Acaricides Market in Europe Size and Trends

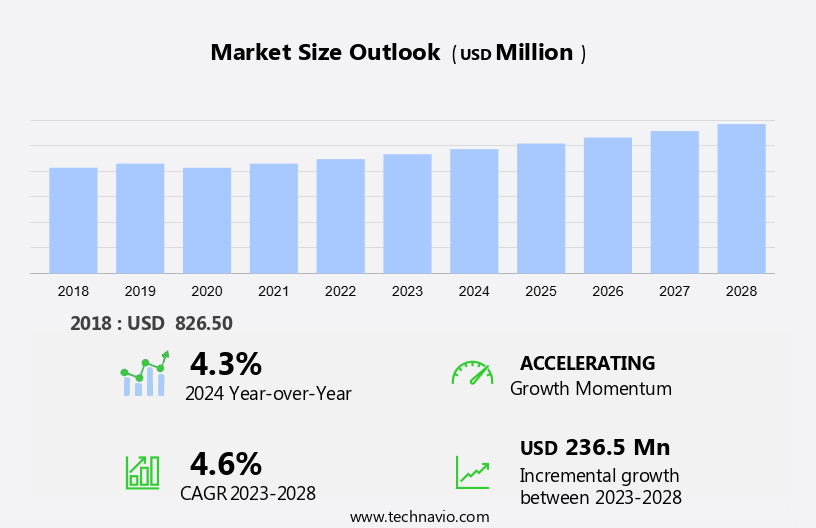

The acaricides market in Europe size is forecast to increase by USD 236.5 million at a CAGR of 4.6% between 2023 and 2028. The acaricides market is experiencing significant growth due to several key drivers. The increasing demand for organic foods and sustainable farming practices is leading to a higher need for effective acaricides that are derived from natural sources. However, the ineffectiveness of traditional acaricides, such as organophosphorus compounds and chlorinated hydrocarbons, and the possibility of pests developing resistance, is a major challenge. To address these issues, there is a growing focus on research and development of new, more effective and eco-friendly acaricides. However, the trend towards more sustainable farming practices and the adoption of alternative pest control methods, such as natural pest management and bio-pesticides, is expected to drive market growth in the coming years. This includes the use of hand dressing and dipping techniques for targeted application, as well as the development of acaricides for managing diseases caused by phytophagous mites. The market is expected to continue growing as farmers seek innovative solutions for insect management in a fresh and sustainable manner. Spraying techniques are also being refined to minimize the impact on the environment and ensure the long-term effectiveness of acaricides.

The carbamate and organophosphate pesticides market plays a significant role in the agricultural sector, providing effective solutions for pest control and ensuring food production sustainability. This market is driven by various factors, including the increasing food demand, the implementation of climate-smart agriculture practices, and the need for sustainable farming methods. Food production is a critical aspect of agricultural economics, and the use of pesticides, including carbamates and organophosphates, is essential to maintain crop yield and protect crops from pests and diseases. Integrated pest management (IPM) strategies have gained popularity in recent years as a sustainable approach to pest control. IPM employs various techniques, such as biological control, cultural practices, and the use of selective pesticides, to minimize the impact on the environment and human health. Carbamate and organophosphate pesticides are effective in controlling a wide range of pests, making them valuable tools in modern agriculture.

However, the use of these pesticides raises concerns regarding their impact on soil health, water conservation, and farm labor. Therefore, there is a growing interest in alternative pest control methods, such as natural insect repellents, beneficial insects, and bio-pesticides. Sustainable agriculture practices, such as organic farming methods, have gained traction in recent years as a response to food security challenges and the need for agricultural sustainability. Organic farming relies on natural fertilizers and pest control methods, reducing the reliance on synthetic pesticides like carbamates and organophosphates. However, the adoption of organic farming practices faces challenges, including higher production costs and lower crop yields compared to conventional farming methods. The agricultural policy landscape is evolving, with a growing emphasis on sustainable farming practices and the reduction of farm subsidies that encourage the use of synthetic pesticides.

