Powered Air Purifying Respirator Market Size 2024-2028

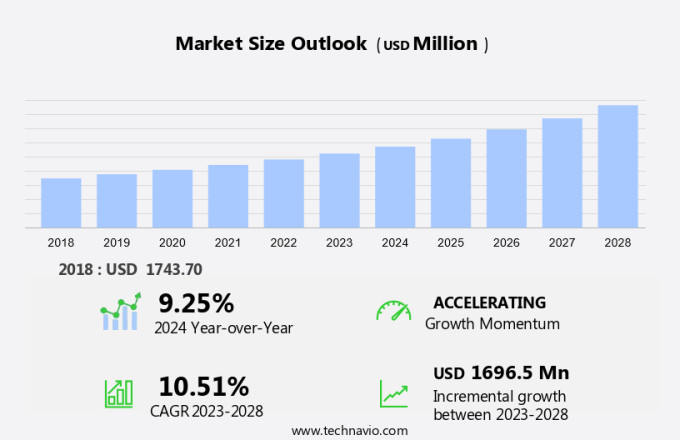

The powered air purifying respirator (PAPR) market size is forecast to increase by USD 1.70 billion at a CAGR of 10.51% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for clean air solutions in various industries. The need for protection against pollutants and pathogens has led to the increasing popularity of PAPR systems, which utilize facepiece respirators, such as N95 masks and positive-pressure masks, along with blower devices to provide continuous airflow. These exposure limits are strictly enforced in various industries, particularly in construction activities. The expansion of end-user industries, particularly in construction, healthcare, and manufacturing, is driving market growth. PAPRs, such as full face masks and half masks equipped with P100 high-efficiency filters, offer superior protection against pollutant and pathogen. However, the possibility of substitution by other air purifying devices, such as masks and filters, may pose a challenge to market growth.

The market is expanding rapidly, driven by increased demand for effective respiratory protection across various industries, including the petrochemical, oil and gas, industrial industry, and pharmaceuticals sectors. These devices are especially vital for doctors and healthcare workers, providing crucial gas and vapor protection in high-risk environments, including during surgeries or handling hazardous chemicals. In the petrochemical industry or chemical industry, where exposure to toxic gases is prevalent, PAPRs ensure enhanced safety. Occupational safety and health agencies, including those overseeing the oil and gas sector, recommend the use of N95 filtering facepiece respirators (FFRs) and surgical N95 FFRs for workplace safety. The growing awareness of respiratory protection in industrial environments, combined with stringent health and safety regulations, drives the adoption of PAPRs, including Full Face Mask PAPR models, to safeguard workers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Full-face mask PAPR

- Half-mask PAPR

- Helmets hoods and visors

- Application

- Industrial

- Pharmaceutical and healthcare

- Oil and gas

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

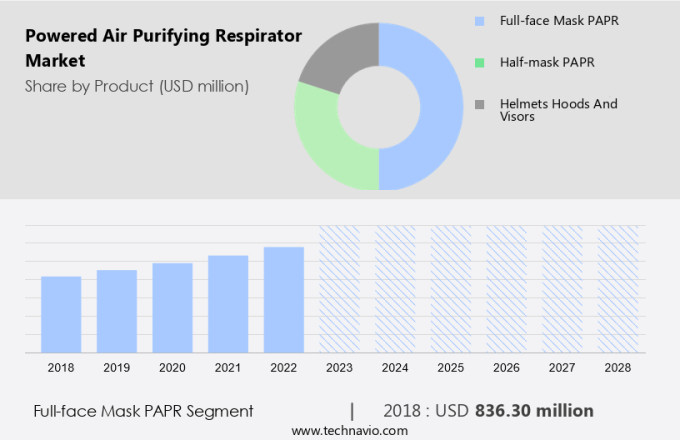

The full-face mask PAPR segment is estimated to witness significant growth during the forecast period. In the United States, adherence to occupational safety regulations is paramount to minimize illness cases caused by exposure to harmful substances such as silica and asbestos. To meet these regulations, the use of Powered Air Purifying Respirators (PAPRs) has become increasingly prevalent. Among the different types of PAPRs, full-face masks have gained significant traction. Full-face mask PAPRs are tight-fitting respirators that shield the nose, mouth, and eyes from irritating gases, vapors, and flying particles. Their popularity stems from their suitability for physically demanding, warm, or lengthy tasks.

Further, the applications of full-face mask PAPRs span across numerous sectors, including agriculture, asbestos abatement, construction and building renovation, mold and lead paint abatement, demolition, food and beverage processing, chemical manufacturing, lead battery plants, medical and healthcare, and metalwork. Given the expanding scope of applications, the demand for full-face mask PAPRs is projected to grow steadily in the coming years. In summary, the increasing need for occupational safety and the growing applications of full-face mask PAPRs in various industries are expected to drive market growth during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The full-face mask PAPR segment accounted for USD 836.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is projected to dominate the global industry due to stringent regulations prioritizing employee health and safety in high-risk sectors, such as mining, construction, and oil and gas. However, a lack of awareness regarding the safety features of various respiratory protective equipment poses challenges in several end-user industries. For instance, the outbreak of coccidioidomycosis in California led to significant economic losses in the construction and agricultural industries. According to the Centers for Disease Control and Prevention (CDC), this disease primarily affects older populations. Half Mask PAPR and Hood PAPR are commonly used for particulate protection, while combination protection caters to both particulate and gas or vapor hazards.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growth of end-user industries is the key driver of the market. The global market for Powered Air Purifying Respirators (PAPRs) is experiencing significant growth due to the expanding production capacities in major end-user industries. These industries, including the petrochemical and industrial sectors, are witnessing an increase in workers exposed to hazardous conditions such as chemicals, heat, fire, and low visibility. In the oil and gas industry, the demand is driven by the continuous growth of China and India's transportation and industrial sectors, leading crude oil-exporting countries to intensify exploration and production activities. Additionally, the demand for natural gas as an industrial fuel and cooking source is on the rise. PAPRs, including full-face masks, hoods, and visors, are essential protective equipment in these industries, ensuring the safety and health of workers.

Market Trends

Increasing focus on emergency management is the upcoming trend in the market. In the face of escalating emergencies, such as natural disasters, medical crises, and terrorist attacks, the role of first responders, including government and non-government agencies, becomes increasingly significant. These teams, comprising medical emergency personnel, necessitate specialized equipment to ensure their safety from harmful pollutants and pathogens.

Further, one such essential piece of equipment is the Powered Air-Purifying Respirator (PAPR), which includes facepiece respirators, such as N95 masks, and positive-pressure masks, as well as blower devices. These advanced respiratory solutions enable first responders to breathe clean air in contaminated environments, safeguarding their health and enabling them to effectively manage emergencies.

Market Challenge

The possibility of substitution by other devices is a key challenge affecting the market growth. In the United States market, Powered Air Purifying Respirators (PAPR) are essential protective equipment used in various industries and applications where contaminated air is a concern. Two significant industry segments for PAPR are Industrial and Fire services. In the Industrial segment, PAPR is utilized in surface mining to safeguard workers from inhaling harmful particles. The Fire services segment uses PAPR to protect firefighters from inhaling toxic gases during firefighting operations. PAPR is a vital piece of equipment consisting of a headgear-and-fan assembly that filters contaminated air before it reaches the wearer. Alternatives to PAPR, such as N95 respirators and facemasks, are also available in the market.

For instance, facemasks are disposable devices that create a physical barrier between the wearer and potential contaminants. N95 respirators, a type of particulate filtering facepiece respirators, offer a close facial fit and efficient filtration of airborne particles. According to the US Food and Drug Administration (FDA), an N95 respirator can block at least 95% of small airborne particles, providing protection against both aerosols and droplets in the air.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co.- The company offers TR 600 PAPR air purifying helmets and Versaflo Helmets M 300 Series.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegro Industries

- Avon Polymer Products Ltd.

- Bullard

- CleanSpace Technology Pty Ltd

- Dragerwerk AG and Co. KGaA

- Gentex Corp.

- Honeywell International Inc.

- ILC Dover LP

- Irillic Pvt. Ltd.

- Jupiter Surface Technologies

- Miller Electric Manufacturing Co.

- MSA Safety Inc.

- National Safety Solution

- Optrel AG

- RSG Safety BV

- SHIGEMATSU WORKS CO. LTD.

- Sundstrom Safety AB

- VENUS Safety and Health Pvt. Ltd.

- Zeotech AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for clean air solutions in various industries. N95 FFRs, full-face masks, hoods, and visors are popular types of PAPRs used to protect workers from contaminated air caused by pollutants and pathogens. The industrial segment, including petrochemical and metal fabrication, is a major consumer of PAPRs due to the presence of hazardous substances. The half mask segment holds a considerable market share in the PAPR market. These respirators provide protection against specific hazards such as silica, asbestos, and other harmful particles. The fire services segment also uses PAPRs to protect against aerosolized microorganisms and other respiratory hazards.

Additionally, the pharmaceutical application segment is another significant market for PAPRs, particularly in surgical settings, where the need for clean air is crucial. The agricultural sector is also adopting PAPRs to protect workers from air pollution and other respiratory hazards. Occupational safety regulations and exposure limits drive the demand for PAPRs in various industries. Personal protective equipment (PPE) and occupational health programs stress the importance of personal hygiene and clean air in preventing illness cases caused by airborne infectious diseases. Blower devices, headgear-and-fan assemblies, and positive-pressure masks are essential components of PAPRs that ensure effective filtration and clean air delivery. PAPRs provide combination protection against particulate and gaseous contaminants, making them an essential tool for workers in industries with high respiratory hazards.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.51% |

|

Market Growth 2024-2028 |

USD 1.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.25 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Allegro Industries, Avon Polymer Products Ltd., Bullard, CleanSpace Technology Pty Ltd, Dragerwerk AG and Co. KGaA, Gentex Corp., Honeywell International Inc., ILC Dover LP, Irillic Pvt. Ltd., Jupiter Surface Technologies, Miller Electric Manufacturing Co., MSA Safety Inc., National Safety Solution, Optrel AG, RSG Safety BV, SHIGEMATSU WORKS CO. LTD., Sundstrom Safety AB, VENUS Safety and Health Pvt. Ltd., and Zeotech AB |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch