the rigid packaging segment will be significant during the forecast period. The growth of the consumer electronics industry will have a direct and positive impact on the demand for rigid packaging in the country during the forecast period. The demand for rigid packaging from end-users such as the manufacturers of consumer electronics products is likely to fuel the demand for retail-ready packagings, such as folding carton packaging, in India during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the packaging market size in India and actionable market insights on post COVID-19 impact on each segment.

|

Packaging Market Scope in India |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.01% |

|

Market growth 2021-2025 |

$ 15.80 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.56 |

|

Regional analysis |

India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Amcor Plc, Balmer Lawrie & Co. Ltd., Bilcare Ltd., Constantia Flexibles Group GmbH, Cosmo Films Ltd., Ess Dee Aluminium Ltd., Essel Propack Ltd., FlexiTuff Ventures International Ltd., Huhtamaki Oyj, Jindal Poly Films Ltd., Kapco Packaging, Oji Holdings Corp., Parekh Aluminex Ltd., Polyplex Corp. Ltd., Tetra Laval International SA, Time Technoplast Ltd., TPCL Packaging Ltd., Tri-Wall Ltd., UFlex Ltd., and Uma Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Packaging Market Report of India?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive packaging market growth in India during the next five years

- Precise estimation of the packaging market size in India and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of packaging market vendors in India

We can help! Our analysts can customize this report to meet your requirements. Get in touch