In conclusion, this shift towards more sustainable farming practices is expected to drive the demand for alternative pest control methods, such as natural pest management and the use of beneficial insects. Furthermore, precision agriculture, which employs technology to optimize farm management and reduce the use of inputs, including pesticides, is gaining popularity. This technology allows farmers to target specific areas of their fields with pesticides, reducing the overall amount used and minimizing the impact on the environment and farm labor. In conclusion, the carbamate and organophosphate pesticides market will continue to play a crucial role in the agricultural sector, providing effective pest control solutions. The agricultural sector must continue to innovate and adapt to meet the challenges of food demand, environmental sustainability, and labor concerns while ensuring food security and rural development.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

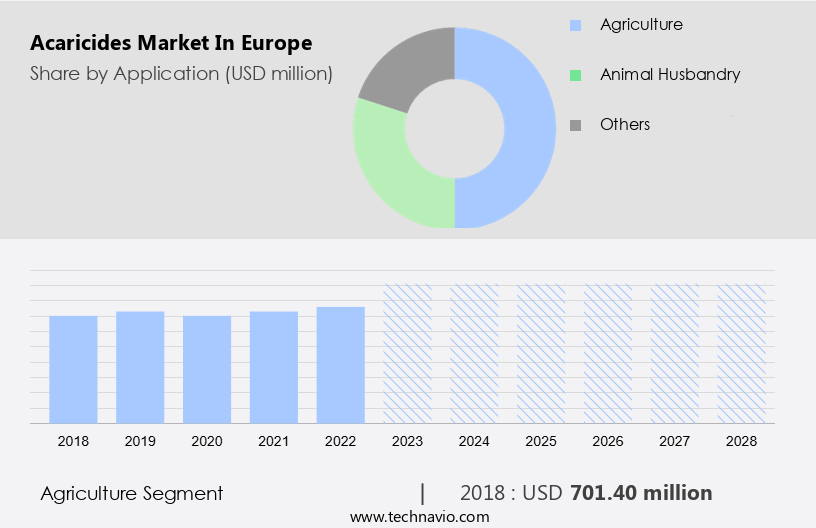

- Application

- Agriculture

- Animal husbandry

- Others

- Geography

- Europe

- Germany

- France

- Spain

- Europe

By Application Insights

The agriculture segment is estimated to witness significant growth during the forecast period. In the agricultural sector, acaricides, also known as miticides, serve a crucial role in managing pests, particularly phytophagous mites, which cause significant damage to crops and ornamental plants. These mites feed on plant cells, leading to economic losses. In addition to protecting crops, acaricides are essential for cattle ranchers to prevent tick infestations among livestock. Ticks carry diseases such as theileriosis, heartwater, anaplasmosis, and babesiosis, which are harmful to animals and can spread quickly. To prevent disease transmission, it's vital to eliminate ticks before they feed on susceptible animals. Organic farming practices have led to an increased focus on sustainable developments in acaricides use. As a result, there is ongoing research and development to create organic acaricides, reducing the reliance on chlorinated hydrocarbons and organophosphorus compounds.

Get a glance at the market share of various segments Download the PDF Sample

The agriculture segment was valued at USD 701.4 million in 2018. These traditional acaricides have been linked to health concerns and environmental issues. Acaricides are applied through various methods, including dipping and hand dressing. Fresh produce may be sprayed with acaricides to protect against pests during transportation and storage. Proper application and adherence to guidelines are essential to minimize potential health risks to consumers. In summary, acaricides play a vital role in protecting agricultural crops and livestock from pests and diseases. With a growing emphasis on sustainable practices, research and development efforts are underway to create organic alternatives to traditional acaricides. Proper application and adherence to guidelines are crucial to ensure the safety and effectiveness of acaricides.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Acaricides Market in Europe Driver

The increasing need for bio-based acaricides is notably driving market growth. Bio-based acaricides are gaining popularity in the market due to growing concerns for animal health and the promotion of sustainable agriculture practices. For instance, ESTEN 80, a bio-acaricide produced by TENSAC (AR), is derived from vegetable oil and sugar. This South American company's product is biodegradable and has a favorable safety profile, making it an attractive option in Europe, where organic farming is on the rise. The lengthy process of producing chemical pesticides, which takes approximately 10-12 years and costs around USD300 million, is a significant factor driving the demand for alternative solutions.

In the context of veterinary medicine, bio-acaricides play a crucial role in preventing the spread of diseases such as African swine fever and Lyme disease among animals. Moreover, adhering to organic norms and environmental regulations is essential for maintaining crop output and product quality. Bio-acaricides made from minerals are an effective and eco-friendly alternative to synthetic pesticides, contributing to food security while minimizing toxicity and environmental effects. Thus, such factors are driving the growth of the market during the forecast period.

Acaricides Market in Europe Trends

Increasing demand for natural products is the key trend in the market. Acarids, or mites and ticks, pose significant challenges to sustainable agriculture and the agricultural sector, affecting arable land, crops, and human health. These parasites can carry diseases that impact not only agricultural crops but also dairy products and urban populations. Traditional crop protection strategies, which often rely on pesticides, have led to the destruction of natural adversaries of formerly harmless species and the development of resistance in many acarid parasites. Currently, the agricultural industry primarily relies on pharmaceuticals to manage acarid-borne diseases in plants, animals, and people.

However, the shortage of effective drugs can limit the control of some parasitic diseases, allowing them to become more dangerous and widespread. In light of population growth and climate change, it is crucial to explore alternative, sustainable methods for acarid control. Plant derivatives and other natural solutions have shown promise in mitigating acarid infestations. By investing in research and development, the agricultural sector can create a more diverse and resilient approach to crop protection. This will not only benefit farmers and food producers but also contribute to the overall health and well-being of the population. Thus, such trends will shape the growth of the market during the forecast period.

Acaricides Market in Europe Challenge

The ineffectiveness of acaricides and the possibility of resistance is the major challenge that affects the growth of the market. Acaricides, a crucial class of pesticides used to control mites in horticulture and agriculture, have faced increasing challenges due to the development of resistance in mites. This resistance can stem from acquired traits or improper usage, such as incorrect dosages or untimely applications. When farmers apply insufficient doses, resistance can accelerate, leading to health risks for humans and animals, as well as the destruction of sensitive individual mites. In turn, resilient mites survive and propagate, resulting in the emergence of new generations of acaricide-resistant mites. The use of bio-based acaricides derived from organic sources has gained traction as a potential solution to mitigate resistance and reduce the impact on the environment.

Moreover, registration and implementation of these eco-friendly alternatives require careful consideration, as they may involve the use of microbes or systemic treatments that can affect crops and plants differently. Farmers must adhere to strict guidelines to ensure effective application and minimize pesticide residues. Proper application and adherence to guidelines are essential to maintain the health of crops, plants, and the overall ecosystem, while also mitigating the risk of irritation from acaricide sprays. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE - The company offers acaricides that provide chemicals, solvents, amines, resins, glues, electronic-grade chemicals, industrial gases, basic petrochemicals, inorganic chemicals, and crop protection, under the brand name BASF SE.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Bayer AG

- Corteva Inc.

- Dow Inc.

- FMC Corp.

- Hockley House

- Lanxess AG

- Merck and Co. Inc.

- Nichino Europe Co. Ltd.

- Nissan Chemical Corp.

- Nufarm Ltd.

- Syngenta Crop Protection AG

- UPL Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The global acaricides market is a significant component of the crop protection industry, playing a crucial role in safeguarding agricultural crops from various pests, including mites, ticks, and other ectoparasites. The agricultural sector, driven by population growth and urbanization, demands sustainable agriculture practices to ensure food security and maintain the quality of fresh produce. Acaricides, derived from plant derivatives such as terpenoids in clove and neem, or synthetic compounds like carbamates and organophosphorus, offer effective solutions for pest management. Climate change poses an additional challenge, necessitating research and development of bio-based and sustainable pest management strategies. Integrated pest management, a holistic approach, combines the use of acaricides with other methods like hand dressing, dipping, and spraying, to minimize environmental health risks and toxicity.

Also, acaricides find applications in various agricultural crops, including cereals, pulses, oilseeds, vegetables, and horticulture. In addition, they are used in livestock management to protect animals from illnesses like African swine fever and lyme disease. Regulations and organic norms govern the registration and use of acaricidal products to ensure safety and minimize environmental effects. Insect management remains a critical application area, with acaricides targeting pests like phytophagous mites and lice. The market also caters to the needs of the dairy industry, where acaricides are used to protect crops that feed dairy animals. The use of acaricides in pest management is essential to maintain crop output, improve quality, and adhere to food safety regulations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 236.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BASF SE, Bayer AG, Corteva Inc., Dow Inc., FMC Corp., Hockley House, Lanxess AG, Merck and Co. Inc., Nichino Europe Co. Ltd., Nissan Chemical Corp., Nufarm Ltd., Syngenta Crop Protection AG, and UPL Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, market trends, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch