Enhanced Vision System Market Size 2024-2028

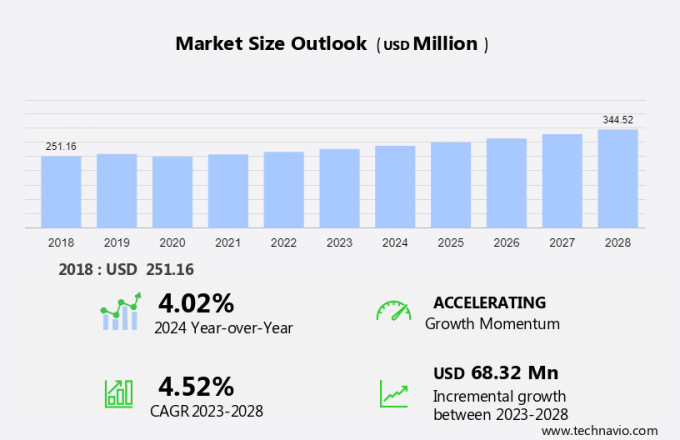

The enhanced vision system market size is forecast to increase by USD 68.32 million at a CAGR of 4.52% between 2023 and 2028. The market is experiencing significant growth due to its increasing adoption in various industries, particularly commercial airlines. This cutting-edge technology enhances situational awareness by utilizing sensor technology such as infrared imaging and multispectral imaging. EVS is particularly valuable in inclement weather conditions, enabling pilots to see runways and obstacles more clearly. The integration of artificial intelligence (AI) in EVS has further advanced its capabilities, with AI-powered image processing and object recognition enhancing the system's accuracy and reliability. The display segment of enhanced vision systems is expected to witness significant growth due to the increasing adoption of these advanced technologies in aviation. However, the increasing manufacturing costs of EVS may hinder market growth. In the maritime industry, EVS is expanding applications in navigation, while in mining and extraction, it is enhancing safety and efficiency.

Enhanced vision systems have become essential components in the aviation industry, revolutionizing flight operations by enhancing pilots' visibility and situational awareness. These systems utilize advanced sensor technologies and imaging displays to provide real-time information about terrain features, runways, and other critical elements during takeoffs, landings, and flight operations. The core of enhanced vision systems consists of high-definition cameras and infrared sensors. These sensors capture data in various wavelengths, including infrared and visible light, to generate synthetic vision images. Synthetic vision systems process this data to create 3D representations of the environment, overlaying essential information such as runway markings and terrain contours on the displays. Augmented reality displays play a crucial role in presenting this information to pilots. These advanced displays integrate the synthetic vision data with real-world views, providing a seamless and comprehensive visual representation of the surroundings.

Further, business jet operators have been early adopters of these technologies, as they offer significant advantages in low visibility conditions and during nighttime operations. Millimeter wave radar is another technology that enhances the capabilities of enhanced vision systems. This technology can detect and display the presence of obstacles and terrain features, providing pilots with critical information for safe takeoffs and landings. Infrared imaging is another essential component of enhanced vision systems. Infrared sensors can detect heat signatures, making them ideal for identifying potential hazards, such as ice on the wings or engine components, during flight operations. Technology developers are continuously working on improving the performance and functionality of enhanced vision systems. These advancements include higher resolution displays, faster processing speeds, and more advanced algorithms for data analysis. The future of enhanced vision systems in aviation looks promising, with significant potential for enhancing safety, efficiency, and overall operational capabilities.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Display

- Camera

- Control electronics

- Processing units

- Sensors

- Platform

- Fixed wing

- Rotary wing

- Geography

- North America

- Canada

- US

- Europe

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Component Insights

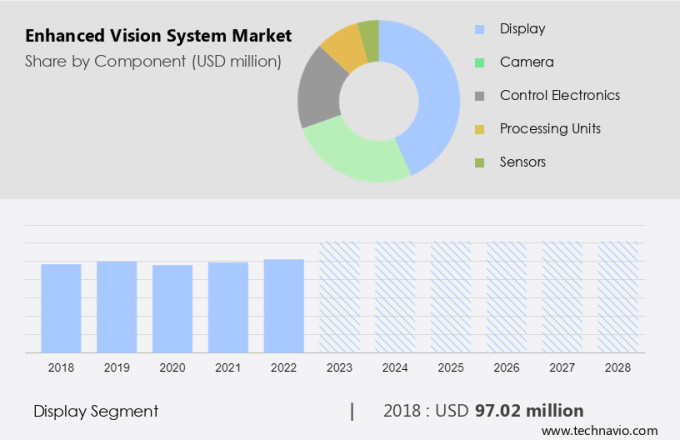

The display segment is estimated to witness significant growth during the forecast period. The Enhanced Vision System (EVS) market is experiencing notable expansion, with various sectors identified for in-depth analysis. A significant segment within this industry is the display technology segment, which is integral to providing real-time information and heightening situational awareness for aviation personnel. This segment comprises diverse devices, such as head-up displays (HUDs), head-mounted displays (HMDs), and primary flight displays (PFDs). These displays utilize sophisticated visualization techniques, presenting critical flight data, terrain, obstacles, and weather conditions in a lucid and user-friendly format.

Moreover, by keeping pilots' focus on the external environment, they minimize the necessity for frequent shifts in attention towards conventional cockpit instruments. The display segment incorporates advanced imaging technologies, including high-definition cameras and infrared sensors, which are integrated with avionics systems and augmented reality displays. These technologies contribute to enhancing the overall functionality and effectiveness of the EVS market.

Get a glance at the market share of various segments Request Free Sample

The display segment accounted for USD 97.02 million in 2018 and showed a gradual increase during the forecast period.

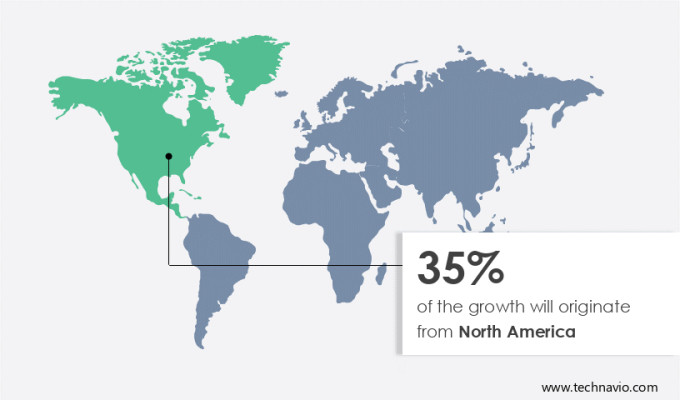

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the Enhanced Vision System (EVS) market has experienced notable growth due to its ability to enhance pilot situational awareness during challenging visual conditions. EVS is a technology designed to support pilots in navigating safely and efficiently during fog, darkness, or adverse weather. This system employs advanced sensor technologies, such as thermal imaging and infrared sensors, along with head-up displays, to present real-time visual data to pilots. With North America being a major player in the global aviation sector, the presence of a large number of commercial and private aircraft operators and stringent safety regulations, the demand for advanced avionics systems, including EVS, is on the rise. This trend is expected to continue, offering substantial growth opportunities for market participants in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Expanding applications of EVS in maritime navigation, mining and extraction, and healthcare is the key driver of the market. The Enhanced Vision System (EVS) market has seen significant growth due to its increasing adoption in various sectors beyond aviation, including maritime navigation, mining and extraction, and healthcare. In maritime navigation, EVS plays a pivotal role in enhancing the safety and efficiency of ship operations. Through the integration of advanced sensors, real-time data processing, and image enhancement technologies, EVS provides superior visibility in challenging weather conditions, low-light environments, and areas with limited visibility. This advanced vision system enables captains and crews to detect obstacles, identify navigation markers, and maneuver vessels with greater precision, thereby reducing the risk of accidents and improving overall maritime operations.

Additionally, technology developers continue to innovate and improve EVS technology to meet the evolving needs of various industries. Aviation regulatory agencies and business jet operators have been early adopters of EVS, and military aviation is also increasingly utilizing this technology for enhanced situational awareness during takeoffs, landings, and flight operations. The expansion of applications for EVS has solidified its position as a key driver in the global EVS market.

