China Preschool Or Childcare Market Size 2026-2030

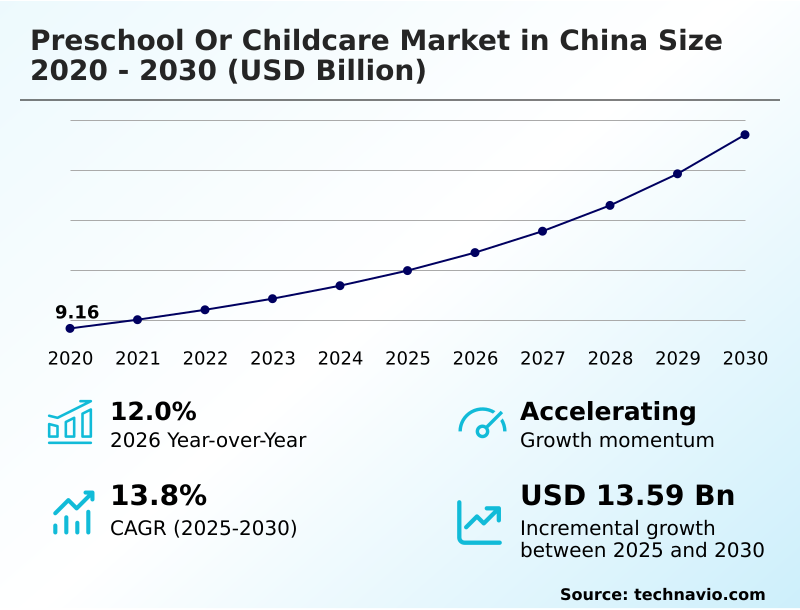

The china preschool or childcare market size is valued to increase by USD 13.59 billion, at a CAGR of 13.8% from 2025 to 2030. Demographic policy alignment and governmental subsidy frameworks will drive the china preschool or childcare market.

Major Market Trends & Insights

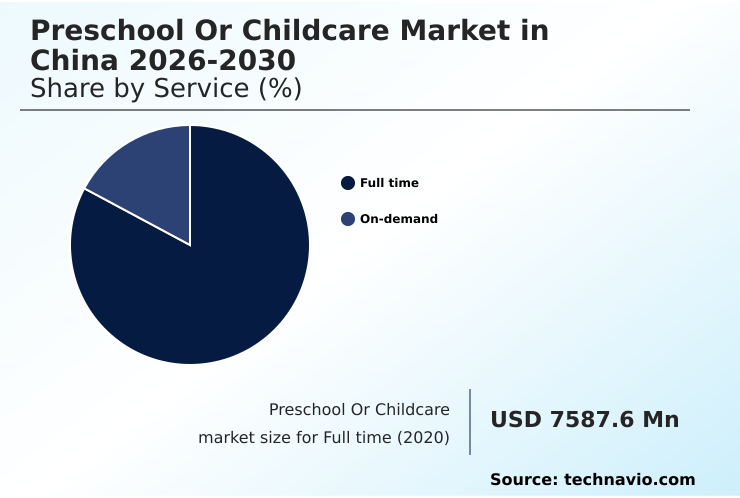

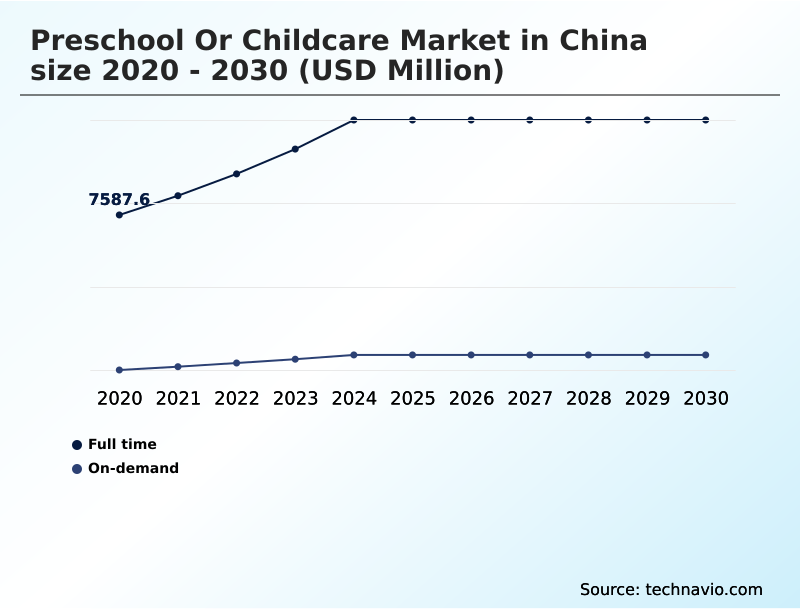

- By Service - Full time segment was valued at USD 11.27 billion in 2024

- By Age Group - below 3 years segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 19.37 billion

- Market Future Opportunities: USD 13.59 billion

- CAGR from 2025 to 2030 : 13.8%

Market Summary

- The preschool or childcare market in China is navigating a period of profound transformation, shaped by regulatory shifts and evolving parental expectations. A primary driver is the governmental push for affordable, high-quality care to address demographic challenges, leading to the expansion of inclusive, state-subsidized facilities.

- This has intensified competition, compelling private operators to differentiate through specialized offerings such as bilingual instruction, STEAM-focused curricula, and holistic child development programs. A key trend is the integration of technology to enhance both operational efficiency and parental communication.

- For instance, a provider might deploy a unified digital management platform that streamlines admissions and automates billing, while also offering a parent engagement tool with real-time updates on a child’s activities and developmental milestones.

- This digital ecosystem not only improves service quality but also addresses the core challenge of maintaining trust and transparency in a highly scrutinized market, allowing providers to build a sustainable model focused on pedagogical excellence and safety.

What will be the Size of the China Preschool Or Childcare Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the China Preschool Or Childcare Market Segmented?

The china preschool or childcare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Service

- Full time

- On-demand

- Age group

- below 3 years

- 3 to 6 years

- Ownership

- Public

- Private

- Geography

- APAC

- China

- APAC

By Service Insights

The full time segment is estimated to witness significant growth during the forecast period.

The full-time care segment is evolving beyond traditional supervision to meet demands for structured early education. Providers are increasingly adopting specialized pedagogy like Montessori methodologies and curricula focused on STEAM education to enhance cognitive development.

This shift is a response to the need for dual-income household support and a growing parental emphasis on high-quality early childhood environments.

Government policies promoting state-supported childcare and inclusive childcare models aim to make these advanced programs more accessible, with a goal of enrolling up to 80% of the age-appropriate population in standardized facilities.

This creates a competitive landscape where holistic child development, including physical literacy, sensory integration, and bilingual instruction, are key differentiators, alongside holistic wellness programs.

The Full time segment was valued at USD 11.27 billion in 2024 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The future of the preschool or childcare market in China hinges on the ability of providers to deliver specialized value beyond basic supervision. Success will depend on integrating comprehensive K-12 education pathway thinking into early years programs. This includes offering structured early learning and care services that focus on cognitive, emotional, and social growth.

- Curricula centered on STEAM exposure and school readiness are becoming standard, while a blended Chinese and Western curricula can offer a distinct advantage. Providers are leveraging digital tools for parent communication, offering real-time feedback and adaptive course content to create personalized learning for child development.

- The most competitive centers will be those that master bilingual English and Chinese instruction and offer programs centered on early learning and holistic development. For instance, facilities offering specialized early intervention and wellness programs report parent retention rates up to 20% higher than standard care centers.

- This focus on unique value, from Montessori-inspired learning and language immersion to play-based and inquiry-driven learning, is critical for attracting families and ensuring long-term viability in an increasingly demanding market.

