3D Printing Market In Healthcare Industry Size 2024-2028

The 3d printing market in healthcare industry size is forecast to increase by USD 5.74 billion, at a CAGR of 23.31% between 2023 and 2028.

- The 3D printing market in the healthcare industry is experiencing significant growth due to the increasing demand for personalized or customized medical devices. This trend is driven by the potential to produce devices tailored to individual patient needs, leading to improved patient outcomes and enhanced satisfaction. Moreover, technological advances in 3D printing are expanding its applications within the healthcare sector, enabling the production of complex medical devices and implants that were previously difficult or impossible to manufacture using traditional methods. However, the high initial setup cost of 3D printing facilities poses a considerable challenge for market entrants.

- Establishing a 3D printing facility requires substantial investment in equipment, materials, and personnel training. This financial barrier may deter some companies from entering the market, creating an opportunity for established players to consolidate their position. To capitalize on the market's potential and navigate the challenges effectively, companies should focus on cost reduction strategies, such as sharing resources and collaborating with other industry players. Additionally, investing in research and development to expand the range of applications for 3D printing in healthcare and exploring partnerships with healthcare providers can help companies gain a competitive edge.

What will be the Size of the 3D Printing Market In Healthcare Industry during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The 3D printing market in the healthcare industry continues to evolve, driven by advancements in technology and its applications across various sectors. Bioprinting technology, which involves the use of living cells to create complex structures, is a significant area of focus. Surgical guides printing, utilizing material extrusion processes and support structure designs, enables more precise and personalized surgical procedures. Material biocompatibility testing is crucial in ensuring the safety and effectiveness of these advanced medical applications. Rapid prototyping in healthcare facilitates the creation of patient-specific implants, enabling better fit and improved patient outcomes. The integration of 3D printing in bone graft substitutes and tissue engineering scaffolds is revolutionizing the field of regenerative medicine.

Bioreactor systems integration further enhances the potential of these technologies, allowing for the growth and maturation of engineered tissues. Healthcare workflow integration and medical imaging are essential aspects of implementing 3D printing in the healthcare industry. Dental model printing and the creation of 3D printed prosthetics have already shown significant benefits, while the potential for 3D bioprinting organs continues to unfold. The ongoing development of 3D printing resolution and printing speed optimization is crucial in expanding the scope and accessibility of these technologies. The regulatory compliance landscape for medical applications of 3D printing is an evolving challenge.

Stereolithography applications and post-processing techniques are under continuous research and development to meet the stringent requirements of the healthcare industry. The integration of biocompatible resins and biocompatibility testing in the 3D printing process is essential in ensuring the safety and efficacy of these advanced medical applications. In the dynamic world of 3D printing in healthcare, the integration of these technologies in various applications is a continuous process, with ongoing research and development shaping the future of personalized medicine and advanced medical procedures.

How is this 3D Printing In Healthcare Industry Industry segmented?

The 3d printing in healthcare industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Orthopedic and spinal

- Dental

- Hearing aids

- Others

- Technology

- Stereolithography

- Granular materials binding

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The orthopedic and spinal segment is estimated to witness significant growth during the forecast period.

In the healthcare industry, 3D printing technology is revolutionizing the production of personalized medical solutions, including patient-specific implants and surgical guides. Selective laser melting and inkjet 3D bioprinting are leading additive manufacturing techniques in healthcare, enabling the creation of complex structures and biocompatible materials. The layer thickness impact on 3D-printed implants and scaffolds is crucial for ensuring proper integration and functionality. Computer-aided design plays a significant role in the healthcare sector, facilitating the design of patient-specific implants and optimizing the manufacturing process. Regulatory compliance is a critical factor in the adoption of 3D-printed medical devices, with rigorous testing for material biocompatibility and sterilization required.

Bone graft substitutes and tissue engineering scaffolds are among the applications of 3D printing in healthcare, with the potential to improve patient outcomes and reduce surgical time. Bioreactor systems integration and healthcare workflow optimization are further advancements in the field, enabling the production of complex structures and streamlining the manufacturing process. Dental model printing and medical imaging integration are also gaining traction in the healthcare industry, allowing for more accurate and efficient diagnosis and treatment planning. The 3D printing of organs and the development of bioinks and biocompatible resins are promising areas of research, with the potential to revolutionize organ transplantation and regenerative medicine.

Post-processing techniques and scaffold design parameters are essential considerations in the 3D printing of medical devices, ensuring optimal functionality and biocompatibility. Stereolithography applications and the optimization of printing speed are further advancements in the field, enabling the mass production of customized medical devices. In summary, 3D printing is transforming the healthcare industry by enabling the production of patient-specific implants, surgical guides, and complex medical devices. The technology offers numerous advantages, including the ability to create customized structures, accelerate healing, and improve patient outcomes. With ongoing research and advancements in materials and manufacturing processes, the potential applications of 3D printing in healthcare are vast and continually evolving.

The Orthopedic and spinal segment was valued at USD 758.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

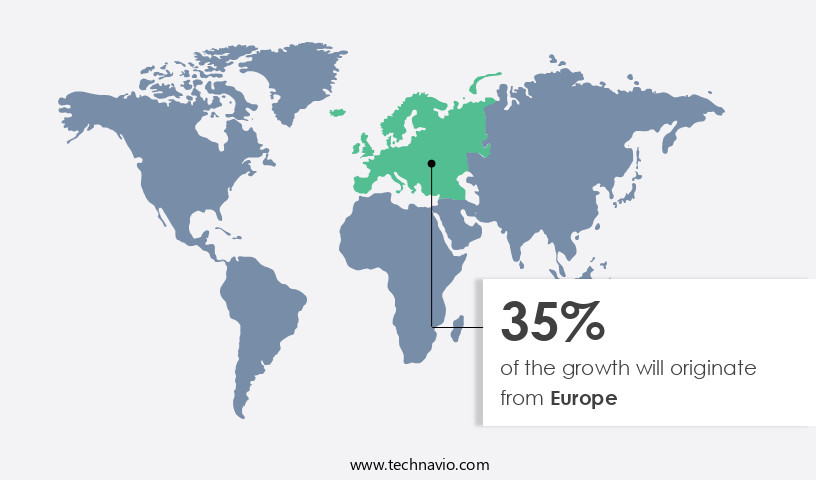

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The 3D printing market in the healthcare industry is experiencing significant growth due to advancements in additive manufacturing technology and its increasing application in various healthcare sectors. Personalized medicine, including patient-specific implants and surgical guides, is a major driver of this market. Selective laser melting and inkjet 3D bioprinting are emerging technologies that hold promise for creating tissue engineering scaffolds, bone graft substitutes, and even 3D-printed organs. Computer-aided design and regulatory compliance are crucial aspects of healthcare applications, ensuring accurate designs and safe, effective products. The layer thickness impact on the quality of 3D-printed medical devices is a significant consideration, as is the optimization of printing speed and resolution.

Sterilization and biocompatibility testing are essential for ensuring the safety and efficacy of 3D-printed medical devices. The integration of 3D printing into healthcare workflows, including dental model printing and medical imaging, is also accelerating the adoption of this technology. In the field of bioprinting, scaffold design parameters and bioinks, such as biocompatible resins, play a vital role in the success of 3D-printed tissue structures. Post-processing techniques are also essential for improving the final product's quality and functionality. The market's growth is further fueled by the increasing use of 3D printing in healthcare facilities, with established companies contributing significantly to the market's revenue, particularly in North America.

Professional societies, such as the Society for Manufacturing Engineers and the Radiological Society of North America, are advocating for the use of 3D printing technologies in medical applications, further propelling the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the integration of advanced technologies such as personalized implants, tissue engineering scaffolds, and computer-aided design surgical guides. In the realm of implantology, 3D printing enables the creation of biocompatible polymer implants with customized designs, ensuring a perfect fit for patients. The selection process of biocompatible polymers is crucial to ensure the implants do not cause adverse reactions. Tissue engineering scaffolds, another application of 3D printing, offer complex architectures that mimic natural tissue structures, facilitating organ development through 3D bioprinting. Patient-specific orthodontic appliances and 3D printed drug delivery systems are further examples of how additive manufacturing is revolutionizing healthcare. Rapid prototyping of surgical instruments and selective laser melting parameters optimize the manufacturing process for medical devices. Ensuring cell viability during 3D bioprinting and conducting finite element analysis of implants are essential steps to maintain quality and regulatory compliance. 3D printing resolution quality control and material biocompatibility testing protocols are crucial to ensure the final product's safety and effectiveness. Post-processing techniques for medical devices and 3D printing sterilization validation are also critical aspects of the manufacturing process. Design for additive manufacturing in healthcare adheres to market research report standards, focusing on regulatory compliance and continuous innovation. As the market continues to evolve, it is essential to prioritize patient safety, quality, and efficiency in every stage of the manufacturing process.

What are the key market drivers leading to the rise in the adoption of 3D Printing In Healthcare Industry Industry?

- The escalating need for personalized medical devices, driven by increasing consumer preferences for customized healthcare solutions, is a primary market growth factor.

- 3D printing is revolutionizing the healthcare industry by enabling the production of personalized medical devices with unprecedented dimensional accuracy. Additive manufacturing techniques, such as selective laser melting and inkjet 3D bioprinting, allow for the creation of patient-specific implants with intricate shapes and geometric features. These customized implants can replicate the unique anatomy of a patient, leading to improved fit and function. The layer thickness in 3D printing can significantly impact the final product's quality and performance. Computer-aided design (CAD) software is essential in creating precise digital models for 3D printing, ensuring regulatory compliance in the medical field. Patient-specific implants offer numerous advantages over traditional subtractive manufacturing techniques, including the ability to create engineered porous structures, tortuous internal channels, and internal support structures, which are crucial for certain medical applications.

- 3D printing is particularly valuable in the development of prosthetic limbs, where customization is vital for optimal patient outcomes. The potential applications of 3D printing in healthcare are vast, and its use is expected to continue growing as the technology advances and becomes more accessible.

What are the market trends shaping the 3D Printing In Healthcare Industry Industry?

- The application of 3D printing technology in medical devices represents a significant market trend, driven by ongoing technological advances in this field. This innovative approach offers numerous benefits, including customized solutions, reduced production costs, and improved patient outcomes.

- The market is experiencing significant advancements, leading to increased production speed and volume capabilities. This technology offers numerous benefits, including reduced material waste, lower capital equipment expenditure, and decreased reliance on milling centers. Dental devices can be produced with higher precision and efficiency using 3D printing. Research and development efforts are focused on creating new material combinations and enhancing existing ones to broaden the scope of 3D printing applications and lower costs. Bioprinting technology and surgical guides printing are emerging areas of interest, with material extrusion processes and support structure designs undergoing extensive research for material biocompatibility testing and rapid prototyping in medical applications.

- The emphasis on innovation and improvement continues to propel the 3D printing market forward in the healthcare sector.

What challenges does the 3D Printing In Healthcare Industry Industry face during its growth?

- The high initial setup costs associated with establishing 3D printing facilities pose a significant challenge to the industry's growth. This expense, which is a mandatory investment for businesses seeking to enter or expand in the 3D printing sector, can hinder the industry's progression and competitiveness.

- The 3D printing market in the healthcare industry holds significant potential, particularly in the areas of tissue engineering scaffolds and dental model printing. However, high capital costs remain a significant barrier to widespread adoption. The costs are primarily driven by the expensive equipment required for 3D printing, such as high-end additive manufacturing printers, which can range from hundreds of thousands to several millions of dollars. Additionally, the proprietary raw materials sold by printer manufacturers contribute to these costs. End-users must also invest in skilled personnel for training or hiring to ensure the production of high-quality devices.

- Moreover, the integration of 3D printing technology into healthcare workflows and bioreactor systems requires advanced software and expertise. Medical imaging integration is another area where 3D printing can bring about significant improvements, enabling the creation of customized implants and prosthetics. The integration of 3D bioprinting organs is still in its infancy but holds immense potential for the future. To optimize 3D printing resolution and speed, ongoing research focuses on improving printer technology and post-processing techniques. Despite the challenges, the benefits of 3D printing in healthcare, such as reduced costs, increased customization, and improved patient outcomes, make it an attractive investment for healthcare providers and researchers.

Exclusive Customer Landscape

The 3d printing market in healthcare industry forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 3d printing market in healthcare industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 3d printing market in healthcare industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3D Systems Corp. - The SLA 750 3D printer model, a notable innovation, excels in generating concept models, cosmetic prototypes, and intricately geometrical components. Engineered for precision, it caters to industries requiring high-quality, complex parts. This advanced technology streamlines design-to-production processes, enhancing efficiency and innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Systems Corp.

- Allevi Inc.

- Anatomics Pty Ltd.

- Dentsply Sirona Inc.

- Desktop Metal Inc.

- EOS GmbH

- Formlabs Inc.

- General Electric Co.

- Groupe Gorge SA

- INTAMSYS TECHNOLOGY CO. LTD.

- MATERIALISE NV

- Mecuris GmbH

- Organovo Holdings Inc.

- Proto Labs Inc.

- Rapid Shape GmbH

- Renishaw Plc

- Roland DG Corp.

- SLM Solutions Group AG

- Stratasys Ltd.

- Ultimaker BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 3D Printing Market In Healthcare Industry

- In January 2024, Stratasys, a leading 3D printing solutions provider, announced the FDA clearance of its J750 3D Printer for producing functional, anatomically accurate, and color models for the healthcare industry. This approval marked a significant milestone in 3D printing's application in medical research and patient-specific solutions (Stratasys Press Release, 2024).

- In March 2024, GE Healthcare and Formlabs, a digital manufacturing leader, entered into a strategic partnership to integrate Formlabs' 3D printing solutions into GE Healthcare's medical imaging and diagnostic platforms. This collaboration aimed to improve workflow efficiency and enhance patient care through advanced imaging and 3D printing technologies (Formlabs Press Release, 2024).

- In May 2024, 3D Systems, a global leader in additive manufacturing, secured a USD125 million investment from Bain Capital Private Equity to expand its 3D printing capabilities in the healthcare sector, focusing on personalized medical devices and pharmaceutical applications (3D Systems Press Release, 2024).

- In April 2025, the European Commission approved the use of 3D-printed heart valves for transplantation, marking a significant regulatory breakthrough for the healthcare 3D printing industry. This decision paved the way for more personalized, cost-effective, and efficient medical solutions (European Commission Press Release, 2025).

Research Analyst Overview

- The 3D printing market in healthcare is experiencing significant advancements, particularly in the realm of 3D printing materials and their application in various healthcare sectors. Scaffold architecture for tissue regeneration and implant customization are key areas of focus, with mechanical properties testing ensuring the optimal performance of these structures. Patient-specific models derived from imaging modalities integration facilitate improved surgical planning and prosthetic fitting. Bioreactor design and cell seeding techniques enable the development of 3D printed pharmaceuticals and diagnostic tools. Clinical trials data and regulatory guidelines for 3D printing in healthcare are under constant scrutiny, driving the need for quality assurance and workflow optimization.

- Biomaterial characterization plays a crucial role in understanding the mechanical and biological properties of 3D printed structures, while defect detection and training simulation tools enhance process monitoring and improve overall efficiency. Surgical planning software and drug elution profiles contribute to personalized healthcare solutions, further expanding the potential of 3D printing in the industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 3D Printing Market In Healthcare Industry insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.31% |

|

Market growth 2024-2028 |

USD 5739.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.59 |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 3D Printing Market In Healthcare Industry Research and Growth Report?

- CAGR of the 3D Printing In Healthcare Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 3d printing market in healthcare industry growth of industry companies

We can help! Our analysts can customize this 3d printing market in healthcare industry research report to meet your requirements.