Medical Diagnostics Market Size 2025-2029

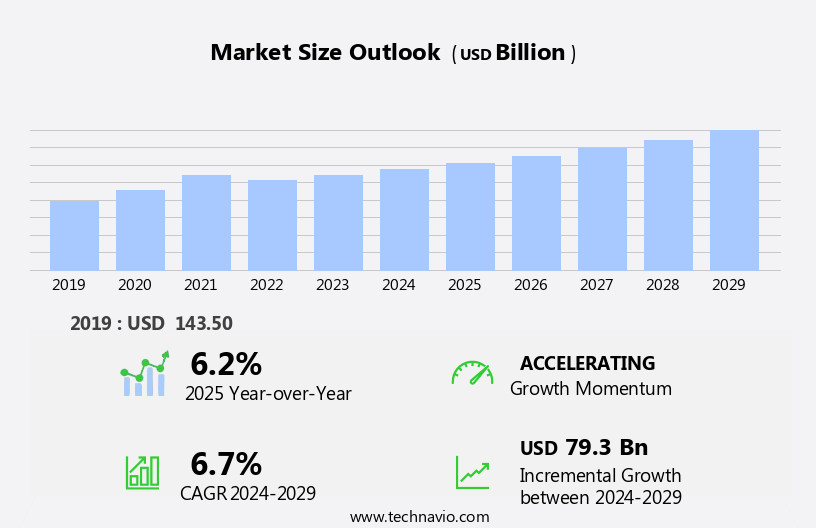

The medical diagnostics market size is forecast to increase by USD 79.3 billion, at a CAGR of 6.7% between 2024 and 2029.

- The market is driven by the high prevalence of infectious diseases and the global adoption of advanced treatment solutions. The increasing incidence of chronic diseases and the growing need for early and accurate diagnosis are key factors fueling market growth. However, the lack of trained laboratory technicians poses a significant challenge to the industry. This shortage can lead to misdiagnosis, delayed diagnosis, or even incorrect diagnosis, which can have serious consequences for patients. To overcome this obstacle, companies can invest in training programs or partner with academic institutions to attract and develop skilled professionals.

- Additionally, the integration of automation and artificial intelligence technologies into diagnostic processes can help mitigate the impact of the labor shortage and improve overall efficiency. Companies that effectively address these challenges while leveraging the latest technological advancements are well-positioned to capitalize on the growing demand for accurate and timely diagnostic services.

What will be the Size of the Medical Diagnostics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing demand for early and accurate detection of various health conditions. The application of data analytics and artificial intelligence (AI) in diagnostics is revolutionizing the industry, enabling predictive diagnostics and improving test accuracy. Urine tests, ELISA tests, and PCR testing are being complemented by in-vitro diagnostics, point-of-care testing, and molecular diagnostics. In-vivo diagnostics and imaging technologies, including digital pathology and medical imaging, are providing valuable insights into the human body. Data security remains a critical concern as diagnostic data is increasingly being stored in the cloud.

Remote diagnostics and wearable sensors enable disease management from a distance, while turnaround time is being reduced through automation and machine learning. Flow cytometry and clinical chemistry are essential tools in the diagnostics toolbox, providing valuable information on cellular and biochemical processes. The market for diagnostic yield is growing as researchers and healthcare providers seek to optimize diagnostic procedures and improve patient outcomes. Infectious disease diagnostics and preventive diagnostics are key areas of focus, with mass spectrometry and genetic testing playing important roles. The ongoing unfolding of market activities reveals a dynamic industry, with continuous innovation and evolving patterns shaping the future of medical diagnostics.

The integration of AI-powered diagnostics, data analytics, and digital technologies is transforming the landscape, offering new opportunities and challenges for stakeholders. The application of these technologies across various sectors, from research institutions to healthcare providers, is driving growth and improving patient care.

How is this Medical Diagnostics Industry segmented?

The medical diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- IVD

- Diagnostic imaging

- Others

- End-user

- Hospitals and clinics

- Diagnostic centers

- Research laboratories and institutes

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

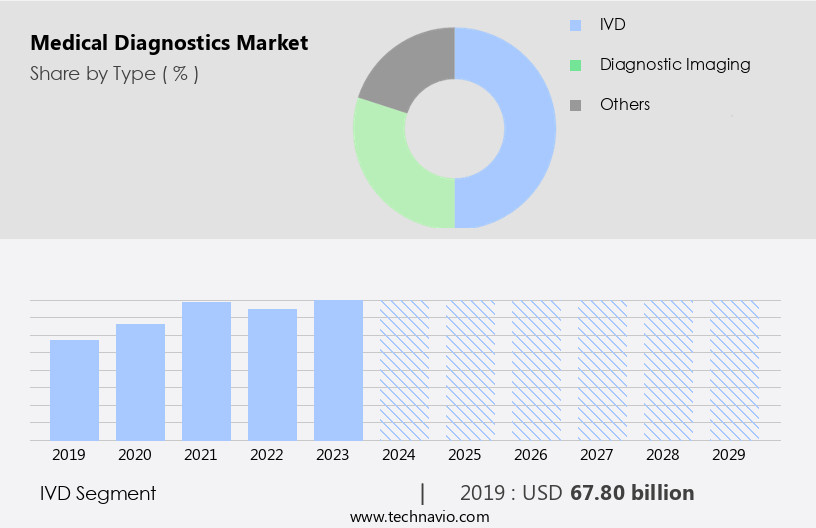

The ivd segment is estimated to witness significant growth during the forecast period.

The In Vitro Diagnostics (IVD) segment is experiencing notable growth in the diagnostics market, surpassing diagnostic imaging and other segments. This expansion is primarily fueled by the increasing significance of molecular, clinical, and immunoassay diagnostic techniques. IVD solutions enable clinicians, researchers, and scientists to identify cellular components for disease diagnosis, providing valuable insights into cell biology. For example, tumor markers, identified through immunohistochemistry (IHC) technology, aid physicians in diagnosing malignancies and determining tumor type, origin, and stage. The demand for IVD tools is escalating due to the growing requirement for advanced real-time diagnostic solutions to facilitate early detection of communicable and chronic diseases.

Additionally, cloud computing, machine learning, and artificial intelligence are transforming the diagnostics landscape by improving test accuracy and turnaround time. Predictive diagnostics, digital pathology, and personalized medicine are also gaining traction, with liquid biopsy, point-of-care testing, and wearable sensors playing crucial roles. Data security and quality control remain essential considerations in this evolving market. Diagnostics software, imaging technologies, ELISA tests, PCR testing, flow cytometry, clinical chemistry, in-vivo diagnostics, and mass spectrometry are integral components of the IVD segment. Infectious disease diagnostics and preventive diagnostics are also gaining momentum, contributing to the overall growth of the market.

The IVD segment was valued at USD 67.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

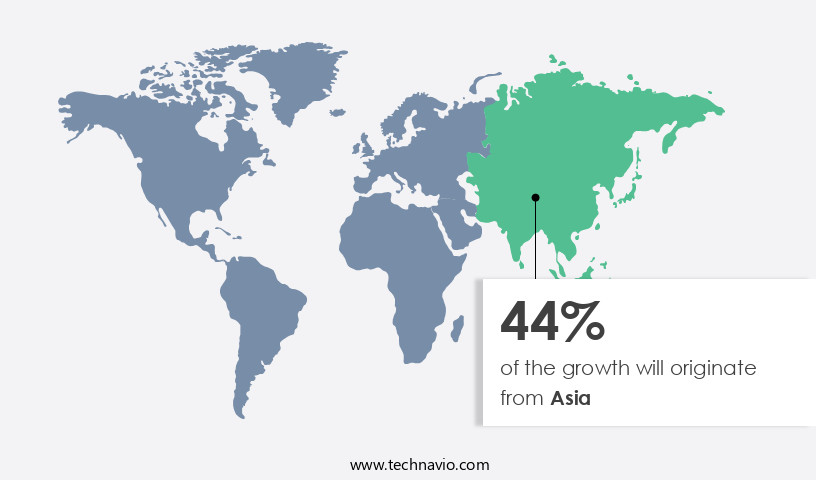

Asia is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market holds a significant share due to factors such as increased insurance coverage, rising research and development expenditure, a large geriatric population with chronic diseases, and high healthcare spending. In the US, immunodiagnostics dominate the market, driven by the demand for reagents and instruments for accurate disease diagnosis. The use of POC tests for early disease detection is on the rise, with healthcare providers emphasizing their importance in improving patient outcomes and reducing healthcare costs. Artificial intelligence and machine learning are transforming diagnostics, enabling predictive and personalized medicine. AI-powered diagnostics and molecular testing, including ELISA, PCR, and mass spectrometry, are increasingly being adopted for their high accuracy and efficiency.

Digital pathology, remote diagnostics, and cloud computing are also gaining traction, enabling faster turnaround times and improved diagnostic yield. Quality control and data security are critical concerns in the medical diagnostics industry. In-vitro diagnostics, including clinical chemistry, flow cytometry, and imaging technologies, are subject to stringent regulations to ensure test accuracy and reliability. Rapid diagnostics, such as urine tests and wearable sensors, offer convenience and quick results, making them popular for disease management and preventive diagnostics. Infectious disease diagnostics and genetic testing are other key areas of growth, with predictive value playing a significant role in disease management and treatment planning.

Medical imaging, including imaging technologies and in-vivo diagnostics, provide valuable insights into disease progression and response to treatment. The integration of AI and machine learning in medical imaging is expected to revolutionize disease diagnosis and management. In conclusion, the market is evolving rapidly, driven by advancements in technology, increasing demand for early and accurate diagnosis, and a growing focus on personalized and preventive medicine. The integration of AI, machine learning, and data analytics is transforming diagnostics, enabling faster, more accurate, and more cost-effective solutions for healthcare providers and patients.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative the market, advanced technologies continue to revolutionize disease detection and diagnosis. From lab-on-a-chip devices to artificial intelligence algorithms, this sector is at the forefront of healthcare innovation. Point-of-care testing solutions enable rapid diagnosis, reducing the need for hospital visits and expediting treatment. Molecular diagnostics, such as polymerase chain reaction (PCR) and next-generation sequencing, offer precise genetic analysis. Imaging diagnostics, including magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound, provide detailed visual insights into the human body. Portable diagnostic devices, telemedicine, and remote monitoring further expand accessibility and convenience. Biomarker discovery and personalized medicine strategies are driving new diagnostic applications. This market's growth is fueled by an aging population, increasing prevalence of chronic diseases, and a heightened focus on early and accurate diagnosis.

What are the key market drivers leading to the rise in the adoption of Medical Diagnostics Industry?

- The high prevalence of infectious diseases serves as the primary market driver, as the ongoing need to develop effective treatments and preventative measures persists.

- The market is experiencing significant growth due to the increasing prevalence of various infectious diseases, such as influenza A, malaria, dengue, HIV, and the ongoing COVID-19 pandemic. These diseases necessitate early and accurate detection for effective treatment and disease control. Diagnostic tests for viral infections like Hepatitis B, Hepatitis C, HIV, Herpes, and COVID-19 are essential for proper diagnosis and management of these conditions. The resurgence of these infections in both developed and developing nations has put immense pressure on healthcare systems to adopt advanced diagnostic strategies. Moreover, global mobility, urbanization, and climate change are contributing factors to the spread of infectious diseases.

- In response, the market is witnessing the adoption of data analytics, AI-powered diagnostics, predictive diagnostics, and diagnostics software. Cloud computing technology is also playing a crucial role in enhancing the accessibility and affordability of diagnostics services. These technological advancements aim to improve test accuracy and efficiency, making diagnostics more accessible to a larger population.

What are the market trends shaping the Medical Diagnostics Industry?

- Advanced treatment solutions are increasingly being adopted globally, marking a significant market trend. This trend reflects the growing demand for effective and innovative healthcare technologies.

- In-vitro diagnostics, including immunoassay and molecular diagnostic devices, are experiencing significant growth in the healthcare sector for managing and testing various conditions such as cancer, cardiovascular diseases, and infectious kidney diseases. The availability of advanced treatment options is driving the adoption of these diagnostic tools among healthcare providers. For instance, Siemens' Xprecia Stride Coagulation Analyzer is a handheld device that offers high accuracy in performing Prothrombin Time International Normalized Ratio (PT/INR) tests. While routine diagnostic testing currently dominates the market, the growth of specialty testing in esoteric, pathology, and genetic areas is expected to surpass it in the forecasted year.

- In response to this trend, laboratories are increasingly opting for bulk purchases from trusted partners instead of buying individual analyzers. Rapid diagnostics, digital pathology, and imaging technologies are also gaining popularity due to their ability to provide quick and accurate results. ELISA tests and PCR testing are commonly used for infectious diseases, while medical imaging technologies offer insights into various health conditions. Quality control measures are crucial in ensuring the accuracy and reliability of these diagnostic tests. The integration of digital technologies and personalized medicine is further revolutionizing the diagnostics market, enabling customized treatment plans based on individual patient needs.

What challenges does the Medical Diagnostics Industry face during its growth?

- The insufficient workforce of adequately trained laboratory technicians poses a significant obstacle to the expansion and growth of the industry.

- The in-vitro diagnostics market encompasses various tests, including clinical chemistry, immunoassays, and molecular diagnosis, which demand skilled laboratory technicians for accurate execution. However, the industry faces a shortage of trained professionals due to several reasons. The immigration of experienced technicians from developing countries to developed regions is one factor. Moreover, the absence of standardized curricula and training programs for handling these complex diagnostic tools is another issue. Furthermore, the requirement of lengthy and costly theoretical studies to acquire the necessary qualifications adds to the problem. This shortage of trained personnel can impact diagnostic yield and increase turnaround time.

- Advanced technologies like liquid biopsy, point-of-care testing, flow cytometry, and in-vivo diagnostics can enhance the diagnostic process, but their effective implementation relies on the expertise of skilled technicians. Data security is another critical concern in the diagnostics market, with the increasing use of digital platforms for remote diagnostics. Ensuring secure data transmission and storage is essential to maintain patient confidentiality and trust.

Exclusive Customer Landscape

The medical diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing advanced medical diagnostic solutions, encompassing Alinity systems, ID NOW, and RealTime PCR assays. These innovative technologies enable accurate and rapid detection of various health conditions, enhancing laboratory efficiency and patient care. Alinity systems offer high-throughput and versatile diagnostic capabilities, while ID NOW delivers point-of-care testing results in mere minutes. RealTime PCR assays ensure precise molecular diagnosis through amplification and detection of DNA or RNA sequences. By implementing these cutting-edge technologies, the company empowers healthcare professionals to make informed decisions and ultimately improve patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- Beckman Coulter Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- Charles River Laboratories International Inc.

- DiaSorin SpA

- F. Hoffmann La Roche Ltd.

- GE Healthcare Technologies Inc.

- Hologic Inc.

- Medtronic Plc

- QIAGEN N.V.

- Quest Diagnostics Inc.

- QuidelOrtho Corp.

- Siemens AG

- Solventum Corp.

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Diagnostics Market

- In January 2024, Roche Diagnostics announced the launch of its new cobas hb A1c 2 system, which automates the process of measuring hemoglobin A1c levels for diabetes diagnosis and monitoring (Roche Press Release). This innovation streamlines laboratory workflows and enhances accuracy.

- In March 2024, Illumina and Grail, Inc. Entered into a strategic collaboration to develop, commercialize, and market comprehensive, multi-cancer early detection tests (Illumina Press Release). This partnership combines Illumina's expertise in genomic sequencing with Grail's cancer detection technology.

- In May 2024, Siemens Healthineers closed a â¬1.3 billion financing round, marking one of the largest financing deals in the medical diagnostics industry (Siemens Healthineers Press Release). This significant investment will support the company's growth initiatives, including product development and expansion into emerging markets.

- In April 2025, the US Food and Drug Administration (FDA) granted approval to Abbott Laboratories for its Alinity m System, a versatile, modular chemistry platform for diagnostic testing (Abbott Laboratories Press Release). This approval expands Abbott's diagnostic offerings and enhances its ability to address diverse testing needs.

Research Analyst Overview

- The market encompasses various technologies and approaches, including point-of-care diagnostics, molecular imaging, next-generation sequencing, and therapeutic drug monitoring. Risk stratification plays a crucial role in identifying patient populations for targeted disease screening and intervention. Regulatory approvals are essential for bringing new diagnostics to market, ensuring test accuracy and quality assurance. Health literacy and patient education are vital components of effective diagnostic processes. False positives and negatives can lead to diagnostic uncertainty and potential harm, necessitating rigorous test interpretation and calibration standards. Clinical trials and epidemiological studies contribute valuable data for diagnostics development, while big data and predictive analytics facilitate more accurate and personalized diagnoses.

- Healthcare reimbursement models and medical billing systems significantly impact diagnostic adoption and utilization. Companion diagnostics and therapeutic drug monitoring enhance treatment efficacy and patient safety. Home health care and remote patient monitoring expand diagnostic access and convenience. Public health surveillance and disease screening are critical for population health management. Diagnostic errors, false positives, and false negatives necessitate ongoing efforts to improve diagnostic accuracy and reduce errors. Data standardization and quality assurance are essential for interoperability and effective communication between healthcare providers. Prognostic biomarkers and optical coherence tomography offer promising avenues for early disease detection and improved patient outcomes.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Diagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 79.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, Canada, China, Germany, Japan, UK, France, South Korea, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Diagnostics Market Research and Growth Report?

- CAGR of the Medical Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical diagnostics market growth of industry companies

We can help! Our analysts can customize this medical diagnostics market research report to meet your requirements.