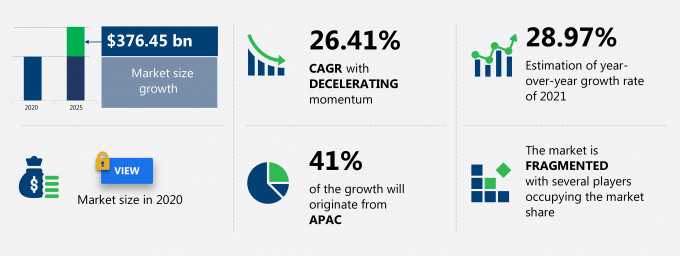

The e-commerce payment market share is expected to increase by USD 376.45 billion from 2020 to 2025, at a CAGR of 26.41%.

This e-commerce payment market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers e-commerce payment market segmentation by type (e-wallets, cards, online banking, and direct debits) and geography (APAC, North America, Europe, South America, and MEA). The e-commerce payment market report also offers information on several market vendors, including Amazon.com Inc., American Express Co., Apple Inc., Capital One Financial Corp., Mastercard Inc., PayPal Holdings Inc., Stripe Inc., The OLB Group Inc., UnionPay International Co. Ltd., and Visa Inc. among others.

What will the E-commerce Payment Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the E-commerce Payment Market Size for the Forecast Period and Other Important Statistics

E-commerce Payment Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post COVID-19 era. The rising number of online transactions is notably driving the e-commerce payment market growth, although factors such as concerns related to privacy and security may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the e-commerce payment industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key E-commerce Payment Market Driver

The rising number of online transactions is notably driving the e-commerce payment market growth. Consumers are progressively adopting internet-connected devices for some transactions. The financial and e-commerce sectors are the main adopters of online transactions. Online transactions are gaining importance among individual consumers as they are very easy, quick, and convenient to use as compared to traditional methods. Consumers are also using smartphones to make online transactions at any time. However, these financial and e-commerce transactions are vulnerable to the threat of cyber-attacks. The use of e-commerce is influenced by the COVID-19 pandemic. To avoid the spread of COVID-19, many countries have announced lockdowns and travel restrictions. Hence, the time spent by people on e-commerce websites is increasing in countries such as the US, the UAE, Italy, India, China, Spain, and Germany. The increase in the use of e-commerce websites is also increasing the demand for e-commerce payment platforms and, consequently, driving the growth of the market.

Key E-commerce Payment Market Trend

The rise in the use of wireless networks is the key market trend driving the e-commerce payment market growth. Increasing internet and wireless broadband penetration are one of the primary drivers for the growth of the e-commerce market as it is driving the social and the mobility phenomenon across the market. The increased distribution of wireless technologies is positively affecting the e-commerce payment market on two levels. Firstly, this infrastructure provides a functional and efficient platform for the vendors to showcase the product in a secure network for all the concerned buyers. Secondly, the entire digital ecosystem of both consumer and enterprise technologies demands the implementation of network access control capabilities to better shield the entire system from malicious software, network vulnerabilities, breaches, and security threats. This growing use of wireless networks will increase the market share of the e-commerce payment market due to their interdependency.

Key E-commerce Payment Market Challenge

The major challenge impeding the e-commerce payment market growth is the concerns related to privacy and security. Payment service providers use online cookies to gather personal data and customer information so that they can customize advertising messages to target key audiences. The indiscriminate use of cookies can infringe client privacy, while location-based online services have raised privacy concerns because these can reveal the geographical location of the customer. In general, online retailers may collect a large volume of data, including addresses, credit card information, passwords, and other credentials. Many companies also collect a large volume of data through cookies and other methods to determine demographics and better target advertising for future transactions. Confidential information, including consumer address and credit card information, is deterrent because m-commerce involves monetary transitions in real time. These factors can inhibit the online experience of customers and hinder the potential growth of the market during the forecast period.

This e-commerce payment market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global e-commerce payment market as a part of the global information technology spending market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the e-commerce payment market during the forecast period.

Who are the Major E-commerce Payment Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Amazon.com Inc.

- American Express Co.

- Apple Inc.

- Capital One Financial Corp.

- Mastercard Inc.

- PayPal Holdings Inc.

- Stripe Inc.

- The OLB Group Inc.

- UnionPay International Co. Ltd.

- Visa Inc.

This statistical study of the e-commerce payment market encompasses successful business strategies deployed by the key vendors. The e-commerce payment market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Amazon.com Inc. - The company offers amazon pay for e-commerce payments.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The e-commerce payment market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

E-commerce Payment Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the e-commerce payment market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for E-commerce Payment Market?

For more insights on the market share of various regions Request for a FREE sample now!

41% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for the e-commerce payment market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Increasing urbanization and increasing penetration of internet services will facilitate the e-commerce payment market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The region was affected by the outbreak of COVID-19 in the first half of 2020. As of July 20, 2021, the number of COVID-19 cases in India, which is a key market for e-commerce companies, was over 32 million, out of which 0.4 million people lost their lives. During the lockdown phase, people preferred purchasing items from e-commerce websites, which acted as a catalyst for the e-commerce payment market in the region. Many e-commerce companies were accepting only digital payments, instead of currency notes, to avoid physical contacts. These factors can influence market growth in the region during the forecast period.

What are the Revenue-generating Type Segments in the E-commerce Payment Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The e-commerce payment market share growth by the e-wallets segment will be significant during the forecast period. The primary factors that are raising the e-commerce payment market share for the e-wallets segment are added features such as rewards point programs specific to wallets, multiple payment options, and ease of sending and receiving money. Additionally, other prominent factors positively affecting the overall growth are the rising penetration of smartphones and growing consumer awareness.

This report provides an accurate prediction of the contribution of all the segments to the growth of the e-commerce payment market size and actionable market insights on post COVID-19 impact on each segment.

|

E-commerce Payment Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 26.41% |

|

Market growth 2021-2025 |

$ 376.45 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

28.97 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 41% |

|

Key consumer countries |

China, US, UK, Germany, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Amazon.com Inc., American Express Co., Apple Inc., Capital One Financial Corp., Mastercard Inc., PayPal Holdings Inc., Stripe Inc., The OLB Group Inc., UnionPay International Co. Ltd., and Visa Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this E-commerce Payment Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive e-commerce payment market growth during the next five years

- Precise estimation of the e-commerce payment market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the e-commerce payment industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of e-commerce payment market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch