Egypt 3PL Market Size and Trends

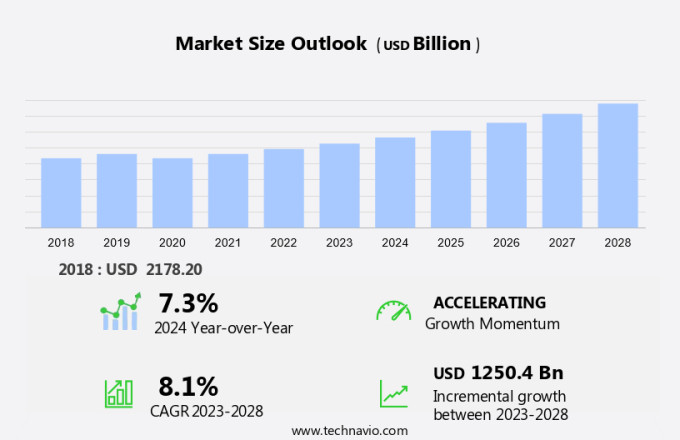

The Egypt 3PL market size is forecast to increase by USD 1,250.4 billion, at a CAGR of 8.1% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The rise in international transportation via roadways and airways has led to an increased demand for efficient logistics solutions. Moreover, government initiatives in transportation and logistics are fostering market expansion. However, high logistics costs remain a challenge for market participants. To address this, there is a growing trend towards implementing smart hospitality solutions and integrating 5G technology to enhance data security and facilitate seamless information sharing. Additionally, the adoption of advanced Facility Management Systems is streamlining operations and reducing costs. These developments are shaping the future of the market, making it an exciting space to watch. From a US perspective, these trends are particularly relevant as the country is a major player in international trade and logistics. By staying informed of these market dynamics, businesses can optimize their supply chain operations and gain a competitive edge.

Third-party logistics (3PL) plays a pivotal role in the success of e-commerce businesses by providing solutions for just-in-time delivery, last-mile delivery, and inventory management. In today's competitive market, businesses require efficient logistics strategies to meet customer expectations and minimize supply chain disruptions. 3PLs offer various services, including warehousing, transportation, freight and forwarding, value-added services, door-to-door delivery, cross-docking, and shipping solutions. These services enable businesses to focus on their core competencies while outsourcing the logistics functions to experts. Effective warehousing and inventory management are essential components of a successful 3PL strategy. 3PLs provide businesses with access to modern warehouses, advanced warehouse management systems, and inventory operations to ensure timely order fulfillment and minimize stockouts. 3PLs offer various transportation modes, such as roadways and airways, to ensure timely and cost-effective delivery of goods. They also provide digital solutions for real-time tracking and visibility of shipments, enabling businesses to make informed decisions and improve customer satisfaction. Some 3PLs offer 4PL services, which involve managing the entire supply chain, from sourcing to delivery. This integrated approach allows businesses to streamline their operations, reduce costs, and improve efficiency.

3PLs enable businesses to implement just-in-time delivery strategies by providing real-time inventory visibility and efficient order fulfillment. This reduces the need for large safety stocks and minimizes carrying costs. Businesses can also consider a hybrid approach, where they manage some logistics functions in-house and outsource others to 3PLs. This approach allows businesses to maintain control over critical functions while leveraging the expertise of 3PLs for non-core logistics functions. In conclusion, 3PLs play a crucial role in enabling e-commerce businesses to provide timely and cost-effective delivery while minimizing inventory carrying costs. By outsourcing logistics functions to experts, businesses can focus on their core competencies and improve their bottom line. Effective logistics strategies, including warehousing, transportation, and inventory management, are essential for businesses to meet customer expectations and stay competitive in the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Service

- Transportation

- Warehousing and distribution

- Others

- End-user

- Manufacturing

- Retail

- Consumer goods

- Healthcare

- Others

- Geography

- Egypt

By Service Insights

The transportation segment is estimated to witness significant growth during the forecast period. In Egypt, the three primary modes of transportation - airways, roadways, and waterways - significantly contribute to the market. Air transportation undergoes continuous improvements to expand cargo capacity and enhance efficiency. Egypt's strategic geographical position, with access to the Mediterranean Sea and the Red Sea, makes the maritime sector a crucial component of the country's transportation business. Maritime transport accounts for over 90% of Egypt's international trade volume.

Get a glance at the market share of various segment Download the PDF Sample

The transportation segment was valued at USD 839.10 billion in 2018. The expansion of key industries, including oil and natural gas, textiles, food processing, and construction, fuels the growth of the marine transport sector. The Suez Canal alone transports approximately 8% of the world's maritime cargo annually. In addition, the implementation of advanced technologies such as 5G, smart hospitality, and facility management systems, as well as data security and information sharing solutions, are transforming the logistics landscape in Egypt. These innovations enable seamless and efficient information exchange between various stakeholders, ensuring timely and accurate decision-making. The integration of these technologies in the market is expected to further boost the growth and competitiveness of the sector.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Egypt 3PL Market Driver

An increase in maritime transportation is notably driving market growth. Egypt's strategic location, bordering the Mediterranean Sea and the Red Sea, positions it as a significant player in the global marine transportation industry. Maritime transport accounts for approximately 90% of Egypt's foreign commerce by volume. The growth of key sectors such as oil and natural gas, textiles, food processing, and construction is contributing to the expansion of this industry. Approximately 8.0% of the world's marine cargo transits through the Suez Canal annually, making Egypt an essential manufacturing hub for exports destined for European markets. With an increasing number of foreign enterprises from countries like India, China, Turkey, and Spain establishing a presence, Egypt's role as a global trading hub continues to strengthen.

Effective retail logistics is crucial for businesses operating in Egypt, requiring strong logistics infrastructure, efficient warehouse management, and reliable shipping services. Cross-border transportation and order fulfillment are essential components of retail logistics, ensuring timely delivery of products to customers. Inventory operations must be streamlined to minimize stockouts and overstocks, reducing costs and enhancing customer satisfaction. As e-commerce continues to gain popularity, the demand for seamless logistics solutions is increasing. Businesses must prioritize these elements to remain competitive in the market. In the US market, retailers and businesses aiming to expand their reach to international markets require efficient logistics solutions. Thus, such factors are driving the growth of the market during the forecast period.

Egypt 3PL Market Trends

Government initiatives in transportation and logistics is the key trend in the market. The third-party logistics (3PL) sector in Egypt has experienced significant growth due to the country's expanding population and increasing e-commerce activities. Cairo, the capital city, faces notoriously heavy traffic congestion, making just-in-time delivery and last-mile delivery challenging. However, Egypt's strategic location between Europe, the Middle East, and Asia presents immense opportunities for logistics and warehousing services. The region's bustling trade activities have fueled the demand for efficient logistics solutions. To alleviate traffic issues and transform Egypt into a global logistics hub, the government has initiated several measures.

These efforts include the promotion of Fourth-Party Logistics (4PL) providers, which act as the primary point of contact between shippers and multiple 3PLs, and the implementation of advanced inventory management systems. These strategies aim to attract foreign investment and foster market expansion during the forecast period. Thus, such trends will shape the growth of the market during the forecast period.

Egypt 3PL Market Challenge

High logistics cost is the major challenge that affects the growth of the market. Egypt's logistics and transportation infrastructure stand out in comparison to its neighboring countries, boasting well-established freight forwarding and supply chain management systems. The transportation network primarily concentrates on Cairo and adheres to the Nile settlement patterns, with inland waterways and an effective rail system contributing significantly to its sustainability. Strategically placed ports play a pivotal role in Egypt's marine transport sector, while domestic flights and ongoing improvements to the air infrastructure are poised to amplify cargo capacity and efficiency. Road transport, which carries over half of the country's freight, is meticulously maintained. However, despite Egypt's advanced logistics and transportation capabilities, the country faces relatively high logistics costs. To optimize these expenses, businesses can leverage shipping solutions and delivery services that cater to their unique requirements.

By implementing efficient supply chain management strategies, businesses can minimize transportation costs and enhance overall operational efficiency. In addition, product warehousing and inventory management can help companies reduce storage costs and ensure timely delivery of goods. Ultimately, by adopting a comprehensive approach to logistics and transportation, businesses in Egypt can overcome the challenges associated with high logistics expenses and thrive in the competitive marketplace. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aramex International LLC - The company offers a wide range of innovative transportation and logistics technologies to support customer business needs in import and export.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DB Schenker

- DCM Logistics

- DHL Express Ltd.

- DP World

- DSV AS

- Eastern Logistics

- El Nada Co.

- Expeditors International of Washington Inc.

- FedEx Corp.

- Intex Express

- Kuehne Nagel Management AG

- United Parcel Service Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Third-party logistics (3PL) refers to the outsourcing of logistics operations to specialized companies. In today's business landscape, 3PL plays a crucial role in enabling businesses, particularly those in the e-commerce sector, to deliver products to customers efficiently and effectively. 3PL providers offer a range of services, including just-in-time delivery, last-mile delivery, freight and forwarding, warehousing, and transportation management. The integration of digital solutions, such as cloud ERP and 5G technology, has revolutionized the logistics industry. These technologies enable real-time data sharing and improved inventory management, leading to better supply chain visibility and more efficient operations. 4PL, or fourth-party logistics, takes this a step further by integrating multiple logistics service providers to create a more complex and comprehensive logistics network.

Logistics strategy is a critical aspect of any business, and 3PL providers offer value-added services such as order fulfillment, shipping solutions, and delivery solutions to help businesses optimize their logistics operations. Cross-docking, cross-border transportation, and value-added warehousing are some of the services that help businesses reduce inventory costs and improve delivery times. Logistics infrastructure, including roadways, airways, railways, seaways, and shipping services, plays a vital role in the efficient movement of goods. Effective inventory operations, shipping services, and order fulfillment are essential for businesses to meet customer demands and stay competitive in the market. Logistics infrastructure disruptions, such as supply chain disruptions, can have a significant impact on businesses, highlighting the importance of strong logistics strategies and partnerships with reliable logistics service providers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market Growth 2024-2028 |

USD 1,250.4 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aramex International LLC, DB Schenker, DCM Logistics, DHL Express Ltd., DP World, DSV AS, Eastern Logistics, El Nada Co., Expeditors International of Washington Inc., FedEx Corp., Intex Express, Kuehne Nagel Management AG, and United Parcel Service Inc. |

|

Market dynamics |

Parent market analysis, Market Trends, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Egypt

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.