Unsaturated Polyester Resin (UPR) Market Size 2024-2028

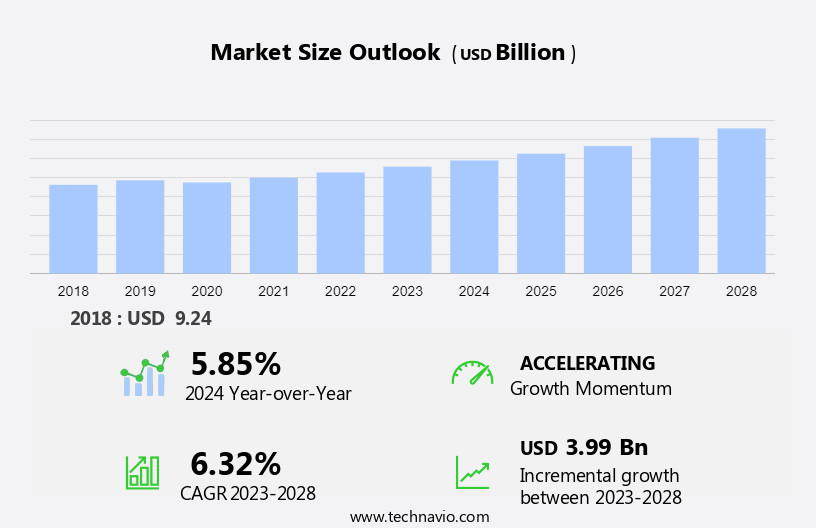

The Unsaturated Polyester Resin (UPR) Market size is forecast to increase by USD 3.99 billion at a CAGR of 6.32% between 2023 and 2028.

The market's growth hinges on various factors, such as the expanding end-use industries, notably driven by the superior properties of unsaturated polyester resins compared to other resins. Additionally, there's a notable trend towards eco-friendly products, boosting demand for unsaturated polyester resins. This shift underscores the market's dependency on environmental concerns and technological advancements, which are pivotal in shaping its trajectory and sustaining growth rates. It also includes an in-depth analysis of drivers, trends, and challenges. Our report examines historical data from 2018-2022, besides analyzing the current market scenario.

What will be the Market Size During the Forecast Period?

Market Definition

Unsaturated polyester resins are thermoset resins that are capable of being cured from liquid to solid state. These resins are made of glycols, monomers, and various acids. They have exceptional strength and durability characteristics, owing to which they are used in manufacturing composite materials, wood paints, gel coats for boats, automotive and bathroom fixtures, and other applications.

To Know more about the market report Request Free Sample

Market Dynamics

The market is driven by increasing demand from the building and construction sector, particularly in pipes & tanks applications. Trends include the rising adoption of Fiber Reinforced Plastic (FRP) and glass fiber-reinforced plastics (FRP) in electric vehicles (EVs) and printed circuit boards. Challenges encompass addressing VOC emissions and enhancing corrosion resistance for sustainable solutions. Moreover, the market faces competition from alternative resins like epoxy and polyurethane, emphasizing the need for continuous innovation to maintain competitiveness. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key market growth analysis, trends, and challenges. A holistic analysis of drivers, trends, and challenges will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The growing shift toward eco-friendly products demanding the use of unsaturated polyester resins is notably driving market growth. With the implementation of strict European Union (EU) regulations, which emphasize on a reduction in the emission of volatile organic compounds (VOC), the focus of vendors has shifted to developing more eco-friendly chemicals. Such regulatory standards have led to a shift in the demand for green products (like unsaturated polyester resins) from solvent-based epoxy polishes. As these products do not contain solvents that evaporate during the curing phase, they are manufactured using an innovative process and renewable raw materials.

Moreover, Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulates the production, use, and import of chemicals in the EU, ensuring their safety and environmental impact. Therefore, the stringent rules and regulations implemented by the European Commission and Federal Government agencies are leading toward the development of eco-friendly products with minimum or zero harmful emissions. As such, vendors that offer polishes and composites adhere to these regulations, thereby augmenting the growth of the market during the forecast period.

Significant Market Trends

Infrastructural developments in emerging economies are an emerging trend shaping market growth. The increasing investments made by emerging economies toward infrastructural developments and long-term projects will positively influence unsaturated polyester resin market growth in the next five years. China, India, Brazil, and countries in the Middle East are likely to increase their expenses in the infrastructure segment. Currently, China is the world's leading market for unsaturated polyester polishes in terms of consumption and production. The country market is registering substantial growth due to the increasing investments in infrastructural development and construction projects.

In addition, the demand for high-performance, high-quality, unsaturated polyester polishes from end-users such as electrical and electronics, artificial stone, wind energy, and automotive sectors is steadily progressing. The increase in infrastructural activities in these regions directly augments the demand. Hence, the trend of ongoing infrastructural developments in emerging economies has tremendous potential to drive the growth of the market during the forecast period.

Major Challenge

The need for styrene in the production of unsaturated polyester resins is a significant challenge hindering market growth. Styrene is a highly flammable and toxic material that is harmful to human health. Styrene vapors can irritate the skin, eyes, and respiratory system if not handled properly. The use of styrene is also restricted because of its unpleasant odor and worker exposure concerns. This challenge, however, can be overcome by developing monomer-free unsaturated polyester resins to reduce VOC emissions. Many companies are researching this technology, and DCPD resins are increasingly being mixed with low-styrene-emission resins to decrease their emission levels.

As such, the demand for DCPD resins over ortho-phthalic resins in the manufacture of sanitary ware, bathtubs, and wind blades has increased in regions such as North America and Europe. This has led to a significant decline in the demand and adoption of unsaturated polyester polishes globally. Hence, the need for styrene in the production of unsaturated polyester resins is a challenge, having the potential to hinder the overall growth of the market during the forecast period.

Segmentation by Type, End-user, and Geography

The market showcases diverse segmentation driven by various factors. Epoxy resin, vinyl ester, and acrylic represent crucial resin types, offering distinct properties for different applications. Polyurethane resins and styrene contribute to versatile formulations. Stringent regulations on VOC emissions propel the demand for eco-friendly options like Orthophthalic resin and FRP materials. Industries such as pipes & tanks and building and construction extensively utilize these resins for their corrosion resistance and thermosetting capabilities. Electric vehicles emphasize fuel efficiency, thus demanding resins with low emissions and high performance, such as those incorporating Isophthalic compounds. Glass fiber-reinforced plastics (FRP) find significant use in the infrastructure of BRICS nations and printed circuit boards, underlining the diversification and innovation in the market.

Type Analysis

The market share growth by the orthophthalic segment will be significant during the forecast years. Orthophthalic type of unsaturated polyester resins showed a significant increase in adoption in the unsaturated polyester resin market. A primary motivator is their widespread use in a variety of industries, including construction, automotive, and marine. Orthophthalic unsaturated polyester resins are in high demand because of their low cost, ease of handling, and adaptability in the production of composite materials.

Get a glance at the market contribution of the End User segment Request Free Sample

The orthophthalic segment was the largest and was valued at USD 3.33 billion in 2018. The construction industry relies on orthophthalic resins to produce corrosion-resistant and long-lasting components, which contributes to overall unsaturated polyester resin market growth. The environmental impact of orthophthalic resins, which are obtained from petrochemical sources, is a serious concern. The increasing use of orthophthalic resins in the automotive industry to manufacture lightweight components contributes to fuel efficiency. These resins are used in the marine industry due to their corrosion resistance when building boats. Composite structures, such as pipes and tanks, demonstrate the adaptability and expanding demand for orthophthalic unsaturated polyester resins. Despite environmental challenges, innovation will keep orthophthalic resins in high demand globally. As a result, the orthophthalic segment is expected to witness continued growth, which in turn is expected to drive the expansion in the market during the forecast period.

End-user Analysis

Based on the end-user, the market has been segmented into building and construction, pipes and tanks, automotive, marine, electrical and others. The building and construction segment will account for the largest share of this segment.? The building and construction sector is one of the most significant end-users in the market. Unsaturated polyester resins have numerous applications in this end-user industry, contributing to the creation of composite materials such as panels, pipes, and architectural components. However, examples of resilience can be found in the construction sector post-pandemic recovery, where increased infrastructure development and housing projects worldwide have driven demand for unsaturated polyester resins, demonstrating the market's ability to rebound in the face of adversity. Prominent players manufacture unsaturated polyester resins for the building and construction sector. Owing to such factors, the building and construction segment is expected to witness significant growth while driving the growth of the market during the forecast period.

Region Analysis

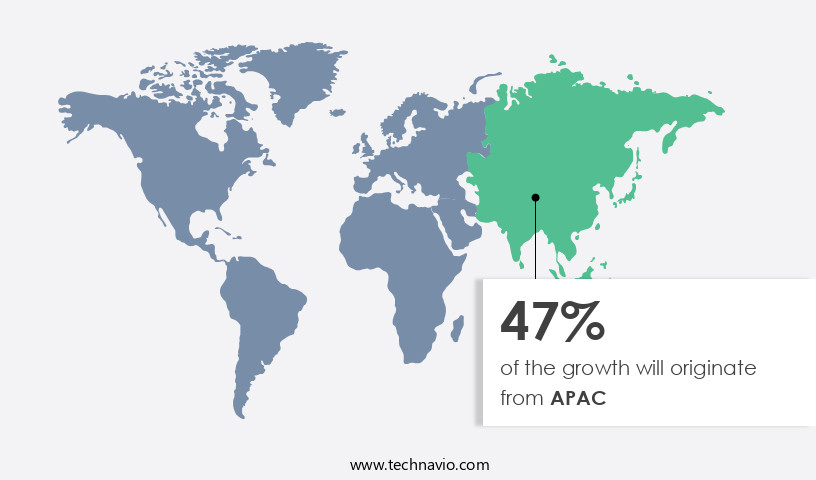

APAC is estimated to contribute 47% to the growth of the global market during the projection period. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the projection period.

For more insights on the market share of various regions Request Free Sample

Further, the growth of the market in APAC was prominent in 2023. Initially, rapid industrialization and vigorous infrastructure development activities in countries such as China and India are driving significant demand for unsaturated polyester resins for construction and manufacturing applications. Furthermore, the developing automotive sector in APAC, notably in China, drives the demand for lightweight and durable materials, where these polishes play an important role. Following that, increased awareness and adoption of sustainable practices drive up demand for eco-friendly formulations, which aligns with the region's environmental concerns.

Furthermore, the developing wind energy sector in countries such as China contributes to the increased use of unsaturated polyester in wind turbine blade manufacture. Ultimately, the availability of raw materials and cost-effective manufacturing capabilities in the region contributes to market expansion during the forecast period.

Key Companies

Companies are implementing various market growth and forecasting strategies by analyzing factors such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product or service launches to enhance their presence in the market.

Allnex GMBH - The company offers unsaturated polyester resins such as UVECOAT 9539, which is an amorphous unsaturated polyester resin for use in industrial metal, paint, and coatings.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including Allnex GMBH, Ashland Inc., BASF SE, Covestro AG, Dow Chemical Co., Eternal Materials Co. Ltd., Evergreen Chemicals Co. Ltd., Huizhou GoodUPR Compites Ltd., INEOS AG, Mitsubishi Gas Chemical Co. Inc., Polynt Spa, Revex Plasticisers Pvt. Ltd., Swancor Holding Co. Ltd., and UPC Technology Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market report predicts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028

- Type Outlook

- Orthophthalic

- DCPD

- Isophthalic

- Others

- End-user Outlook

- Building and Construction

- Pipes and tanks

- Automotive

- Marine

- Electrical and others

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market caters to various industries, such as construction & mining, with applications in pipes & tanks, benefiting from FRP and PVC materials. These resins are vital in boat hulls, decks, and interior components, utilizing processes like resin infusion and pultrusion for efficient production. Architects and builders favor these thermosetting polymers for roofing and architectural elements, capitalizing on their aesthetic appeal and chemical resistance. In electric vehicles, they serve as body panels, under-the-hood components, and thermal insulation, contributing to emission reduction. The unsaturated polyester resin market also caters to renewable energy sources like wind turbine blades, resisting UV radiation and saltwater corrosion. Isophthalic resin and DCPD resin formulations ensure adhesion and water resistance, vital in pipes, ducts, and tanks manufacturing. Bio-based materials tackle VOC emissions, aligning with sustainability efforts across industries.

Further, the market is integral to various sectors, such as the pipes & tanks industry and construction & mining activities, due to its use in FRP (Fiber Reinforced Plastic) applications. Leveraging polyester monomers and reactive diluents, these polishes undergo crosslinking reactions to form sturdy matrix materials for fiberglass-reinforced plastics (FRPs). They find applications in electric vehicles (EVs), providing aesthetically pleasing and high-performance materials for interior parts and acoustic insulation. Compression molding techniques ensure accurate dosing and reduced waste in both liquid and powder forms. With a focus on UV radiation resistance and VOC emissions reduction, Dicyclopentadiene (DCPD) resin formulations meet the demands of electronic products and architectural elements. Raw material suppliers play a critical role in providing sustainable solutions for the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.32% |

|

Market Growth 2024-2028 |

USD 3.99 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.85 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Allnex GMBH, Ashland Inc., BASF SE, Covestro AG, Dow Chemical Co., Eternal Materials Co. Ltd., Evergreen Chemicals Co. Ltd., Huizhou GoodUPR Compites Ltd., INEOS AG, Mitsubishi Gas Chemical Co. Inc., Polynt Spa, Revex Plasticisers Pvt. Ltd., Swancor Holding Co. Ltd., and UPC Technology Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market forecast during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch