Wilson'S Disease (Wd) Drugs Market Size 2024-2028

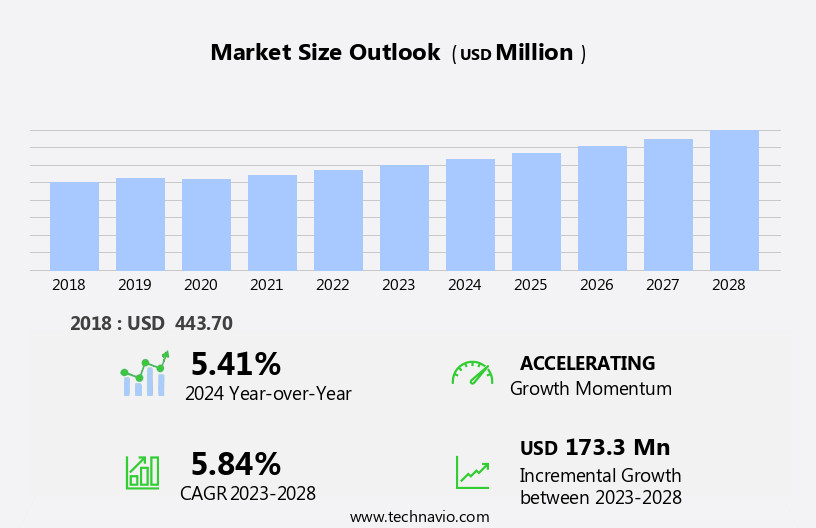

The wilson's disease (wd) drugs market size is forecast to increase by USD 173.3 million at a CAGR of 5.84% between 2023 and 2028.

What will be the Size of the Wilson'S Disease (Wd) Drugs Market During the Forecast Period?

How is this Wilson'S Disease (Wd) Drugs Industry segmented and which is the largest segment?

The wilson's disease (wd) drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Product

- Chelators

- Minerals

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

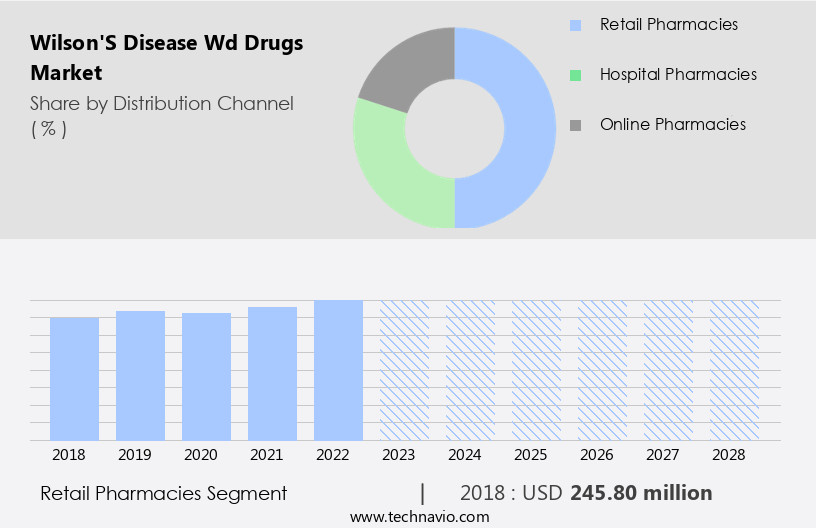

By Distribution Channel Insights

The retail pharmacies segment is estimated to witness significant growth during the forecast period. Wilson's disease is a rare, autosomal recessive disorder that affects copper metabolism, leading to liver and central nervous system damage. Key symptoms include neurologic symptoms such as tremors, muscle rigidity, and speech difficulties, as well as the presence of Keyser Fleisher rings In the eyes. The primary treatment options for Wilson's disease are chelators, which help to remove excess copper from the body. These include penicillamine, trientine, zinc salts, and tetrathiomolybdate. Chelating agents are available in various forms, including oral, parenteral, and injectable. Hospitals, homecare, specialty clinics, and online pharmacies are significant channels for procuring Wilson's disease drugs. Diagnostic tests, such as blood, urine, imaging tests, and liver function tests, are crucial in diagnosing Wilson's disease.

Genetic testing is also essential for confirming the diagnosis and identifying carriers. Liver transplantation is a surgical option for severe cases of Wilson's disease. Retail pharmacies, including chain pharmacies, independent pharmacies, and drugstores, play a vital role in dispensing Wilson's disease medications to patients outside of a hospital setting. These pharmacies purchase drugs in smaller quantities and stock a range of medications to manage the condition. Their convenient location in communities improves patient adherence to medication regimens, leading to better health outcomes.

Get a glance at the market report of various segments Request Free Sample

The Retail pharmacies segment was valued at USD 245.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

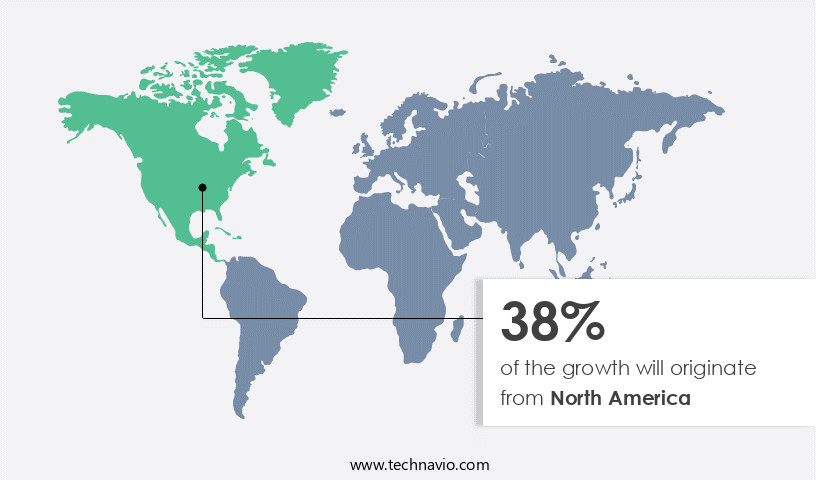

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Wilson's disease is a rare, autosomal recessive disorder characterized by copper accumulation In the liver, brain, and central nervous system. Neurologic symptoms, including tremors, slurred speech, and personality changes, may develop due to copper's toxic effects. Key diagnostic indicators include Kayser-Fleischer rings and low ceruloplasmin levels. Treatment options include chelators such as penicillamine, trientine, zinc salts, and tetrathiomolybdate, which help maintain copper balance and prevent liver failure and encephalopathy. These medications can be administered orally or parenterally. Hospital pharmacies, retail pharmacies, and online pharmacies offer access to these drugs. Diagnostic tests, including blood, urine, imaging tests, and liver function tests, are crucial for proper diagnosis.

The ATP7B gene mutation is the primary cause of Wilson's disease. Favorable regulatory initiatives and ongoing research have led to the development of therapeutic candidates in Phase II and III clinical trials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Wilson'S Disease (Wd) Drugs Industry?

- Increasing awareness among people for disease treatment is the key driver of the market.Wilson's disease is a rare, autosomal recessive disorder that affects the liver's ability to metabolize copper, leading to its accumulation in various organs, particularly the liver, brain, and central nervous system. Neurologic symptoms, such as tremors, stiff muscles, and mood changes, can occur when copper accumulates In the brain. Key diagnostic indicators include Kayser-Fleischer rings around the cornea and liver function abnormalities. The market for Wilson's disease drugs is driven by the increasing awareness and diagnosis of this condition. Organizations like the Wilson Disease Association and the National Organization for Rare Disorders are working to educate the public and healthcare professionals about Wilson's disease, which will lead to more patients being diagnosed and treated.

Chelating agents, such as penicillamine, trientine, zinc salts, and tetrathiomolybdate, are the primary treatments for Wilson's disease. These medications help to remove excess copper from the body and maintain copper balance. They can be administered orally or parenterally and are available through hospital pharmacies, retail pharmacies, and online pharmacies. Diagnostic tests, including blood, urine, imaging tests, and liver function tests, are essential for diagnosing Wilson's disease. Genetic testing for the ATP7B gene mutation can also confirm the diagnosis. In some cases, surgery, such as liver transplantation, may be necessary for patients with advanced liver failure or encephalopathy. Therapeutic candidates, including Phase II and Phase III drugs, are being developed to address the unmet needs of Wilson's disease patients.

These new treatments have the potential to improve patient outcomes and quality of life.

What are the market trends shaping the Wilson'S Disease (Wd) Drugs market?

- Growing prevalence of chronic pain is the upcoming market trend.Wilson's disease, an autosomal recessive rare disease, affects the liver and central nervous system, leading to neurologic symptoms such as tremors, slurred speech, and muscle rigidity. Key diagnostic tests include Eye Exam for the presence of Kayser-Fleisher rings, Genetic Testing for the ATP7B gene mutation, and diagnostic tests like Blood, Urine, Imaging tests, and Liver function tests. The primary treatment options include Chelators such as Penicillamine, Trientine, Zinc, and chelating agents like Tetrathiomolybdate. Medications can be administered orally or parenterally in Hospitals, Homecare, Specialty Clinics, and Online Pharmacies. Copper balance maintenance is crucial to prevent Liver failure, Encephalopathy, and Decompensated cirrhosis.

Therapeutic candidates like D-penicillamine, Cuprimine, Syprine, and Zinc salts are in various stages of clinical trials, including Phase II and Phase III. The increasing prevalence of Wilson's disease and the need for effective treatment options are driving market growth.

What challenges does the Wilson'S Disease (Wd) Drugs Industry face during its growth?

- Stringent regulatory environment on Wilson's drug development and approval is a key challenge affecting the industry growth.Wilson's Disease, an autosomal recessive rare disease, affects the liver and central nervous system, causing neurologic symptoms such as tremors, slurred speech, and muscle rigidity. Diagnosis involves Keyser Fleisher rings, genetic testing, and diagnostic tests like blood, urine, imaging tests, and liver function tests. Treatment includes chelators such as penicillamine, trientine, zinc salts, and tetrathiomolybdate, which help maintain copper balance and prevent liver failure and its complications, including encephalopathy and decompensated cirrhosis. These medications can be administered orally or parenterally and are available in hospitals, homecare, specialty clinics, and online pharmacies. Drug development for Wilson's Disease undergoes rigorous regulatory scrutiny, with clinical trials in various phases.

Failure to meet safety, efficacy, and pharmacological criteria may result in regulatory rejection, necessitating additional data and clinical trials, thereby increasing R&D costs.

Exclusive Customer Landscape

The wilson's disease (wd) drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wilson's disease (wd) drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wilson's disease (wd) drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ANI Pharmaceuticals Inc. - The company specializes in providing treatments for Wilson's Disease, including ANI Pharmaceuticals' Cuprimine. This medication is essential for managing the symptoms of this rare and potentially life-threatening condition. Wilson's Disease is a genetic disorder that results In the accumulation of copper in various body tissues, leading to liver damage, neurological issues, and psychiatric symptoms. ANI Pharmaceuticals' Cuprimine is a copper chelating agent that effectively binds copper and facilitates its excretion from the body. This medication plays a crucial role in preventing further damage and improving the overall health of Wilson's Disease patients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANI Pharmaceuticals Inc.

- Apotex Inc.

- AstraZeneca Plc

- Bausch Health Companies Inc.

- Breckenridge Pharmaceutical Inc.

- Dr Reddys Laboratories Ltd.

- Endo International Plc

- Lupin Ltd.

- Merck and Co. Inc.

- Navinta LLC

- Noblepharma Co. Ltd.

- Panacea Biotec Ltd.

- Recordati S.p.A

- Sanofi SA

- Taj Pharmaceutical Ltd.

- Teva Pharmaceutical Industries Ltd.

- Tsumura and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wilson's Disease, an autosomal recessive disorder, is characterized by the accumulation of copper In the liver and other organs, leading to various clinical manifestations. The primary symptoms include those affecting the liver and central nervous system. Liver symptoms include jaundice, fatigue, abdominal pain, and ascites. The presence of Kayser-Fleischer rings In the cornea is a diagnostic indicator of Wilson's Disease. The disease progression can lead to liver failure and encephalopathy, necessitating urgent intervention. The treatment of Wilson's Disease primarily involves the use of chelating agents to remove excess copper from the body. These agents include penicillamine, trientine, zinc salts, and tetrathiomolybdate.

The choice of therapy depends on the severity of the disease and the patient's response to treatment. Chelating agents can be administered orally or parenterally. Hospitals and specialty clinics are common settings for the initiation of treatment, while homecare and retail pharmacies play a crucial role in ensuring long-term adherence to medication regimens. Online pharmacies have also emerged as a convenient option for patients to access their medications. Diagnostic tests for Wilson's Disease include blood, urine, and imaging tests. Liver function tests, MRI, and CT scans are commonly used to assess liver damage. Neurological and psychiatric evaluations are essential to identify and manage neurologic symptoms.

Genetic testing can confirm the diagnosis and identify carriers. The market for Wilson's Disease drugs is driven by the high prevalence of the disease and the need for effective and safe treatments. The pipeline is rich with therapeutic candidates in various stages of development, including Phase II and Phase III clinical trials. Chelating agents remaIn the cornerstone of treatment for Wilson's Disease. Penicillamine, trientine, and zinc salts have been the mainstay of therapy for decades. However, the emergence of new chelating agents, such as tetrathiomolybdate, offers the potential for improved efficacy and safety. Liver transplantation is a viable option for patients with advanced liver disease.

While it can alleviate the symptoms of liver failure, it does not address the underlying cause of the disease. Therefore, chelating agents remain an essential component of the treatment regimen for Wilson's Disease. In conclusion, Wilson's Disease is a complex and challenging condition that requires a multifaceted approach to treatment. The market for Wilson's Disease drugs is dynamic, with ongoing research and development efforts aimed at improving the efficacy and safety of existing therapies and discovering new ones. The use of chelating agents, diagnostic tests, and various delivery channels, including hospitals, specialty clinics, retail pharmacies, and online pharmacies, plays a crucial role in managing this rare and debilitating disease.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.84% |

|

Market growth 2024-2028 |

USD 173.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.41 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wilson'S Disease (Wd) Drugs Market Research and Growth Report?

- CAGR of the Wilson'S Disease (Wd) Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wilson's disease (wd) drugs market growth of industry companies

We can help! Our analysts can customize this wilson's disease (wd) drugs market research report to meet your requirements.