Whiskey Warehousing Market Size 2024-2028

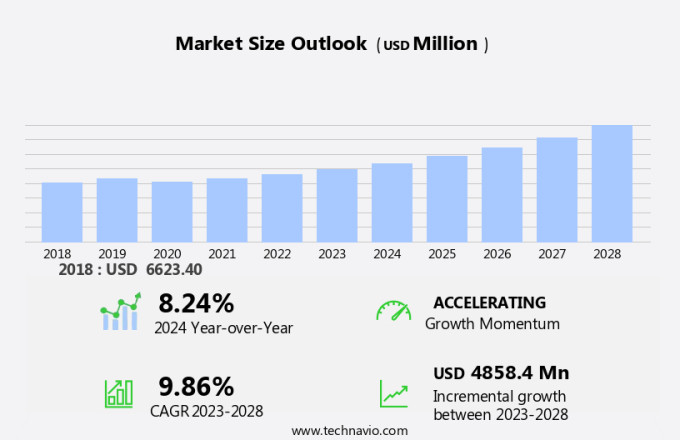

The whiskey warehousing market size is forecast to increase by USD 4.86 billion at a CAGR of 9.86% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for whiskey among men, particularly in the age groups of 25-54 and above. This trend is driving the storage business forward, as whiskey requires specialized storage conditions to age properly. One key development in this industry is the adoption of advanced coating technologies and storage solutions to optimize the aging process and protect the whiskey from external factors. Facility expansions are also common as companies seek to meet the rising demand. For instance, Lux Row Distillers and Balcones Distilling have recently expanded their warehousing capacity to accommodate more barrels. Despite these growth opportunities, the high cost associated with whiskey warehousing remains a challenge for market participants. This report provides a comprehensive analysis of the market, including market size, growth, trends, and challenges.

What will be the Size of the Market During the Forecast Period?

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Blended whiskey

- Single malt whiskey

- Bourbon

- Grain whiskey

- Others

- Ownership

- Company-owned warehouses

- Third-party warehouses

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- India

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

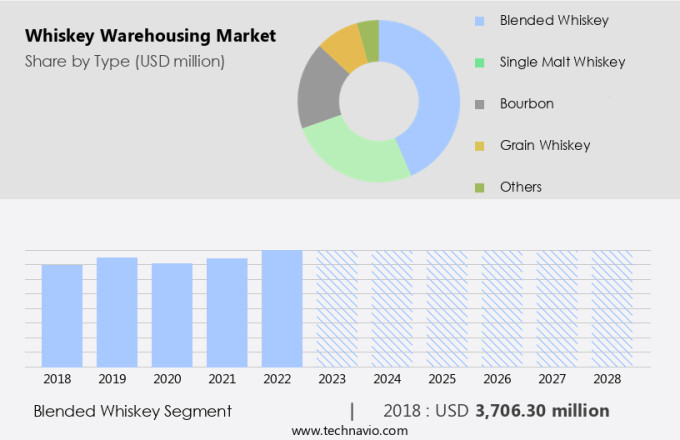

The blended whiskey segment is estimated to witness significant growth during the forecast period. The market is experiencing growth due to the increasing demand for blended whiskeys. Blended whiskeys, which offer a smoother and more approachable flavor profile compared to single malts, are popular among a diverse consumer base. Their consistent flavor profiles also make them a preferred choice for both consumers and bartenders. Additionally, blended whiskeys are generally more affordable than single malts, expanding their reach to a broader customer base. High-end blended whiskeys are challenging the notion that blends are inferior to single malts. Major brands in the whiskey industry are investing in sustainability, appealing to environmentally conscious consumers. The growing middle class income in countries such as India and China is fueling the demand for premium spirits, including blended whiskeys.

Further, demand for whiskey warehousing is particularly strong in countries like India, where blended whiskeys are gaining popularity. The whiskey storage business is essential for maintaining the quality and consistency of these spirits. With high-tech security measures in place, warehouses ensure the safekeeping of valuable whiskey goods. In the complex whiskey industry, both on-trade and off-trade channels play significant roles in the distribution of blended whiskeys. Raw material prices can impact the market, as the cost of storing and aging whiskey can be substantial. Nevertheless, the demand for blended whiskeys remains strong, making the warehousing market an attractive investment opportunity.

Get a glance at the market share of various segments Request Free Sample

The blended whiskey segment accounted for USD 3.71 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

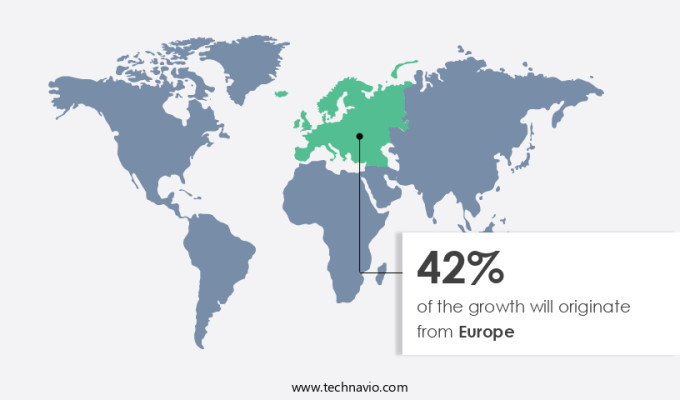

Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing significant growth due to the escalating consumer preference for whiskey and the increasing global demand for this distilled alcohol. Factors contributing to this expansion include the expansion of distillery operations, implementation of stringent quality control measures, and the rising trend toward premium and artisan whiskey varieties. As a result, whiskey makers require more storage facilities to accommodate their expanding inventories. The growing popularity of whiskey, particularly Scotch and Bourbon, has led to a swell in demand for oak barrels to age the whiskey and enhance its flavor and aroma. To meet this demand, private warehouses are increasingly being utilized by whiskey producers and retailers.

These facilities offer optimal conditions for aging whiskey, ensuring the highest quality product for consumers. Moreover, technological advancements in whiskey warehousing, such as energy-efficient procedures and intelligent warehousing systems, are attracting significant investment. These innovations not only improve operational efficiencies but also reduce costs and ensure a consistent product. The market for whiskey warehousing in North America is poised for continued growth, providing ample opportunities for investors and stakeholders.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing whiskey consumption globally is notably driving market growth. Whiskey warehousing plays a crucial role in the production and storage of distilled alcohol, specifically whiskey, for both Whiskey makers and consumers. Whisky barrels, typically made of oak, are used to age the distilled alcohol, enhancing its flavor and aroma. The choice between private, public, and bonded warehouses depends on the specific needs of the distillery operations, with temperature and humidity control being essential for optimal aging processes.

Moreover, whiskey demand continues to grow, driven by the drinking culture and popularity of Scotch and Bourbon. As a result, the storage business has become increasingly important, with strategic warehousing locations, energy-efficient practices, and smart solutions being adopted to meet the evolving needs of the industry. Barrel size and materials also impact storage requirements, with some distilleries opting for coating technologies and facility expansions to enhance their offerings. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Increasing adoption of smart warehousing solutions for whiskey is the key trend in the market. Whiskey warehousing plays a crucial role in the production and storage of distilled alcohol, specifically whiskey, for both Whiskey makers and consumers. Whisky barrels, typically made of oak, are essential in the aging processes that give whiskey its unique flavor and aroma.

Moreover, these barrels are stored in various types of warehouses, including private, public, and bonded, to ensure optimal conditions for aging. The on-trade and off-trade sectors, as well as distillery operations, rely on whiskey warehousing for quality control and efficient storage solutions. Aging whiskey requires specific temperature and humidity conditions, as well as security measures to prevent damage or contamination. The size and materials of barrels also impact storage requirements. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

High cost associated with whiskey warehousing is the major challenge that affects the growth of the market.

Whiskey warehousing plays a crucial role in the production and storage of distilled alcohol, particularly whiskey, for both Whiskey makers and consumers. Whisky barrels, typically made of oak, are essential in the aging processes that impart unique flavors and aromas to Scotch and Bourbon.

Moreover, whiskey warehouses come in various types, including private, public, and bonded, catering to different needs in the supply chain. Distillery operations require strategic warehousing locations to ensure efficient quality control and temperature and humidity control during the aging process. The size and materials of barrels, as well as storage requirements, impact the demand for whiskey warehousing solutions. E-commerce growth and cross-docking practices necessitate energy-efficient and smart warehousing solutions. Hence, the above factors will impede the growth of the market during the forecast period.

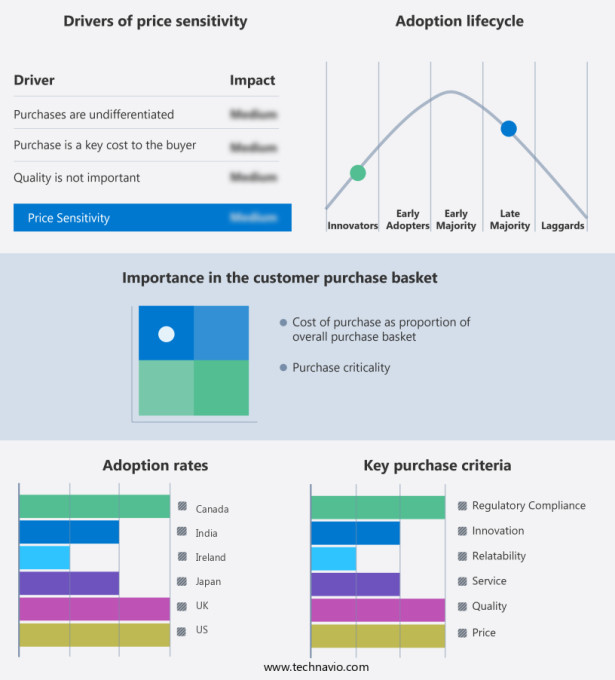

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amrut Distilleries Pvt. Ltd: The company offers whiskey warehousing solutions such as Amrut Distilleries Maturation Warehouse in India.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ardbeg

- Brindiamo Group LLC

- Brown Forman Corp.

- Caley Casks

- Campbell Meyer and Co. Ltd

- CVH SPIRITS LTD.

- Diageo Plc

- Dunnage Spirits

- FOUR ROSES DISTILLERY LLC

- Heaven Hill Sales Co.

- Hinch Distillery

- ISG Ltd.

- Mossburn Distillers Ltd.

- Moving Spirits

- Murray McDavid Ltd.

- Piccadily Distilleries

- R and B Distillers Ltd.

- Stafford Bonded.

- The Spirited Bond Ltd

- Young spirits

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Whiskey warehousing is a crucial aspect of the whiskey industry, ensuring the proper storage and aging of distilled alcohol in oak barrels. Whiskey makers rely on the unique properties of oak barrels to enhance the flavor and aroma of their scotch and bourbon. Private, public, and bonded warehouses cater to the varying needs of whiskey producers. On-trade and off-trade channels require different storage solutions. Whiskey demand continues to rise, necessitating facility expansions and the adoption of smart warehousing solutions. Energy-efficient practices, cross-docking, and temperature and humidity control are essential for optimal whiskey storage. The aging process significantly influences the quality of whiskey, with barrel size and storage requirements varying based on the specific type.

E-commerce growth and strategic warehousing locations are also essential considerations for whiskey storage businesses. Barrel materials, coating technologies, and security measures are essential factors in maintaining the integrity and value of whiskey. The whiskey industry's producers continually innovate, exploring alternative ingredients, luxury products, and rare blends. Whiskey tourism and crafted cocktails in bars, restaurants, and hotels further fuel demand for high-quality whiskey storage. Alcohol consumption remains a part of various cultures and social events, making the whiskey storage business a vital component of the alcoholic beverages sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.86% |

|

Market growth 2024-2028 |

USD 4858.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.24 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 42% |

|

Key countries |

US, UK, Canada, Ireland, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amrut Distilleries Pvt. Ltd., Ardbeg, Brindiamo Group LLC, Brown Forman Corp., Caley Casks, Campbell Meyer and Co. Ltd, CVH SPIRITS LTD., Diageo Plc, Dunnage Spirits, FOUR ROSES DISTILLERY LLC, Heaven Hill Sales Co., Hinch Distillery, ISG Ltd., Mossburn Distillers Ltd., Moving Spirits, Murray McDavid Ltd., Piccadily Distilleries, R and B Distillers Ltd., Stafford Bonded., The Spirited Bond Ltd, and Young spirits |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch