Saudi Arabia Vinyl Flooring Market Size 2022-2026

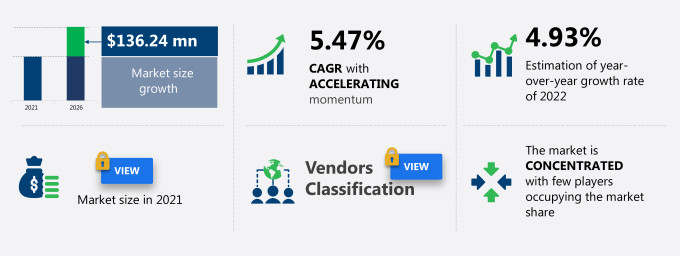

The risng market share in Saudi Arabia is expected to increase by USD 136.24 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 5.47%.

The Vinyl Flooring Market in Saudi Arabia is witnessing significant growth, driven by the increasing demand for durable and aesthetically appealing flooring solutions in commercial spaces, such as shopping malls, restaurants, and hotels. Retail construction activities are also on the rise, with contractors seeking easy to install and cost-effective flooring options. Vinyl planks, especially rigid core LVT, are becoming popular for their ability to withstand high-traffic areas while offering a homely feeling in spaces like living rooms and bedrooms.

Vinyl flooring is highly favored for its resistant to stains, abrasion, and wear and tear properties, making it suitable for areas with high foot traffic. The market also sees significant adoption in resorts and specialty stores, where durability and hygiene are essential. Luxury tile options with a photographic print layer and UV coating provide an aesthetically pleasing look and a long life in both residential settings and commercial spaces. Moreover, composite tile and homogeneous flooring options offer flexibility in application types and design preferences

What will the Vinyl Flooring Market Size in Saudi Arabia be During the Forecast Period?

Download the Free Report Sample

Various industrial spaces, commercial construction, and educational flooring needs. Low maintenance flooring options are in demand across offices, bathrooms, and kitchens, especially in high-traffic areas like hallways and stairs. With an increasing preference for durable flooring solutions, businesses are opting for waterproof flooring, particularly in bathrooms, kitchens, and outdoor spaces such as patios.

Healthcare flooring and hotel flooring also see a rise in demand for luxury tile flooring, known for its scratch-resistant and durable properties. Additionally, flooring solutions for warehouses, retail stores, and schools require flooring that is not only resistant to scratches but also affordable, flexible, and lightweight. The growing popularity of heterogeneous flooring ensures a wide range of product types suitable for various applications, including resort flooring and shopping mall flooring. With increasing interest in modern flooring designs, flooring installation costs remain a key consideration for both residential and commercial sectors. The rise of online distribution channels and best flooring brands has made it easier for customers to access flexible, smooth surface, and high-quality options.

Market Dynamics

The booming global construction industry is notably driving the vinyl flooring market growth in Saudi Arabia, although factors such as shortage of skilled labor may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the vinyl flooring industry in Saudi Arabia. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Vinyl Flooring Market Driver in Saudi Arabia

One of the key factors driving growth in the vinyl flooring market in Saudi Arabia is the booming global construction industry. Over the forecast period, the growth of the market for vinyl floorings is expected to be driven by the increased demand for low-maintenance, cost-effective, and lightweight building materials in residential construction. Vinyl goods are a cost-effective alternative to wood and carpet tiles, and they provide greater comfort; therefore, their demand is likely to grow throughout the projection period.

Key Vinyl Flooring Market Trends in Saudi Arabia

The augmented reality (AR) in flooring industry is another factor supporting the Saudi Arabia vinyl flooring market share growth. With the introduction of AR floor visualizer applications in the flooring industry, consumers can modify the design of rooms or homes without the need to view samples physically. Some major flooring vendors are also leveraging AR and VR technologies on their websites. For instance, Armstrong Flooring offers DesignVisualizer, a virtual reality tool that allows users to visualize and select from a variety of flooring products. Similarly, Mohawk Industries has recently tied up with Theia Interactive to create a VR experience while introducing its Lichen flooring collection at NeoCon, a design expo and conference event for commercial interiors. The trend of using VR/AR is expected to increase among vendors, as these technologies are customer-friendly. Thus, this will propel the growth of the vinyl flooring market in Saudi Arabia.

Key Vinyl Flooring Market Challenge in Saudi Arabia

The shortage of skilled labor will be a major challenge for the vinyl flooring market in Saudi Arabia during the forecast period. Flooring dealers are being compelled to decline work offers, given this shortage. Another drawback is that dealers are forced to pay substandard labor for the sake of retaining the workforce. Such a practice can affect the quality of flooring installation work. Moreover, the paucity of labor has increased average flooring labor costs. Although investments in construction activities are constantly increasing, the shortage of skilled workers can negatively impact the global vinyl flooring market. Manufacturers are losing revenue, as they are being forced to turn down project offers due to a labor shortage, and they are paying more to retain the existing workforce. Overall, the shortage of skilled labor will be a key challenge for the vinyl flooring market in Saudi Arabia.

This vinyl flooring market in Saudi Arabia analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the vinyl flooring market in Saudi Arabia as a part of the global construction materials market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the vinyl flooring market in Saudi Arabia during the forecast period.

Who are the Major Vinyl Flooring Market Vendors in Saudi Arabia?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- Abdul Rahman Al Shareef Group

- Al Souriya

- Armstrong Flooring Inc.

- Forbo Holding AG

- Gerflor Group

- Highmoon Home Furnitures Trading LLC

- KhalidSaad Trading Co.

- Nesma Group Co.

- Polyflor Ltd.

- Toli Floor Corp.

This statistical study of the Saudi Arabia vinyl flooring market encompasses successful business strategies deployed by the key vendors. The vinyl flooring market in Saudi Arabia is concentrated and the vendors are deploying growth strategies such as creating products that have a minimal environmental effect and are more durable to compete in the market.

Product Insights and News

-

Armstrong Flooring Inc. - The company offers vinyl flooring products such as luxury vinyl tile, static control flooring, and heterogeneous sheet.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The vinyl flooring market in Saudi Arabia forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Vinyl Flooring Market in Saudi Arabia Value Chain Analysis

Our report provides extensive information on the value chain analysis for the vinyl flooring market in Saudi Arabia, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the construction materials market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Product Segments in the Vinyl Flooring Market in Saudi Arabia?

To gain further insights on the market contribution of various segments Request for a FREE sample

The vinyl flooring market share growth in Saudi Arabia by the vinyl sheets and vinyl composite tiles segment will be significant during the forecast period. Vinyl flooring is popular because it is water-resistant, somewhat durable, adjustably robust and insulating, quick to install, available in a variety of looks, and relatively affordable. If bought professionally, custom-printed vinyl sheet flooring can cost an order of magnitude more. Vinyl composition tile (VCT) is a type of completed flooring that is commonly utilized in commercial and institutional settings. Colored polyvinyl chloride (PVC) chips are molded into solid sheets of varied thicknesses by heat and pressure and have been used in modern vinyl floor tiles and sheet flooring since the early 1980s. Using a carefully designed vinyl adhesive or tile mastic that remains bendable, floor tiles or sheet flooring is applied to a smooth, flat subfloor.

This report provides an accurate prediction of the contribution of all the segments to the growth of the vinyl flooring market size in Saudi Arabia and actionable market insights on post COVID-19 impact on each segment.

|

Vinyl Flooring Market Scope in Saudi Arabia |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.47% |

|

Market growth 2022-2026 |

USD 136.24 million |

|

Market structure |

Concentrated |

|

YoY growth (%) |

4.93 |

|

Regional analysis |

Saudi Arabia |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Abdul Rahman Al Shareef Group, Al Souriya, Armstrong Flooring Inc., Forbo Holding AG, Gerflor Group, Highmoon Home Furnitures Trading LLC, KhalidSaad Trading Co., Nesma Group Co., Polyflor Ltd., and Toli Floor Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Vinyl Flooring Market in Saudi Arabia Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive vinyl flooring market growth in Saudi Arabia during the next five years

- Precise estimation of the vinyl flooring market size in Saudi Arabia and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the vinyl flooring industry in Saudi Arabia

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of vinyl flooring market vendors in Saudi Arabia

We can help! Our analysts can customize this report to meet your requirements. Get in touch