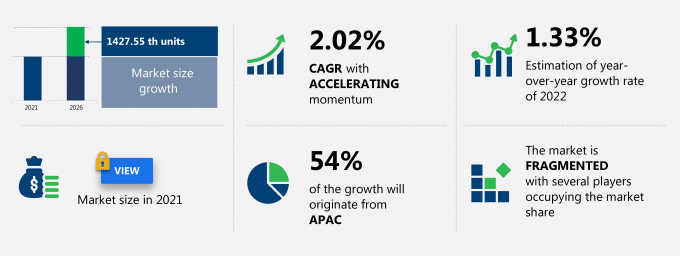

The sodium sulfate market share is expected to increase by 1427.55 thousand units from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 2.02%.

This sodium sulfate market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers sodium sulfate market segmentations by product (synthetic sodium sulfate and natural sodium sulfate), application (detergent, glass, pulp and paper, and others), and geography (APAC, Europe, North America, MEA, and South America). The sodium sulfate market report also offers information on several market vendors, including Alkim Alkali Kimya, Bhagwati Chemicals, CGC SAMCA, Cooper Natural Resources Inc, Cordenka GmbH and Co. KG, Elementis Plc, Grupo Industrial Crimidesa SL, Krishna Chemicals, Lenzing AG, and Nippon Chemical Industrial Co. Ltd. among others.

What will the Sodium Sulfate Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Sodium Sulfate Market Size for the Forecast Period and Other Important Statistics

Sodium Sulfate Market: Key Drivers, Trends, and Challenges

The growing demand for sodium sulfate in China is notably driving the sodium sulfate market growth, although factors such as increasing substitutes for sodium sulfate may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the sodium sulfate industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Sodium Sulfate Market Driver

The growing demand for sodium sulfate in China is one of the key drivers supporting the sodium sulfate market growth. Sodium sulfate is a key raw material in the production of glass, wood pulp, and textiles. It is also used for manufacturing detergents. In APAC, the presence of many emerging countries is expected to drive the demand for sodium sulfate during the forecast period. Sodium sulfate is considerably used in the textiles, automotive, construction, and surfactants industries of the major emerging countries such as China, India, Bangladesh, and Vietnam. Moreover, China is one of the largest producers and consumers of sodium sulfate. Thus, as sodium sulfate is used in kraft pulping, its demand is expected to be high during the forecast period.

Key Sodium Sulfate Market Trend

Growth in demand as a dyeing agent in the textile industry is one of the key sodium sulfate market trends. Sodium sulfate is used as a dyeing agent in the textile industry. It acts as a leveling agent, which reduces the negative charge on the fibers, allowing the dyes to penetrate evenly. Salt has an extremely high affinity for water, for which it is used to drive the dye into the textile during the dyeing process. The use of salt leads to maximum exhaustion of dye molecules during the dyeing process. Moreover, sodium sulfate acts as an electrolyte for migration, adsorption, and fixation of the dyestuff to the cellulose material. Furthermore, India, China, Vietnam, Ethiopia, and Bangladesh are the major textile manufacturing countries, wherein sodium sulfate is used for dyeing fabric. Thus, growing textile production is expected to increase the demand for sodium sulfate during the forecast period.

Key Sodium Sulfate Market Challenge

The increasing substitutes for sodium sulfate is one of the factors hindering the sodium sulfate market growth. There are various substitutes for sodium sulfate including calcium sulfate, soda ash, and others. These substitutes meet the demand from several end-user industries. In the pulp and paper industry, emulsified sulfur and caustic soda can replace sodium sulfate. These chemicals are used in kraft pulping. In glassmaking, soda ash and calcium sulfate are used substitutes for sodium sulfate. Thus, the increasing number of substitutes for sodium sulfate is expected to affect the consumption of sodium sulfate in major applications and negatively impact the global sodium sulfate market during the forecast period.

This sodium sulfate market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the sodium sulfate market as a part of the global commodity chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the sodium sulfate market during the forecast period.

Who are the Major Sodium Sulfate Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alkim Alkali Kimya

- Bhagwati Chemicals

- CGC SAMCA

- Cooper Natural Resources Inc

- Cordenka GmbH and Co. KG

- Elementis Plc

- Grupo Industrial Crimidesa SL

- Krishna Chemicals

- Lenzing AG

- Nippon Chemical Industrial Co. Ltd.

This statistical study of the sodium sulfate market encompasses successful business strategies deployed by the key vendors. The sodium sulfate market is fragmented and the vendors are deploying growth strategies such as formulations, purity, portfolio range, and services to compete in the market.

Product Insights and News

- Alkim Alkali Kimya - The company offers sodium sulfate that is free from the heavy metals such as arsenic, lead, zinc, chrome which are present in sulphate produced by chemical methods nor toxic minerals, under the brand name of Alkim.

- CGC SAMCA - The company offers sodium sulfate that is an ideal filler and diluent, as it is noncorrosive, neutral and cheap, under the brand name of Minera de Santa Marta.

- Cooper Natural Resources Inc - The company offers sodium sulfate that is used as a fining agent to help remove small air bubbles from molten glass, under the brand name of Cooper Natural Resources.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The sodium sulfate market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Sodium Sulfate Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the sodium sulfate market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the commodity chemicals market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Sodium Sulfate Market?

For more insights on the market share of various regions Request for a FREE sample now!

54% of the market’s growth will originate from APAC during the forecast period. China, Japan, and Mexico are the key markets for the sodium sulfate market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Growth in the construction and textile industries will facilitate the sodium sulfate market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The COVID-19 pandemic in 2020 had an adverse impact on several countries in the region, such as India, Japan, Australia, and Malaysia. However, in Q4 2020 and H1 2021, the vendors of sodium sulfate in the region started resuming their operations with proper social distancing and sanitization norms owing to progressing vaccination drives in the region. Such factors are expected to drive the growth of the regional sodium sulfate market during the forecast period.

What are the Revenue-generating Product Segments in the Sodium Sulfate Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The sodium sulfate market share growth by the synthetic sodium sulfate segment will be significant during the forecast period. Sodium sulfate is a low-cost, key raw material used in manufacturing powder detergents. It is a neutral pH substance that can easily dissolve in warm water. It is used as a desiccant. By binding to multiple molecules of water to form hydrates, sodium sulfate avoids clump formation in powder detergents. Moreover, increasing awareness about health and cleanliness has led to the use of powder detergents globally. In emerging countries, such as India and China, a growing population with increasing awareness about hygiene is driving the demand for detergents. This, in turn, is expected to lead to higher demand for sodium sulfate in manufacturing powder detergents during the forecast period

This report provides an accurate prediction of the contribution of all the segments to the growth of the sodium sulfate market size and actionable market insights on post COVID-19 impact on each segment.

|

Sodium Sulfate Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.02% |

|

Market growth 2022-2026 |

1427.55 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

1.33 |

|

Regional analysis |

APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 54% |

|

Key consumer countries |

China, US, Spain, Russian Federation, Japan, and Mexico |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alkim Alkali Kimya, Bhagwati Chemicals, CGC SAMCA, Cooper Natural Resources Inc, Cordenka GmbH and Co. KG, Elementis Plc, Grupo Industrial Crimidesa SL, Krishna Chemicals, Lenzing AG, and Nippon Chemical Industrial Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Sodium Sulfate Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive sodium sulfate market growth during the next five years

- Precise estimation of the sodium sulfate market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the sodium sulfate industry across APAC, Europe, North America, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of sodium sulfate market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch