Paints And Coatings Additives Market Size 2024-2028

The paints and coatings additives market size is forecast to increase by USD 2.21 billion at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Paints And Coatings Additives Market During the Forecast Period?

How is this Paints And Coatings Additives Industry segmented and which is the largest segment?

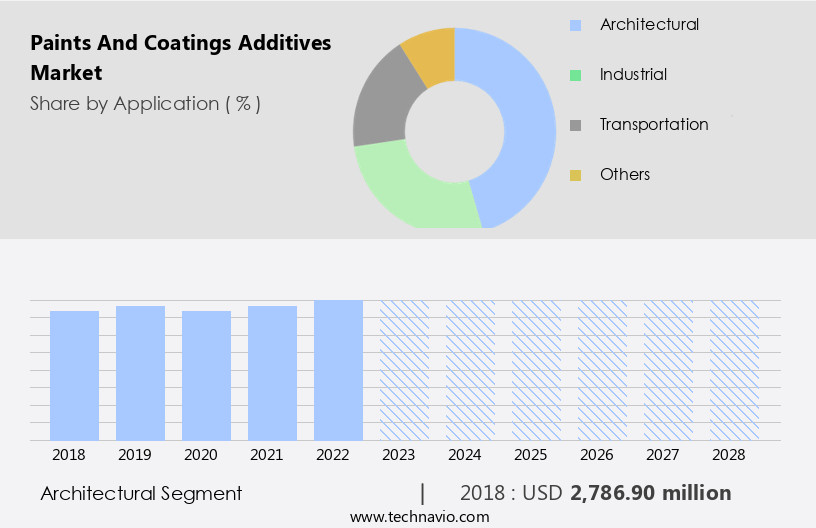

The paints and coatings additives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Architectural

- Industrial

- Transportation

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

- The architectural segment is estimated to witness significant growth during the forecast period.

The market experienced notable expansion in 2023, driven by the construction industry's growth, particularly in developing countries like India, China, Brazil, and Thailand. Consumer preference for low Volatile Organic Compounds (VOC) and low-odor additives in paints and coatings is fueling market growth. Paints and coating additives serve various applications, including defoamers, dispersants, rheological modifiers, and wetting agents, ensuring structural integrity in residential and non-residential buildings. Architectural paints and coatings cater to both exterior and interior applications, providing waterproof coatings. Key additives include polymers, silicates, chemicals, gases, liquids, and rheology modifiers, pigments, colorants, fillers, solvents, UV stabilizers, and biocides.

Market trends prioritize sustainability, with the adoption of water-borne and powder-based coatings, as well as eco-friendly products. Regulations and sustainability concerns influence formulations, with a focus on VOC content, greener constructions, and nanotechnology. The market comprises segments such as architectural, automotive, wood, industrial, and DIY, with each segment presenting unique challenges and opportunities.

Get a glance at the Paints And Coatings Additives Industry report of share of various segments Request Free Sample

The Architectural segment was valued at USD 2.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is experiencing significant growth due to increasing construction activities and industrialization, particularly in China and India. This growth is driven by the rising demand from industries such as automotive, architectural, and defense. China and India, being the largest automotive producers globally, have a high demand for automotive products, which is expected to fuel the growth of the market in APAC. Key applications of these additives include performance enhancement, appearance improvement, durability, adhesion, rheology modification, UV radiation protection, corrosion resistance, abrasion resistance, and impact resistance. Additives used include polymers, silicates, chemicals, gases, liquids, rheology modifiers, pigments, colorants, fillers, solvents, UV stabilizers, and various others.

Environmental concerns and sustainability are also influencing the market, with a shift towards water-borne coatings and powder-based coatings. Regulations and raw material availability are some of the technical hurdles In the market. Key segments include architectural, automotive, wood, industrial, aerospace, marine, and DIY sectors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Paints And Coatings Additives Industry?

Growing construction activities is the key driver of the market.

What are the market trends shaping the Paints And Coatings Additives Industry?

Potential application of nano-structured additives in paints and coatings is the upcoming market trend.

What challenges does the Paints And Coatings Additives Industry face during its growth?

Regulations on high emissions of VOC is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The paints and coatings additives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paints and coatings additives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paints and coatings additives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allnex GMBH - The market encompasses a range of products that enhance and improve the performance of paint and coating formulations. One notable offering within this category includes ADDITOL XL 6592 and ADDITOL P 964. These additives contribute to the formulation's durability, color stability, and overall quality. By incorporating such additives, manufacturers can produce paints and coatings that offer superior resistance to weathering, corrosion, and other environmental factors. This results in products that deliver enhanced performance and longevity for consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allnex GMBH

- Arkema SA

- Arxada AG

- BASF SE

- CHT Germany GmbH

- Clariant International Ltd.

- Dow Inc.

- Eastman Chemical Co.

- Elementis Plc

- Evonik Industries AG

- King Industries Inc.

- Kusumoto Chemicals Ltd.

- Lankem Ltd.

- Lanxess AG

- Momentive Performance Materials Inc.

- Sanyo Chemical Industries Ltd.

- Shamrock Technologies Inc.

- Shin Etsu Chemical Co. Ltd.

- Solvay SA

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of substances that enhance the performance, characteristics, and appearance of coatings and paints. These additives play a crucial role in improving the durability, adhesion, rheology, and other properties of coatings. Coating additives can be categorized into various types, including polymers, silicates, chemicals, gases, liquids, and rheology modifiers. Each type offers unique benefits to the coating formulation. For instance, polymers provide excellent film formation and adhesion, while silicates offer excellent water resistance and corrosion protection. Coatings and paints are used in various industries and applications, including architectural, industrial, automotive, aerospace, marine, and wood.

In the architectural segment, water-borne coatings and powder-based coatings are gaining popularity due to their sustainability and low volatile organic compound (VOC) content. In the industrial segment, epoxy coatings are widely used for their high durability and corrosion protection. Coating additives also play a significant role in addressing environmental concerns. For example, bio-based additives and nanoscale additives are gaining popularity due to their eco-friendly nature. Additionally, regulations regarding VOC content and other environmental concerns are driving the development of greener coatings and additives. The formulation of coatings and paints involves a complex interplay of various additives. For instance, anti-foaming agents prevent the formation of foam during application, while wetting and dispersion agents improve the spreading and leveling of the coating.

Adhesion promoting agents enhance the bond between the coating and the substrate, while texturizers provide a desirable texture to the coating. The use of coatings and paints extends beyond their decorative functions. For instance, In the wind energy industry, coatings are used to protect wind turbines from UV radiation and corrosion. In the automotive industry, coatings are used to improve impact resistance and provide a glossy finish. Despite the numerous benefits of coatings and paints, there are technical hurdles that need to be addressed. For example, the use of aramid fibers in coatings for ballistic protection requires the development of additives that can effectively disperse and wet the fibers.

In conclusion, the market is a dynamic and evolving industry that plays a crucial role in enhancing the performance, characteristics, and appearance of coatings and paints. The use of various types of additives, such as polymers, silicates, chemicals, gases, liquids, and rheology modifiers, offers unique benefits to the coating formulation. The development of eco-friendly and sustainable coatings and additives, as well as the addressing of technical hurdles, are key trends driving the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2209.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paints And Coatings Additives Market Research and Growth Report?

- CAGR of the Paints And Coatings Additives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paints and coatings additives market growth of industry companies

We can help! Our analysts can customize this paints and coatings additives market research report to meet your requirements.