Air Hoist Market Size 2024-2028

The air hoist market size is forecast to increase by USD 175.15 thousand at a CAGR of 5.3% between 2023 and 2028.

- The market is experiencing significant growth due to the rise in building and construction activities worldwide. This sector's expansion is driven by the increasing demand for efficient and safe material handling solutions in various industries, including construction, manufacturing, and mining. Additionally, technological advancements in air hoist designs have led to innovations such as remote control systems, improved load capacity, and energy efficiency, making them increasingly popular. However, the high initial cost and maintenance requirements of air hoists remain challenges for market growth. E-commerce and the need for efficient Logistics and Warehousing solutions have also contributed to the growth of the market. Despite these hurdles, the market is expected to continue its upward trajectory, driven by the need for reliable and efficient material handling solutions. The market trends and analysis report provides a comprehensive study of these growth factors and challenges, offering valuable insights for stakeholders and industry participants.

What will be the Size of the Air Hoist Market During the Forecast Period?

- The market encompasses mechanical devices utilized for lifting applications, primarily powered by compressed air. These hoists cater to various industries, including construction, logistics, warehousing, assembly lines, and shipyards. The demand for air hoists is driven by their versatility in high lifting capacity applications, as well as their suitability for hazardous environments. Air hoists are available in light duty, medium duty, and heavy-duty configurations, catering to diverse industry requirements. Key end-users include oil and gas, general industry, mining and excavating, and the automobile industry. The hoist mechanism, consisting of lifting hooks, ceiling lifts, and hoisting instrumentation, plays a crucial role In the assembly, loading, staging, and material handling processes. Air hoists contribute significantly to crane production, enhancing productivity and efficiency in material handling operations.

How is this Air Hoist Industry segmented and which is the largest segment?

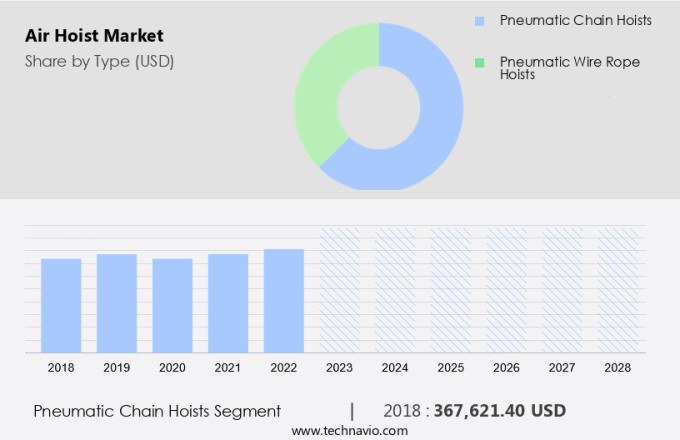

The air hoist industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pneumatic chain hoists

- Pneumatic wire rope hoists

- Application

- Manufacturing

- Construction

- Aerospace and aviation

- Oil and gas

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Type Insights

- The pneumatic chain hoists segment is estimated to witness significant growth during the forecast period.

The market encompasses various types, with pneumatic chain hoists gaining popularity due to their distinct advantages and applications. These hoists are particularly preferred in industries where safety, durability, and minimal maintenance are essential. Pneumatic chain hoists are explosion-proof by design, making them suitable for hazardous environments with flammable gases or dust. This trend is driven by the increasing demand for efficient and safe handling and lifting equipments in large-scale projects. This feature ensures a safer working environment by minimizing the risk of ignition. Furthermore, they are self-cooling, preventing overheating during prolonged use, thereby enhancing their operational lifespan and ensuring consistent performance under demanding conditions. Compared to electric hoists, pneumatic chain hoists offer simpler maintenance and repair processes.

Get a glance at the Air Hoist Industry report of share of various segments Request Free Sample

The pneumatic chain hoists segment was valued at USD 367.62 thousand in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Air hoists play a crucial role in various industries, particularly In the APAC region, where infrastructure development and industrialization are driving growth. These mechanical devices, which operate using compressed air as a power source, are essential for safe and efficient lifting operations in construction, logistics, and warehousing. In the APAC region, infrastructure projects, such as the M6 Motorway Expansion in Australia, contribute significantly to the demand for air hoists. These mechanical devices rely on compressed air as a power source, making them an essential component in construction, logistics, warehousing and storage, assembly lines, and various other applications. The expansion project, valued at approximately USD7 billion, began in late 2021 and is expected to be completed by the end of 2025. The construction sector, along with others, relies on air hoists to ensure productivity and safety in lifting applications. Overall, the APAC market is poised for steady growth, fueled by the region's expanding industries and infrastructure development.

Market Dynamics

Our air hoist market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Air Hoist Industry?

The rise in building and construction activities is the key driver of the market.

- The market in the US is witnessing significant growth due to the increasing demand for mechanical devices in various industries such as construction, logistics, warehousing, shipyards, and manufacturing. Compressed air, as a power source, is increasingly being used for lifting applications due to its versatility and efficiency. Air hoists offer high lifting capacity and are suitable for use in hazardous environments, making them ideal for industries like oil and gas, mining and excavating, and elevator production.

- Advanced lifting solutions are being adopted to ensure worker safety and comply with compliance standards. These solutions include overload protection, emergency stop functions, remote-control operation, and digital load displays. Air hoists are also being used in assembly lines, storage facilities, and material handling for product customization and crane production. The demand for air hoists is also driven by the need for portability and the increasing trend towards urbanization and infrastructure development. The market offers a range of heavy duty, medium duty, and light duty air hoists to cater to various industry requirements. Furthermore, air hoist mechanism, including hoisting instrumentation and lifting hooks, are essential components of the air hoist system.

What are the market trends shaping the Air Hoist Industry?

Technological advancements in air hoist designs are the upcoming market trend.

- The market is experiencing notable growth due to the integration of mechanical devices powered by compressed air for lifting applications in diverse industries. This market expansion is fueled by the increasing demand for efficient and safe lifting solutions in construction, logistics, warehousing, assembly lines, and shipyards. Modern air hoists incorporate high lifting capacity mechanisms, suitable for hazardous environments and infrastructure development. In addition, the e-commerce sector's growth and product customization requirements have increased the demand for air hoists in material handling applications. Rental services have gained popularity due to their cost-effectiveness and flexibility, while safety features such as overload protection, emergency stop functions, and remote-control operation enhance worker safety.

- Furthermore, digital load displays and compliance standards ensure accurate and secure lifting processes. Air hoists cater to various industries, including oil and gas, mining and excavating, and the elevator industry, with offerings ranging from light duty to heavy duty. Advanced lifting solutions are increasingly being adopted to streamline production processes in industries like Crane production, engineering, metal forming, and the oil industry. Urbanization and construction instrumentation also contribute to the market's growth, with crane manufacture and engineering firms integrating air hoists into their projects. The market continues to evolve, offering innovative solutions that cater to diverse lifting needs while maintaining safety and energy efficiency.

What challenges does the Air Hoist Industry face during its growth?

The high initial cost and maintenance of air hoists is a key challenge affecting the industry's growth.

- Air hoists, mechanical devices that utilize compressed air for lifting, play a crucial role in various industries including construction, logistics, warehousing, assembly lines, storage facilities, shipyards, and infrastructure development. These devices offer high lifting capacity, making them suitable for hazardous environments and heavy lifting tasks. However, their initial investment cost and ongoing maintenance expenses can pose challenges for small and medium-sized enterprises (SMEs). Air hoists are available in different duty classes, ranging from light duty to heavy duty, catering to diverse applications. Prices for these devices can range from USD 2,000 to USD 5,000, depending on factors such as size, quality, and load capacity. This substantial upfront cost can deter businesses, particularly SMEs, from investing in air hoists, despite their potential benefits, which include increased operational efficiency, enhanced safety features, and compliance with industry standards. Air hoists are essential for industries such as oil and gas, mining and excavating, and elevator production. They are used in material handling, crane production, and engineering applications, including metal forming.

- Furthermore, advanced lifting solutions offer features such as remote-control operation, digital load displays, overload protection, emergency stop functions, and compliance with safety standards. Rental services provide an alternative solution for businesses that cannot afford to purchase air hoists outright. These services offer flexibility, reducing the need for a large capital investment. Additionally, worker safety is a primary concern, with air hoists offering advanced safety features, such as automatic shut-off and load sensing systems. In summary, the market offers advanced lifting solutions for various industries, providing benefits such as increased efficiency, enhanced safety, and compliance with industry standards. Advanced safety features, such as load monitoring system and hoist mechanism, lifting hooks, ceiling lift, and hoisting instrumentation, ensure secure and efficient lifting processes. However, the high initial investment and ongoing maintenance expenses can pose challenges for SMEs. Rental services offer a viable alternative, providing flexibility and reducing the need for substantial capital outlay.

Exclusive Customer Landscape

The air hoist market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air hoist market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air hoist market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alimak Group AB

- Columbus McKinnon Corp.

- Elephant Lifting Products

- Endo Kogyo Co. Ltd

- Gardner Denver Hoists

- HENAN DONGQI MACHINERY CO LTD

- Hoisting Equipment Specialists Pty Ltd.

- Ingersoll Rand Inc.

- J.D.Neuhaus Gmbh and Co. KG

- Kito Corp

- MME Manufacturing Co Pty Ltd

- Red Rooster Lifting

- Redfern Flinn Cranes and Hoisting Equipment Pty Ltd

- Sky Climber LLC

- Stratalign Ltd.

- The David Round Co Inc

- Tiger Lifting

- Toku Pneumatic Co Ltd

- Tri-State Wire Rope Supply, Inc.

- Vestil Manufacturing Corp

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of mechanical devices designed to facilitate lifting processes in various industries. These devices harness the power of compressed air as a primary source of energy, making them an essential component in construction, logistics, warehousing, assembly lines, storage facilities, shipyards, and more. At the heart of these systems lies the hoist mechanism, which is responsible for lifting and lowering heavy loads. Air hoists offer several advantages over other lifting solutions, including high lifting capacity, portability, and the ability to operate in hazardous environments. Infrastructure development projects, such as urbanization and oil industry expansion, heavily rely on these advanced lifting solutions to ensure efficient and safe material handling. The construction sector is a significant consumer of air hoists, with their applications extending from lifting building materials and equipment to erecting structures. In logistics and warehousing, air hoists are used for loading and unloading goods, as well as for material handling within facilities. In the oil and gas industry, they are crucial for lifting heavy drilling equipment and pipelines. Safety is a primary concern In the market. Advanced safety features, such as overload protection, emergency stop functions, and remote-control operation, ensure that workers are shielded from potential hazards.

However, compliance with industry standards is essential, and digital load displays enable operators to monitor weight limits in real-time. Air hoists are available in various duty classes, including light duty, medium duty, and heavy duty, catering to the diverse needs of different industries. For instance, heavy-duty air hoists are often employed in mining and excavating, where extreme lifting capacities are required. The market is also characterized by the presence of rental services, which offer flexible solutions for businesses with fluctuating lifting requirements. Product customization is another trend gaining traction, with manufacturers offering tailored solutions to meet specific industry needs. Thus, the market plays a pivotal role in powering various industries by providing efficient and safe lifting solutions. The use of compressed air as a power source offers numerous advantages, including portability, high lifting capacity, and the ability to operate in hazardous environments. As industries continue to evolve and expand, the demand for advanced lifting solutions will undoubtedly persist.

|

Air Hoist Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2024-2028 |

USD 175.15 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

US, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Hoist Market Research and Growth Report?

- CAGR of the Air Hoist industry during the forecast period

- Detailed information on factors that will drive the Air Hoist growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air hoist market growth of industry companies

We can help! Our analysts can customize this air hoist market research report to meet your requirements.