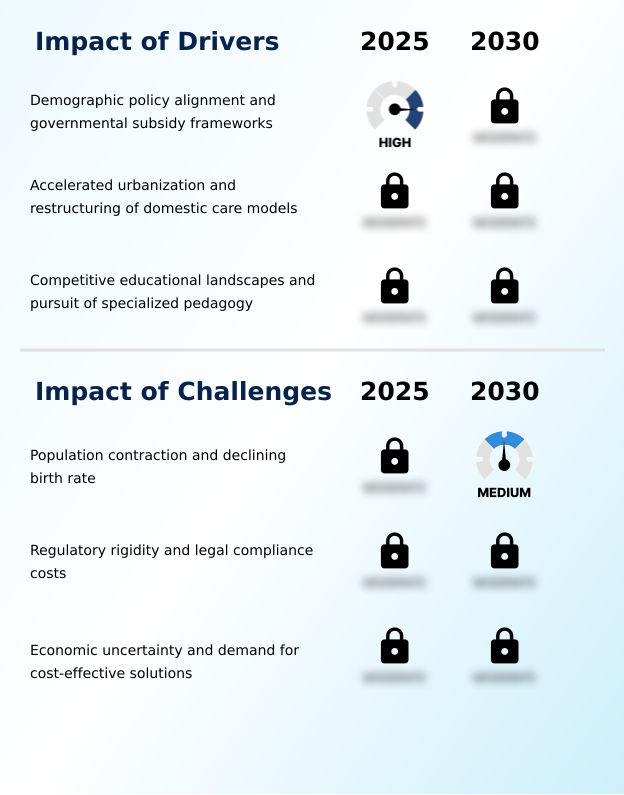

What are the key market drivers leading to the rise in the adoption of China Preschool Or Childcare Industry?

- Demographic policy alignment and governmental subsidy frameworks are key drivers of market expansion.

- Demand is increasingly driven by accelerated urbanization and the need for reliable childcare solutions like full-time care and flexible on-demand care. Parents are seeking sophisticated educational approaches, including bilingual immersion education and whole-person learning, supported by modern play-based learning frameworks.

- Facilities that utilize digital curriculum management to track developmental milestones are gaining a competitive edge, with some reporting a 15% higher rate of achieving key learning objectives.

- The focus on holistic development has also spurred demand for nature-based learning and early identification services.

- This push for quality is evident across the international school network and within the expanding public-benefit childcare system, where bilingual kindergarten programs and inquiry-driven learning models are becoming more common.

What are the market trends shaping the China Preschool Or Childcare Industry?

- The market is witnessing a significant transition toward state-supported inclusive childcare models. This shift is driven by policies aimed at increasing affordability and accessibility for a broader population.

- A significant trend is the diversification into specialized care, with an emphasis on social-emotional learning and early intervention services integrated into daily activities. Providers are shifting toward play-based learning and inquiry-based learning to improve educational outcomes. Technology adoption is accelerating, with digital management platforms improving operational efficiency by over 25%.

- These systems, along with parent engagement tools and smart surveillance technology, enhance transparency and safety, which is crucial in dense urban care models. The rise of community-based centers and government-subsidized programs is making these advanced services more accessible, though maintaining low student-to-teacher ratios and high pedagogical standards remains a priority for premium operators.

What challenges does the China Preschool Or Childcare Industry face during its growth?

- Population contraction and a declining birth rate present a key challenge affecting industry growth.

- Providers face significant challenges from stringent safety and compliance norms and rising operational costs. The need to invest in technologies like access control technologies, digital monitoring tools, and cloud-based solutions increases financial pressure, with compliance-related expenses rising by 10-15% for many operators. Maintaining high teacher qualification standards while adhering to fee caps further constrains profitability.

- In this environment, differentiating through a structured learning environment and a clear academic excellence focus is critical. Some centers are adopting adaptive learning platforms with real-time progress tracking and personalized learning modules to justify premium pricing. Others explore partnerships for corporate-sponsored childcare or enhance their offerings with family support services and programs for global citizenship development.

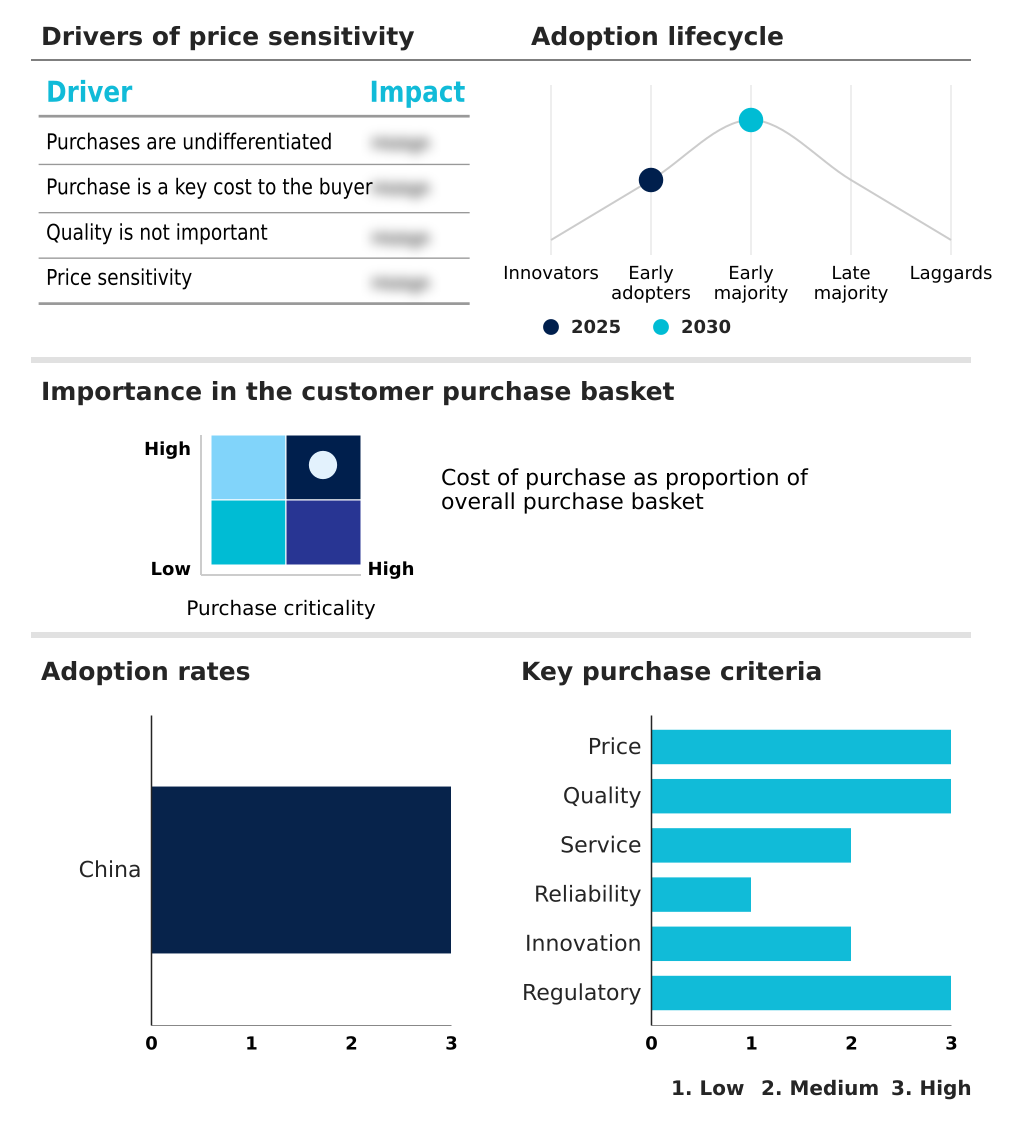

Exclusive Technavio Analysis on Customer Landscape

The china preschool or childcare market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the china preschool or childcare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of China Preschool Or Childcare Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, china preschool or childcare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3e International School - Delivers bilingual nursery, pre-kindergarten, and kindergarten programs focused on early learning and holistic child development, integrating global educational standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3e International School

- Beanstalk Education Group

- Bright Scholar Education Ltd.

- Canadian International School

- Crestar Education Group

- Eton Intl. Kindergarten Co.

- EtonHouse Education Group

- Ivy Education Group

- Kid Castle Education Institute

- Noah Education Holdings Ltd.

- Nord Anglia Education Ltd.

- RYB Education Inc.

- Shanghai American School

- Soong Ching Ling School

- The Intl. Montessori School

- Xiehe Education

- Yew Chung International School

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in China preschool or childcare market

- In August 2024, China's State Council unveiled new guidelines aimed at promoting high-quality service consumption, which directly impacts the preschool and childcare sector by encouraging investment in premium educational services and facilities.

- In November 2024, China's National People's Congress adopted the Preschool Education Law, establishing a stringent legal framework that requires all providers to enhance safety standards and teacher qualifications, impacting operational costs.

- In January 2025, leading education technology firms in China began deploying AI-powered study rooms and adaptive learning platforms in preschools, offering personalized lessons and real-time progress tracking for students aged 3-6.

- In February 2025, in response to new government regulations on public security video systems, major childcare chains announced comprehensive upgrades to their smart surveillance and access control technologies to improve safety and data protection.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled China Preschool Or Childcare Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 166 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 13.8% |

| Market growth 2026-2030 | USD 13588.8 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 12.0% |

| Key countries | China |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The preschool or childcare market in China is undergoing a strategic realignment, driven by new regulations and a parental demand for specialized educational experiences. Providers are moving beyond conventional care to incorporate sophisticated pedagogical approaches, including bilingual instruction, Montessori methodologies, and STEAM education.

- A central theme is the emphasis on holistic child development, which integrates cognitive development with social-emotional learning, physical literacy, and sensory integration. Technology is a critical enabler, with the adoption of digital management platforms, smart surveillance technology, and advanced parent engagement tools becoming standard.

- Boardroom decisions are increasingly focused on allocating capital for these technological upgrades to meet stringent safety norms, as modern access control technologies have been shown to reduce security incidents by over 40%.

- This investment is essential for maintaining a competitive edge, as the market pivots toward inquiry-based learning, early intervention services, and structured, play-based learning frameworks that deliver measurable developmental outcomes and justify premium service offerings.

What are the Key Data Covered in this China Preschool Or Childcare Market Research and Growth Report?

-

What is the expected growth of the China Preschool Or Childcare Market between 2026 and 2030?

-

USD 13.59 billion, at a CAGR of 13.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Service (Full time, and On-demand), Age Group (below 3 years, and 3 to 6 years), Ownership (Public, and Private) and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

APAC

-

-

What are the key growth drivers and market challenges?

-

Demographic policy alignment and governmental subsidy frameworks, Population contraction and declining birth rate

-

-

Who are the major players in the China Preschool Or Childcare Market?

-

3e International School, Beanstalk Education Group, Bright Scholar Education Ltd., Canadian International School, Crestar Education Group, Eton Intl. Kindergarten Co., EtonHouse Education Group, Ivy Education Group, Kid Castle Education Institute, Noah Education Holdings Ltd., Nord Anglia Education Ltd., RYB Education Inc., Shanghai American School, Soong Ching Ling School, The Intl. Montessori School, Xiehe Education and Yew Chung International School

-

Market Research Insights

- Market dynamics are shaped by a confluence of demographic, economic, and social factors. The prevalence of dual-income household support structures in urban centers has made professional childcare a necessity, moving beyond traditional domestic care models. This shift is fueling demand for both full-time and flexible on-demand services.

- Providers are responding by creating specialized early childhood environments that promise superior educational outcomes. The adoption of digital parent engagement tools has improved communication, leading to parent satisfaction scores increasing by up to 15%. Furthermore, the government’s focus on childbearing burden alleviation through subsidized, inclusive childcare models is altering the competitive landscape, compelling private operators to innovate.

- This has led to an emphasis on specialized pedagogy and holistic wellness programs to attract discerning families.

We can help! Our analysts can customize this china preschool or childcare market research report to meet your requirements.