Stainless Steel Wire Rods Market Size 2024-2028

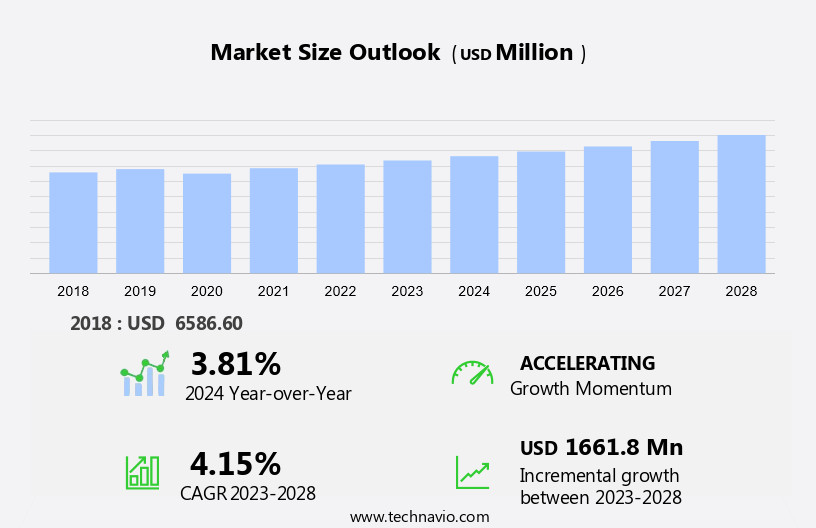

The stainless steel wire rods market size is forecast to increase by USD 1.66 billion at a CAGR of 4.15% between 2023 and 2028.

What will be the Size of the Stainless Steel Wire Rods Market During the Forecast Period?

How is this Stainless Steel Wire Rods Industry segmented and which is the largest segment?

The stainless steel wire rods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Steel wire

- Steel fasteners

- Steel bright bars

- Others

- Product

- 8 mm

- 10 mm

- 6 mm

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- US

- Middle East and Africa

- South America

- APAC

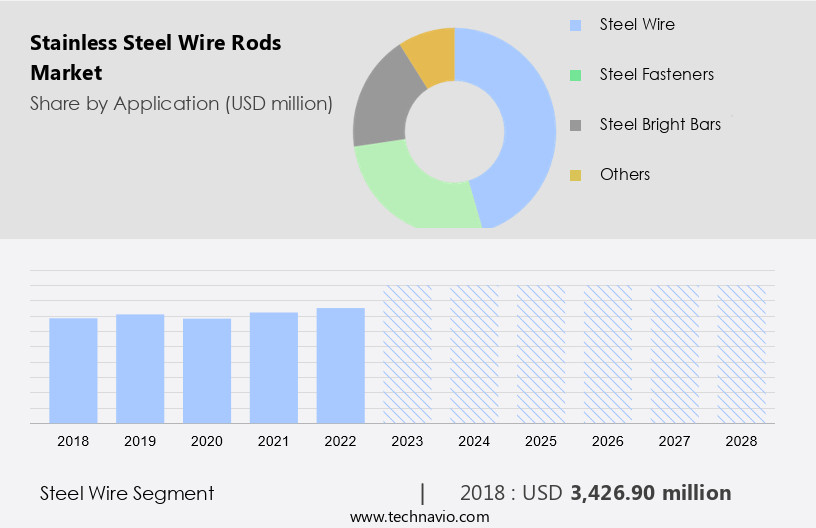

By Application Insights

The steel wire segment is estimated to witness significant growth during the forecast period. Steel wire, derived from high-carbon and low-carbon steel, is a versatile material used extensively in various industries, including construction, manufacturing, automotive, and agriculture. The rising demand for steel wire is attributed to its superior strength, durability, and corrosion resistance. In construction, steel wire is employed as reinforcement for concrete structures, and in suspension bridges, it is utilized for ropes due to its high tensile strength. Furthermore, steel wires find extensive applications in industries like mining, marine, oil & gas, aviation, medical, paper mills, and household applications. The lightweight yet robust nature of steel wires makes them suitable for use in construction projects, such as vibration dampening in marine applications and support cables in suspension bridges.

Steel wires' reliability and problem-solving capabilities are evident In their use as mooring cables, scaffolding systems, anchoring buildings, hoisting equipment, and load-carrying cables. The strength-to-weight ratio, biocompatibility, and durability of steel wires make them a preferred choice for numerous applications, offering cost savings and enhanced performance.

Get a glance at the market report of various segments Request Free Sample

The Steel wire segment was valued at USD 3.43 billion in 2018 and showed a gradual increase during the forecast period.

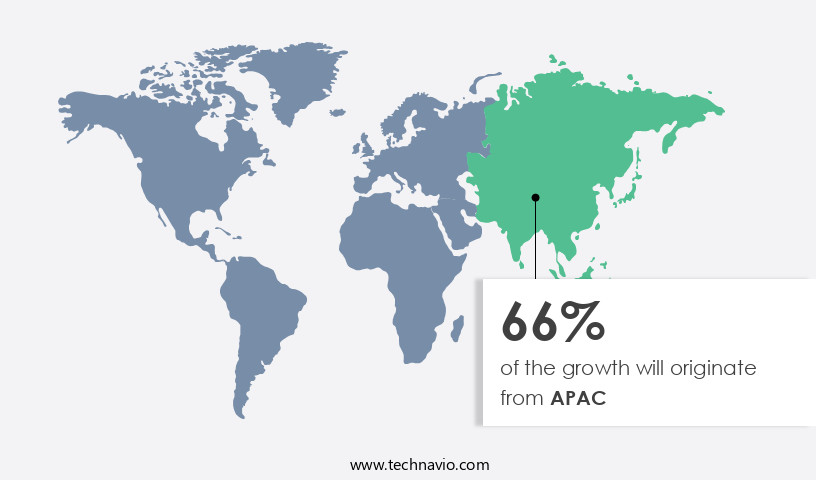

Regional Analysis

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the expansion of end-user industries, particularly In the Asia Pacific (APAC) region. Countries like China, Japan, and India are key contributors due to their growing automotive and construction sectors. For instance, India's National Smart Cities Mission aims to invest USD150 billion in urban development, with numerous public-private partnerships (PPP) already underway for smart city projects. These projects require high-performance, reliable, and durable stainless steel wire rods for various applications, including construction projects, vibration dampening, and marine applications. APAC's dominance In the market is attributed to its vast infrastructure development and increasing industrialization. The market's growth is further fueled by the demand for stainless steel wire rods in industries like mining, oil & gas, aviation, and manufacturing, among others.

The versatility, strength-to-weight ratio, and corrosion resistance of stainless steel wire rods make them an ideal choice for numerous applications, offering cost savings and enhanced reliability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Stainless Steel Wire Rods Industry?

- Growing demand from construction industry is the key driver of the market.Stainless steel wire rods are a crucial component In the construction industry, providing strength, durability, and corrosion resistance for various structures and infrastructures. With a chromium content ranging from 11.5% to 30%, these long products offer superior tensile strength and resistance to harsh environments, making them ideal for construction projects in marine, mining, and other industries. Stainless steel wire rods are versatile and reliable, used in a wide range of applications such as support cables for suspension bridges, mast stays, hoist ropes, guard rails, mooring cables, scaffolding systems, anchoring buildings, and hoisting equipment. Their high strength-to-weight ratio and biocompatibility make them suitable for medical applications as well.

In the mining industry, stainless steel wire rods are used as load-carrying cables for slope stabilization, emergency support, and lifting operations. In the marine industry, they are used for vibration dampening in marine applications, towering operations, shipbuilding, and offshore oil rigs. The aviation industry utilizes stainless steel wire rods for control cables, parachute cables, and safety cables. With their excellent performance, reliability, and cost savings, stainless steel wire rods are a problem-solver for various industries, offering installed capacity up to ultra-fine wires and robust wires for diverse applications.

What are the market trends shaping the Stainless Steel Wire Rods market?

- Strategic alliance and partnership among steel manufacturers is the upcoming market trend.Stainless steel wire rods are in high demand due to their superior corrosion resistance and high tensile strength. The chromium content In these wires enhances their resistance to rust and makes them ideal for various industries. In the construction sector, they are used in applications requiring vibration dampening and strength-to-weight ratio advantages, such as support cables for suspension bridges, mast stays, and hoist ropes. Stainless steel wire rods are also extensively used In the mining industry for load-carrying cables, slope stabilization, and emergency support. In the marine industry, these wires are essential for mooring cables, scaffolding systems, and anchoring buildings.

The oil & gas, aviation, and medical industries also rely on stainless steel wire rods for their durability and versatility. In manufacturing, these wires are used in various applications, including lifting operations, towing operations, and In the production of ultra-fine wires. Exporting stainless steel wire rods from integrated facilities ensures performance and reliability for global customers. The wires' biocompatibility makes them suitable for household applications, further expanding their market reach. The market is driven by the increasing demand for cost savings, high tensile strength, and flexibility. The market's growth is also influenced by the need for problem-solvers in harsh environments, such as coastal bridge construction and offshore oil rigs.

Stainless steel wire rods are used in various industries, including the mining industry, for load-carrying cables, slope stabilization, and emergency support. In the marine industry, they are essential for mooring cables, scaffolding systems, and anchoring buildings. The oil & gas, aviation, and medical industries also rely on stainless steel wire rods for their durability and versatility. In manufacturing, these wires are used in various applications, including lifting operations, towing operations, and In the production of ultra-fine wires. Exporting stainless steel wire rods from integrated facilities ensures performance and reliability for global customers. The wires' biocompatibility makes them suitable for household applications, further expanding their market reach.

The market's growth is also driven by the need for cost savings, high tensile strength, and flexibility. The market's growth is further fueled by the increasing demand for problem-solvers in harsh environments, such as coastal bridge construction and offshore oil rigs. The market is expected to witness significant growth during the forecast period.

What challenges does the Stainless Steel Wire Rods Industry face during its growth?

- Fluctuation in prices of raw materials is a key challenge affecting the industry growth.The market is subject to price volatility due to fluctuations in raw material costs. The prices of metals like aluminum, iron, stainless steel, and nickel, which are essential components of stainless-steel wire rods, significantly impact their cost. For instance, In the second quarter of 2021, world iron ore prices reached a record high of over USD212 per ton, almost double the level of 2015. By contrast, in January 2022, prices were around USD133 per ton, illustrating the unpredictability of raw material prices. This volatility poses a challenge for market participants, as once raw material agreements are made, price fluctuations cannot be negotiated.

Consequently, manufacturers absorb the loss. Stainless steel wire rods are extensively used in various industries, including Construction, Mining, Marine, Oil & Gas, Aviation, Medical, Paper Mills, Household Applications, Manufacturing, and Exporting, due to their superior corrosion resistance, high tensile strength, lightweight, and versatility. They are employed in various applications such as support cables, suspension bridges, mast stays, hoist ropes, guard rails, mooring cables, scaffolding systems, anchoring buildings, lifting operations, mining industry, slope stabilization, emergency support, marine industry, lifting operations, towing operations, shipbuilding, offshore oil rigs, downhole tools, aviation industry, control cables, parachute cables, safety cables, and safety. The high performance and reliability of stainless steel wire rods make them a problem-solver in harsh environments and coastal bridge construction.

Their strength-to-weight ratio, durability, biocompatibility, and versatility contribute to cost savings In the long run. The market's growth is driven by the increasing installed capacity of ultra-fine wires and the demand for robust wires in various industries.

Exclusive Customer Landscape

The stainless steel wire rods market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the stainless steel wire rods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, stainless steel wire rods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acerinox SA - Stainless steel wire rods are a key product offering from the company, encompassing various types such as Annealed wire rod, Annealed and pickled wire rod with ecological coating, and Pickled wire rod. These offerings cater to diverse industry requirements, with Annealed wire rod suitable for cold drawing and forming applications, Annealed and pickled wire rod with ecological coating for enhanced corrosion resistance, and Pickled wire rod for applications where bright surface finish is essential. The company's commitment to innovation and sustainability is reflected in its ecological coating, which minimizes environmental impact without compromising product performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acerinox SA

- Aperam SA

- ArcelorMittal SA

- E United Group

- EVRAZ Plc

- Fasten.it S r l

- Gustav Wolf GmbH

- HONG YUE STAINLESS STEEL Ltd.

- Ivaco Rolling Mills

- JFE Holdings Inc.

- Jindal Steel and Power Ltd.

- JSW Group

- Mirach Metallurgy Co. Ltd.

- Nippon Steel Corp.

- NV Bekaert SA

- Outokumpu Oyj

- POSCO holdings Inc.

- Shagang Group Inc.

- Tsingshan Holding Group Co. Ltd.

- Venus Wire Industries Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Stainless steel wire rods have gained significant traction in various industries due to their exceptional properties, making them a preferred choice over traditional materials. These long products offer a unique blend of corrosion resistance, strength, and lightweight characteristics, making them indispensable in construction, mining, marine, oil & gas, aviation, medical, paper mills, and household applications. The demand for stainless steel wire rods can be attributed to their superior performance and reliability. The chromium content In these rods enhances their resistance to corrosion, making them ideal for use in harsh environments. Moreover, their high tensile strength and flexibility make them a problem-solver for various applications, from construction projects to vibration dampening in marine applications.

Stainless steel wire rods are extensively used In the construction industry for various applications, including support cable for suspension bridges, mast stays, hoist ropes, guard rails, mooring cables, and scaffolding systems. Their high strength-to-weight ratio makes them an excellent choice for anchoring buildings and hoisting heavy loads. In the mining industry, stainless steel wire rods are used as load-carrying cable for mining operations, slope stabilization, and emergency support. Their robustness and durability make them an essential component In the mining process, ensuring safety and cost savings. The marine industry also heavily relies on stainless steel wire rods for various applications, including mooring cables, tow cables, and control cables.

These rods offer excellent rust resistance, making them suitable for use in coastal bridge construction and other harsh marine environments. The oil & gas industry utilizes stainless steel wire rods for downhole tools and lifting operations. Their high tensile strength and flexibility make them ideal for use In the demanding conditions of offshore oil rigs. In the aviation industry, stainless steel wire rods are used for safety cables, parachute cables, and control cables. Their biocompatibility and durability make them a preferred choice for medical applications, including surgical instruments and implants. Paper mills and household applications also benefit from the use of stainless steel wire rods due to their versatility and reliability.

These rods offer weight capacities suitable for various applications, from small household appliances to large-scale industrial machinery. In conclusion, stainless steel wire rods offer a unique blend of properties that make them a preferred choice in various industries. Their corrosion resistance, strength, and lightweight characteristics make them an essential component in construction, mining, marine, oil & gas, aviation, medical, paper mills, and household applications. The reliability and versatility of these rods ensure cost savings and improved performance in harsh environments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.15% |

|

Market growth 2024-2028 |

USD 1661.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.81 |

|

Key countries |

China, India, US, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Stainless Steel Wire Rods Market Research and Growth Report?

- CAGR of the Stainless Steel Wire Rods industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the stainless steel wire rods market growth of industry companies

We can help! Our analysts can customize this stainless steel wire rods market research report to meet your requirements.