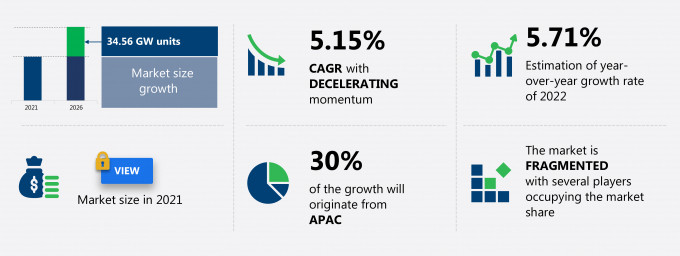

The prime movers market share is expected to increase by 34.56 gigawatts units from 2021 to 2026, at a CAGR of 5.15%.

This prime movers market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers prime movers market segmentation by type (wind turbine, hydro turbine, and steam turbine) and geography (APAC, North America, South America, Europe, and MEA). The prime movers market report also offers information on several market vendors, including Caterpillar Inc., ENTSOG AISBL, Komatsu Ltd., Mitsubishi Heavy Industries Ltd., Prime mover engineering Co. Pvt. LTD, Prime Movers Lab, ReGen Powertech Pvt Ltd., Suzlon Energy Ltd., The Raymond Corp., and Wartsila Corp. among others.

What will the Prime Movers Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Prime Movers Market Size for the Forecast Period and Other Important Statistics

Prime Movers Market: Key Drivers, Trends, and Challenges

The economical and efficient renewable energy resources is notably driving the prime movers market growth, although factors such as challenges associated with the installations may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the prime movers industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Prime Movers Market Driver

One of the key factors driving the global prime movers market growth is the economical and efficient renewable energy resources. Countries are shifting their focus from non-renewable sources of energy to renewable sources to produce power using prime movers. Wind power is considered to be the most efficient source of power among all renewable energy sources. According to GWEC, in APAC, 30.6 gigawatts of new wind energy capacity were installed in 2019. China was the leading country in terms of new offshore wind power capacity additions, with 2.3 gigawatts installed in 2019. Europe held 59% of new wind capacity installations in 2019 and remained the largest market for offshore wind power. In addition, in September 2021, GE Renewable Energy announced that it would supply 40 onshore wind turbines for the 200 MW Aftissat onshore wind farm extension in Morocco. Thus, the growing installation of wind turbines along with prime movers will drive demand in the market in focus during the forecast period.

Key Prime Movers Market Trend

Another key factor driving the global prime movers market growth is the declining levelised cost of energy (LCOE) of wind power generation. According to the IEA, factors such as technological advances, the presence of environmental policies, and the maturity of the supply chain for offshore wind turbines increase the adoption of wind energy in Europe. Moreover, the reduction in LCOE has led to a decrease in the cost of installation of wind farms. As a result, the cost of generating onshore wind power is almost equal to the cost of generating power from conventional. For instance, the cost of producing electricity from new onshore wind power plants is 10.29% lesser than the electricity generated from new gas power plants. The generation of energy from wind is also complemented by solar and battery technologies. Such factors are projected to further accelerate the installation of wind turbines, thereby supporting the market growth in the forecast period.

Key Prime Movers Market Challenge

One of the key factors impeding the global prime movers market growth is the challenges associated with the installations. The main challenges for the installation of prime movers are installation time and vessel cost, deepwater mooring and electrical cable installations, weather restrictions imposed by tugboat and barge limitations, adverse seabed conditions, and mating turbine onto the structure among many others. In addition, the cost of funding an offshore wind farm is high when compared with that of other renewable power sources. The span of transmission cables is an added factor that influences the cost of prime movers. Moreover, independent power developers face challenges while raising and handling funds. These installation challenges make it difficult for companies to install prime movers for wind turbines, which are adversely affecting the growth of the global prime movers market.

This prime movers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global prime movers market as a part of the global industrial machinery market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the prime movers market during the forecast period.

Who are the Major Prime Movers Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Caterpillar Inc.

- ENTSOG AISBL

- Komatsu Ltd.

- Mitsubishi Heavy Industries Ltd.

- Prime mover engineering Co. Pvt. LTD,

- Prime Movers Lab

- ReGen Powertech Pvt Ltd.

- Suzlon Energy Ltd.

- The Raymond Corp.

- Wartsila Corp.

This statistical study of the prime movers market encompasses successful business strategies deployed by the key vendors. The prime movers market is fragmented and the vendors are deploying growth strategies such as product differentiation to compete in the market.

Product Insights and News

- Caterpillar Inc. - The company offers prime movers which are designed for oil and gas applications.

- ENTSOG AISBL - The company offers prime movers for energy solutions through oil and gas supply.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The prime movers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Prime Movers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the prime movers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Prime Movers Market?

For more insights on the market share of various regions Request for a FREE sample now!

30% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for prime movers market in APAC. Market growth in this region will be slower than the growth of the market in other regions.

The significant increase in the energy demand owing to the rapid growth in population and an enhanced standard of living will facilitate the prime movers market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 in 2020 caused an economic recession and massively disrupted industrial operations in the region owing to the implementation of lockdown measures. The governments of various nations, such as India, imposed the first lockdown in March 2020 to cope with an increase in the number of COVID-19 cases. Thus, energy consumption in the region declined dramatically. For instance, India's energy demand dropped by 26% within ten days after imposing the lockdown on March 24, 2020. However, economic activities picked up in late 2020 owing to a decline in the number of COVID-19 cases and an increase in mobility due to the lifting of lockdown restrictions. This has been increasing the commercial and industrial demand for electricity in 2021, which will positively impact the renewable electricity sector such as wind and others and lead to an increase in the use of wind turbines. This will thereby drive the regional market growth during the forecast period.

What are the Revenue-generating Type Segments in the Prime Movers Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The prime movers market share growth by the wind turbine segment will be significant during the forecast period. Factors such as favorable government initiatives and increased investments from major companies toward the adoption of wind energy for power generation as an alternative to conventional fuels will drive the growth of the market in focus in the coming years.

This report provides an accurate prediction of the contribution of all the segments to the growth of the prime movers market size and actionable market insights on post COVID-19 impact on each segment.

|

Prime Movers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 5.15% |

|

Market growth 2022-2026 |

34.56 GW units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.71 |

|

Regional analysis |

APAC, North America, South America, Europe, and MEA |

|

Performing market contribution |

APAC at 30% |

|

Key consumer countries |

China, US, Brazil, Canada, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Caterpillar Inc., ENTSOG AISBL, Komatsu Ltd., Mitsubishi Heavy Industries Ltd., Prime mover engineering Co. Pvt. LTD, Prime Movers Lab, ReGen Powertech Pvt Ltd., Suzlon Energy Ltd., The Raymond Corp., and Wartsila Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Prime Movers Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive prime movers market growth during the next five years

- Precise estimation of the prime movers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the prime movers industry across APAC, North America, South America, Europe, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of prime movers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch