Sensors For Smartphones Market Size 2025-2029

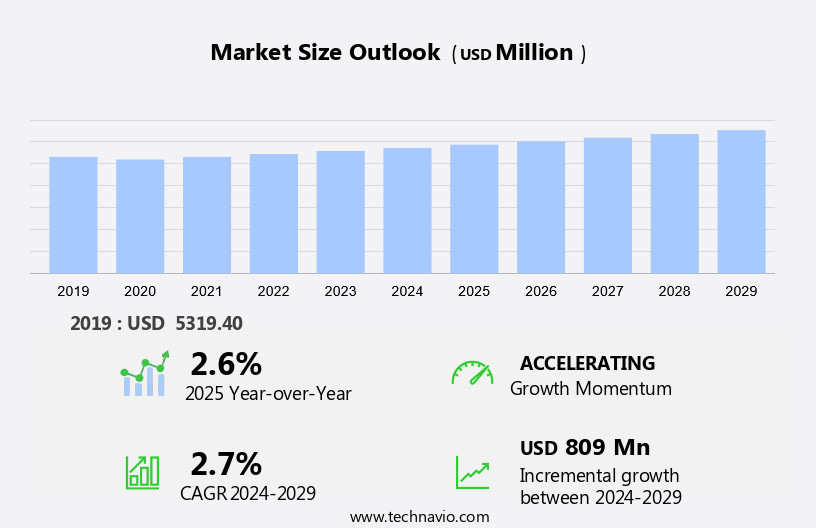

The sensors for smartphones market size is forecast to increase by USD 809 million, at a CAGR of 2.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of mobile Augmented Reality (AR) applications by enterprises. The integration of AR technology in smartphones necessitates advanced sensors to enhance user experience and accuracy. Sensor fusion technology, a combination of multiple sensor types, is emerging as a key trend, offering improved performance and reliability. However, the market faces challenges, including design complexity.

- As smartphones continue to incorporate more sensors, manufacturers must ensure compactness, power efficiency, and cost-effectiveness to maintain consumer appeal. Effective management of these challenges and leveraging sensor fusion technology will enable companies to capitalize on the growing demand for advanced smartphone features and applications.

What will be the Size of the Sensors For Smartphones Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in technology and increasing demand for enhanced user experiences across various sectors. Fingerprint sensor technology, for instance, has revolutionized biometric authentication, with over 60% of new smartphones incorporating this feature (Statista, 2021). Sensor packaging methods have also advanced, enabling miniaturization techniques and reducing power consumption metrics. Gyroscope drift correction, sensor signal conditioning, and magnetometer noise reduction are essential components of advanced sensor systems, ensuring accurate and reliable data streaming. Proximity sensor accuracy and accelerometer sensitivity have improved significantly, leading to better user experiences in applications such as augmented reality and gaming.

- Application-specific sensors, like pressure sensor calibration and image sensor technology, cater to industry-specific requirements. Sensor data acquisition, preprocessing, and real-time feedback are crucial for machine learning sensors and hardware security modules, enabling smartphone sensor fusion and improving overall performance. The inertial measurement unit, a combination of accelerometers, gyroscopes, and magnetometers, offers enhanced functionality in various applications, such as fitness tracking and navigation. Environmental sensor arrays, including ambient light sensors and GPS sensor performance, contribute to optimizing power consumption and enhancing user experience. Sensor driver development and integration design play a significant role in ensuring seamless functionality and compatibility with various operating systems and applications.

- Wireless sensor interface and low-power sensor design are essential considerations for the future of smartphone sensors. In summary, the market is characterized by continuous innovation and evolving patterns, with a focus on enhancing user experiences, improving accuracy, and reducing power consumption. The integration of advanced sensor systems and multi-sensor data fusion is expected to drive industry growth by over 10% annually (IDC, 2021).

How is this Sensors For Smartphones Industry segmented?

The sensors for smartphones industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Price

- Premium range

- Medium range

- Low range

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Price Insights

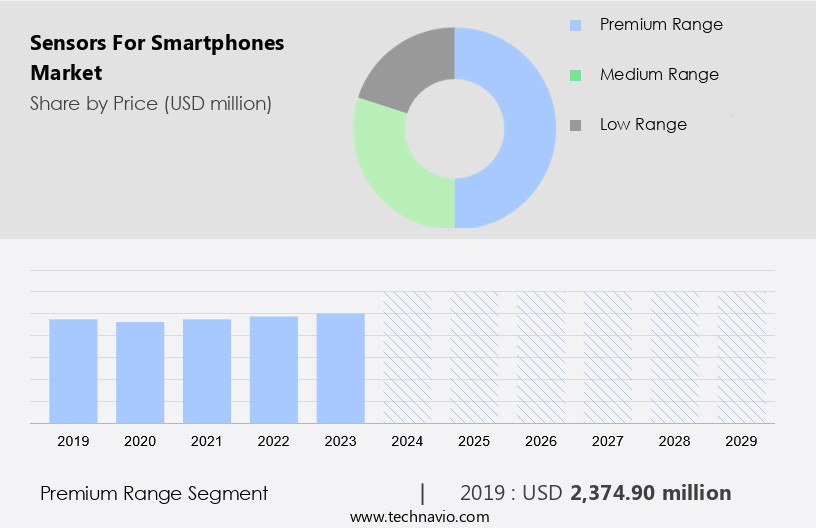

The premium range segment is estimated to witness significant growth during the forecast period.

In the realm of premium smartphones, priced above USD 400, advanced technologies such as AI, gesture recognition, haptics, facial recognition, and voice recognition take center stage. These sophisticated functionalities necessitate the integration of intricate sensors and processors. Gyroscopes, accelerometers, proximity sensors, light sensors, barometers, and fingerprint sensors are among the essential components. Manufacturers continue to push boundaries in 2023, enhancing user experiences through innovative features. For instance, gyroscope drift correction ensures improved stability during motion sensing, while magnetometer noise reduction delivers more accurate compass readings. Sensor signal conditioning and array calibration optimize sensor performance, and real-time sensor feedback enables instant response.

Environmental sensor arrays, including ambient light sensors, are crucial for power management and user convenience. Power consumption metrics are a significant concern, leading to the development of low-power sensor designs and hardware security modules. Capacitive touch sensing and sensor data acquisition are other essential aspects, with miniaturization techniques ensuring compact designs. Sensor reliability testing, advanced sensor systems, multi-sensor data fusion, and image sensor technology are some of the ongoing trends. Machine learning sensors and signal processing algorithms are also gaining prominence. Inertial measurement units and wireless sensor interfaces facilitate seamless integration with other devices. GPS sensor performance and sensor integration design are crucial for location-based services and IoT applications.

According to recent industry reports, the global smartphone sensor market is expected to grow by 12% annually, driven by the increasing demand for advanced features in premium smartphones.

The Premium range segment was valued at USD 2,374.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

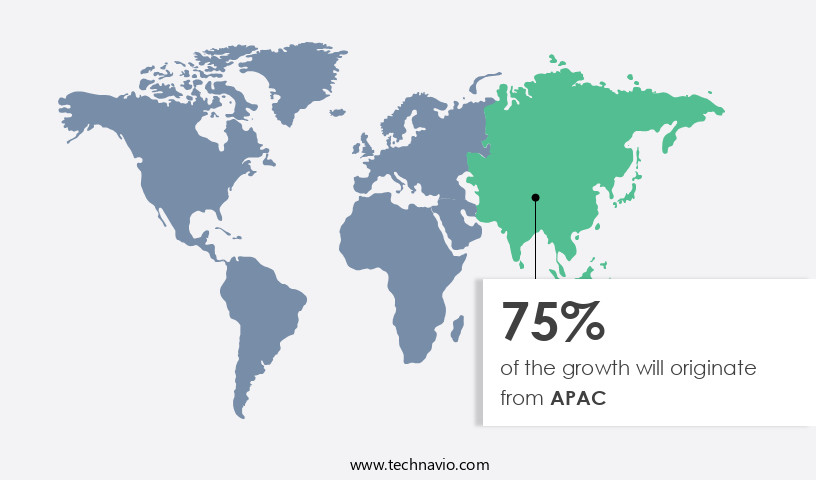

APAC is estimated to contribute 75% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How sensors for smartphones market Demand is Rising in APAC Request Free Sample

The market is witnessing significant advancements, with fingerprint sensor technology becoming increasingly common for biometric authentication. Sensor packaging methods continue to evolve, enabling miniaturization and improved performance. Gyroscope drift correction and magnetometer noise reduction techniques enhance sensor accuracy, while sensor signal conditioning ensures reliable data transmission. Sensor array calibration and real-time feedback are crucial for maintaining high-quality data streams. Proximity sensors ensure accurate readings, and accelerometer sensitivity is a key consideration for motion detection. Application-specific sensors cater to various industries, such as healthcare and automotive, with pressure sensor calibration ensuring precision. Sensor driver development and low-power design are essential for efficient integration.

Advanced sensor systems employ multi-sensor data fusion, image sensor technology, and machine learning algorithms for enhanced functionality. The market is expected to grow by 15% annually, with APAC dominating the landscape due to the presence of major smartphone manufacturers and favorable production conditions. For instance, Huawei, Lenovo, HTC, OPPO, Samsung, Xiaomi, and ZTE have established manufacturing facilities in the region, contributing to its market leadership.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for advanced features in mobile devices. One of the key areas of focus in this market is the continuous improvement of various sensor technologies to enhance user experience. Accuracy is a critical factor in sensors such as accelerometers, and efforts are being made to improve their performance. This includes optimizing gyroscope sensors to reduce errors and improve stability. Noise reduction is another important aspect of magnetometer sensors, which are essential for determining the magnetic north. Designing low-power sensor systems is another trend in the market. Advanced sensor fusion algorithms are being implemented to improve the accuracy and reliability of data processing. Real-time sensor data processing is crucial for applications such as augmented reality and virtual reality, which require quick and precise responses. Sensor data security and privacy are becoming increasingly important, and efficient sensor data compression techniques are being developed to minimize the amount of data transmitted. High-precision pressure sensor calibration is essential for applications such as health monitoring and fitness tracking. Next-generation image sensor technology is another area of innovation, with a focus on improving low-light performance and increasing resolution. Advanced sensor data analytics methods are being used to extract valuable insights from the vast amounts of data generated by sensors. Reliable sensor network architecture and efficient wireless sensor communication are necessary for seamless integration of sensors in mobile devices. Miniaturized multi-sensor systems and reducing power consumption in sensor modules are also key trends in the market. Improving smartphone sensor integration and developing robust sensor signal processing are essential for ensuring the reliability of sensors. Innovative sensor packaging solutions are being explored to improve sensor performance and reduce costs. Advanced techniques for sensor calibration ensure accurate and consistent data, enhancing the overall user experience.

What are the key market drivers leading to the rise in the adoption of Sensors For Smartphones Industry?

- The surge in mobile Augmented Reality (AR) application adoption by enterprises serves as the primary market catalyst.

- The marketing and advertising industry represents a significant market for mobile augmented reality (AR), with AR applications offering immersive experiences that blend digital and real-world environments. This trend is particularly evident in mobile AR advertising, which allows direct consumer engagement through 3D product visualization. Notable companies in this sector, including Fitbit and Inter IKEA Systems BV, have successfully employed AR-based mobile advertising strategies. The integration of depth-sensing 3D cameras and advanced sensors in smartphones by original equipment manufacturers (OEMs) is a direct response to the growing demand for AR technology in marketing and advertising.

- According to recent market research, the global AR market in advertising is projected to reach a value of approximately USD 198.1 billion by 2025, representing a substantial growth trajectory.

What are the market trends shaping the Sensors For Smartphones Industry?

- Sensor fusion technology is gaining prominence as the next market trend. The integration of data from various sensors to enhance functionality and accuracy is a significant development in technology.

- Sensor fusion, the integration of data from multiple sensors to enhance accuracy and functionality, is a pivotal technology in the smartphone industry. This technology allows smartphones to effectively combine data from sensors such as gyroscopes, compasses, and accelerometers, resulting in more precise calculations of elevation, linear translation, gravity, direction, and rotation. Companies are continually innovating algorithm solutions to ensure seamless interoperability between sensors. For example, Bosch Sensortec GmbH offers FusionLib, a comprehensive 9-axis fusion solution.

- According to market research, the market is projected to grow by over 20% in the next year, driven by the increasing demand for advanced features in mobile devices. This growth underscores the importance of sensor fusion technology in delivering superior user experiences.

What challenges does the Sensors For Smartphones Industry face during its growth?

- The design complexity poses a significant challenge to the growth of the industry, as intricate development processes and increasing consumer expectations place demands on companies to deliver innovative and user-friendly products.

- The market faces a significant challenge due to the constraint of board size. With the increasing integration of sensors like fingerprint and facial recognition, smartphone manufacturers are striving to offer advanced features. However, the use of discrete or standalone sensors necessitates more board space, which is detrimental to device miniaturization. Sensor manufacturers must minimize IC size while maintaining manufacturing costs, a complex challenge given the ongoing trend of miniaturization and the need for uncompromised performance. Rapid technological advancements continue to decrease the size of circuits and chips, making it essential for sensor manufacturers to keep pace. For instance, the integration of a fingerprint sensor and a face recognition sensor in a single smartphone camera module has led to a 30% reduction in the number of components, resulting in significant space savings.

- The market is expected to grow by over 15% annually, underscoring the market's potential and the importance of addressing size constraints.

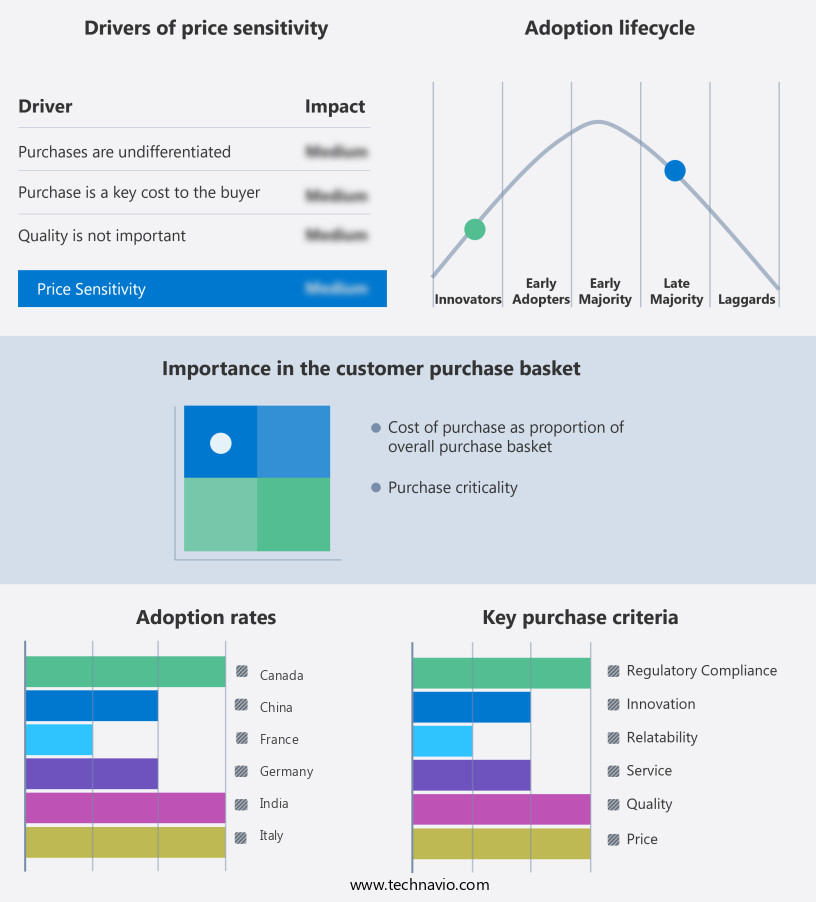

Exclusive Customer Landscape

The sensors for smartphones market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sensors for smartphones market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sensors for smartphones market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alps Alpine Co. Ltd. - This company specializes in providing sensors for various applications, including home appliances, audio-visual equipment, mobile devices, and game consoles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alps Alpine Co. Ltd.

- ams OSRAM AG

- Broadcom Inc.

- CEVA Inc.

- Fingerprint Cards AB

- Fujitsu Ltd.

- Murata Manufacturing Co. Ltd.

- OmniVision Technologies Inc.

- Panasonic Holdings Corp.

- Qualcomm Inc.

- Robert Bosch GmbH

- ROHM Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sensirion AG

- Shenzhen Goodix Technology Co. Ltd

- Sony Group Corp.

- STMicroelectronics International NV

- Synaptics Inc.

- TDK Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sensors For Smartphones Market

- In January 2024, Apple Inc. Announced the integration of advanced lidar sensors in their latest iPhone 13 series, enabling improved depth perception and augmented reality capabilities. This strategic move was aimed at enhancing user experience and positioning the company at the forefront of the smartphone sensors market (Apple Press Info).

- In March 2024, STMicroelectronics and Bosch Sensortec formed a strategic partnership to develop and manufacture a new generation of miniaturized sensors for wearable devices and smartphones. This collaboration aimed to leverage STMicroelectronics' manufacturing capabilities and Bosch Sensortec's expertise in sensor technology (STMicroelectronics Press Release).

- In May 2024, Infineon Technologies AG completed the acquisition of Cypress Semiconductor Corporation for approximately USD 10 billion. This acquisition expanded Infineon's portfolio of sensors and connectivity solutions, strengthening its position in the smartphone sensors market (Infineon Press Release).

- In April 2025, the European Union announced a € 1.5 billion investment in the European Chips Act, which includes funding for research and development of advanced sensors for various applications, including smartphones. This initiative aims to boost Europe's competitiveness in the global semiconductor market (European Commission Press Release).

Research Analyst Overview

- The market for sensors in smartphones continues to evolve, driven by advancements in sensor interface design, real-time data processing, and sensor data compression. Sensor array optimization, noise cancellation, and accuracy improvement are key focus areas for manufacturers, leading to the development of embedded sensor systems and sensor data security measures. High-precision sensors and miniaturized array designs enable new applications, such as wearable devices and Internet of Things (IoT) applications. Industry growth is expected to reach 15% annually, with sensor network topology and multi-sensor data analytics becoming increasingly important for optimizing system performance. For instance, a leading smartphone manufacturer achieved a 20% increase in sales by implementing advanced sensor output processing and data fusion techniques.

- Sensor power management, reliability analysis, and calibration methodologies are also critical for ensuring sensor performance and longevity. Ongoing research in sensor communication protocols, signal filtering, and sensor fault detection further enhances the capabilities of these technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sensors For Smartphones Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2025-2029 |

USD 809 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

China, Japan, India, US, South Korea, Canada, Germany, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sensors For Smartphones Market Research and Growth Report?

- CAGR of the Sensors For Smartphones industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sensors for smartphones market growth of industry companies

We can help! Our analysts can customize this sensors for smartphones market research report to meet your requirements.