DC Motor Drivers Market Size 2025-2029

The DC motor drivers market size is forecast to increase by USD 2.17 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing adoption of DC motor drivers in various industries such as automotive, industrial, and consumer electronics. Technological innovation by companies is a key growth factor in the market, with companies investing in research and development to produce motor drivers with improved efficiency, power density, and compact designs. Product launches are another trend in the market, as companies introduce new and advanced motor driver solutions to meet the evolving needs of their customers. In the HVAC industry, DC motor drivers are being used to power fans and compressors for energy-efficient heating and cooling systems. Control circuits and industrial technology are at the heart of industrial automation solutions. However, challenges such as noise and electromagnetic interference continue to pose a threat to market growth. Companies are addressing these challenges by developing motor drivers with advanced control algorithms and shielding techniques to minimize interference and ensure smooth operation. Overall, the market is expected to grow steadily in the coming years, driven by these market trends and challenges.

What will be the Size of the Market During the Forecast Period?

- DC motor controllers and control boards play a crucial role in the efficient operation of various industries, including aerospace and automotive. The selection of the appropriate controllers and control units is essential for optimizing performance, ensuring industrial reliability, and integrating control systems. Efficiency is a significant factor in the choice of control hardware for industrial applications. Control systems design and optimization, including feedback mechanisms and control algorithms, are critical components in achieving optimal efficiency. Stepper motors, encoders, and voltage control are integral parts of the control system, contributing to the precision and accuracy of industrial machinery. Digital transformation in industries has led to the integration of advanced control systems, including pump control systems and industrial maintenance solutions.

- Furthermore, control system optimization, maintenance, and repair are essential aspects of industrial modernization and industrial automation. Industrial sustainability and development are also driving the demand for efficient and reliable control systems. Control systems design, industrial machinery, and industrial automation are interconnected, with each component playing a vital role in ensuring industrial reliability and efficiency. Industrial control systems integration is a key aspect of industrial 4.0, enabling seamless communication between various industrial components and systems. In conclusion, the selection and optimization of DC motor controllers and control boards are essential for industrial applications.

How is this market segmented and which is the largest segment?

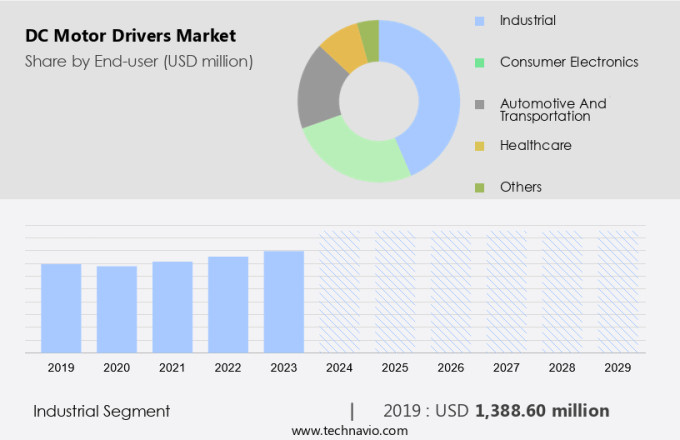

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Consumer electronics

- Automotive and transportation

- Healthcare

- Others

- Type

- Brushless DC motor drivers

- Brushed DC motor drivers

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Brazil

- Middle East and Africa

- APAC

By End-user Insights

- The industrial segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the industrial sector, due to the demand for efficient and reliable motor control solutions. Notable developments include ABB India's partnership with SMS Group to supply medium and low voltage motors and drives for ArcelorMittal Nippon Steel's new hot strip mill in Gujarat. This collaboration underscores the importance of high-performance motor drivers in heavy-duty applications. In the e-mobility sector, technological advancements continue to drive market expansion, with DC motor drivers playing a crucial role in powering electric vehicles, HVAC systems, AC drives, home appliances, and consumer electronics. As the market evolves, key players are focusing on enhancing product performance and functionality to meet evolving industry demands.

Get a glance at the market report of share of various segments Request Free Sample

The industrial segment was valued at USD 1.39 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is experiencing significant growth in the market due to the increasing demand for energy-efficient and high-performance motor control solutions in various industries. Major economies in this region, including China, Japan, South Korea, and India, are driving the market expansion in sectors such as automotive, industrial automation, consumer electronics, and home appliances. In October 2023, Toshiba Electronic Devices and Storage Corporation introduced two new 600V small intelligent power devices (IPDs) in Japan, specifically designed for brushless DC motor drive applications. These applications, prevalent in the APAC market due to regional climatic conditions and industrial needs, include air conditioners, air cleaners, and pumps. Investment in this market is expected to continue, with key players focusing on innovation and development of advanced DC drives to meet the growing demand for efficient and reliable motor control solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of DC Motor Drivers Market?

Technological innovation by companies is the key driver of the market.

- The market is experiencing significant growth due to technological advancements in motor control technology. One notable example is ABB's introduction of the ACS8080 medium voltage air-cooled drive in November 2024. This innovative converter boasts up to 98% efficiency, setting a new standard for performance in drive systems. The ACS8080 utilizes advanced motor control technology, MP3C, which enhances efficiency and motor compatibility. By reducing harmonic distortions by approximately 50% compared to traditional control and modulation schemes, the ACS8080 extends equipment lifespan and delivers substantial energy savings. This solution is particularly attractive for various industrial applications, including manufacturing electric vehicles, home appliances such as vacuum cleaners and fans, HVAC systems, and automated guided vehicles.

- Additionally, the market is driven by government regulations promoting energy efficiency and economic growth in sectors like aerospace and defense, oil & gas, and power generation. Cost-efficient DC motor drivers are also gaining popularity in e-mobility applications, building automation, and water & wastewater treatment. The market competition is fierce, with companies continually investing in research and development to offer more programmable, efficient, and cost-effective solutions.

What are the market trends shaping the DC Motor Drivers Market?

Product launches is the upcoming trend in the market.

- The market is experiencing notable growth and innovation, with a focus on integrating multiple functionalities into compact packages for simplified motor control system designs. This trend is exemplified by Microchip Technology's recent introduction of a new family of integrated motor drivers in February 2024. These devices combine a digital signal controller (DSC), a three-phase MOSFET gate driver, and optional LIN or CAN FD transceivers into a single package. This integration reduces component count, leading to smaller printed circuit board (PCB) dimensions, and enhances the efficiency and reliability of motor control systems. Several industries, including manufacturing electric vehicles, aerospace and defense, home appliances, HVAC, AC drives, consumer electronics, fans, breast pumps, electric vehicles, automated guided vehicles, appliances, servo motors, brushless DC motors, and various industrial applications, are adopting DC motor drivers due to their energy-efficiency and cost-effectiveness.

- Furthermore, government regulations and economic growth are also driving the demand for energy-efficient motors in industries such as oil & gas, power generation, industrial infrastructure, metal & mining, and water & wastewater. Technological advancements in DC motor drivers, such as programmability, higher power rating, and voltage rating, are enabling these motors to be used in a wide range of applications. For instance, DC motor drivers are being used in vacuum cleaners to improve suction power and energy efficiency. In the aerospace industry, DC motor drivers are being used to power control pumps and servo motors for aircraft systems.

What challenges does DC Motor Drivers Market face during the growth?

Noise and electromagnetic interference is a key challenge affecting the market growth.

- The market encompasses various industries, including manufacturing electric vehicles, home appliances, HVAC, aerospace and defense, consumer electronics, and industrial infrastructure. A key challenge in this market is managing noise and electromagnetic interference (EMI) in applications utilizing conventional DC motors, such as vacuum cleaners, fans, pumps, and automated guided vehicles. Brushed DC motors are notorious for generating substantial electrical noise and EMI, which can negatively impact the performance of nearby electronic devices and systems. To mitigate these issues, effective noise reduction and EMI shielding techniques are essential. This may involve the implementation of filters, such as capacitors and inductors, to suppress high-frequency noise.

- Moreover, shielding materials, including metal enclosures and conductive coatings, are also employed to block or redirect electromagnetic emissions away from sensitive components. Technological advancements, such as the adoption of brushless DC motors and servo motors, are driving the market's growth in various applications, including e-mobility, aerospace, building automation, and power generation. Government regulations and economic growth are also significant factors influencing market trends. Cost-efficient and energy-efficient motors, such as those used in HVAC, water & wastewater, gas pipeline compressors, and refinery compressors, are in high demand due to their increased efficiency and reduced operational costs. Competition in the market is fierce, with companies continually investing in modernization and innovation to stay competitive.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd - This company offers DC motor drivers like the DCS880 series, which are built on an all compatible drive platform.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegro MicroSystems Inc.

- Allied Motion Technologies Inc.

- Analog Devices Inc.

- Emerson Electric Co.

- Infineon Technologies AG

- Kollmorgen Corp.

- Lin Eng. Inc.

- maxon

- Microchip Technology Inc.

- Nanotec Electronic GmbH and Co. KG

- Parker Hannifin Corp.

- Power Integrations Inc.

- Renesas Electronics Corp.

- Siemens AG

- SparkFun Electronics

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the broader electric motor market, playing a crucial role in the efficient conversion and control of direct current (DC) power for various applications. This market encompasses a diverse range of industries, including manufacturing electric vehicles, home appliances, HVAC systems, consumer electronics, aerospace, defense, and industrial infrastructure, among others. The market is driven by several factors, including the increasing demand for energy-efficient motors, technological advancements, and economic growth. Energy efficiency is a critical factor in today's industrial landscape, as industries strive to reduce their carbon footprint and operating costs.

Moreover, DC motor drivers, with their ability to provide high efficiency and precise control, are increasingly being adopted in various applications. Technological advancements, such as the development of brushless DC motors and servo motors, have significantly expanded the capabilities of DC motor drivers. Brushless DC motors offer higher efficiency, longer lifespan, and better performance compared to conventional DC motors. Servo motors, on the other hand, provide precise control and positioning, making them ideal for applications requiring high accuracy. Moreover, the increasing adoption of DC motor drivers in e-mobility applications, such as electric vehicles and automated guided vehicles, is expected to drive market growth.

Furthermore, the growing popularity of electric vehicles, driven by factors such as environmental concerns and increasing fuel prices, is expected to create significant opportunities for DC motor drivers in the coming years. The aerospace and defense industry is another significant market for DC motor drivers. These industries require high-performance, reliable, and efficient motors for various applications, such as control systems, actuators, and propulsion systems. DC motor drivers are preferred in these applications due to their high power density, efficiency, and precise control capabilities. However, the market faces several challenges, including competition from alternative motor technologies, such as AC drives and energy storage systems, and regulatory compliance. Government regulations, particularly in the areas of emissions and safety, can significantly impact the market dynamics and growth. Investment in modernization and industrial infrastructure is another key factor influencing the market. The oil & gas, metal & mining, and power generation industries, for instance, are investing heavily in modernizing their infrastructure to improve efficiency and reduce operational costs. DC motor drivers are expected to play a significant role in these modernization efforts, particularly in applications such as gas pipeline compressors and refinery compressors. In conclusion, the market is driven by several factors, including energy efficiency, technological advancements, and economic growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 2.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, US, Japan, Germany, South Korea, India, Italy, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch