Air Traffic Control Equipment Market Size 2024-2028

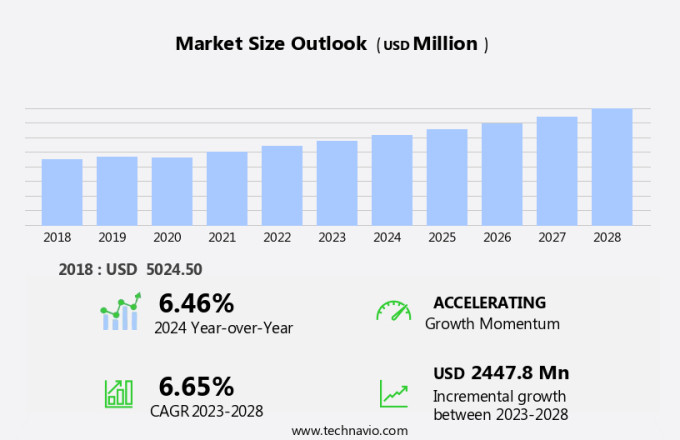

The air traffic control equipment market size is forecast to increase by USD 2.45 billion at a CAGR of 6.65% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing air traffic and the preference for smart airports. The growing air traffic necessitates the need for advanced air traffic control systems to ensure safety and efficiency. Moreover, the adoption of smart airport technologies, such as Automatic Dependent Surveillance-Broadcast (ADS-B), is driving market growth. However, technical shortcomings of airborne radars, such as limited range and reliability, pose challenges to market growth. To address these challenges, market participants are focusing on developing innovative solutions, such as multi-lateration systems and space-based ADS-B, to enhance the accuracy and reliability of air traffic control systems.

- Overall, the market is expected to grow steadily during the forecast period, driven by these key trends and challenges.

What will be the Size of the Air Traffic Control Equipment Market During the Forecast Period?

- The market encompasses technologies and solutions essential for managing aircraft movement at airports and In the skies. Microelectronics development drives market growth, enabling advanced communication and navigation systems for both commercial and private aircraft. The commercial aircraft segment dominates the market due to the high volume of air travel. Communication equipment, including voice communication systems and communication networks, and surveillance equipment, such as holographic radar systems, are key segments. Civil aviation authorities prioritize air traffic management, leading to investments in air traffic control technology upgrades, both in brownfield and greenfield projects. The military aircraft segment also contributes significantly to the market, utilizing specialized navigation and communication equipment.

- Aviation infrastructure continues to evolve, with a focus on enhancing safety, efficiency, and capacity In the face of increasing air traffic demands.

How is this Air Traffic Control Equipment Industry segmented and which is the largest segment?

The air traffic control equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Communication equipment

- Navigation equipment

- Others

- Application

- Commercial

- Military and defense

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Type Insights

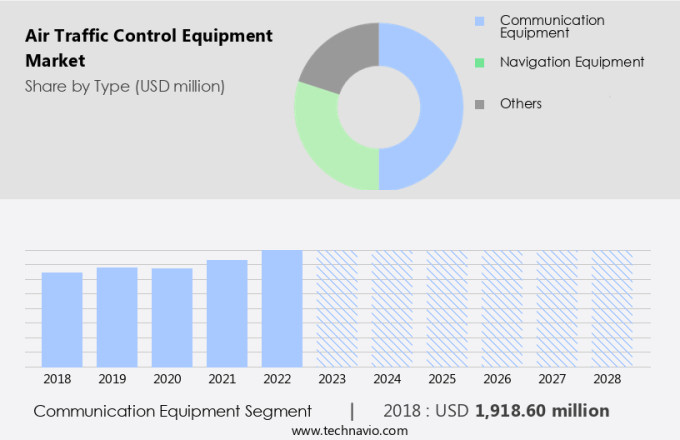

- The communication equipment segment is estimated to witness significant growth during the forecast period.

The communication equipment segment dominates the Air Traffic Control (ATC) market due to increasing investments in advanced technology and the growing need for safe and reliable air traffic operations. Communication equipment facilitates ground and air-to-ground communication, enabling the exchange of critical avionics data. International standards govern communication systems, ensuring interoperability between aeronautical and aircraft stations. Modernized communication networks provide mobile services, enhancing air traffic management efficiency. The commercial aircraft segment and private aircraft segment also contribute significantly to the market's growth, necessitating advanced communication systems for their operations. The integration of holographic radar systems, voice communication systems, and artificial intelligence in ATC equipment further boosts market expansion.

The military aircraft segment and defense sector also leverage ATC equipment for surveillance and navigation purposes. The use of high definition cameras, remote sensing technologies, high-speed computers, and communication backbone solutions, such as microwave links, is prevalent in terminal areas and ATC centers, rescue coordination centers, and ATC towers. FAA certification requirements and the integration of unmanned aerial systems further expand the market scope.

Get a glance at the Air Traffic Control Equipment Industry report of share of various segments Request Free Sample

The Communication equipment segment was valued at USD 1.92 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

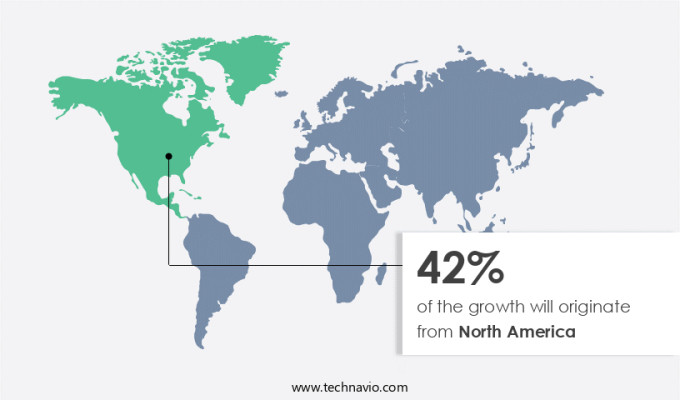

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region dominates the global Air Traffic Control (ATC) equipment market due to increasing air traffic and advanced aviation infrastructure. The US and Canada are significant contributors to the market's growth. Technologically advanced aerospace companies In the region focus on developing ATC equipment and related technologies, catering to the demand for aircraft parts, systems, and components. The surge in global demand for new aircraft has led to substantial investments In the aircraft manufacturing sector, driving the development of advanced ATC equipment in North America. The ATC equipment market in North America comprises communication equipment, surveillance equipment, navigation equipment, and voice communication systems.

Commercial aircraft and military aircraft segments are the primary consumers of ATC equipment In the region. The commercial aircraft segment is expected to witness significant growth due to the increasing number of passengers and the need for efficient air traffic management. The military aircraft segment also contributes to the market growth due to the defense sector's continuous investment in modernizing their fleets and improving their operational capabilities. Advancements in microelectronics development have led to the integration of artificial intelligence, automation, and remote tower operations in ATC equipment. High definition cameras, remote sensing technologies, and high-speed computers are essential components of modern ATC equipment.

The communication backbone of the ATC system includes communication networks, microwave links, and other communication solutions. ATC centers, ATC towers, rescue coordination centers, and pilots rely on these advanced systems to ensure safe and efficient air traffic management. FAA certification requirements ensure the safety and reliability of ATC equipment. The integration of holographic radar systems, advanced material selection, low drag, low lift airfoils, and thicker airfoils in ATC equipment enhances their performance and efficiency. The use of unmanned aerial systems and voice communication systems further streamlines air traffic management processes. In conclusion, the North American ATC equipment market is expected to continue its growth trajectory due to the region's robust aviation infrastructure, increasing air traffic, and technological advancements.

Market Dynamics

Our air traffic control equipment market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Air Traffic Control Equipment Industry?

Growing air traffic is the key driver of the market.

- Air traffic control equipment plays a crucial role in ensuring the safe and efficient management of aircraft movement at airports. The market for this equipment is driven by the increasing number of commercial and private aircraft, as well as the modernization of aviation infrastructure. Microelectronics development has led to advancements in communication and navigation equipment, including voice communication systems and high definition cameras for surveillance. The commercial aircraft segment and military aircraft segment are significant contributors to the market's growth. Communication equipment and navigation equipment segments are expected to dominate the market due to the increasing demand for advanced communication networks and navigation tools.

- Brownfield and greenfield projects are driving the demand for air traffic control equipment upgrades. Air traffic management systems, including holographic radar systems, are essential for air traffic controllers to monitor and manage aircraft movements effectively. Remote tower operations and unmanned aerial systems are also gaining popularity In the industry. FAA certification requirements and the integration of artificial intelligence and automation are key trends In the market. High-speed computers, terminal areas, and communication backbone systems, including microwave links, are essential components of modern air traffic control equipment. The defense sector, including naval forces, also utilizes air traffic control equipment for military aircraft operations.

- Advanced material selection, such as low drag, low lift airfoils, and thicker airfoils, is crucial for the development of military aircraft. In conclusion, the market is experiencing significant growth due to the increasing number of aircraft, modernization of aviation infrastructure, and advancements in technology. Communication equipment and navigation equipment segments are expected to dominate the market, while holographic radar systems, remote tower operations, and unmanned aerial systems are emerging trends. FAA certification requirements and the integration of artificial intelligence and automation are key drivers of innovation In the market.

What are the market trends shaping the Air Traffic Control Equipment Industry?

Growing preference for smart airports is the upcoming market trend.

- The Air Traffic Control (ATC) Equipment Market encompasses various technologies and systems used for managing aircraft movement at airports. This market is driven by the advancements in microelectronics development and the increasing demand for improved communication, navigation, and surveillance solutions in both the commercial and private aircraft segments. Communication equipment and navigation tools are essential components of the ATC market, facilitating voice communication systems and data exchange between pilots, ATC officers, and ATC Centers. Surveillance equipment, including holographic radar systems and high definition cameras, plays a crucial role in ensuring safety and efficiency in airport operations. The commercial aircraft segment dominates the market due to the high volume of traffic and stringent FAA certification requirements.

- The military aircraft segment and defense sector, including naval forces, also contribute significantly to the market growth. Advanced material selection, such as low drag, low lift airfoils, and thicker airfoils, is a trend in modern aircraft design, necessitating the development of advanced ATC systems. The integration of artificial intelligence, automation, remote tower operations, and unmanned aerial systems further enhances the capabilities of ATC equipment. High-speed computers, communication backbone, and microwave links form the communication infrastructure for ATC systems, ensuring seamless information exchange between various stakeholders. The integration of these technologies in smart airport terminals, which are developed around a single, converged integration platform, significantly improves operational efficiency and enhances the passenger experience.

- In conclusion, the market is poised for growth due to the increasing demand for advanced communication, navigation, and surveillance solutions In the aviation industry. The integration of smart technologies, such as artificial intelligence, automation, and remote tower operations, further enhances the capabilities of ATC systems, ensuring safety and efficiency in airport operations.

What challenges does the Air Traffic Control Equipment Industry face during its growth?

Technical shortcomings of airborne radars is a key challenge affecting the industry growth.

- Air Traffic Control (ATC) equipment plays a vital role in ensuring the safe and efficient management of aircraft movement at airports. Two primary segments In the ATC equipment market are the Commercial Aircraft and Private Aircraft segments. Microelectronics development has significantly impacted the Commercial aircraft segment, leading to the integration of advanced communication and navigation equipment. Communication equipment, including voice communication systems, is essential for effective communication between pilots, ATC officers, and ATC Centers. Navigation equipment, such as holographic radar systems, helps air traffic controllers monitor and manage aircraft positions in real-time. Surveillance equipment, including high definition cameras and remote sensing technologies, enhances situational awareness and safety.

- The Military aircraft segment and defense sector, including naval forces, also rely on ATC equipment for mission-critical operations. The communication and navigation equipment segment, as well as the surveillance equipment segment, are integral to Military Air Traffic Management. Brownfield and Greenfield projects are ongoing to modernize aviation infrastructure, with a focus on automation, artificial intelligence, and remote tower operations. UNO Technology, including communication backbone, microwave links, and high-speed computers, enables the integration of these advanced technologies. Civil Aviation Authorities and Air Traffic Management systems worldwide prioritize the implementation of FAA certification requirements and adherence to international standards.

- The integration of advanced material selection, such as low drag, low lift airfoils, and thicker airfoils, enhances the performance of modern aircraft. In conclusion, the market is dynamic, with continuous advancements in technology and regulatory requirements shaping its evolution. Communication, navigation, and surveillance equipment are essential components of ATC systems, driving innovation and investment In the aviation industry.

Exclusive Customer Landscape

The air traffic control equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air traffic control equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air traffic control equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adacel Technologies Ltd. - Air traffic control equipment plays a crucial role in ensuring the safe and efficient management of increasingly congested airspace. This technology is essential for monitoring and managing the movement of aircraft, providing real-time information to pilots and air traffic controllers, and maintaining communication between various aviation stakeholders. The advanced systems employed in air traffic control must prioritize heightened situational awareness and security features to mitigate potential risks and ensure the safety of passengers and crew.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adacel Technologies Ltd.

- Advanced Navigation and Positioning Corp.

- Aeronav Inc.

- Aquila Air Traffic Management Services Ltd.

- BAE Systems Plc

- Becker Avionics Inc.

- Frequentis AG

- Indra Sistemas SA

- Intelcan Technosystems Inc.

- Kongsberg Geospatial Ltd.

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- RTX Corp.

- Saab AB

- Searidge Technologies

- Sierra Nevada Corp.

- Telephonics Corp.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The air traffic control (ATC) equipment market encompasses a range of technologies and systems designed to facilitate the safe and efficient management of air traffic. This market is driven by several factors, including the increasing demand for air travel, advancements in technology, and the need for improved communication, navigation, and surveillance solutions. The commercial aircraft segment is a significant contributor to the market's growth, as the aviation industry continues to expand and modernize. Commercial airlines require advanced ATC equipment to manage the large volume of air traffic and ensure the safety of passengers. The private aircraft segment also plays a role In the market's growth, as private aviation continues to gain popularity.

The communication equipment segment is a critical component of the ATC market, as it enables effective communication between air traffic controllers, pilots, and other aviation stakeholders. This segment includes voice communication systems, communication networks, and other communication technologies. The navigation equipment segment is another key area of focus, as it provides aircraft with critical information about their position and direction. This segment includes navigation tools such as Global Positioning System (GPS) and Instrument Landing Systems (ILS). The surveillance equipment segment is essential for monitoring air traffic and ensuring safety. This segment includes holographic radar systems, high definition cameras, and remote sensing technologies.

These solutions provide air traffic controllers with real-time information about the location and movement of aircraft, enabling them to make informed decisions and respond to potential safety concerns. The military aircraft segment is a significant user of ATC equipment, as military aviation requires robust and reliable communication, navigation, and surveillance systems. The defense sector invests heavily In the development of advanced ATC technologies to support military operations and ensure the safety of military personnel. The aviation infrastructure market, including civil aviation authorities, ATC centers, ATC towers, and rescue coordination centers, also plays a crucial role In the growth of the ATC equipment market.

These organizations rely on advanced technologies to manage air traffic and ensure safety, driving demand for innovative solutions. Advancements in technology, such as automation, artificial intelligence, remote tower operations, and unmanned aerial systems, are transforming the ATC market. These technologies enable more efficient and effective air traffic management, reducing the workload on air traffic controllers and improving safety. The FAA certification requirements for ATC equipment are stringent, ensuring that only safe and reliable solutions are used In the aviation industry. Manufacturers invest heavily in research and development to meet these requirements and bring new technologies to market. The ATC equipment market is dynamic, with ongoing advancements in technology and evolving market trends driving growth.

The market is expected to continue expanding as the aviation industry grows and modernizes, providing opportunities for innovation and investment.

|

Air Traffic Control Equipment Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.65% |

|

Market growth 2024-2028 |

USD 2447.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.46 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Traffic Control Equipment Market Research and Growth Report?

- CAGR of the Air Traffic Control Equipment industry during the forecast period

- Detailed information on factors that will drive the Air Traffic Control Equipment growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air traffic control equipment market growth of industry companies

We can help! Our analysts can customize this air traffic control equipment market research report to meet your requirements.