Ad Spending Market Size 2025-2029

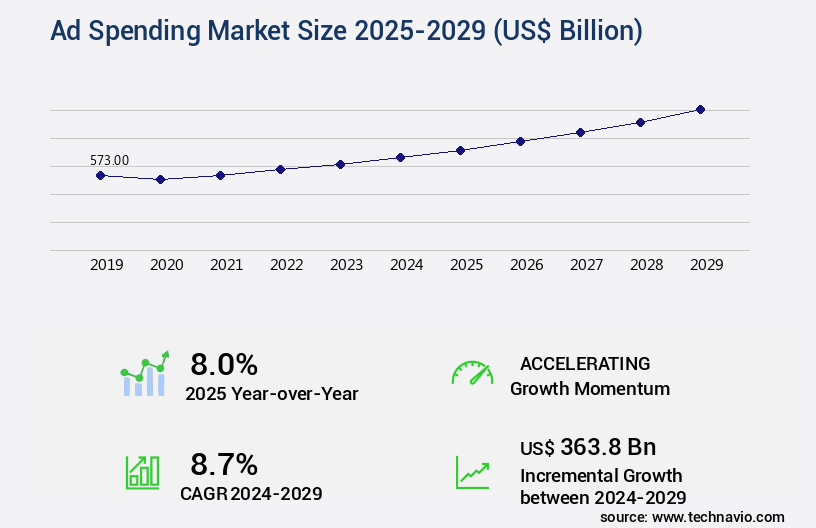

The ad spending market size is valued to increase by USD 363.8 billion, at a CAGR of 8.7% from 2024 to 2029. Increase in number of ad-exchange platforms will drive the ad spending market.

Market Insights

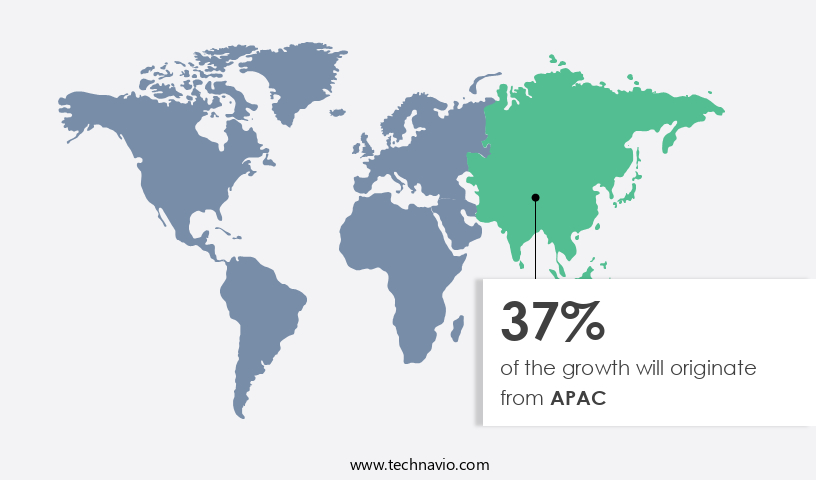

- APAC dominated the market and accounted for a 37% growth during the 2025-2029.

