Surface Mount Technology (SMT) Equipment Market Size 2025-2029

The surface mount technology (smt) equipment market size is forecast to increase by USD 4.03 billion at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the miniaturization trend in electronic components. As electronic devices continue to shrink in size, the demand for SMT equipment that enables the manufacturing of smaller, more intricate components increases. Furthermore, the expanding electronic industry, fueled by the rise of IoT, automotive, and telecommunications sectors, is expected to boost market growth. However, the high cost of deploying SMT equipment, including the initial investment and ongoing maintenance expenses, poses a challenge for small and medium-sized enterprises (SMEs). To capitalize on this market opportunity, companies must focus on offering cost-effective and efficient SMT solutions. Additionally, collaboration with industry partners and exploring emerging technologies, such as automation and robotics, can help mitigate the high deployment costs and improve overall productivity.

- In summary, the SMT Equipment Market is poised for growth due to the miniaturization trend and expanding electronic industry, but the high cost of deployment presents a significant challenge. Companies seeking to capitalize on this market opportunity must focus on cost-effective and efficient solutions, while also exploring collaborations and emerging technologies.

What will be the Size of the Surface Mount Technology (SMT) Equipment Market during the forecast period?

- The market encompasses machinery and tools utilized in the production of circuit boards with surface-mounted electronic components. This market experiences significant growth due to the increasing demand for advanced electronic devices in various sectors, including consumer electronics and telecommunications. The consumer electronics market's expansion, driven by smartphone adoption rates, fuels the need for more intricate and compact circuit boards, which SMT equipment facilitates. In the realm of electronic components, SMT plays a crucial role in the assembly of passive components and semiconductors.

- The ongoing research and development in semiconductor packaging and PCB design contribute to the continuous advancement of SMT technology. The wireless communication standards' evolution and the increasing complexity of electronic devices further reinforce the market's importance. Despite the intense focus on innovation, the SMT equipment market maintains a steady growth trajectory, providing ample opportunities for industry participants.

How is this Surface Mount Technology (SMT) Equipment Industry segmented?

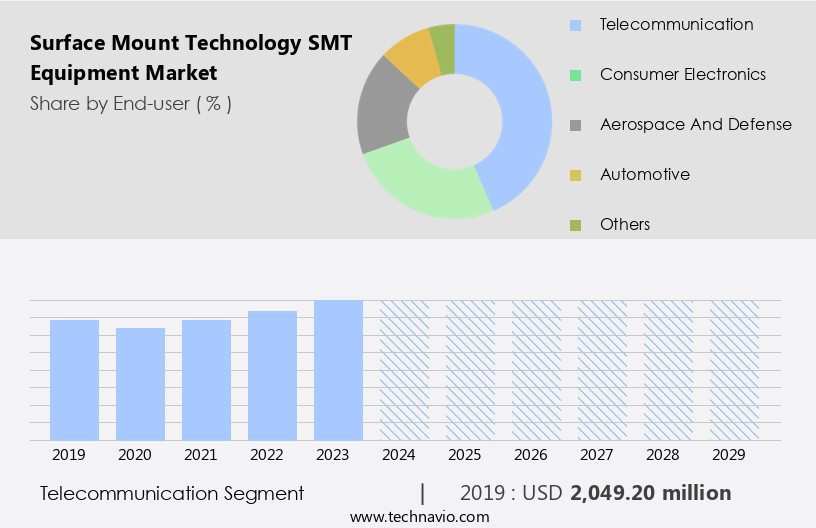

The surface mount technology (smt) equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Telecommunication

- Consumer electronics

- Aerospace and defense

- Automotive

- Others

- Type

- Placement equipment

- Inspection equipment

- Soldering equipment

- Screen printing equipment

- Others

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

The telecommunication segment is estimated to witness significant growth during the forecast period.

The telecommunications sector's growth is fueling the demand for advanced technologies, such as Surface Mount Technology (SMT) equipment, in the manufacturing process of various networking and telecom products. The need for miniaturization and quicker time-to-market (TTM) is driving the adoption of SMT equipment for high-speed component placement. Industry players are expected to adapt to evolving design and manufacturability trends in the telecom industry. The standard component size in the industry is now 0402 packaging, making high-speed placement a necessity. With continuous design changes, the use of SMT equipment for surface mount technology is becoming increasingly popular.

This technology enables automated systems, including precision tools, placement equipment, soldering equipment, inspection equipment, and cleaning equipment, to streamline manufacturing services, designing services, supply chain services, and aftermarket services in the industrial industry. The integration of artificial intelligence (AI) and machine learning (ML) in SMT equipment further enhances automation technology, improving efficiency and productivity. Trade regulations and logistics industry challenges necessitate the adoption of advanced technologies to maintain competitiveness.

Get a glance at the market report of share of various segments Request Free Sample

The Telecommunication segment was valued at USD 2.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is anticipated to experience significant growth, driven by the industrial sectors of China, South Korea, Japan, India, and Taiwan. These countries' semiconductor industries and manufacturing units are the primary contributors to the market's expansion. The automotive, electrical and electronics, and renewable energy sectors are expected to be the major application areas for SMT equipment due to their increasing demand for advanced technology and automation. China and Japan, as leading manufacturing nations, are particularly focusing on flexible automation in their electronics and appliances, semiconductor, and automotive industries. The adoption of automation technology, including inspection equipment, soldering equipment, screen printing equipment, placement equipment, and cleaning equipment, is crucial for these industries to maintain precision and efficiency.

Additionally, designing services, supply chain services, manufacturing services, and aftermarket services play a vital role in the SMT equipment market's growth. Key industries, such as the semiconductor, telecommunications, and consumer electronics sectors, are also significant contributors to the market's growth due to the increasing adoption rates of smartphones, wireless communication standards, and electronic devices. The integration of artificial intelligence (AI) and machine learning (ML) in SMT equipment further enhances automation and precision, making it an essential investment for manufacturers. Trade regulations and logistics industry challenges may impact the market's growth, but the overall outlook remains positive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surface Mount Technology (SMT) Equipment Industry?

Miniaturization of components is the key driver of the market.

- The market is experiencing growth due to the increasing trend towards miniaturization in consumer products. With a focus on reducing the cost per board and manufacturing smaller goods, there is a rising demand for automated and accurate placement solutions. As the electronics industry shifts towards smaller passive components with size factors approaching 0.5 mm, the need for advanced software and feeder technology in SMT equipment becomes increasingly important.

- This demand for higher assembly densities is driving market growth during the forecast period. The SMT equipment market is poised for expansion as manufacturers continue to prioritize smaller footprints and increased efficiency in their manufacturing processes.

What are the market trends shaping the Surface Mount Technology (SMT) Equipment Industry?

Growing electronic industry to increase demand for SMT equipment is the upcoming market trend.

- The Surface-Mount Technology (SMT) equipment market is experiencing notable growth due to the increasing demand for electric vehicles (EVs) and their components. SMT is extensively used in the manufacturing of EVs as it provides superior mechanical efficiency under shock and vibration, making it an ideal choice for producing circuit boards. These boards, which utilize conductive tracks and other features, mechanically support and electrically connect electronic components. In contrast to the traditional method of fixing components, SMT allows for easier disassembly through the use of solder joints.

- This is crucial in the event of component failure, as it simplifies the process of removing spare parts and materials. The shift towards SMT in PCB assembly has significantly improved manufacturing processes and offers valuable opportunities for market participants.

What challenges does the Surface Mount Technology (SMT) Equipment Industry face during its growth?

High cost of deployment is a key challenge affecting the industry growth.

- Surface Mount Technology (SMT) equipment refers to automated systems used in the electronics industry for mounting components directly onto printed circuit boards. These systems employ sensors and advanced technologies, leading to high equipment costs and a substantial initial investment. Customization requirements based on industry and operational needs further increase the expense. While large enterprises can afford these significant upfront costs, small and medium-sized enterprises (SMEs) may find it challenging due to limited financial resources. Despite the high costs, SMT equipment offers substantial savings in labor costs and a quick return on investment (ROI). The automation of the mounting process reduces the need for manual labor, leading to increased efficiency and productivity.

- Additionally, the high precision and consistency offered by SMT equipment contribute to improved product quality. The adoption of Industry 4.0 and the increasing demand for miniaturization and high-density circuit boards are driving the growth of the SMT equipment market. The integration of artificial intelligence and machine learning technologies in SMT equipment is also expected to boost market growth. In , while the initial investment for SMT equipment is high, the cost savings and productivity gains make it an attractive option for electronics manufacturers. SMEs may require creative financing solutions or partnerships to afford the upfront costs, but the long-term benefits outweigh the initial investment.

Exclusive Customer Landscape

The surface mount technology (smt) equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surface mount technology (smt) equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surface mount technology (smt) equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amistar Automation Inc. - ASMPT SMT Solutions, a division of the company, provides advanced SMT (Surface Mount Technology) equipment solutions for businesses seeking efficient and high-performing manufacturing processes. Our expertise in this domain ensures enhanced search engine visibility and delivers clear, informative messages that resonate with research analysts. We remain committed to maintaining a professional tone, aligning our content with the company's description, and avoiding specific product or geographic references.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amistar Automation Inc.

- ASMPT Ltd.

- Autotronik SMT GmbH

- Beijing Torch Co. Ltd.

- DDM Novastar Inc.

- Europlacer Ltd.

- FRITSCH GmBH

- FUJI Corp.

- Hanwha Corp.

- Juki Corp.

- Kulicke and Soffa Industries Inc.

- Mirae Corp.

- Mycronic AB

- Nordson Corp.

- Panasonic Holdings Corp.

- SMTnet

- SumiLax SMT Technologies Pvt Ltd

- Universal Instruments Corp.

- Versatec LLC

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market: An In-depth Analysis Surface Mount Technology (SMT) has revolutionized the electronics industry by enabling the production of smaller, more complex, and efficient electronic devices. SMT equipment plays a crucial role in the manufacturing process of these devices by automating various stages, from component placement to soldering and inspection. In this analysis, we delve into the dynamics of the SMT equipment market, focusing on market trends, growth drivers, and challenges. The SMT equipment market is driven by the increasing demand for electronic devices in various industries, including consumer electronics, telecommunications, and industrial automation. The proliferation of smartphones, smart homes, and the Internet of Things (IoT) has fueled the growth of the consumer electronics market, leading to a in demand for SMT equipment.

In the telecommunications sector, the adoption of advanced wireless communication standards, such as 5G, has necessitated the development of more sophisticated electronic components and manufacturing processes, further boosting the demand for SMT equipment. Moreover, the industrial sector's shift towards automation and Industry 4.0 initiatives has led to the widespread adoption of SMT equipment in manufacturing processes. Precision tools and automated systems have become essential components of modern assembly lines, enabling the production of high-quality electronic components and devices. The SMT equipment market is characterized by continuous innovation and technological advancements. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being integrated into SMT equipment to improve efficiency, accuracy, and productivity.

These technologies enable real-time monitoring and analysis of manufacturing processes, allowing for quick identification and resolution of issues. Furthermore, they facilitate predictive maintenance, reducing downtime and increasing equipment uptime. Despite the numerous opportunities, the SMT equipment market faces several challenges. Trade regulations and logistics issues can significantly impact the cost and availability of components and raw materials, affecting the profitability of SMT equipment manufacturers. Additionally, the complexity of SMT manufacturing processes requires a high level of expertise and specialized knowledge, making it challenging for small and medium-sized enterprises (SMEs) to enter the market. In , the SMT equipment market is poised for significant growth, driven by the increasing demand for electronic devices and the shift towards automation and Industry 4.0 initiatives.

Continuous innovation and technological advancements, particularly in the areas of AI and ML, are expected to further fuel market growth. However, challenges such as trade regulations and logistics issues must be addressed to ensure the sustainability and competitiveness of SMT equipment manufacturers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 4028.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Japan, India, South Korea, UK, Canada, Germany, Australia, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surface Mount Technology (SMT) Equipment Market Research and Growth Report?

- CAGR of the Surface Mount Technology (SMT) Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surface mount technology (smt) equipment market growth of industry companies

We can help! Our analysts can customize this surface mount technology (smt) equipment market research report to meet your requirements.