Sodium Nitrate Market Size 2024-2028

The sodium nitrate market size is forecast to increase by USD 32.5 million at a CAGR of 4.65% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for fertilizers in agriculture. Sodium nitrate is a valuable additive element in the production of fertilizers for crops such as corn, wheat, and soybeans. In addition to its agricultural applications, sodium nitrate finds usage in the pyrotechnics industry as a non-toxic and non-poisonous substitute for black powder. It is an essential additive element in the production of cereal crops like sugarcane, corn, and wheat. Furthermore, the renewable energy sector is also utilizing sodium nitrate as a stabilizing agent. However, the market growth is being challenged by the deterioration of soil caused by the extensive use of chemical fertilizers. To mitigate this issue, researchers are exploring the potential of sodium nitrate as a sustainable alternative to chemical fertilizers.

Sodium nitrate, a vital inorganic chemical compound, is widely used in various industries due to its unique properties. This salt of nitric acid and sodium hydroxide is known for its non-toxic and non-poisonous nature, making it a preferred choice in several applications. The agricultural industry is a significant consumer of sodium nitrate. In the agricultural sector of India, which caters to a vast population and expanding agricultural production, sodium nitrate plays a crucial role.

In addition, the Indian agriculture sector's reliance on sodium nitrate is increasing due to its ability to improve crop yield and enhance their nutritional value. Besides agriculture, sodium nitrate finds extensive applications in the explosives industry. As a stable and reliable additive, it is used to enhance the performance and safety of explosives. In glass manufacturing, sodium nitrate is employed as a fluxing agent, which reduces the melting point of silica and facilitates the smooth flow of molten glass. Pyrotechnics, an industry that deals with the production of fireworks and other explosive substances, also utilizes sodium nitrate as a primary component.

Furthermore, it acts as a vital oxidizer in the formulation of various pyrotechnic compositions. Despite its wide usage, sodium nitrate's application industries must adhere to stringent regulations to ensure its safe handling and disposal. In the context of environmental concerns, sodium nitrate's impact on groundwater and drinking water must be monitored. However, the compound's non-toxic and non-poisonous nature makes it a preferred choice over other potentially harmful chemicals. The consumption of sodium nitrate in the chemical industries is substantial due to its versatile applications. Its use in the production of various chemicals, including nitrates and nitrites, is essential. The compound's stability and ease of handling make it a preferred choice in the chemical industry.

In conclusion, sodium nitrate's applications span across various industries, including agriculture, explosives, glass, and pyrotechnics. Its unique properties, such as non-toxicity and non-poisonous nature, make it a preferred choice for numerous applications. The increasing demand for sodium nitrate in the agricultural sector, driven by population growth and expanding agricultural production, is a significant market trend. The compound's role in enhancing crop yield and improving nutritional value makes it an indispensable additive in cereal crop production. Sodium nitrate is consumed in substantial quantities in the explosives industry due to its stability and performance-enhancing properties. Its use as a fluxing agent in glass manufacturing and as an oxidizer in pyrotechnics further expands its market potential.

Despite the environmental concerns, sodium nitrate's non-toxic and non-poisonous nature makes it a preferred choice over other potentially harmful chemicals. The market for sodium nitrate is expected to grow steadily, driven by its diverse applications and increasing demand across various industries.

Market Segmentation

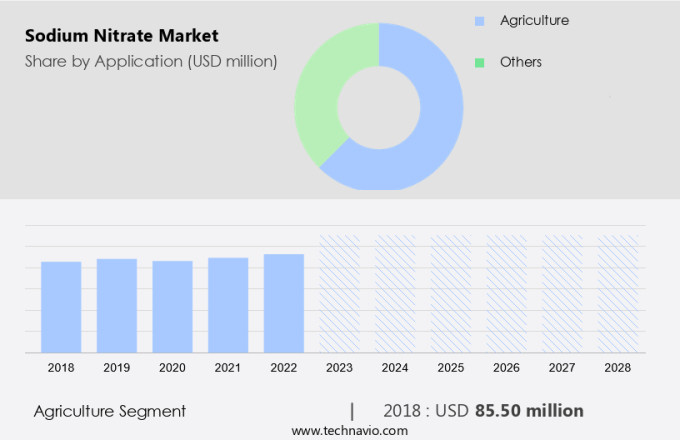

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Agriculture

- Others

- Grade Type

- Industrial

- Food

- Pharmaceutical

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The agriculture segment is estimated to witness significant growth during the forecast period. Sodium nitrate is an essential component in cereal crop production, providing necessary nutrients for optimal plant growth. This vital chemical is utilized on agricultural land and arable land worldwide to enhance food crop yield. Farmers apply food-grade sodium nitrate as a preservative and antimicrobial agent to ensure healthy plant development, particularly during unfavorable environmental conditions such as low rainfall, cold weather, or infertile soil. Sodium nitrate plays a crucial role in regulating soil acidity, acting as a neutralizer. With its ability to improve crop yield and maintain soil health, sodium nitrate remains a valuable asset in the agriculture industry.

Get a glance at the market share of various segments Request Free Sample

The agriculture segment accounted for USD 85.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Sodium nitrate is a versatile chemical compound with various applications across multiple industries, including electronics, agriculture, and food processing. In the electronics sector, sodium nitrate is utilized as a solvent and in the production of certain adhesives. In the agriculture industry, it functions as a fertilizer, contributing significantly to the growth of crops. In the food industry, sodium nitrate is primarily used as a food preservative, particularly in APAC, where population growth has led to an increase in demand for ready-to-eat food products and processed foods. The need for extended shelf life and improved food safety has further fueled the adoption of sodium nitrate in food processing.

Moreover, sodium nitrate finds extensive use in the manufacturing of drain cleaners and heat transfer agents. In the United States, sodium nitrate is also approved as a food additive, adhering to stringent purity levels set by regulatory bodies to ensure food safety. As per the latest market research, the market is projected to witness steady growth in the coming years.

The United States, being a major consumer of fireworks, generates substantial revenue for the market. According to the Observatory of Economic Complexity (OEC), the US imported approximately USD 153 million worth of sodium nitrate in 2022.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for fertilizers is the key driver of the market. Sodium nitrate, a water-soluble fertilizer, is a crucial component in agriculture as it enhances the nitrogen content of soil, thereby promoting plant growth. Classified under nitrogen-containing fertilizers, sodium nitrate acts as an oxidizer and is the oldest known nitrogen-rich fertilizer.

The global population growth has led to an increasing demand for food, necessitating advanced methods and techniques in crop production. Fertilizers, including sodium nitrate, play a vital role in this process by improving crop yields in a shorter timeframe. As a result, the market for sodium nitrate in the fertilizer industry is experiencing significant growth. The demand for sodium nitrate is driven by its ability to boost crop yields and improve overall agricultural productivity.

Market Trends

Use of sodium nitrate in renewable energy segment is the upcoming trend in the market. The market holds significant importance in various industries, particularly in the production of fertilizers for Corn, Wheat, and Soybeans. Sodium Nitrate is a crucial additive element that enhances the growth of these crops by improving their nitrogen content. Beyond agriculture, Sodium Nitrate finds extensive applications in Black Powder and Pyrotechnics, where it acts as a stabilizer and enhances the performance of these products. Sodium Nitrate is renowned for its non-toxic and non-poisonous properties, making it a preferred choice over other nitrate salts. Its stability under various conditions is another key factor contributing to its wide usage.

Furthermore, these reports offer valuable information on market size, growth trends, and key players, among other vital aspects. The increasing demand for Sodium Nitrate across diverse industries is expected to drive market growth during the forecast period. The solar energy sector, in particular, is poised for significant expansion, with Sodium Nitrate playing a crucial role in the functioning of solar power plants. By storing heat energy generated by these plants, Sodium Nitrate facilitates the conversion of heat into electric current, thereby contributing to the reduction of carbon emissions and the conservation of natural resources.

Market Challenge

Soil deterioration caused by chemical fertilizers is a key challenge affecting the market growth. Sodium nitrate is a versatile chemical compound with significant applications in various industries, including fertilizers and explosives. In the agricultural sector, it is widely used due to its ability to provide nitrogen to the soil, making it easily soluble in water and other solvents. This characteristic makes it an essential ingredient in fertilizers, ensuring optimal crop growth. However, it is crucial to use sodium nitrate judiciously to prevent soil degradation over time. Excessive use of sodium nitrate in agriculture can negatively impact soil health. Several developing countries, including the Indian agriculture sector, have grappled with the consequences of overusing chemical fertilizers for decades.

