Aerosol Refrigerants Market Size 2024-2028

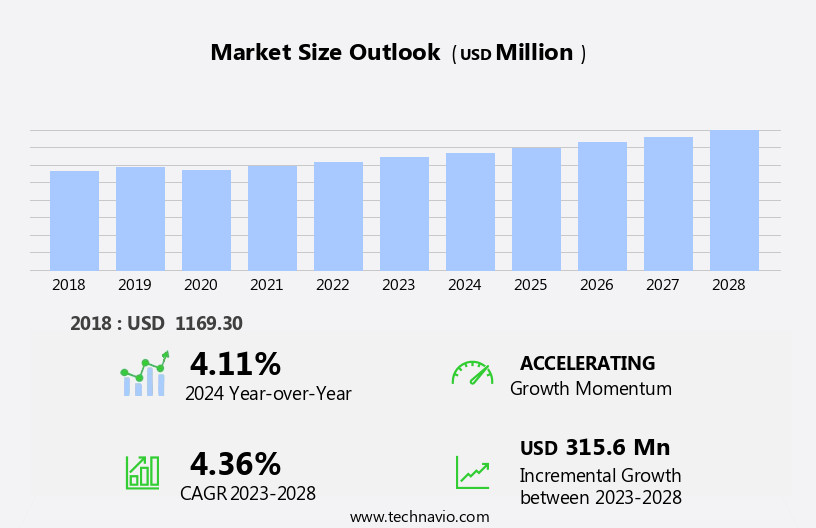

The aerosol refrigerants market size is forecast to increase by USD 315.6 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for refrigeration and air conditioning systems in both residential and commercial applications. This trend is driven by population growth, urbanization, and rising disposable income levels in various regions. However, the market is not without challenges. One of the primary drivers of growth is the replacement of high-Global Warming Potential (GWP) refrigerants with low-GWP alternatives, in line with regulatory initiatives aimed at reducing greenhouse gas emissions. This shift presents both opportunities and challenges for market participants, as the production and adoption of low-GWP refrigerants require significant investments in research and development, manufacturing, and distribution.

- Another factor impacting the market is the volatility of raw material prices, particularly hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), which are key components of aerosol refrigerants. Price fluctuations can significantly affect the profitability of manufacturers and impact the overall market dynamics. To capitalize on market opportunities and navigate these challenges effectively, companies must stay abreast of regulatory developments, invest in research and development, and build strategic partnerships and collaborations to mitigate the risks associated with raw material price volatility.

What will be the Size of the Aerosol Refrigerants Market during the forecast period?

- The aerosol refrigerant market encompasses various aspects, including refrigerant recycling and recovery, product development, and innovation. These processes aim to reduce environmental impact and enhance safety assurance throughout the aerosol product lifecycle. Refrigerant leak detection is crucial for maintaining customer profiles and ensuring regulatory compliance. Aerosol application development focuses on sustainability and technology advancement, while performance testing and quality assurance are essential for customer loyalty. Non-flammable refrigerants are increasingly used for refrigerant charging and manufacturing efficiency, while flammable refrigerants necessitate stringent safety regulations. Aerosol industry associations and regulatory landscape play a significant role in shaping the market's innovation strategy and competitive advantage.

- Moreover, aerosol labeling requirements, refrigerant management, and container design contribute to market differentiation. Sustainability and safety are key priorities in the aerosol industry, with companies focusing on reducing their environmental footprint and ensuring regulatory compliance. Aerosol innovation continues to drive growth in this market, with ongoing advancements in refrigerant technology and product customization.

How is this Aerosol Refrigerants Industry segmented?

The aerosol refrigerants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Others

- Product

- Aluminum

- Steel

- Geography

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- Japan

- South America

- Rest of World (ROW)

- North America

By End-user Insights

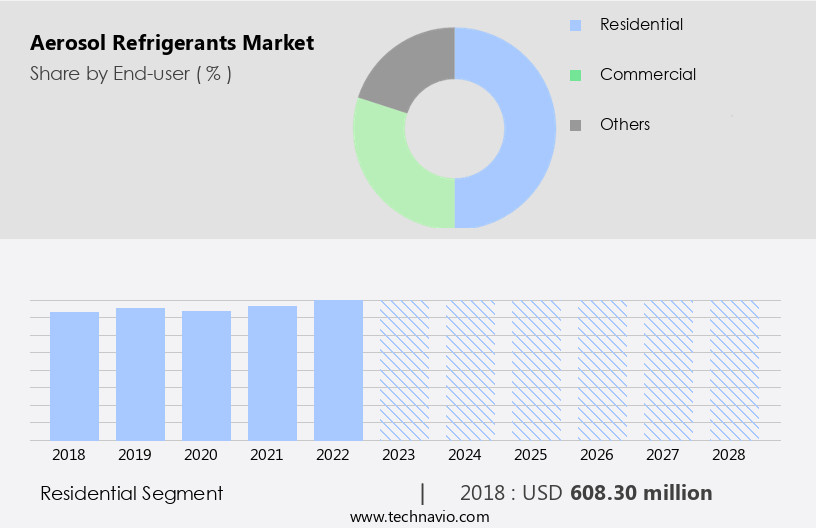

The residential segment is estimated to witness significant growth during the forecast period.

The aerosol refrigerant market is experiencing significant growth due to the increasing demand for air conditioning systems and other cooling appliances in both residential and commercial sectors. The rise in smart city projects and construction activities is driving this trend, as consumers seek to improve indoor environments for healthier and more comfortable living conditions. Aerosol refrigerants, which are essential components of these cooling systems, are therefore in high demand. The development of low-global warming potential (GWP) and ozone depletion potential (ODP) refrigerant blends is a key area of research and development in the market. These environmentally friendly refrigerants are increasingly being adopted to reduce carbon footprint and comply with regulatory requirements.

Quality control is a critical factor in ensuring the safety and performance of aerosol refrigerants, and stringent safety protocols are being implemented to address concerns around potential hazards. In addition to air conditioning, aerosol refrigerants have applications in various industries, including personal care, food and beverage, and renewable energy. Aerosol valves, cans, and dispensers are integral components of these applications, and advancements in technology are leading to improved energy efficiency and environmental impact assessment. Brand awareness and product differentiation are also important factors in the aerosol refrigerant market. Companies are investing in research and development to create technologically advanced refrigerant mixtures and formulations that offer superior performance and longer can life.

Supply chain management and emission reduction are also key areas of focus, as companies seek to optimize their operations and reduce their carbon footprint. Regulatory compliance and consumer behavior are also shaping the market dynamics. Regulations around the use of refrigerants with high GWP and ODP are driving the adoption of alternative refrigerants, while consumer preferences for eco-friendly and sustainable products are increasing demand for environmentally friendly refrigerants. Aerosol safety and stability are also critical considerations, as companies seek to ensure the safety and reliability of their products. In conclusion, the aerosol refrigerant market is experiencing significant growth due to the increasing demand for cooling appliances in both residential and commercial sectors.

The development of technologically advanced, environmentally friendly refrigerants and the focus on regulatory compliance and consumer preferences are key drivers of market trends. Companies are investing in research and development to create superior performing, sustainable refrigerant solutions that meet the evolving needs of consumers and regulatory requirements.

Get a glance at the market report of share of various segments Request Free Sample

The Residential segment was valued at USD 608.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

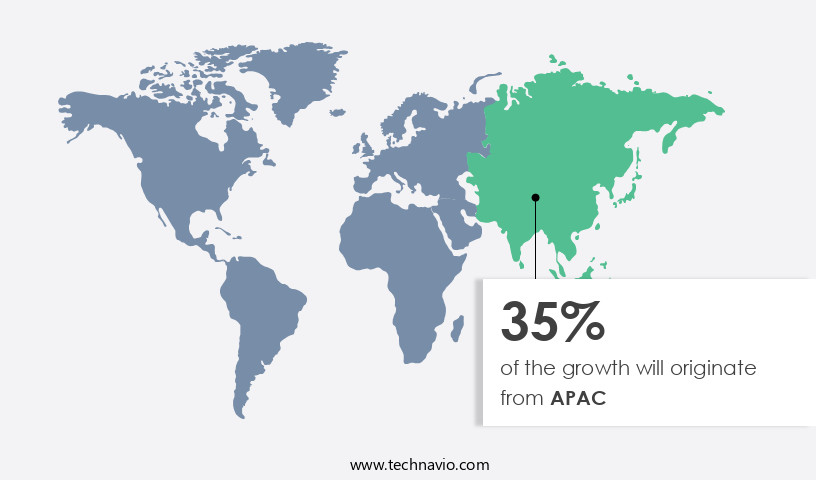

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market experiences significant growth due to the increasing demand for commercial refrigeration in various industries, particularly in food and beverage. Europe, with Germany and the UK leading the way, is a major contributor to this market. Fluorinated gases (F-gases), a family of synthetic refrigerants, are gaining popularity as they do not deplete the ozone layer and offer energy efficiency. These gases are subject to stringent regulations due to their high global warming potential and ozone depletion potential. As a result, research and development efforts are focused on producing low-global warming potential (GWP) refrigerants and improving quality control.

In the aerosol industry, companies are turning to renewable energy sources and environmentally friendly refrigerants to reduce their carbon footprint and enhance brand awareness. Regulatory compliance and consumer behavior are key factors influencing market trends. Aerosol manufacturers are investing in technology development to improve aerosol performance, stability, and safety protocols. Additionally, alternative refrigerants and refrigerant mixtures are being explored to reduce greenhouse gas emissions and meet the evolving needs of various applications, including air conditioning, personal care, home care, and aerosol dispensers. The aerosol industry's focus on emission reduction and environmental impact assessment is driving growth in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aerosol Refrigerants Industry?

- Increasing demand for refrigerators, chillers, and air conditioners is the key driver of the market.

- The market has witnessed significant growth due to various factors. The introduction of energy efficiency labels like ENERGY STAR has heightened consumer awareness towards the costs, energy consumption, and benefits of appliances. End-users increasingly prefer refrigerators, chillers, and air conditioners with non-ozone-depleting refrigerants and glass shelves. The rising number of dual-income families in urban areas and high purchasing power fuels the demand for home appliances. To meet efficiency standards, manufacturers have expanded refrigerator sizes by 20% and introduced user-friendly technological advances, such as through-the-door ice and water dispensers.

- In recent years, the demand for high-capacity frost-free refrigerators has risen, with manufacturers targeting the high-income group and offering premium products. Side-by-side refrigerators, with their increased storage space compared to conventional refrigerators, are gaining popularity among the upper-middle class.

What are the market trends shaping the Aerosol Refrigerants Industry?

- Replacement of high-GWP refrigerants with low-GWP alternatives is the upcoming market trend.

- Aerosol refrigerants have long been utilized due to their favorable flammability and toxicity characteristics. However, these conventional options come with high Ozone Depletion Potential (ODP) and Global Warming Potential (GWP). The environmental impact of refrigerants is gaining increasing attention, leading to a rising demand for sustainable refrigeration and air conditioning solutions. Authorities worldwide are mandating the development of refrigerants that offer satisfactory cooling performance with zero ODP and lower GWP. For instance, the European Union's f-gas regulations aim to reduce the use of HFCs with higher GWP.

- The transition to sustainable refrigerants, however, poses challenges. Most zero-ODP, low-GWP alternatives exhibit undesirable characteristics, such as higher flammability, toxicity, or lower volumetric capacity than HFC refrigerants. Balancing environmental sustainability with cooling performance and safety remains a significant challenge for manufacturers. As regulatory pressure mounts, innovation in refrigerant technology is crucial to meet these demands while ensuring energy efficiency and safety.

What challenges does the Aerosol Refrigerants Industry face during its growth?

- Raw material price fluctuations is a key challenge affecting the industry growth.

- The market is influenced by the availability and price fluctuations of raw materials, primarily crude oil and natural gas. These resources are essential for producing key ingredients, such as chlorofluorocarbons and hydrocarbons, used in aerosol refrigerants. The Middle East, as the leading oil supplier, plays a significant role in market dynamics. Supply-demand imbalances and geopolitical instability in this region can result in volatile crude oil prices, directly impacting the pricing of aerosol refrigerants.

- Consequently, market growth experiences fluctuations, making it essential for businesses to stay informed about raw material trends and prices.

Exclusive Customer Landscape

The aerosol refrigerants market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aerosol refrigerants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aerosol refrigerants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A Gas International Ltd. - The company specializes in providing aerosol refrigerants, encompassing HFC and low GWP options. These refrigerants contribute to sustainable cooling solutions, aligning with industry advancements towards reduced greenhouse gas emissions. Our product portfolio caters to diverse applications, ensuring energy efficiency and environmental stewardship.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A Gas International Ltd.

- Airosol Co. Inc.

- Akzo Nobel NV

- Arkema Group.

- Baltic Refrigeration Group

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- E.F. International BVBA

- First Continental International

- Gujarat Fluorochemicals Ltd.

- Harp International Ltd.

- Honeywell International Inc.

- Linde Plc

- National Refrigerants Ltd.

- Navin Fluorine International Ltd.

- Orbia Advance Corp. S.A.B. de C.V.

- Sinochem Group Co. Ltd.

- SRF Ltd.

- The Chemours Co.

- Zhejiang Fotech International Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The aerosol refrigerant market is witnessing significant developments as industry participants focus on research and development to introduce low-global warming potential (GWP) and zero ozone depletion potential (ODP) refrigerant blends. These blends are gaining popularity due to their environmental benefits, as they contribute less to greenhouse gas emissions and do not deplete the ozone layer. Quality control is a crucial aspect of the aerosol refrigerant market, with manufacturers implementing stringent measures to ensure the safety and performance of their products. Life cycle assessment and carbon footprint reduction are key areas of focus, as companies strive to meet regulatory requirements and enhance their competitive advantage.

The use of renewable energy in the production and manufacturing of aerosol refrigerants is gaining momentum, as industry players seek to reduce their environmental impact. Aerosol safety is another critical area, with manufacturers implementing safety protocols to ensure the safe handling and disposal of aerosol cans and their contents. The personal care and home care sectors are major consumers of aerosol refrigerants, with their applications ranging from hair sprays and deodorants to air fresheners and cleaning products. Aerosol regulations play a significant role in shaping the market dynamics, with governments and regulatory bodies setting standards for product safety, performance, and environmental impact.

Technology development is a key growth driver in the aerosol refrigerant market, with advancements in aerosol valves, actuators, and can sealing technologies driving innovation and improving product performance. Product differentiation is another important factor, with companies investing in research and development to create unique formulations and offerings that cater to evolving consumer preferences. The food and beverage sector is another significant consumer of aerosol refrigerants, with applications ranging from whipped cream dispensers to canned beverages. Aerosol stability is a critical factor in this sector, with manufacturers ensuring that their products maintain their quality and consistency throughout their shelf life.

Energy efficiency is a major consideration in the aerosol refrigerant market, with manufacturers focusing on reducing the energy consumption of their production processes and improving the energy efficiency of their aerosol cans. Aerosol filling technologies are also being developed to optimize the use of refrigerants and reduce waste. Brand awareness and consumer behavior are key factors influencing the market dynamics, with companies investing in marketing and advertising to build brand recognition and loyalty. Regulatory compliance is another critical area, with manufacturers ensuring that their products meet the latest regulations and standards. Alternative refrigerants are gaining popularity in the aerosol refrigerant market, with companies exploring natural and biodegradable options to reduce their environmental impact.

The use of these refrigerants is expected to increase as governments and regulatory bodies continue to push for more sustainable and eco-friendly solutions. In conclusion, the aerosol refrigerant market is a dynamic and evolving industry, with a focus on research and development, environmental sustainability, and regulatory compliance. The market is driven by a range of factors, including consumer preferences, technological advancements, and regulatory requirements. The use of low-GWP and zero-ODP refrigerant blends, renewable energy, and alternative refrigerants are key trends shaping the market's future direction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 315.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aerosol Refrigerants Market Research and Growth Report?

- CAGR of the Aerosol Refrigerants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aerosol refrigerants market growth of industry companies

We can help! Our analysts can customize this aerosol refrigerants market research report to meet your requirements.