Turbinado Sugar Market Size 2024-2028

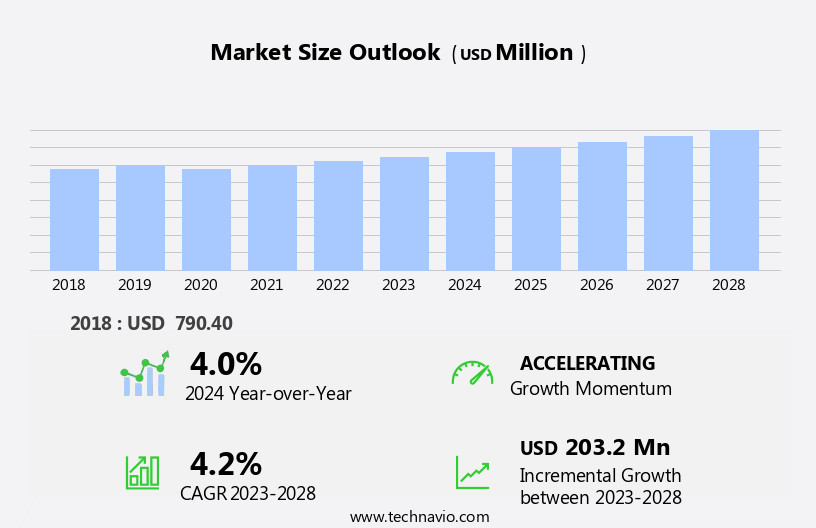

The turbinado sugar market size is forecast to increase by USD 203.2 million at a CAGR of 4.2% between 2023 and 2028.

What will be the Size of the Turbinado Sugar Market During the Forecast Period?

How is this Turbinado Sugar Industry segmented and which is the largest segment?

The turbinado sugar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Regular turbinado sugar

- Turbinado sugar cubes and other turbinado sugar forms

- End-user

- Foodservice and packaged food and beverage manufacturers

- Retail end-users

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

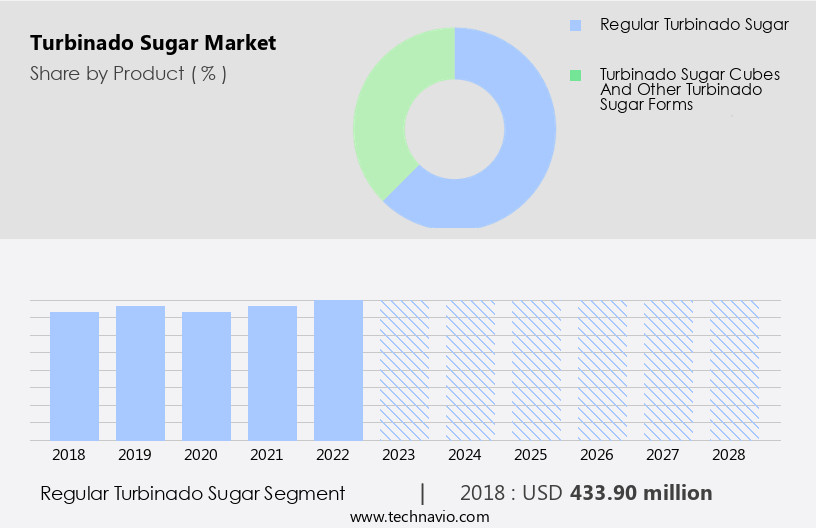

- The regular turbinado sugar segment is estimated to witness significant growth during the forecast period.

Turbinado sugar, also known as raw sugar, is a minimally processed natural sweetener with golden-brown crystals and a toffee flavor derived from the natural molasses of sugar cane. Its essential minerals and nutritional advantages make it an attractive option for health-conscious consumers. Ethically sourced and sustainably produced, turbinado sugar aligns with the growing trend towards environmental conservation and fair labor practices. In the food and beverage industry, turbinado sugar is used in traditional recipes and modern culinary creations, including bakery and confectionery, dairy products, and beverages. The sugar market for turbinado sugar is driven by consumer preference for natural sweeteners and minimal processing.

Despite regulatory and trade barriers, the demand for turbinado sugar continues to grow due to its long shelf life, flavor profiles, and dietary choices. The retail and foodservice sectors, including supermarkets, convenience stores, and organic sugar producers, offer turbinado sugar in various forms, such as organic and conventional, for household and commercial use.

Get a glance at the Turbinado Sugar Industry report of share of various segments Request Free Sample

The Regular turbinado sugar segment was valued at USD 433.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

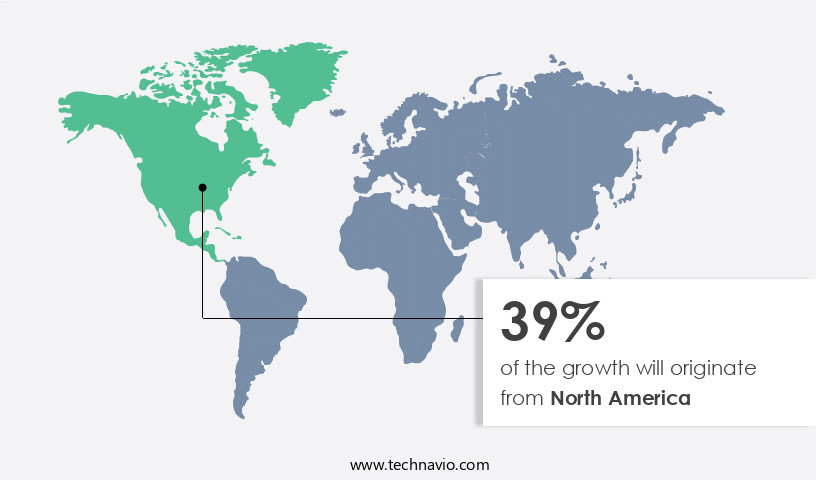

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Turbinado sugar, also known as raw sugar or golden brown sugar, is a minimally processed natural sweetener with a light golden color and toffee flavor. It contains natural molasses and essential minerals, making it a preferred choice among health-conscious consumers. The sugar crystals are ethically sourced and produced using sustainable methods, aligning with the growing trend of environmental conservation and fair labor practices. The sugar market for turbinado sugar is driven by its nutritional advantage and versatility in various food and beverage applications, including baked goods, beverages, cereal toppings, and modern culinary creations. The US, as the market leader, has a significant influence on The market due to its high consumption In the foodservice and retail sectors.

The increasing preference for natural and chemical-free products, healthier eating habits, and food safety standards further boost the demand for turbinado sugar.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Turbinado Sugar Industry?

Increasing demand for alternatives to white sugar is the key driver of the market.

What are the market trends shaping the Turbinado Sugar Industry?

Growing demand for organic-certified food products is the upcoming market trend.

What challenges does the Turbinado Sugar Industry face during its growth?

Allergies resulting from consumption of turbinado sugar is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The turbinado sugar market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the turbinado sugar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, turbinado sugar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ASR GROUP - Turbinado sugar, also known as raw cane sugar, is a type of unrefined sugar with a rich, molasses flavor and golden brown color. The company specializes In the production and distribution of turbinado sugar products, marketed under the brand name Qwik Flo. This sugar undergoes minimal processing, retaining its natural molasses content and resulting in a distinct sweetener with a unique taste profile. Qwik Flo turbinado sugar caters to consumers seeking an alternative to refined white sugar, offering a more natural and flavorful option for various culinary applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASR GROUP

- Bobs Red Mill Natural Foods Inc.

- Cargill Inc.

- Conscious Food Pvt. Ltd.

- Cumberland Packing Corp.

- DW Montgomery and Co.

- Incauca S.A.S.

- Louis Dreyfus Co. BV

- Nordzucker AG

- NOW Health Group Inc.

- Sunbest Natural

- Thai Roong Ruang Group

- Thai Sugar Group

- The Hain Celestial Group Inc.

- Thermo Fisher Scientific Inc.

- Usina Sao Francisco SA

- Whole Earth Sweetener Co. LLC

- Wholesome Sweeteners Inc.

- Wilmar International Ltd.

- Woodland Foods Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Turbinado sugar, also known as raw or golden-brown sugar, is a type of minimally processed natural sweetener. Unlike refined sugars, it retains some of the essential minerals and molasses content, giving it a distinct toffee flavor and light caramel color. This sugar is produced through a fine processing method, which allows the sugar crystals to maintain a raw-like form, preserving the natural sweetness and nutritional advantage. The demand for turbinado sugar is driven by several factors. The health consciousness of consumers is a significant factor, as many prefer natural sweeteners over refined alternatives. Turbinado sugar is often perceived as a healthier option due to its minimal processing and the presence of natural minerals.

Another factor fueling the growth of the market is the increasing trend towards sustainable and ethically sourced products. Consumers are becoming more aware of the environmental impact of sugar production and are looking for sugar options that align with their values. Turbinado sugar is often produced using organic farming practices and fair labor practices, making it an attractive choice for health-conscious consumers. The food industry is also contributing to the growth of the market. This sugar is used in a wide range of food and beverage applications, including bakery and confectionery, dairy products, and beverages. Its light golden color and caramel flavor make it an excellent choice for traditional recipes and modern culinary creations alike.

The retail sector and foodservice sector are significant markets for turbinado sugar. Supermarkets and electronic commerce platforms are popular channels for household consumers to purchase this sugar. Convenience stores also offer turbinado sugar as an option for consumers on-the-go. Despite its growing popularity, the market faces regulatory and trade barriers. Food safety standards and quality control are essential considerations for sugar producers. Shelf life and flavor profiles are also critical factors that must be addressed to meet consumer expectations. Dietary choices and sweetening options are also influencing the market. As consumers become more health-conscious, they are seeking out natural sweeteners that fit into their dietary preferences.

Turbinado sugar is a popular choice for those following a low glycemic index diet or looking for wholesome sweeteners. In conclusion, the market is driven by several factors, including health consciousness, sustainability, and the food industry. Despite regulatory and trade barriers, the market is expected to continue growing as consumers seek out natural and healthier sweetener options. Turbinado sugar's unique flavor profile, minimal processing, and nutritional advantage make it an attractive choice for both household consumers and the food industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2024-2028 |

USD 203.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.0 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Turbinado Sugar Market Research and Growth Report?

- CAGR of the Turbinado Sugar industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the turbinado sugar market growth of industry companies

We can help! Our analysts can customize this turbinado sugar market research report to meet your requirements.