In addition, the population's increasing demand for agricultural production, particularly in crops like sugarcane, has led to an overreliance on sodium nitrate and other chemical fertilizers. As a result, there is a growing trend towards alternative fertilizers that have a less harmful effect on the soil. This shift is driven by the need to maintain soil health for future agricultural production. Sodium nitrate remains an essential component of the agricultural industry, but its use must be balanced with the long-term health of the soil. In summary, sodium nitrate plays a vital role in various industries, including fertilizers and explosives. Its application in agriculture is crucial for crop growth, but its excessive use can lead to soil degradation. Therefore, it is essential to use sodium nitrate judiciously and explore alternative fertilizers to maintain soil health for future agricultural production.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AG Chemi Group s.r.o. - The company primarily offers chemicals, ceramics, refractory materials, detergents, fertilizers, mining fuels, automotive, construction, and explosives. The key offerings of the company include sodium nitrate for solid propellants, explosives, and fertilizers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akshay Group of Companies

- All Chemical Manufacturing and Consultancy Pty Ltd.

- Anish Chemicals

- Arihant Chemical

- Avantor Inc.

- BASF SE

- Deepak Nitrite Ltd.

- Jagannath Chemicals

- Jost Chemical Co.

- Nitroparis S.L.

- Otto Chemie Pvt. Ltd.

- Penta s.r.o

- Quality Chemicals S.L

- Ravi Chem Industries

- SNDB

- SQM S.A.

- Spectrum Laboratory Products Inc.

- Vizag Chemical International

- Weifang Haiye Chemistry and Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sodium nitrate is a crucial inorganic compound with various applications in diverse industries. It is widely used as an additive element in the production of fertilizers due to its ability to enhance agricultural productivity. In the agricultural industry, sodium nitrate is employed to boost the growth of food crops such as sugarcane, corn, wheat, and soybeans. The Indian agriculture sector, with its large population and expanding agricultural production, is a significant consumer of sodium nitrate. Beyond fertilizers, sodium nitrate finds extensive use in the explosives industry. It is a critical component of black powder and pyrotechnics, contributing to their stability and effectiveness.

Furthermore, in the glass industry, sodium nitrate acts as a non-toxic and non-poisonous additive, enhancing the quality of the final product. The market is driven by the increasing demand from the agricultural industry and the explosive manufacturing industries. However, concerns regarding the potential contamination of groundwater and drinking water due to sodium nitrate have led to stringent regulations, which may impact the market growth. Sodium nitrate is also used in the chemical industries for various purposes, including as a solvent, adhesive, drain cleaner, heat transfer agent, and in the production of food-grade sodium nitrate as a preservative, antimicrobial, and coloring agent in fish, cheese, meats, and ready-to-eat food products.

In addition, the industrial-grade segment of the market includes applications in construction, electronics, and various other industries, with a focus on maintaining high purity levels. The growing population and population growth necessitate an increase in cereal crop production, leading to a higher demand for sodium nitrate. However, the potential health risks associated with sodium nitrate, such as diseases like blue baby syndrome, may pose challenges to the market. The World Bank's focus on sustainable agricultural practices and the development of alternative fertilizers may also impact the market. In conclusion, the market is diverse, with applications ranging from agriculture and explosives to glass and chemical industries. Its uses as a food additive and its role in various industrial processes make it an essential compound in multiple industries. However, concerns regarding its potential health risks and environmental impact may pose challenges to the market's growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.65% |

|

Market growth 2024-2028 |

USD 32.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AG Chemi Group s.r.o., Akshay Group of Companies, All Chemical Manufacturing and Consultancy Pty Ltd., Anish Chemicals, Arihant Chemical, Avantor Inc., BASF SE, Deepak Nitrite Ltd., Jagannath Chemicals, Jost Chemical Co., Nitroparis S.L., Otto Chemie Pvt. Ltd., Penta s.r.o, Quality Chemicals S.L, Ravi Chem Industries, SNDB, SQM S.A., Spectrum Laboratory Products Inc., Vizag Chemical International, and Weifang Haiye Chemistry and Industry Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch