Zinc Flake Market Size 2024-2028

The zinc flake market size is forecast to increase by USD 24.1 million at a CAGR of 4.37% between 2023 and 2028.

- The market is experiencing significant growth due to the expanding construction industry and the increasing automotive sector worldwide. The construction industry's growth is driven by urbanization, infrastructure development, and housing demand, leading to an increased need for galvanized steel, a primary application for zinc flakes. Additionally, the automotive industry's growth, fueled by rising consumer income levels and increasing vehicle production, is resulting in increased demand for automotive coatings, another significant application for zinc flakes. However, the market faces challenges due to the volatility in prices of raw materials, such as zinc, which can significantly impact the production costs of zinc flakes.

- Producers must navigate these price fluctuations to maintain profitability and competitiveness in the market. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on optimizing their production processes, exploring alternative raw material sources, and expanding their product offerings to cater to various end-use industries. By staying agile and responsive to market trends and challenges, players in the market can position themselves for long-term success.

What will be the Size of the Zinc Flake Market during the forecast period?

- The market encompasses the production and application of zinc-based coatings, including zinc-aluminum flakes, for corrosion protection on various ferrous substrates. This market exhibits significant growth due to the increasing demand for rust prevention in automotive components, wind electric applications, and industrial machinery. Self-healing and smart coatings, which incorporate advanced polymers and nano-technologies, are emerging trends in this sector. Corrosion-resistant coatings, such as zinc flake coatings, are essential in the mechanical industry for protecting car bodies, chassis, springs, and other metal surfaces from corrosion. Industrialization and infrastructure development activities fuel the market's expansion, with zinc flakes being used as an anti-corrosive agent in various applications, from paint on refrigerators to protective coatings for fasteners.

- Alternative coating technologies, like nano-coatings, are gaining traction as they offer enhanced corrosion resistance and improved performance. Overall, the market is a dynamic and growing sector, driven by the need for effective corrosion protection on a global scale.

How is this Zinc Flake Industry segmented?

The zinc flake industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Particle size below 15 micrometer

- Particle size 15 micrometer to 20 micrometer

- Particle size above 20 micrometer

- Application

- Automotive application

- Mechanical application

- Wind electric application

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

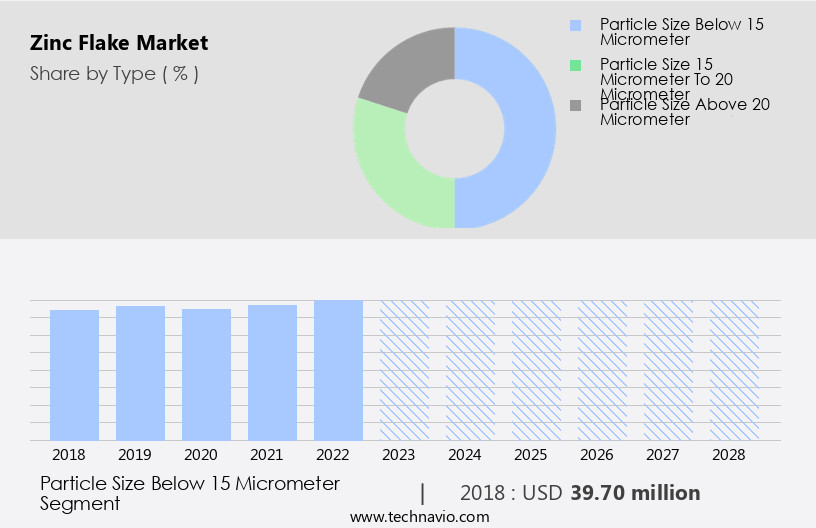

The particle size below 15 micrometer segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and supply of fine particle zinc flakes, primarily used in various industries for corrosion protection and aesthetic purposes. These fine particles, with a size below 15 micrometers, offer advantages such as improved coverage, smoothness, and better adhesion. The smaller particle size allows for uniform coating distribution, filling in imperfections, and seamless film formation during application. This results in enhanced corrosion resistance for substrates like ferrous metals, wheel rims, refrigerators, and chassis. Additionally, zinc flakes are used in advanced coatings, such as self-healing and smart coatings, and in industries like automotive, mechanical, oil & gas, and heavy machinery.

The flexibility of zinc flake coating applications extends to underbody coatings, exhaust pipes, paint, and even aircraft components. Advanced polymers, binders, and alternative coating technologies, such as dip-spinning and robotic spraying, are utilized to create corrosion-resistant coatings using zinc flakes. Zinc flake coating also offers wear resistance, thermal resistance, and impact resistance, making it a valuable addition to various industries. Despite raw material price fluctuations, the demand for zinc flakes remains strong due to their essential role in protecting metal surfaces from rust and corrosion.

Get a glance at the market report of share of various segments Request Free Sample

The Particle size below 15 micrometer segment was valued at USD 39.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

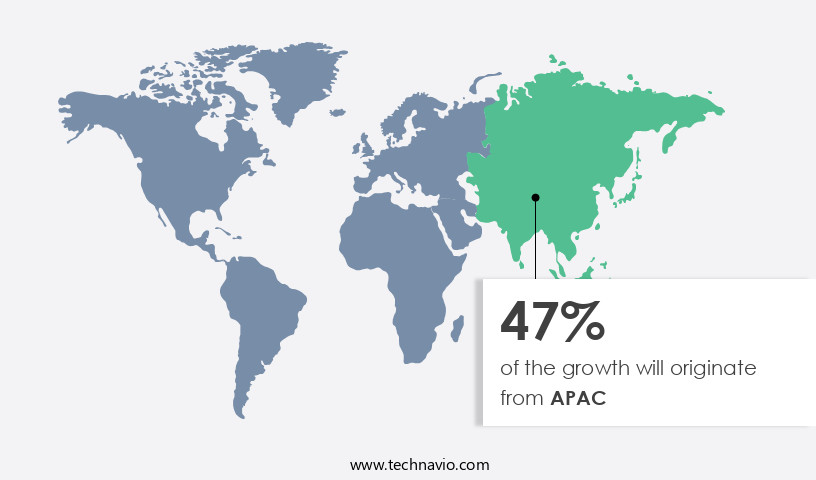

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth in the Asia Pacific region due to increasing demand from key industries such as construction and automotive. In the construction sector, zinc flakes are utilized in the construction of various infrastructure projects, including buildings, pedestrian bridges, highway bridges, and railway bridges, due to their corrosion-resistant and load-bearing properties. These advantages make zinc flakes an ideal choice for heavy-duty applications in diverse climatic conditions, resulting in low maintenance costs and extended durability. Similarly, in the automotive industry, zinc flakes are used in various components, such as wheel rims, exhaust pipes, and chassis, to enhance their corrosion protection and wear resistance.

Additionally, the use of zinc flakes in advanced coatings, such as smart coatings, self-healing coatings, and zinc-aluminum flake coatings, further boosts their demand. The market growth is also driven by the increasing use of zinc flakes in the production of paints, coatings, and adhesives, as well as in the oil & gas industry for rust protection and in heavy machinery for improved thermal resistance and friction control.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Zinc Flake Industry?

- Growth of global construction industry is the key driver of the market.

- The global construction industry has undergone substantial transformations in the last decade, with developed economies, including the US and the UK, addressing the issue of aging infrastructure. This trend is driving the construction market in these regions, as maintenance and renovation projects, as well as a shift towards sustainable building development and retrofitting practices, gain momentum. Moreover, the focus on green and sustainable buildings has resulted in substantial investments and technological innovations.

- The global economy's overall growth is further supporting the expansion of the construction industry. This growth dynamic presents substantial opportunities for The market, which is experiencing growth due to increased government spending, population growth, rising per capita income, and economic advancement in developing countries.

What are the market trends shaping the Zinc Flake Industry?

- Growing global automotive industry is the upcoming market trend.

- The market is driven by several factors, including the increasing production in the automotive industry and the demand for corrosion-resistant materials. The automotive sector's expansion, particularly in emerging economies such as China, India, and Brazil, is fueled by factors like rising disposable income, urbanization, and improved transport infrastructure. This growth in automotive manufacturing leads to a corresponding increase in the demand for zinc flakes.

- These materials offer excellent resistance to corrosion and rust, making them essential for various automotive components and parts. Stringent government regulations also necessitate the use of reliable and effective corrosion protection solutions, further boosting the market's growth. The market is poised for significant expansion due to these factors.

What challenges does the Zinc Flake Industry face during its growth?

- Volatility in prices of raw materials is a key challenge affecting the industry growth.

- The market faces challenges due to the volatility in raw material prices, specifically zinc. As a crucial component in zinc flake production, price fluctuations can significantly impact companies' production costs. In April 2023, zinc prices experienced a substantial decline, dropping from over USD4,500 per ton in April 2022 to below USD2,500/ton in May 2023 â the lowest level since October 2020.

- This 40% price decrease within 13 months poses a considerable challenge for market participants.

Exclusive Customer Landscape

The zinc flake market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the zinc flake market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, zinc flake market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aalberts NV - The company specializes in applying zinc flake coatings via advanced techniques, including dip-spin, rack dip-spin, and automated spray processes, ensuring superior protection and durability for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aalberts NV

- Altana AG

- American Elements

- AVL METAL POWDERS n.v.

- Dorken

- Hunan Jinhao New Material Technology Co. Ltd.

- MKS Instruments Inc.

- Noelson Chemicals

- NOF Metal Coatings Group

- Novamet Specialty Products Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and application of zinc flakes in various industries. These flakes, which are thin, flat pieces of zinc, serve as essential components in the manufacture of corrosion-resistant coatings. The demand for such coatings is driven by the need for improved protection against rust and other forms of corrosion in diverse sectors. Zinc flakes are commonly used in the production of zinc-aluminum flake coatings. These coatings offer superior corrosion resistance, making them popular choices for applications in the oil & gas industry, mechanical industry, and automotive components. In addition, they are used in underbody coatings for cars and trucks, as well as in coatings for infrastructure development activities.

The market for zinc flakes is influenced by several factors. One key factor is the ongoing industrialization and automation of various industries. For instance, the use of automated spraying techniques, such as robotic spraying, has become increasingly common in the manufacturing of corrosion-resistant coatings. This trend is expected to continue, driving demand for zinc flakes. Another factor is the development of advanced polymers and smart coatings. These coatings offer enhanced properties, such as self-healing and thermal resistance, which make them attractive to industries that require high-performance coatings. Zinc flakes play a crucial role in the production of these coatings, as they provide the necessary corrosion protection and other desirable properties.

The flexibility of zinc flake coatings is another factor contributing to their popularity. They can be applied using various techniques, such as dip-spin coating and dip-drain coating, to suit the specific requirements of different applications. Additionally, they can be formulated with a range of binders, including silicate, waterborne, and inorganic binders, to optimize their properties for different uses. The use of zinc flake coatings is not limited to industrial applications. They are also used in decorative coatings, where their aesthetic properties are valued. For example, they are used in the production of paint for car bodies and aircraft, as well as in exhaust pipes and wheel rims for vehicles.

The market for zinc flakes is influenced by raw material prices, particularly the price of zinc. Fluctuations in the price of zinc can impact the cost of producing zinc flakes and, in turn, the price of corrosion-resistant coatings. However, the demand for these coatings is expected to remain strong due to their essential role in protecting various industries from corrosion. Alternative coating technologies, such as nano-coatings, are emerging in the market. These coatings offer unique properties, such as increased abrasion resistance and lubricity. However, they may not be able to match the proven performance and cost-effectiveness of zinc flake coatings in certain applications.

As a result, zinc flake coatings are expected to remain a significant player in the market for the foreseeable future. In , the market is driven by the need for corrosion protection in various industries. The ongoing industrialization and automation of manufacturing processes, as well as the development of advanced coatings, are key factors contributing to the growth of this market. Zinc flakes play a crucial role in the production of these coatings, and their versatility and performance make them an attractive choice for a wide range of applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.37% |

|

Market growth 2024-2028 |

USD 24.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.15 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Zinc Flake Market Research and Growth Report?

- CAGR of the Zinc Flake industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the zinc flake market growth of industry companies

We can help! Our analysts can customize this zinc flake market research report to meet your requirements.