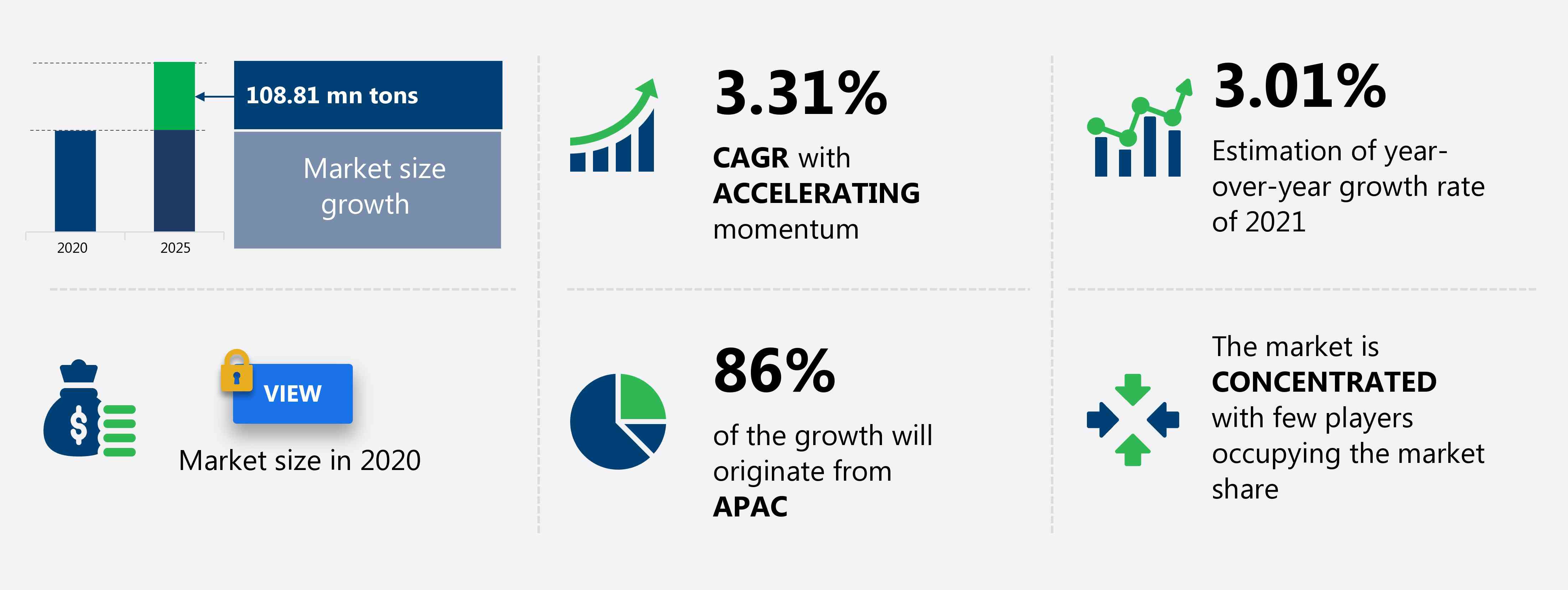

The acetylene gas market share is expected to increase by 108.81 million tons from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 3.31%.

This acetylene gas market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers acetylene gas market segmentations by application (chemical synthesis, welding and metal fabrication, and others) and geography (APAC, Europe, North America, MEA, South America, APAC, Europe, North America, MEA, and South America). The acetylene gas market report also offers information on several market vendors, including Air Products and Chemicals Inc., BASF SE, Clariant International Ltd., Coregas Pty Ltd, Koatsu Gas Kogyo Co. Ltd., L Air Liquide SA, Premier Cryogenics Ltd., Saudi Basic Industries Corp., SOL Spa, and The Linde Group among others.

What will the Acetylene Gas Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Acetylene Gas Market Size for the Forecast Period and Other Important Statistics

Acetylene Gas Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The superior properties of acetylene is notably driving the acetylene gas market growth, although factors such as volatility in raw material prices may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the acetylene gas industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Acetylene Gas Market Driver

The superior properties of acetylene is a major factor driving the global acetylene gas market share growth. The high demand for acetylene in the metal fabrication industry is attributable to the superior properties of acetylene. The gas is the most effective for oxyacetylene cutting, heat treatment, oxy-welding, gas welding applications, brazing, soldering, flame heating, flame straightening, flame gouging, and flame cleaning. Acetylene gas has the highest flame temperature of all hydrocarbons available in the market. Acetylene's flame is the third hottest next only to dicyanoacetylene and cyanogen. It is among the hottest and most efficient of all gases in welding applications. It is the only fuel gas which is hot enough to weld steel. It is used to achieve a flame temperature of around 5,594 F releasing about 55 kJ/liter of energy. It is lighter than air; therefore, has the least tendency to accumulate at the lower levels. It is the only fuel gas that is used to weld steel. Such factors will positively drive the growth of the market during the forecast period.

Key Acetylene Gas Market Trend

The inorganic expansion and increase in M&A activities is another factor supporting the global acetylene gas market share growth. Major vendors in acetylene and other industrial gases market are increasingly relying on inorganic expansion for growth. They are either acquiring the operations of their competitors or are merging with the other prominent vendors. Inorganic growth is preferred in the acetylene gas business as it gives an immediate gestation for investment while providing access to the existing customer base and distribution network of the acquired company. Another major trend observed is that there is an increased emphasis on enhancing their distribution reach to gain wider access to small- and medium-scale customer base. Such forward integration strategies by vendors ensure an increased top line while imparting a competitive advantage in terms of distribution reach. Vendors are increasingly placing emphasis on focused growth strategy; wherein, they tend to strengthen their operations and improve operational efficiencies in their sales territories. In view of the same, an increase in acquisition in core geographies and divestments in non-focused business segments is observed. Due to such reasons, the market will continue to grow during the forecast period.

Key Acetylene Gas Market Challenge

The volatility in raw material prices will be a major challenge for the global acetylene gas market share growth during the forecast period. One of the most important consumer-driven factors in the selection of material in the automotive industry is its cost. In the acetylene gas market, the price of raw materials fluctuates significantly. Acetylene is mainly formed from the partial combustion of methane, which is obtained from hydrocarbon products such as naphtha, crude oil, coal, natural gas, and bunker C oil. It is also obtained as a by-product from the ethylene stream during the cracking of hydrocarbons. The main source of acetylene is petroleum products. The other important raw material is calcium carbide. The prices of these materials vary in tandem with the prices of natural gas and crude oil. Because of the decline in crude oil prices, many offshore drilling companies have begun cutting costs by reducing the size of their operation. This has affected the revenue of vendors and the market. Therefore, this price volatility has increased the uncertainty in the market, thereby posing a challenge to the market growth.

This acetylene gas market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global acetylene gas market as a part of the global industrial gases market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the acetylene gas market during the forecast period.

Who are the Major Acetylene Gas Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Air Products and Chemicals Inc.

- BASF SE

- Clariant International Ltd.

- Coregas Pty Ltd

- Koatsu Gas Kogyo Co. Ltd.

- L Air Liquide SA

- Premier Cryogenics Ltd.

- Saudi Basic Industries Corp.

- SOL Spa

- The Linde Group

This statistical study of the acetylene gas market encompasses successful business strategies deployed by the key vendors. The acetylene gas market is concentrated and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Air Products and Chemicals Inc.- The company offers Acetylene Gas such as Acetylene Integra cylinder, Acetylene Premier, and Full cylinder range.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The acetylene gas market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Acetylene Gas Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the acetylene gas market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global industrial gases market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Acetylene Gas Market?

For more insights on the market share of various regions Request for a FREE sample now!

86% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for acetylene gas market in APAC. Market growth in this region will be faster than the growth of the market in all other regions.

The rapid expansion of end-user industries such as automotive, paper, glass, plastics, and others along with the abundant supply of raw materials used for producing acetylene will facilitate the acetylene gas market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 slowed down the growth of the market in 2020, as it hit the operations and services of various industries, which led to an economic slowdown in 2020. Moreover, the supply chain of the market was disrupted in 2020 due to mandatory lockdowns imposed by government authorities in this region. Chemical industries and manufacturing units were shut down in this region, which led to market disruptions in APAC in 2020. Although complete lockdown restrictions were lifted in Q4 of 2020, partial lockdowns and night curfews are still being imposed in some countries, such as India, due to the growing number of COVID-19 cases. This is expected to slow down market growth in APAC during the forecast period.

What are the Revenue-generating Application Segments in the Acetylene Gas Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The acetylene gas market share growth by the chemical synthesis segment will be significant during the forecast period. Acetylene is a versatile compound in the specialty and fine chemical industry and is widely used in many synthetic applications. It is used for producing perfume components, polymer additives, plastics, vitamins, solvents, and other surface-active compounds. Acetylene is primarily used for manufacturing 1,4-butanediol. It comprises around 85% of the share of chemicals synthesized from acetylene.

This report provides an accurate prediction of the contribution of all the segments to the growth of the acetylene gas market size and actionable market insights on post COVID-19 impact on each segment.

|

Acetylene Gas Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.31% |

|

Market growth 2021-2025 |

108.81 mn tons |

|

Market structure |

Concentrated |

|

YoY growth (%) |

3.01 |

|

Regional analysis |

APAC, Europe, North America, MEA, South America, APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 86% |

|

Key consumer countries |

China, Japan, US, Germany, and France |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Air Products and Chemicals Inc., BASF SE, Clariant International Ltd., Coregas Pty Ltd, Koatsu Gas Kogyo Co. Ltd., L Air Liquide SA, Premier Cryogenics Ltd., Saudi Basic Industries Corp., SOL Spa, and The Linde Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Acetylene Gas Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive acetylene gas market growth during the next five years

- Precise estimation of the acetylene gas market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the acetylene gas industry across APAC, Europe, North America, MEA, South America, APAC, Europe, North America, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of acetylene gas market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch