Tire Material Market Size 2024-2028

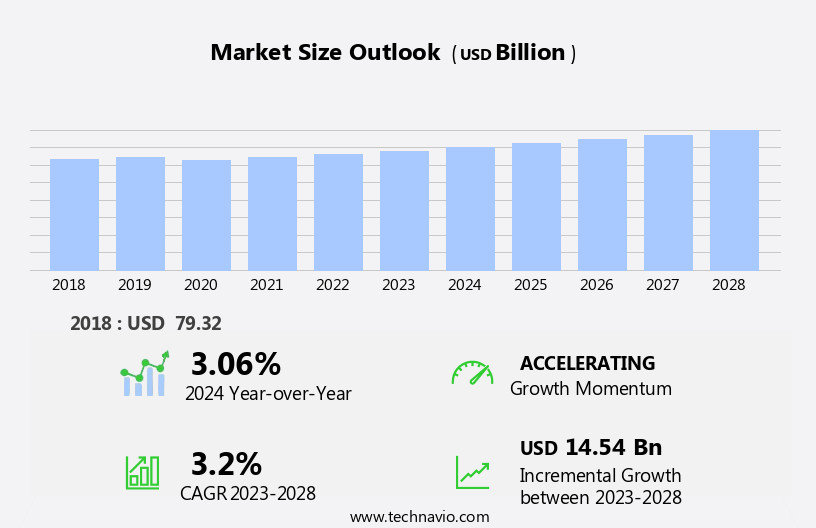

The tire material market size is forecast to increase by USD 14.54 billion at a CAGR of 3.2% between 2023 and 2028.

What will be the Size of the Tire Material Market During the Forecast Period?

How is this Tire Material Industry segmented and which is the largest segment?

The tire material industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Elastomers

- Reinforcing fillers

- Plasticizers

- Chemicals

- Vehicle Type

- Passenger cars

- Trucks

- Buses

- LCV

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Type Insights

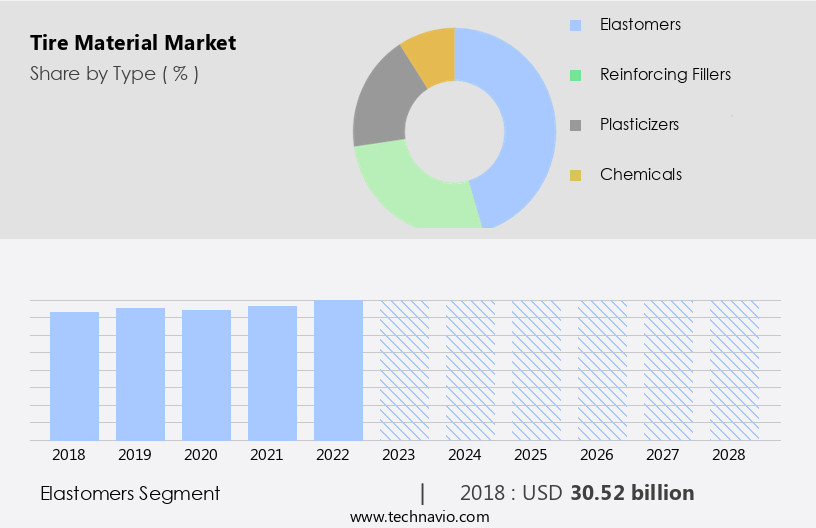

- The elastomers segment is estimated to witness significant growth during the forecast period.

The elastomer segment is poised for continued dominance In the market due to the rising demand for high-performance, durable tires in various industries, including automotive and aviation. Elastomers' exceptional elasticity, abrasion resistance, and low rolling resistance contribute significantly to both safety and fuel efficiency. Synthetic rubber elastomers, such as poly-butadiene rubber (BR) and styrene-butadiene rubber (SBR), are extensively utilized in tire production. The market's growth is further fueled by the development of eco-friendly elastomers, such as bio-based elastomers, in response to the increasing emphasis on sustainability. These advancements are expected to bolster the elastomer segment's position In the market during the forecast period.

Get a glance at the Tire Material Industry report of share of various segments Request Free Sample

The Elastomers segment was valued at USD 30.52 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

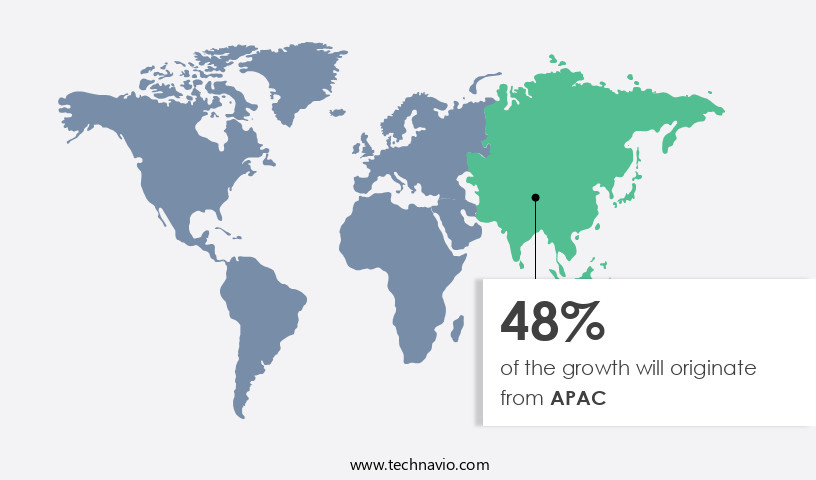

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC tire materials market is experiencing substantial growth due to the expanding automotive industry and increasing vehicle demand In the region. Major manufacturers, including Great Wall Motors, Toyota, Hyundai, and Tata Motors, are based in China, Japan, South Korea, and India, respectively, making APAC a significant hub for tire production. The demand for passenger cars and commercial vehicles is driven by population growth, urbanization, and rising disposable incomes. Government policies and regulations positively impact tire material quality. In the APAC region, electric and hybrid vehicles are gaining popularity, leading to the increased use of rubber materials such as synthetic rubber, butadiene, and styrene butadiene rubber.

The tire industry is also focusing on eco-friendly materials, including fillers, textiles, metals, and natural rubber, to improve vehicle safety and reduce environmental impact. The automotive sector's emphasis on automotive safety, particularly in relation to road accidents, brake stability, and vehicle weight, is driving the need for high-performance tires with superior abrasion resistance and low hysteresis. Tire replacements and vehicle utilization are also significant factors influencing market growth. Urbanization and the increasing use of bumpy roads and wet roads further highlight the importance of tire materials in ensuring vehicle safety and performance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tire Material Industry?

Rise in sales of passenger vehicles globally is the key driver of the market.

What are the market trends shaping the Tire Material Industry?

Shift towards sustainable materials is the upcoming market trend.

What challenges does the Tire Material Industry face during its growth?

Fluctuating prices of raw materials of tire manufacturing materials is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The tire material market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tire material market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tire material market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aditya Birla Management Corp. Pvt. Ltd. - The market encompasses various offerings, including Birla Carbon's 2123 product. This material is a crucial component in tire manufacturing, contributing to enhanced durability, improved fuel efficiency, and superior grip. Birla Carbon's 2123 tire material offers exceptional strength and flexibility, making it a preferred choice for tire manufacturers worldwide. The tire industry continues to evolve, driven by advancements in technology and increasing consumer demand for high-performance tires. Tire material suppliers, such as Birla Carbon, play a pivotal role in meeting these demands by providing innovative and reliable solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Bridgestone Corp.

- Cabot Corp.

- Continental AG

- Dassault Systemes SE

- Evonik Industries AG

- Exxon Mobil Corp.

- GRI Tires

- Hyosung Advanced Materials

- Indorama Ventures Public Co. Ltd.

- JSR Corp.

- KURARAY Co. Ltd.

- Lanxess AG

- Nokian Tyres Plc.

- PetroChina Co. Ltd.

- Schubert and Salzer GmbH

- Trelleborg AB

- Umicore SA

- Yokohama Rubber Co. Ltd.

- ZEPPELIN GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of components that play crucial roles In the production of tires for various types of vehicles. These materials include elastomers, plasticizers, chemicals, reinforcing fillers, metals, and rim materials, among others. Elastomers, the primary component of rubber compounds, are essential for tire flexibility and durability. Plasticizers enhance the elasticity and workability of rubber compounds, while chemicals serve as curatives, accelerators, and vulcanizing agents. Reinforcing fillers, such as textiles and metals, provide strength and stability to tires. Metal, specifically steel cables, is used for tire reinforcement, particularly In the sidewalls. Rims, another essential component, support the tire and facilitate its attachment to the wheel hub.

The market is influenced by several factors, including advancements in tire technology for electric and hybrid vehicles. Synthetic rubber, like butadiene, is increasingly used due to its superior performance in extreme temperatures and improved fuel efficiency. The rubber material sector is undergoing significant changes as the vehicle industry shifts towards eco-friendly materials and sustainable manufacturing practices. The automotive sector's relentless pursuit of safety and performance continues to drive innovation in tire technology. Automotive safety is a critical concern, with tire stability and resistance to bumpy roads and wet surfaces being key considerations. The market is responding with high-performance tires that offer superior abrasion resistance and low hysteresis.

Health challenges, such as the potential health risks associated with the use of certain tire materials, are also influencing market dynamics. The tire material industry is addressing these concerns by developing eco-friendly alternatives and improving production processes to minimize environmental impact. The market is influenced by various factors, including vehicle utilization, tire replacements, urbanization, and the demand for luxury and regular vehicles. The increasing weight of vehicles and the need for improved fuel efficiency are also significant factors. The raw materials used in tire production, such as natural rubber, carbon black, and various chemical compounds, significantly impact the market.

The availability and cost of these raw materials can significantly influence the price and competitiveness of tire manufacturers. Despite the growing awareness of the importance of tire safety and performance, there remains a lack of awareness regarding the importance of using high-quality tire materials. This presents an opportunity for tire material manufacturers to educate consumers and promote the benefits of their products. Tar materials, while not directly related to tire production, can impact the market by influencing the cost and availability of raw materials. The market is also influenced by technological advancements, such as the development of new tire materials and manufacturing processes.

In conclusion, the market is a dynamic and complex industry that is influenced by various factors, including technological advancements, environmental concerns, and market trends. The industry is undergoing significant changes as the vehicle industry shifts towards eco-friendly materials and sustainable manufacturing practices. The market is expected to continue growing as the demand for high-performance tires and sustainable manufacturing practices increases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 14.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

China, US, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tire Material Market Research and Growth Report?

- CAGR of the Tire Material industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tire material market growth of industry companies

We can help! Our analysts can customize this tire material market research report to meet your requirements.