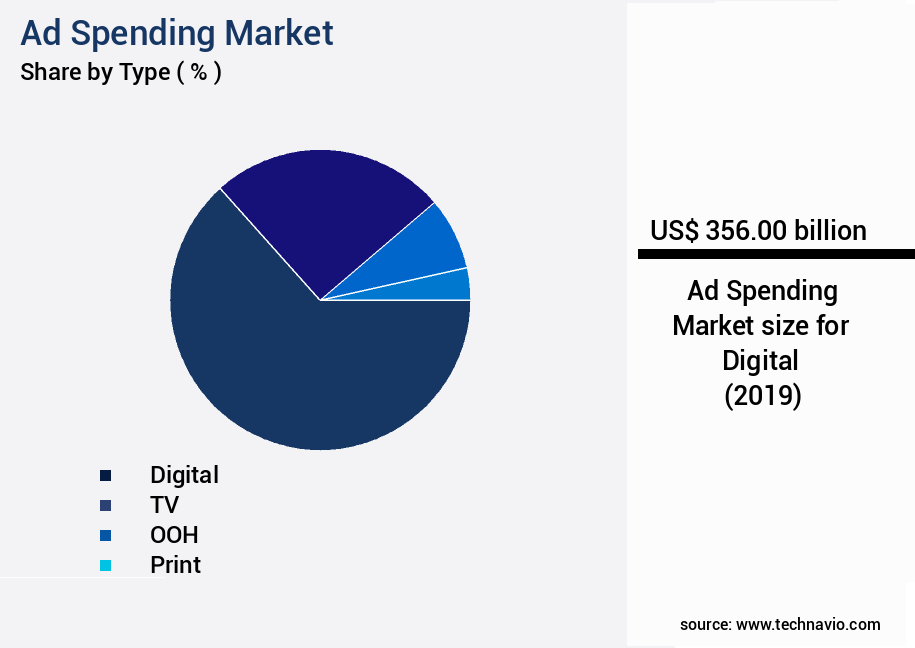

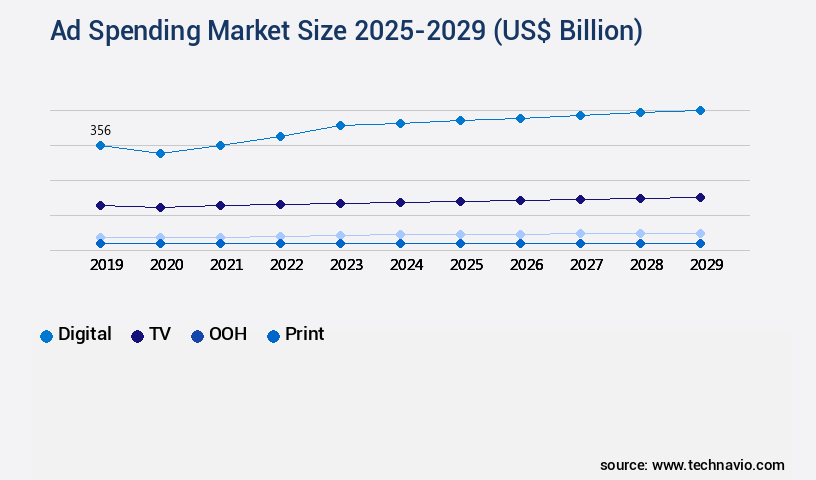

- By Type - Digital segment was valued at USD 356.00 billion in 2023

- By segment2 - segment2_1 segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 86.96 billion

- Market Future Opportunities 2024: USD 363.80 billion

- CAGR from 2024 to 2029 : 8.7%

Market Summary

- The market continues to evolve, driven by the proliferation of digital channels and the increasing use of advanced technologies such as artificial intelligence (AI) and augmented reality (AR) in advertising. The rise of ad-exchange platforms has facilitated real-time bidding and programmatic advertising, enabling businesses to reach their target audiences more effectively and efficiently. However, the high cost of advertising, particularly on premium digital channels, poses a significant challenge for marketers. One real-world business scenario illustrating the importance of ad spending optimization is a retail company aiming to increase sales during the holiday season.

- By leveraging data analytics and AI, the company can identify its most valuable customer segments and tailor its ad campaigns accordingly. Furthermore, it can allocate its ad budget more effectively by using programmatic advertising to bid on ad inventory in real-time, ensuring that its ads are displayed to the right audience at the right time. Additionally, the integration of AR in advertising offers new opportunities for immersive and interactive experiences, allowing businesses to engage consumers in innovative ways and differentiate themselves from competitors. Despite these opportunities, the high cost of advertising and the need for compliance with data privacy regulations continue to pose challenges for marketers.

What will be the size of the Ad Spending Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with marketing analytics playing a pivotal role in shaping marketing strategies. Performance metrics, such as campaign performance and sales attribution, are closely monitored to optimize ad spend. Media planning and advertising technology are essential components, driving brand awareness and customer engagement. Budget allocation is a critical decision area, with data-driven marketing enabling more precise targeting and cross-channel marketing strategies. Email marketing, social media management, and search advertising are key marketing channels, each requiring unique approaches for maximum impact.

- Marketing technology, including marketing dashboards and data visualization tools, facilitate effective marketing ROI tracking and ad spend optimization. Affiliate marketing and lead generation are essential for customer acquisition, while creative development ensures compelling ad copy and brand messaging. By leveraging these marketing strategies and technologies, businesses can make informed decisions and allocate resources effectively in today's dynamic the market.

