Artificial Intelligence (AI) In Games Market Size 2025-2029

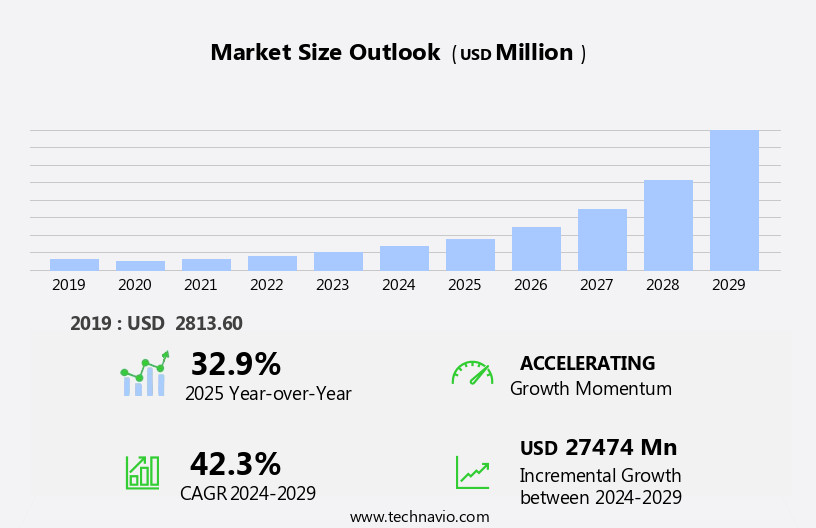

The artificial intelligence (ai) in games market size is forecast to increase by USD 27.47 billion, at a CAGR of 42.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of Augmented Reality (AR) and Virtual Reality (VR) games. These immersive technologies are revolutionizing the gaming industry by providing more realistic and interactive experiences, thereby fueling the demand for advanced AI capabilities. AI algorithms enable more intelligent and responsive non-player characters, dynamic game environments, and personalized user experiences. However, the market faces challenges, primarily due to the latency issues in between games. As AI-driven games become more complex and data-intensive, ensuring seamless and low-latency interactions between players and the game environment becomes crucial. Addressing these latency issues will require continuous advancements in AI technologies, network infrastructure, and cloud gaming solutions.

- Companies seeking to capitalize on the market opportunities must focus on developing AI solutions that deliver high-performance, low-latency experiences while ensuring data security and privacy. Effective collaboration between game developers, technology providers, and network infrastructure companies will be essential to address these challenges and drive the growth of the AI in Games market.

What will be the Size of the Artificial Intelligence (AI) In Games Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, integrating advanced technologies such as e-sports integration, player behavior analysis, game analytics, game engine optimization, computer vision, UI, QA, game balance, game AI, character AI, social features, gameplay mechanics, cloud gaming, game physics engines, in-app purchases, game localization, multiplayer networking, performance benchmarking, streaming integration, pathfinding algorithms, procedural generation, UX, subscription models, competitive gaming, machine learning models, neural networks, advertising integration, and audio design. These technologies are not static entities but rather dynamic components that unfold and intertwine, shaping the market's intricate landscape. E-sports integration and player behavior analysis enable game developers to create more engaging experiences, while game analytics offers valuable insights into player preferences and trends.

Game engine optimization and computer vision enhance game performance and visual quality, respectively. UI and QA ensure seamless user experiences and bug-free gameplay, respectively. Game balance and character AI add depth and complexity to game mechanics. Machine learning models and neural networks facilitate intelligent decision-making, while social features and gameplay mechanics foster community engagement. Cloud gaming and streaming integration expand accessibility, and game physics engines and in-app purchases generate revenue. Game localization and multiplayer networking cater to diverse player bases, and performance benchmarking ensures optimal game performance. The ongoing interplay of these technologies shapes the market's dynamics, with new applications and innovations continually emerging.

How is this Artificial Intelligence (AI) In Games Industry segmented?

The artificial intelligence (ai) in games industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- AI enabled platforms

- AI enabled games

- Technology

- Machine learning

- Natural language processing

- Computer vision

- Robotics

- Game

- Action

- Adventure

- Casual

- Racing

- Simulation

- Sports

- Strategy

- Application

- Gameplay Optimization

- Character Behavior Generation

- Level Design

- Player Engagement

- End-User

- Developers

- Publishers

- Players

- Platform Type

- Console

- PC

- Mobile

- Cloud

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

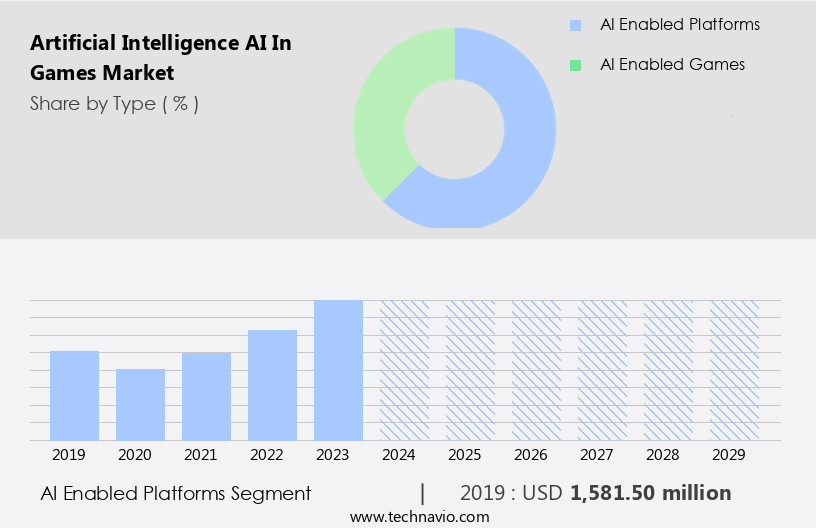

The ai enabled platforms segment is estimated to witness significant growth during the forecast period.

In the dynamic gaming industry, Artificial Intelligence (AI) is revolutionizing game development and player experience. AI technologies, including deep learning, reinforcement learning, and machine learning models, are integrated into various aspects of game creation. These tools enhance level design by optimizing game engine performance and facilitating procedural generation. AI aids in bug reporting through automated issue detection and resolution. Game development tools employ AI for 3D modeling, enabling faster and more accurate character and environment creation. AI-driven game testing identifies and rectifies bugs, ensuring a high-quality gaming experience. Community management is streamlined through AI-powered chatbots and sentiment analysis.

Monetization strategies are improved through player behavior analysis, which informs targeted in-app purchases and subscription models. Decision trees and neural networks are employed for competitive gaming and e-sports integration, enhancing the player experience. Game engine optimization and physics engines benefit from AI, ensuring smooth gameplay mechanics and realistic player interactions. AI also powers game AI, character AI, and game balance, creating more intelligent and responsive opponents. Social features and user experience (UX) are elevated through AI-driven recommendations and personalized content. Cloud gaming, streaming integration, and performance benchmarking are facilitated by AI, enabling seamless gaming experiences. In the realm of game development, AI is a transformative force, driving innovation and enhancing player experiences.

The AI enabled platforms segment was valued at USD 1.58 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

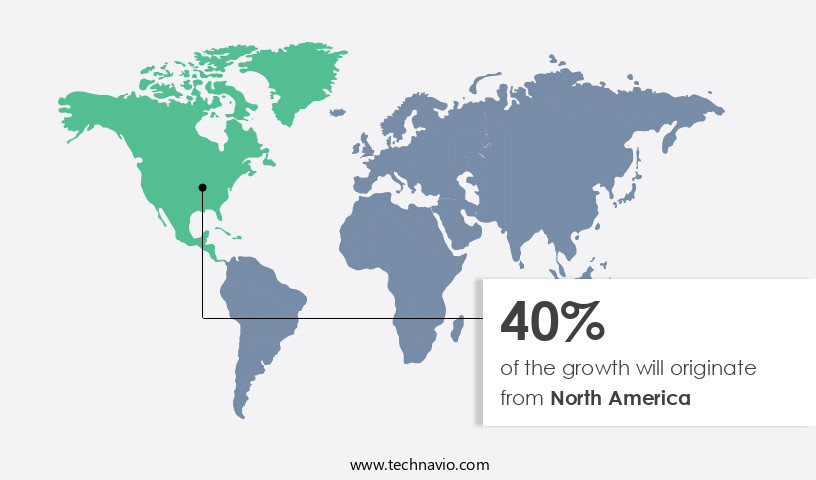

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The AI market in North American games is experiencing significant growth due to the rising popularity of esports and the increasing use of AI technology in gaming. Esports competitions, such as the international DOTA 2 championship, are attracting a large following, making gaming a professional career option in countries like the US. In response, game developers and publishers are investing in the creation of multiplayer games to cater to this demand. AI integration in esports games is becoming increasingly common, with machine learning models and neural networks used to enhance fan engagement and improve player experience.

Game development tools, including deep learning algorithms, are being utilized for level design, bug reporting, and game testing. Reinforcement learning is being employed for game balance and character AI, while decision trees and pathfinding algorithms are used for gameplay mechanics and multiplayer networking. Additionally, AI is being used for game engine optimization, computer vision, user interface design, and game physics engines. Monetization strategies, such as in-app purchases and subscription models, are being optimized using AI-driven analytics. The integration of AI in gaming is also leading to advancements in areas like e-sports integration, player behavior analysis, game analytics, and performance benchmarking.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global AI in games market size and forecast projects growth, driven by AI in games market trends 2025-2029. B2B AI gaming solutions leverage AI-driven game development tools for immersive experiences. AI in games market growth opportunities 2025 include AI for game NPC behavior and AI-enhanced game graphics, enhancing player engagement. Game AI management software optimizes development, while AI in games market competitive analysis highlights key studios. Sustainable AI gaming practices align with eco-friendly gaming trends. AI in games regulations 2025-2029 shapes AI gaming demand in North America 2025. Procedural content generation AI and premium AI gaming insights drive innovation. AI for mobile gaming and customized AI game features target niches. AI in games market challenges and solutions address ethics, with direct procurement strategies for AI tools and AI gaming pricing optimization boosting profitability. Data-driven AI gaming analytics and real-time AI game trends fuel growth.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence (AI) In Games Industry?

- The increasing prevalence of augmented reality (AR) and virtual reality (VR) games is the primary catalyst fueling market growth in this sector.

- Artificial Intelligence (AI) is revolutionizing the gaming industry, particularly in Virtual Reality (VR) and Augmented Reality (AR), by generating immersive and harmonious content in real time. AI algorithms enhance gaming experiences by creating dynamic level designs based on player inputs, generating realistic 3D models for characters and environments, and improving community management through intelligent bug reporting and decision trees. Game development tools are increasingly incorporating AI for game testing and monetization strategies, utilizing techniques such as deep learning and reinforcement learning.

- As AI continues to advance, it will further transform the gaming landscape, offering more engaging and interactive experiences for users.

What are the market trends shaping the Artificial Intelligence (AI) In Games Industry?

- The emergence of cloud gaming is gaining significant traction in the market, representing a notable trend in the industry. This development reflects the increasing demand for accessible and flexible gaming solutions.

- Artificial Intelligence (AI) integration in the games market is revolutionizing the way games are developed and played. Cloud gaming, which allows access to games on remote servers via Internet-connected devices, is a key area of growth. AI technologies such as player behavior analysis, game analytics, game engine optimization, computer vision, and user interface (UI) enhance the gaming experience. AI-driven game engines optimize game performance and improve game balance. Character AI and game AI create more immersive and harmonious gaming environments. Grid computing enables content streaming to devices using wired or wireless broadband connections. The advantages of cloud gaming over traditional console gaming include fewer hassles, as it does not require new hardware or complicated setups.

- It also offers a cost-effective price structure, making it accessible to non-core gamers who play games on social media and mobile devices. AI technologies in games market also facilitate e-sports integration and quality assurance (QA) testing. Computer vision technology can be used for player tracking and object recognition in e-sports. AI-driven QA tools can automate testing and identify bugs more efficiently. In conclusion, the integration of AI technologies in the games market is driving innovation and growth. Cloud gaming, AI-driven game engines, and AI-enhanced UI are transforming the gaming industry, offering a more immersive, harmonious, and cost-effective gaming experience.

What challenges does the Artificial Intelligence (AI) In Games Industry face during its growth?

- Network latency, which refers to the delay in data transmission between games, is a significant challenge that can hinder industry growth. This issue can adversely affect user experience, potentially leading to player dissatisfaction and decreased engagement. To mitigate this problem, ongoing research and development efforts are focused on improving network infrastructure and reducing latency, ensuring a more seamless and enjoyable gaming experience for users.

- The integration of Artificial Intelligence (AI) in the gaming industry has significantly enhanced social features and gameplay mechanics. Cloud gaming, a key trend in this market, enables players to access games on demand, reducing the need for high-end hardware. However, network latency poses a significant challenge, impacting gameplay experiences, particularly in multiplayer games. This delay, caused by factors such as internet connection quality, distance to game servers, and network infrastructure, can lead to poor synchronization and response times. Multiplayer networking, game physics engines, streaming integration, pathfinding algorithms, and performance benchmarking are essential components in mitigating latency issues.

- In-app purchases and game localization also contribute to the market's growth. Companies invest in research and development to improve these aspects, ensuring immersive and harmonious gaming experiences for players.

Exclusive Customer Landscape

The artificial intelligence (ai) in games market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence (ai) in games market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence (ai) in games market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard Inc. - Utilizing advanced AI algorithms, our gaming division enhances realism and competition in titles like FIFA. Sophisticated player behavior and decision-making models elevate user experience, setting a new standard in immersive gaming.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard Inc.

- Amazon Web Services Inc.

- Bandai Namco Entertainment Inc.

- DeepMind (Google)

- Electronic Arts Inc.

- Epic Games Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NetEase Inc.

- Niantic Inc.

- NVIDIA Corporation

- Sony Interactive Entertainment

- Square Enix Holdings Co. Ltd.

- Supercell Oy

- Take-Two Interactive Software Inc.

- Tencent Holdings Limited

- Ubisoft Entertainment SA

- Unity Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence (AI) In Games Market

- In January 2024, gaming giant Electronic Arts (EA) announced the launch of its new AI-powered game, "EA Sports AI Soccer," which uses advanced machine learning algorithms to create more realistic player behaviors and dynamic gameplay. (EA Press Release)

- In March 2024, tech behemoth Microsoft and gaming company Unity Technologies formed a strategic partnership to integrate Microsoft's Azure AI platform into Unity's game development engine, enabling developers to easily add AI capabilities to their games. (Microsoft News Center)

- In May 2024, Nvidia, a leading technology company, secured a strategic investment of USD200 million from SoftBank Vision Fund 2 to accelerate the development and deployment of AI in gaming and other industries. (Nvidia Press Release)

- In April 2025, Sony Interactive Entertainment and Google Cloud announced a multi-year collaboration to bring AI and machine learning technologies to Sony's PlayStation gaming platform, enhancing game development and player experiences. (Google Cloud Blog)

Research Analyst Overview

- In the dynamic games market, Artificial Intelligence (AI) is revolutionizing various aspects, from game design to user experience. Emotion AI enhances player engagement by recognizing and responding to players' emotions, thereby improving retention rates. AI-assisted level design and AI-powered game design facilitate the creation of more complex and immersive game environments. Crowdsourced content and user-generated content are being augmented with AI, enabling more personalized and interactive gameplay experiences. Reward systems are becoming smarter with AI, offering players tailored incentives based on their behavior and preferences. Voice acting and music composition are being transformed through AI, allowing for more realistic and adaptive in-game interactions.

- Realistic NPC interactions and behavioral modeling are essential components of AI-driven character development. Game asset creation, texture mapping, and procedural animation are streamlined through AI, ensuring efficient and high-quality production. Patch management and version control are also optimized, reducing downtime and improving player satisfaction. Dynamic storytelling, adaptive difficulty, and real-time shading are some of the advanced features made possible by AI, enhancing the overall gaming experience. Progression systems and player engagement metrics are analyzed and adjusted in real-time, ensuring a seamless and enjoyable gameplay loop. Sound effects and motion capture are being augmented with AI, allowing for more nuanced and responsive in-game audio and visuals.

- Game updates are delivered more efficiently and effectively, keeping players engaged and invested in the game.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence (AI) In Games Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.3% |

|

Market growth 2025-2029 |

USD 27474 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence (AI) In Games Market Research and Growth Report?

- CAGR of the Artificial Intelligence (AI) In Games industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence (ai) in games market growth of industry companies

We can help! Our analysts can customize this artificial intelligence (ai) in games market research report to meet your requirements.