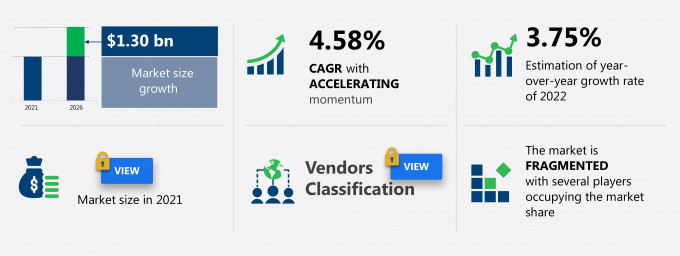

The road freight transport market share in Colombia is expected to increase by USD 1.30 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 4.58%.

This road freight transport market in Colombia research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers road freight transport market in Colombia segmentation by end-user (construction, manufacturing, food and beverages, agriculture, and others) and type (full truckload and less-than truckload). The road freight transport market in Colombia report also offers information on several market vendors, including CLM Cargo, CONSIGNACIONES TRANSITOS Y TRANSPORTES INTERNACIONALES SA, COORDINADORA, Deutsche Post AG, DSV Panalpina AS, Logistics Plus Inc., OPL CARGA SAS, TCC INVERSIONES SA, Transportes Sanchez Polo, and TRANSPORTES VIGIA SAS among others.

What will the Road Freight Transport Market Size in Colombia be During the Forecast Period?

Download the Free Report Sample to Unlock the Road Freight Transport Market Size in Colombia for the Forecast Period and Other Important Statistics

Road Freight Transport Market in Colombia: Key Drivers, Trends, and Challenges

The need to increase operational efficiency is notably driving the road freight transport market growth in Colombia, although factors such as high operational costs and competitive pricing may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the road freight transport industry in Colombia. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Road Freight Transport Market Driver in Colombia

The need to increase operational efficiency is one of the key drivers supporting the road freight transport market growth in Colombia. An increase in fleet operating costs because of a rise in vehicle and fuel prices has created the need for increased operational efficiency. This has affected the profit margins of logistics businesses. Companies rely more on intermodal transportation to ship automotive parts, consumer goods, and heavy vehicles. The main reasons for the increased use of intermodal transportation are improved efficiency, cost reduction, and environmental impact. It offers many advantages over other modes of transportation. Intermodal transportation is cost-effective, easy to track, and has only a few idle periods. Other benefits include door-to-door delivery, faster delivery, the safety of the cargo, and the ability to use different routes. Such beneficiary attributes are driving the market growth.

Key Road Freight Transport Market Trend in Colombia

The increasing popularity of RFID tags is one of the key trends contributing to the road freight transport market growth in Colombia. RFID tags reduce the time for companies to identify trucks at the inbound/outbound gates at different locations, such as warehouse gates or cross-border gates. It has many other applications, such as capturing a truck's arrival and departure time or by including a reader at the fueling depot. The reader will help companies track the fuel consumption of vehicles. It is estimated that there has been a significant cost reduction due to the implementation of RFID tags. Moreover, the use of RFID tags saves time. This, in turn, allows a truck to do more trips in a month, increasing the profit by 10%–20%. Hence, the growing use of RFID tags will fuel the growth of the road freight transport market in Colombia during the forecast period.

Key Road Freight Transport Market Challenge in Colombia

High operational costs and competitive pricing are some of the factors hindering the road freight transport market growth in Colombia. Vendors in the market are under constant pressure from customers to keep prices low. While these providers have made profits from fixed-term contracts with customers, the volatility of fuel prices has decreased profitability. Users demand additional services at the same price, making it difficult for companies to price their services. The market requires a capital-intensive infrastructure in terms of a large fleet of vehicles and containers at ports, technology-equipped warehouses that store different products, and skilled labor. Furthermore, logistics service providers must control their operational costs to compete in the market. Small-sized logistics companies, which generate low revenue from their business operations, have long breakeven periods because of high operating costs. Hence, these factors are expected to hamper the growth of the market in focus during the forecast period

This road freight transport market in Colombia analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the road freight transport market in Colombia as a part of the global trucking market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the road freight transport market in Colombia during the forecast period.

Who are the Major Road Freight Transport Market Vendors in Colombia?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- CLM Cargo

- CONSIGNACIONES TRANSITOS Y TRANSPORTES INTERNACIONALES SA

- COORDINADORA

- Deutsche Post AG

- DSV Panalpina AS

- Logistics Plus Inc.

- OPL CARGA SAS

- TCC INVERSIONES SA

- Transportes Sanchez Polo

- TRANSPORTES VIGIA SAS

This statistical study of the road freight transport market in Colombia encompasses successful business strategies deployed by the key vendors. The road freight transport market in Colombia is fragmented and the vendors are deploying growth strategies such as expanding their geographical reach and realigning their product offerings to compete in the market.

Product Insights and News

- CLM Cargo - The company offers road freight transport that provides solutions for logistics, ocean freight, air freight, ground transportation, customs broker, warehousing and storage, courier.

- CONSIGNACIONES TRANSITOS Y TRANSPORTES INTERNACIONALES SA - The company offers road freight transport that provides services for air transport, marine transport, ground transportation, customs services, logistics and distribution, special transport.

- COORDINADORA - The company offers road freight transport that provides services such as request free pickup, delivery times, merchandise shipping service, sending documents, messaging and stationery filing, international deliveries, bulk load, chemical and chemical dangerous goods, online service.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The road freight transport market in Colombia forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Road Freight Transport Market in Colombia Value Chain Analysis

Our report provides extensive information on the value chain analysis for the road freight transport market in Colombia, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the trucking market includes the following core components:

- Shippers

- Truck operators

- Trucking carriers

- Consignees

- Marketing and sales

- Services

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

What are the Revenue-generating End-user Segments in the Road Freight Transport Market In Colombia?

To gain further insights on the market contribution of various segments Request for a FREE sample

The road freight transport market share growth in Colombia by the construction segment will be significant during the forecast period. The rising residential construction in the country is fuelling the demand for specialized construction equipment which is enhancing the demand for road freight transportation in the country. Furthermore, the US-Colombia Trade Promotion Agreement (TPA) allows road and construction equipment to enter Colombia duty-free, creating opportunities for road freight transportation in the construction industry in Colombia. The industry in Colombia is also the third-largest industry in Latin America. Moreover, the government initiatives for the development of the Colombian construction industry are driving the growth of the construction industry.

This report provides an accurate prediction of the contribution of all the segments to the growth of the road freight transport market size in Colombia and actionable market insights on post COVID-19 impact on each segment.

|

Road Freight Transport Market Scope in Colombia |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.58% |

|

Market growth 2022-2026 |

$ 1.30 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.75 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

CLM Cargo, CONSIGNACIONES TRANSITOS Y TRANSPORTES INTERNACIONALES SA, COORDINADORA, Deutsche Post AG, DSV Panalpina AS, Logistics Plus Inc., OPL CARGA SAS, TCC INVERSIONES SA, Transportes Sanchez Polo, and TRANSPORTES VIGIA SAS |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Road Freight Transport Market in Colombia Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive road freight transport market growth in Colombia during the next five years

- Precise estimation of the road freight transport market size in Colombia and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the road freight transport industry in Colombia

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of the road freight transport market vendors in Colombia

We can help! Our analysts can customize this report to meet your requirements. Get in touch