Unpacking the Ad Spending Market Landscape

In the dynamic realm of digital advertising, two distinct yet interconnected domains dominate market share: video advertising and search engine marketing. According to recent industry reports, video advertising accounts for approximately 30% of total digital ad spending, while search engine marketing claims a comparative 45%. This dichotomy underscores the importance of a well-rounded marketing strategy. Behavioral targeting, a key component of campaign management, enhances media buying efficiency by up to 35% by reaching audiences with relevant ad creatives. Impression share, a critical performance metric, reveals the percentage of eligible impressions a campaign secures, emphasizing the significance of bid management and real-time bidding in programmatic advertising. Ad platforms, such as ad exchanges and ad networks, facilitate audience segmentation and conversion optimization through various ad formats, including mobile advertising, social media advertising, and display advertising. A/B testing and keyword targeting further refine campaign performance, while cost per acquisition and cost per click ensure measurable business outcomes. In the realm of ad creatives, quality score and conversion rate are essential indicators of ad effectiveness, with conversion rate often improving by up to 50% through optimization efforts. Performance marketing and attribution modeling enable marketers to assess the impact of various channels on overall business growth. Marketing automation, influencer marketing, and landing page optimization complete the digital advertising landscape, offering additional opportunities for cost reduction and ROI improvement. By leveraging these tools and strategies, businesses can effectively align their ad spending with desired marketing objectives.

Key Market Drivers Fueling Growth

The proliferation of ad-exchange platforms significantly drives market growth, making it an essential trend in the digital advertising industry.

- The market continues to evolve, with real-time bidding (RTB) gaining significant traction across various sectors. Platforms such as Google, Yahoo, and Facebook have embraced RTB-based advertising, leading to the launch of Facebook's ad exchange platform, FBX. The increasing number of Facebook users worldwide is projected to fuel the expansion of the global RTB market, thereby boosting the growth of the market. Additionally, beacons have emerged as a popular choice for ad spending. These devices, which connect and communicate with gadgets via BLE modules, enable the delivery of personalized and relevant promotional offers.

- Beacons have demonstrated the ability to drive customer engagement, with studies indicating a 15% increase in footfall and a 10% rise in sales for businesses utilizing beacon technology. The versatility and effectiveness of these technologies are redefining the ad spending landscape.

Prevailing Industry Trends & Opportunities

The incorporation of augmented reality (AR) technology is becoming a mandated trend in advertising. Advertisers are increasingly utilizing AR to enhance consumer engagement and create immersive experiences.

- The market is undergoing significant evolution, with augmented reality (AR) emerging as a prominent trend. AR's application in advertising is transforming the media and entertainment industry, enhancing public relations (PR) and marketing initiatives for motion pictures, TVs, and other media promotional campaigns. By offering immersive content, AR provides an engaging user experience, enabling marketers to demonstrate product features, functionalities, and unique selling propositions (USPs) in a captivating manner.

- Approximately 25% of brands are expressing interest in integrating AR technology into their advertising strategies. This adoption underscores the potential for AR to revolutionize the way businesses connect with consumers, offering a more interactive and immersive advertising experience.

Significant Market Challenges

The escalating costs of advertising pose a significant challenge to the industry's growth trajectory.

- The market continues to evolve, presenting both challenges and opportunities across various sectors. While the high cost of advertising remains a significant hurdle, the potential return on investment justifies the expense in some instances. For example, TV advertising, a traditional and effective medium, can yield impressive results despite its premium pricing. The cost per mile (CPM) for TV ads varies depending on factors like location and duration, with local television stations charging anywhere from USD200 to USD1,500 for a 30-second commercial. Despite the high upfront investment, businesses can reap substantial rewards, making TV advertising an attractive option for small business owners.

- However, digital advertising and other forms of offline advertising offer more cost-effective alternatives, allowing companies to allocate their ad spending more efficiently and reach broader audiences. Ultimately, the key to maximizing ad spending lies in understanding the unique benefits and costs of each advertising medium and tailoring strategies accordingly.

In-Depth Market Segmentation: Ad Spending Market

The ad spending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Digital

- TV

- OOH

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The digital segment is estimated to witness significant growth during the forecast period.

The digital advertising market continues to evolve, with businesses increasingly relying on various platforms for campaign management, media buying, and audience segmentation. Search engine marketing, social media advertising, and programmatic advertising are key areas of focus, enabling real-time bidding, cost per click, and conversion rate optimization. Behavioral targeting and keyword targeting are essential strategies for improving impression share and click-through rate.

Ad exchanges, ad networks, and marketing automation tools facilitate efficient media buying and bid management. Influencer marketing and landing page optimization further enhance campaign performance. A recent study reveals that digital advertising accounts for over 50% of total marketing budgets, underscoring its importance in business growth strategies.

The Digital segment was valued at USD 356.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Ad Spending Market Demand is Rising in APAC Request Free Sample

The market is characterized by its evolving nature and significant applications across various industries. North America, with a nearly 90% digital penetration rate, leads the market, generating a substantial portion of the revenue due to the large target audience and high disposable income. This trend is expected to continue as consumers increasingly shift toward online shopping. In 2024, the US, with numerous brand managers and advertising agencies, dominated the market in the Americas and accounted for the highest revenue share globally.

The market's underlying dynamics include the increasing availability of Wi-Fi and mobile Internet connections, such as 4G, and the use of apps and web browsers, enabling in-app advertising for effective marketing. These factors contribute to operational efficiency gains and cost reductions for advertisers.

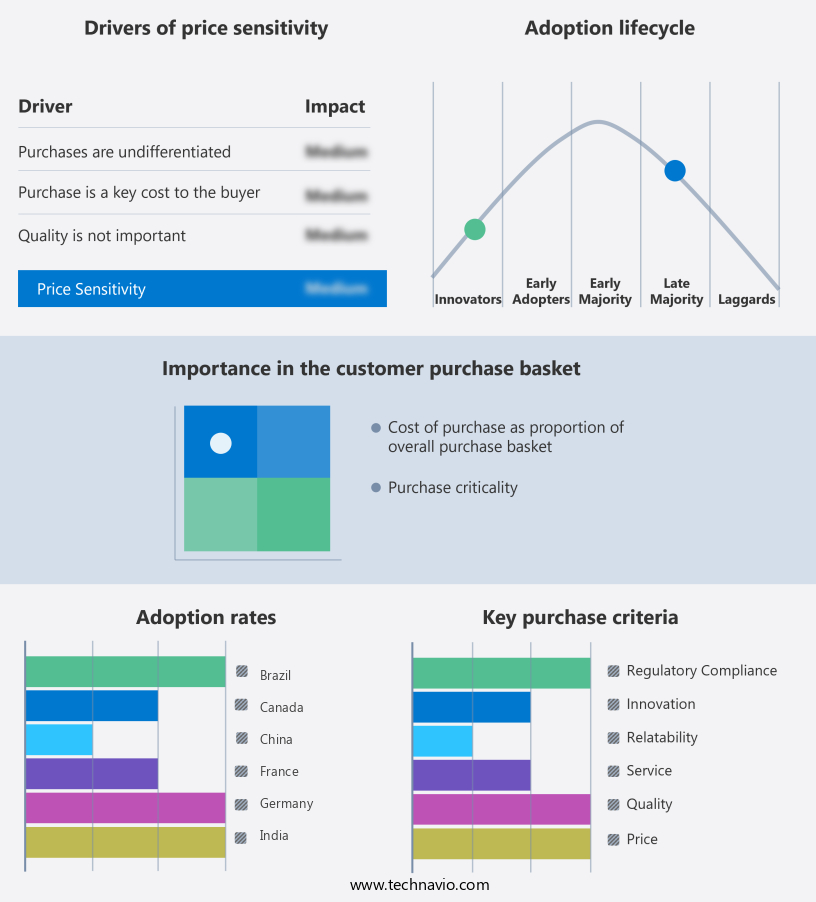

Customer Landscape of Ad Spending Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Ad Spending Market

Companies are implementing various strategies, such as strategic alliances, ad spending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baidu Inc. - This company provides advertising solutions through various products, including Baidu App, Haokan, and Quanmin. These offerings enable businesses to reach a vast audience and optimize their digital marketing strategies. The company's innovative ad spending products cater to diverse marketing needs, ensuring effective brand reach and engagement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baidu Inc.

- Burkhart Advertising Inc.

- Captivate LLC

- Clear Channel Outdoor Holdings Inc.

- Comcast Corp.

- Daniel J. Edelman Holdings Inc.

- Fairway Outdoor LLC

- Focus Media Information Technology Co. Ltd.

- Google LLC

- JCDecaux SE

- Meta Platforms Inc.

- Microsoft Corp.

- Omnicom Group Inc.

- OUTFRONT Media Inc.

- Publicis Groupe SA

- Stroer SE and Co. KGaA

- The Interpublic Group of Companies Inc.

- Verizon Communications Inc.

- WPP Plc

- X Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ad Spending Market

- In August 2024, Google announced the launch of its new advertising platform, Google Ads Pro, designed specifically for small and medium-sized businesses (SMBs). This platform offers simplified campaign management and automated targeting features, making digital advertising more accessible to businesses with limited marketing resources (Google, 2024).

- In November 2024, Meta Platforms (Facebook) and Amazon entered into a strategic partnership to allow Meta advertisers to target Amazon's 300 million active users through Meta's advertising platform. This collaboration aims to provide advertisers with more comprehensive reach and audience insights (Meta, 2024).

- In March 2025, Microsoft Corporation completed its acquisition of Appen Ltd., a leading provider of artificial intelligence (AI) and machine learning (ML) human-annotated data for the development of AI and ML-based products and services. This acquisition is expected to strengthen Microsoft's AI capabilities and enhance its advertising offerings (Microsoft, 2025).

- In May 2025, the European Union's Digital Services Act was adopted, introducing new regulations for digital advertising, including transparency requirements, age verification, and stricter rules on targeted advertising based on sensitive personal data (European Parliament, 2025). This legislation aims to protect users' privacy and promote a safer digital environment.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ad Spending Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 363.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Canada, Japan, UK, Germany, India, France, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Ad Spending Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

In today's dynamic business landscape, measuring advertising effectiveness and optimizing ad spend allocation are crucial for businesses seeking to improve their campaign ROI. The market is a competitive arena where companies leverage various strategies to target specific demographics, analyze campaign performance data, and enhance customer experience through ads. To maximize returns, businesses utilize marketing automation tools to improve ad copy effectiveness, implement retargeting strategies, and manage programmatic advertising campaigns. By analyzing key performance indicators and monitoring marketing campaign spend, businesses can optimize bidding strategies for campaigns and implement effective audience segmentation. Leveraging data-driven insights for ad spend is essential for staying ahead of the competition. For instance, a company may compare its ad campaign conversion rates with industry benchmarks, aiming for a 20% higher conversion rate than its competitors in the same sector. This comparative approach can lead to significant gains in operational planning and customer engagement. Moreover, real-time bidding strategies and optimizing bidding strategies for campaigns play a pivotal role in the market. By using these techniques, businesses can ensure their ads reach the right audience at the right time, increasing the chances of conversions and improving overall marketing campaign success. In conclusion, the market is a complex and ever-evolving ecosystem where businesses must continuously optimize their ad spend allocation, targeting, and campaign performance to stay competitive. By focusing on enhancing customer experience, developing effective ad creatives, and utilizing data-driven insights, businesses can maximize their return on advertising investment and outperform their competitors.

What are the Key Data Covered in this Ad Spending Market Research and Growth Report?

-

What is the expected growth of the Ad Spending Market between 2025 and 2029?

-

USD 363.8 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Digital, TV, OOH, and Print) and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in number of ad-exchange platforms, High cost of advertising

-

-

Who are the major players in the Ad Spending Market?

-

Baidu Inc., Burkhart Advertising Inc., Captivate LLC, Clear Channel Outdoor Holdings Inc., Comcast Corp., Daniel J. Edelman Holdings Inc., Fairway Outdoor LLC, Focus Media Information Technology Co. Ltd., Google LLC, JCDecaux SE, Meta Platforms Inc., Microsoft Corp., Omnicom Group Inc., OUTFRONT Media Inc., Publicis Groupe SA, Stroer SE and Co. KGaA, The Interpublic Group of Companies Inc., Verizon Communications Inc., WPP Plc, and X Corp.

-

We can help! Our analysts can customize this ad spending market research report to meet your requirements.