Market Trends

Integration of AI-powered image processing and object recognition is the upcoming trend in the market. The Enhanced Vision System (EVS) market is experiencing a notable shift towards incorporating machine learning algorithms and advanced technologies such as LiDAR, edge computing, and fusion. These innovations aim to enhance operational efficiency and improve the functionality of EVSs in various industries, including autonomous car navigation and aerial collision avoidance. Machine learning algorithms enable EVSs to analyze and interpret visual data in real-time, leading to more accurate object recognition. LiDAR technology provides high-resolution 3D imaging, while edge computing enables data processing at the source, reducing latency and increasing response time. The integration of these technologies is essential for safety and security applications, such as medical diagnostics and surveillance systems.

Moreover, AI-powered image processing and object recognition are crucial for enhancing the performance of EVSs, enabling them to capture, process, and interpret complex visual data with greater accuracy and speed. The adoption of these advanced technologies is expected to drive growth in the EVS market.

Market Challenge

Increased manufacturing cost of EVS is a key challenge affecting the market growth. The market in the commercial aviation sector is witnessing significant growth due to the integration of cutting-edge technology to enhance situational awareness. EVS systems utilize sensor technology, including infrared imaging and multispectral imaging, to provide real-time visuals to pilots, improving safety and reducing the risks associated with inclement weather or low-visibility environments. These systems are essential for ensuring smooth operations in challenging conditions, thereby increasing the demand for EVS in commercial airlines.

Further, artificial intelligence (AI) is also being integrated into EVS to provide enhanced image processing capabilities, further improving situational awareness for pilots. The EVS market is experiencing increased demand due to the growing focus on safety and the need for advanced technologies to support the increasing number of flights. Despite the higher manufacturing costs, the benefits of EVS far outweigh the investment, making it a worthwhile investment for commercial airlines.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Astronics Corp.: The company offers dual sensor, Max Viz system, and single sensor vision systems.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAE Systems Plc

- Elbit Systems Ltd.

- Honeywell International Inc.

- Industrial Vision Systems Ltd.

- Kawasaki Heavy Industries Ltd.

- Keyence India Pvt. Ltd.

- Konica Minolta Inc.

- Mercury Systems Inc.

- Raytheon Technologies Corp.

- Robert Bosch GmbH

- Rosenbauer International AG

- Rotorcraft Services Group

- Samvardhana Motherson International Ltd.

- SOLOMON TECHNOLOGY CORP.

- Techman Robot Inc.

- Thales Group

- Vision Components GmbH

- Zebra Technologies Corp.

- Skeyes

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Enhanced vision systems are revolutionizing the aviation industry by providing pilots with superior situational awareness during flight operations. These systems utilize advanced sensor technologies, such as high-definition cameras and infrared sensors, to capture and process real-time imaging data. Augmented reality displays then overlay this information onto the pilot's view, enhancing their vision and enabling them to better navigate terrain features, runways, and other environmental factors. Avionics systems in both business and commercial aviation are incorporating these enhanced vision systems to improve safety and operational efficiency. Infrared (IR) technology and millimeter-wave radar are key sensor technologies used in these systems. IR technology enables thermal imaging, while millimeter-wave radar provides data on the distance and size of objects.

Moreover, competing technologies, such as Lidar and artificial intelligence (AI) optimization, are also being explored for enhanced vision systems. Data security is a critical consideration for these systems, as they handle sensitive information. Regulatory agencies and business jet operators in military aviation and commercial airlines are collaborating with technology developers to integrate these systems into aircraft. These systems are not limited to aviation applications. They are also being used in maritime security and consumer applications, such as autonomous car navigation and aerial collision avoidance. Miniaturization and AI optimization are key trends in the development of these systems, enabling greater functionality and ease of use.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.52% |

|

Market Growth 2024-2028 |

USD 68.32 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.02 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, Canada, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Astronics Corp., BAE Systems Plc, Elbit Systems Ltd., Honeywell International Inc., Industrial Vision Systems Ltd., Kawasaki Heavy Industries Ltd., Keyence India Pvt. Ltd., Konica Minolta Inc., Mercury Systems Inc., Raytheon Technologies Corp., Robert Bosch GmbH, Rosenbauer International AG, Rotorcraft Services Group, Samvardhana Motherson International Ltd., SOLOMON TECHNOLOGY CORP., Techman Robot Inc., Thales Group, Vision Components GmbH, Zebra Technologies Corp., and Skeyes |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch