Power Tool Accessories Market Size 2024-2028

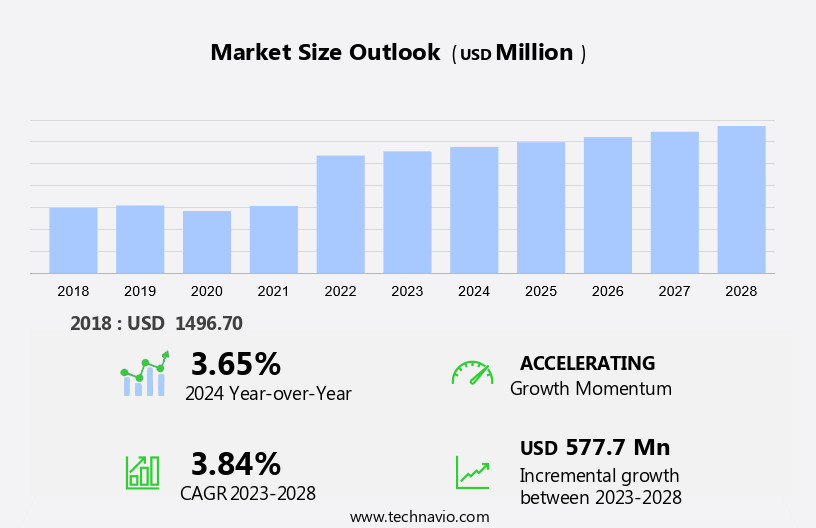

The power tool accessories market size is forecast to increase by USD 577.7 million at a CAGR of 3.84% between 2023 and 2028. The market is experiencing significant growth due to various driving factors. One of the primary factors is the increase in sales of passenger cars, leading to a rise in DIY automotive repairs and home improvement projects. Another trend influencing the market is the increased integration of the Internet of Things (IoT) in manufacturing processes, enabling the production of smart power tools and accessories. However, the market faces challenges, including the decline in construction and automobile sales in China, a major consumer market, which may impact the demand for power tools and their accessories. Despite these challenges, the market is expected to grow steadily, driven by technological advancements and the increasing popularity of cordless power tools.

The market is a significant segment of the power tools industry, encompassing a wide range of products used for cutting, drilling, sanding, and polishing on various surfaces, including wood and metal. Key accessories include drill bits, screwdrivers, router bits, abrasive wheels, saw blades, chippers, threading products, and fabricated metals or stamped metal products. Fasteners are another essential accessory category. Accessories for cutting and drilling tools include drill machine bits such as drill bits, circular saw blades, jig saw blades, band saw blades, reciprocating saw blades, and milter saw blades. Springs are used in various power tools for their mechanical advantage.

Moreover, cordless power tools, driven by lithium-ion (Li-ion) batteries, have gained popularity in both professional and consumer markets. Sanding and polishing accessories include sandpaper, abrasive pads, and buffing pads made of rubber. Accessories for professional use often cater to heavy-duty applications in mass townships and public construction projects.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Professional

- Consumer

- Type

- Drill bits

- Screwdriver bits

- Router bits

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

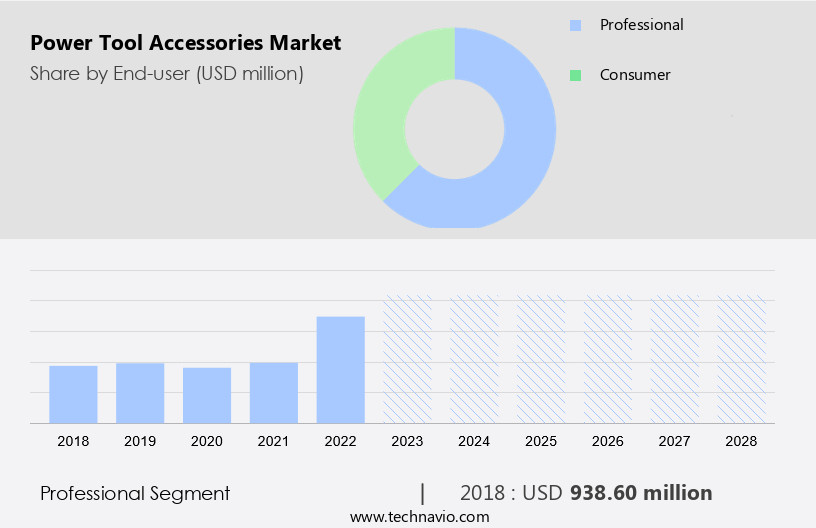

The professional segment is estimated to witness significant growth during the forecast period. The global market encompasses a wide range of products, including Drills, Screwdrivers, Router bits, abrasive wheels, Saw blades, Chippers, Threading products, and various types of bits and blades for Fabricated metals and Stamped metal products. These accessories cater to the demands of both the professional and consumer segments. In the professional sector, the construction, manufacturing, aerospace, and logistics industries drive the market due to their extensive use of power tools and accessories. Professionals prioritize quality and durability over cost, leading to a higher demand for accessories for Cordless power tools, Lithium-ion batteries, Hammer drills, Impact wrenches, Circular saws, and other power tools.

Moreover, the professional segment also shows a preference for pneumatic and hydraulic power tools, necessitating a significant demand for their corresponding accessories. Additionally, the adoption of smart technologies, energy-efficient power tools, and urbanization trends further boosts the market growth. The market for Sanding and Polishing, Cutting, and Drilling accessories is expected to witness substantial growth due to the increasing demand for these power tools in various industries.

Get a glance at the market share of various segments Request Free Sample

The professional segment was valued at USD 938.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the increasing demand for renovation and construction activities in both residential and commercial sectors. The market is witnessing demand from various end-user industries such as housing, public construction projects, renewable energy, telecommunications, and mass townships. Metal surfaces, particularly in high-rise buildings and infrastructure projects, are major consumers of power tool accessories, driving the market's growth. Router machines are among the most popular power tools used for metalworking, and their demand is expected to remain high due to the increasing number of construction projects. Additionally, the use of power tool accessories in the manufacturing of steel, plastic, rubber, and batteries is also contributing to the market's growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Power Tool Accessories Market Driver

Increase in sales of passenger cars is the key driver of the market. The market encompasses a wide range of products used in conjunction with power tools for various applications in industries such as Construction, Manufacturing, Aerospace, and Urbanization. These accessories include Drills and Screwdrivers with accompanying Drill Bits and Screwdriver Bits, Router bits, Abrasives wheels, Saw blades like Circular Saw Blades, Reciprocating Saw Blades, Milter Saw Blades, Hole Saw, Threading supplies, and Chippers. Additionally, Fabricated metals and Stamped metal products, Fasteners, Springs, and Cordless power tools with Lithium-ion (Li-ion) batteries are integral to the market. Smart technologies and energy-efficient power tools have gained traction in recent times, with Impact wrenches and Circular saws being popular choices. The market caters to both the Professional and Consumer segments, with the Electronics and Logistics industries also relying on these accessories for Cutting and Drilling tasks.

Power Tool Accessories Market Trends

Increased integration of the Internet of Things (IoT) in manufacturing processes is the upcoming trend in the market. The market encompasses a wide range of products designed to enhance the functionality of drills, screwdrivers, routers, abrasives wheels, saw blades, chippers, threading products, fabricated metals, stamped metal products, fasteners, springs, and various other power tools. These accessories include drill and screwdriver bits, circular saw blades, abrasive wheels, reciprocating saw blades, milter saw blades, and hole saws. In addition, lithium-ion (Li-ion) batteries are increasingly becoming popular for cordless power tools, such as hammer drills, impact wrenches, and circular saws. The market caters to both professional and consumer segments in various industries, including construction, logistics, manufacturing, aerospace, and urbanization. Smart technologies and energy-efficient power tools are gaining traction, with an emphasis on sanding and polishing, cutting, and drilling applications.

Power Tool Accessories Market Challenge

Decline in construction and automobile sales in China is a key challenge affecting the market growth. The market encompasses a wide range of products used in conjunction with drills, screwdrivers, routers, abrasives wheels, saw blades, chippers, threading products, fabricated metals, stamped metal products, fasteners, springs, and various other power tools. These accessories include cordless power tools, such as hammer drills and impact wrenches, as well as lithium-ion batteries. In the construction, manufacturing, aerospace, and logistics industries, power tools and their accessories play a crucial role in various applications, including electronics assembly, urbanization projects, and energy-efficient power tools.

Moreover, smart technologies and urbanization have led to an increased demand for power tool accessories, particularly in cutting and drilling applications, such as circular saws, hole saws, drill bits, screwdriver bits, circular saw blades, reciprocating saw blades, milter saw blades and abrasives. Additionally, sanding and polishing supplies are essential for finishing and refining projects. The professional and consumer sectors both benefit from the availability of these accessories, with woodworking and metalworking being prominent areas of usage.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atlas Copco AB: The company offers power tools accessories such as circular cutters with bolting solutions, screw feeders, and torque controllers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANDREAS STIHL AG and Co. KG

- Bahco

- Baker Hughes Co.

- Caterpillar Inc.

- Drill King International

- Emerson Electric Co.

- Festool GmbH

- Halliburton Co.

- Hilti AG

- KKR and Co. Inc.

- Koki Holdings Co. Ltd.

- KYOCERA Corp.

- Makita Corp.

- Robert Bosch GmbH

- Sandvik AB

- Snap on Tools Pvt. Ltd.

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

- Tools4Trade

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the power tools industry, encompassing a wide range of products used in various applications across multiple industries. Key accessories include drill and screwdriver bits, router bits, abrasive wheels, saw blades, chippers, threading products, and fabricated or stamped metal products. These accessories are essential for cutting, drilling, sanding, and polishing in construction, manufacturing, aerospace, electronics, and urbanization projects. Cordless power tools, fueled by lithium-ion batteries, have gained popularity due to their energy efficiency and portability. Accessories for these tools include hammer drills, impact wrenches, circular saws, and reciprocating saws. The market also caters to both professional and consumer segments, with smart technologies and urbanization driving demand for energy-efficient and advanced power tool accessories. Woodworking applications, such as hole saws, milter saws, and drill machines, also contribute to the market's growth. Overall, the market is a dynamic and evolving sector, catering to the diverse needs of various industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.84% |

|

Market growth 2024-2028 |

USD 577.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.65 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, UK, Canada, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ANDREAS STIHL AG and Co. KG, Atlas Copco AB, Bahco, Baker Hughes Co., Caterpillar Inc., Drill King International, Emerson Electric Co., Festool GmbH, Halliburton Co., Hilti AG, KKR and Co. Inc., Koki Holdings Co. Ltd., KYOCERA Corp., Makita Corp., Robert Bosch GmbH, Sandvik AB, Snap on Tools Pvt. Ltd., Stanley Black and Decker Inc., Techtronic Industries Co. Ltd., and Tools4Trade |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch