Payment As A Service Market Size 2024-2028

The payment as a service market size is forecast to increase by USD 10.4 million at a CAGR of 17% between 2023 and 2028.

What will be the Size of the Payment As A Service Market During the Forecast Period?

How is this Payment As A Service Industry segmented and which is the largest segment?

The payment as a service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Retail

- Healthcare

- Hospitality

- Others

- Geography

- APAC

- China

- India

- South Korea

- Europe

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The retail segment is estimated to witness significant growth during the forecast period.

The Payment as a Service (PaaS) market is witnessing significant growth due to the increasing preference for cloud-based financial services and automated payment solutions among businesses. Traditional payment models are being replaced with cost-effective, predictable cost structure approaches that offer advanced features such as real-time reporting, customizable payment workflows, and enhanced security. These solutions provide seamless payment processing, enabling businesses to digitize and automate payments for various transactions, including business payments, online card payments, disbursements, and miscellaneous expenses. Third-party providers offer cloud solutions for payment processing infrastructure, authorization, and settlement, ensuring a secure environment for encrypted transactions. Advanced encryption, tokenization, fraud detection, and risk mitigation are essential components of these solutions.

Moreover, the adoption of AI-driven fraud detection and cross-border payments is increasing In the financial ecosystem. The use of API-managed payment platforms for accounts payable and receivable management enhances productivity and efficiency in financial planning and budgeting. The scalability of these services enables businesses to handle global transactions with ease, making PaaS a productive and efficient solution for local businesses and enterprises alike.

Get a glance at the Payment As A Service Industry report of share of various segments Request Free Sample

The Retail segment was valued at USD 2.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

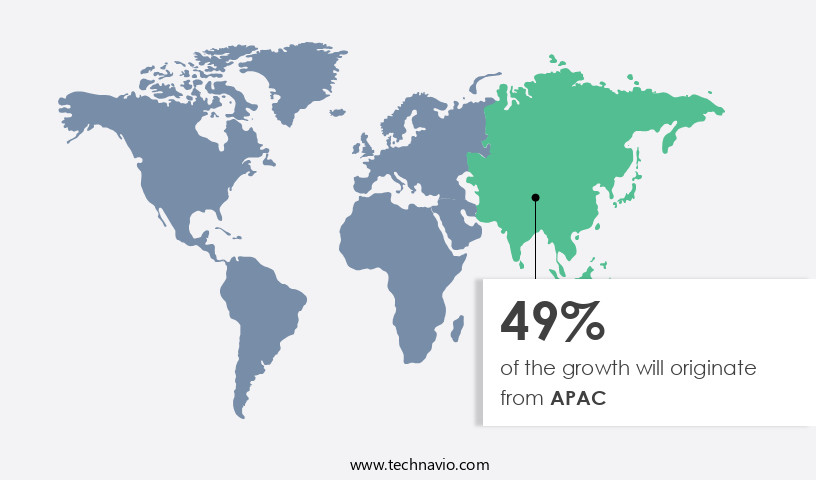

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Payment as a Service (PaaS) is a cloud-based financial solution that enables businesses to outsource payment processing infrastructure and authorization, settlement, and security functions from third-party providers. This cost-effective approach offers predictable cost structures, budgeting, and financial planning advantages, making it increasingly popular among various sectors, particularly e-commerce and BFSI. PaaS solutions provide real-time reporting, customizable payment workflows, and advanced features like AI-driven fraud detection, tokenization, and risk mitigation. They offer seamless payment processing across multiple platforms, including desktop apps, mobile apps, business payments, online card payments, disbursements, and miscellaneous expenses. The adoption of PaaS is on the rise due to its ability to digitize and automate payments, ensuring transparency in accounting, bills management, invoice management, and receipts management in a secure environment with encrypted transactions.

Cross-border payments and transactions are also facilitated through these advanced financial ecosystems, enhancing global business operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Payment As A Service Industry?

High adoption of contactless payment solutions is the key driver of the market.

What are the market trends shaping the Payment As A Service Industry?

Rise in mobile biometrics for payment is the upcoming market trend.

What challenges does the Payment As A Service Industry face during its growth?

Lack of awareness for online payment in developing economies is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The payment as a service market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the payment as a service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, payment as a service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABOUT-PAYMENTS.com B.V. - Agilysys provides Payment as a Service (PaaS) solutions for property management, point of sale, and numerous other applications. This innovative approach enables businesses to streamline their payment processing, enhancing operational efficiency and customer convenience. By outsourcing payment processing, companies can reduce costs, mitigate risks, and focus on their core competencies. PaaS solutions offer flexibility, scalability, and ease of integration, making them an attractive option for businesses seeking to modernize their payment processing systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABOUT-PAYMENTS.com B.V.

- Agilysys Inc.

- Alphabet Inc.

- Aurus Inc.

- BlueSnap Inc.

- Fidelity National Information Services Inc.

- First American Payment Systems L.P.

- First Data Corp.

- Helcim Inc.

- Ingenico Group SA

- MTACC Ltd.

- PayPal Holdings Inc.

- Paysafe Ltd.

- Paystand Inc.

- PPRO Financial Ltd.

- Stripe Inc.

- Thales Group

- Total System Services LLC

- Valitor

- VeriFone Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Payment as a Service (PaaS) is a cloud-based financial solution that enables businesses to outsource their payment processing infrastructure. This approach offers several advantages over traditional payment models. By utilizing a third-party provider, businesses can adopt a cost-effective approach to payment processing, transitioning from upfront investments to a predictable cost structure. This budgeting and financial planning tool allows businesses to focus on their core competencies while ensuring seamless payment processing. The PaaS market is witnessing significant growth due to its ability to provide enhanced security features. Advanced encryption, tokenization, and fraud detection systems are integral components of PaaS solutions.

These features help mitigate risks and protect sensitive financial data, ensuring a secure environment for transactions. Moreover, PaaS solutions offer scalability, allowing businesses to accommodate increasing transaction volumes without the need for additional infrastructure. Real-time reporting and customizable payment workflows provide businesses with transparency in accounting and efficient management of bills, invoices, and receipts. The financial ecosystem is evolving, with businesses increasingly relying on digital transactions. PaaS solutions cater to this trend by offering API-managed payment platforms, enabling integration with various business applications. These platforms support online card payments, disbursements, miscellaneous expenses, and other business payments. PaaS solutions are not limited to large corporations.

Local businesses and SMEs can also benefit from these cloud solutions, which offer desktop apps, mobile apps, and online payment services. This flexibility allows businesses to choose the most productive and efficient method for managing their payment processes. Cross-border payments are another area where PaaS solutions excel. These solutions offer advanced features, such as AI-driven fraud detection and real-time reporting, making international transactions more efficient and secure. In conclusion, Payment as a Service is a game-changer In the financial technology landscape. It offers businesses a cost-effective, scalable, and secure solution for managing their payment processing infrastructure. With advanced security features, real-time reporting, and customizable payment workflows, PaaS solutions are transforming the way businesses manage their financial practices, from cash transactions to global transactions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17% |

|

Market growth 2024-2028 |

USD 10.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.9 |

|

Key countries |

India, China, US, UK, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Payment As A Service Market Research and Growth Report?

- CAGR of the Payment As A Service industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the payment as a service market growth of industry companies

We can help! Our analysts can customize this payment as a service market research report to meet your requirements.