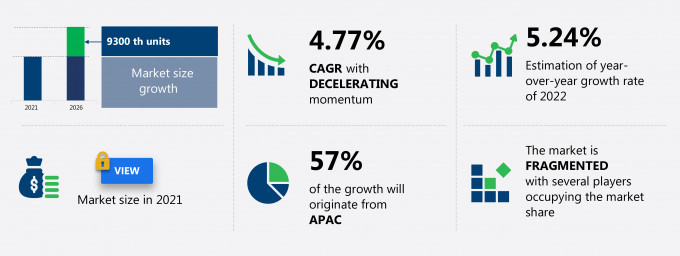

The utility vehicle market share is expected to increase to 9300 thousand units from 2021 to 2026, at a CAGR of 4.77%.

This utility vehicle market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers utility vehicle market segmentations by type (SUV, MUV, and UTV) and geography (APAC, Europe, North America, South America, and Middle East and Africa). The utility vehicle market report also offers information on several market vendors, including AB Volvo, Bayerische Motoren Werke AG, Bombardier Recreational Products Inc., Deere and Co., Ford Motor Co., General Motors Co., Honda Motor Co. Ltd., Hyundai Motor Co., Hyundai Motor Group, Kawasaki Heavy Industries Ltd., Mahindra and Mahindra Ltd., Mercedes Benz Group AG, Mitsubishi Motors Corp., Renault sas, SAIC Motor Corp. Ltd., Suzuki Motor Corp., Tata Sons Pvt. Ltd., Toyota Motor Corp., Volkswagen AG, and Yamaha Motor Co. Ltd. among others.

What will the Utility Vehicle Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Utility Vehicle Market Size for the Forecast Period and Other Important Statistics

Utility Vehicle Market: Key Drivers, Trends, and Challenges

The increase in penetration of the AWD and 4WD vehicles is notably driving the utility vehicle market growth, although factors such as the decrease in production and sale of automotive may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the utility vehicle industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Utility Vehicle Market Driver

- The increase in penetration of the AWD and 4WD vehicles is one of the key factors driving the utility vehicle market growth.

- The end-users of utility vehicles such as manufacturing, construction, and agricultural industries are demanding more output efficiency and optimum performance in high-end driving operations owing to operational conditions.

- The demand for four-wheel drive and all-wheel drive vehicles by end-users to achieve higher levels of safety and vehicle dynamics is increasing. Furthermore, most utility vehicle manufacturers are producing these drive systems to meet the evolving demands of end-users.

- Both end-users and manufacturers are demanding for AWD and 4WD vehicles. This, in turn, will drive the utility vehicle market growth during the forecast period.

Key Utility Vehicle Market Trend

- The development of electric-powered utility vehicles is one of the key utility vehicle market trends propelling market growth.

- In recent years, most automobiles, including utility vehicles, have witnessed a significant transformation. Market players are now focusing on electrical components due to their output efficiency and lightweight to meet evolving consumer demands.

- Vehicle emissions are an important element as hazardous greenhouse gases increase environmental and health concerns. As a result, governments globally are adopting vehicle emission standards to reduce greenhouse gas emissions and maintain environmental balance. Manufacturers are required to follow these regulations to maintain emissions under control.

- The Government of India established the BS6 emission standard in April 2020 to restrict the outflow of air pollutants from vehicles. Such vehicle emission standards adopted by the government may propel the utility vehicle market growth during the forecast period.

Key Utility Vehicle Market Challenge

- The decrease in production and sale of automobiles is one of the key factors challenging the utility vehicle market growth.

- The automotive industry witnessed a decline in overall growth in 2021 and 2022 due to the COVID-19 pandemic and the ongoing Russia-Ukraine war. Also, most automotive manufacturers shut down their manufacturing plants in various regions such as Europe, MEA, and North America.

- In 2020, Honda Motor Company, Ltd. shut down its manufacturing plant due to an increasing number of COVID-19 cases in North America and suspended the export of vehicles to Russia in March 2022.

- There is a decrease in vehicle demand and a decline in the production of utility vehicles due to the changes in automotive production standards and low customer confidence in purchasing vehicles owing to uncertainties in government laws regulating emission and safety, which, in turn, increase the prices of utility vehicles. Such high costs may challenge the utility vehicle market growth during the forecast period.

This utility vehicle market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global utility vehicle market as a part of the global automotive market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the utility vehicle market during the forecast period.

Who are the Major Utility Vehicle Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AB Volvo

- Bayerische Motoren Werke AG

- Bombardier Recreational Products Inc.

- Deere and Co.

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Hyundai Motor Group

- Kawasaki Heavy Industries Ltd.

- Mahindra and Mahindra Ltd.

- Mercedes Benz Group AG

- Mitsubishi Motors Corp.

- Renault sas

- SAIC Motor Corp. Ltd.

- Suzuki Motor Corp.

- Tata Sons Pvt. Ltd.

- Toyota Motor Corp.

- Volkswagen AG

- Yamaha Motor Co. Ltd.

This statistical study of the utility vehicle market encompasses successful business strategies deployed by the key vendors. The utility vehicle market is fragmented and the vendors are deploying growth strategies such as quality, price, service, brand image, distribution, and marketing to compete in the market.

Product Insights and News

- Volvogroup.com - The company offers utility vehicles that have an electric motor and petrol engine which work for the ultimate plug-in hybrid SUV for less tailpipe emissions, more traction, and instant power.

- Bmwgroup.com - The company offers utility vehicles that have sporty design enhancements like the Aerodynamic Kit, M wheels, and optional Misano Blue Metallic paint with the available M Sport Package.

- Ford.com - The company offers utility vehicles that have a bold front grille which gives an aura of rugged masculinity with colour-coordinated seats, door accents and charcoal black dashboard.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The utility vehicle market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Utility Vehicle Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the utility vehicle market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Utility Vehicle Market?

For more insights on the market share of various regions Request for a FREE sample now!

57% of the market’s growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for the utility vehicle market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The increase in disposable income of the individuals and the rising popularity of UTVs in India and China will facilitate the utility vehicle market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of the COVID-19 in 2020 hampered the growth of the regional market. However, in Q3 2021, supply chain operations for utility vehicles were resumed, owing to the increased rate of vaccination drives in APAC. This, in turn, will drive the utility vehicle market growth during the forecast period.

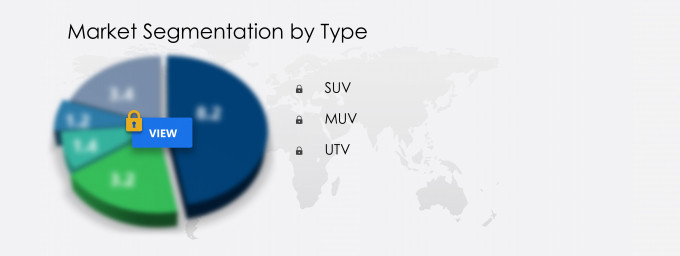

What are the Revenue-generating Type Segments in the Utility Vehicle Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The utility vehicle market share growth by the SUV segment will be significant during the forecast period. The sports utility vehicle (SUV) segment in the global utility vehicle market is expected to witness significant growth in terms of market revenue when compared to the other segment, such as multi-utility vehicle (MUV) and utility task vehicle (UTV) segments during the forecast period. This is owing to the additional benefits that SUVs offer compared to passenger vehicles, such as high load carrying capacity, additional passenger capacity, and improved safety and comfort while off-roading, which increases demand for SUVs globally. Such factors of SUV will boost the utility vehicle market growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the utility vehicle market size and actionable market insights on post COVID-19 impact on each segment.

|

Utility Vehicle Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 4.77% |

|

Market growth 2022-2026 |

9300 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.24 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 57% |

|

Key consumer countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AB Volvo, Bayerische Motoren Werke AG, Bombardier Recreational Products Inc., Deere and Co., Ford Motor Co., General Motors Co., Honda Motor Co. Ltd., Hyundai Motor Co., Hyundai Motor Group, Kawasaki Heavy Industries Ltd., Mahindra and Mahindra Ltd., Mercedes Benz Group AG, Mitsubishi Motors Corp., Renault sas, SAIC Motor Corp. Ltd., Suzuki Motor Corp., Tata Sons Pvt. Ltd., Toyota Motor Corp., Volkswagen AG, and Yamaha Motor Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Utility Vehicle Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive utility vehicle market growth during the next five years

- Precise estimation of the utility vehicle market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the utility vehicle industry across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of utility vehicle market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch