Aircraft Auxiliary Power Unit Market Size 2024-2028

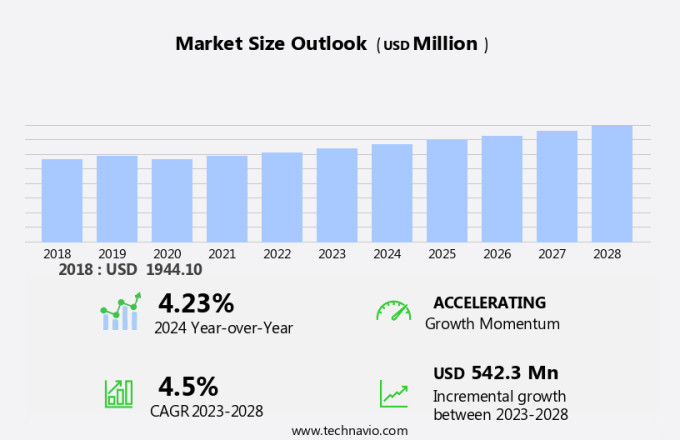

The aircraft auxiliary power unit market size is forecast to increase by USD 542.3 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing number of military aircraft and commercial aircraft in operation. The emergence of hydrazine-powered emergency power units is a key trend in the market, offering high performance and low noise levels. Additionally, the development of fuel cells for Unmanned Aerial Vehicles (UAVs) is gaining momentum, as electric aircraft become more prevalent to reduce noise pollution. The market caters to various aircraft types, including fixed-wing and rotary-wing, and has applications in both commercial and military sectors. APUs play a crucial role in providing auxiliary power for various aircraft systems during ground operations and in-flight, and their efficiency and performance are critical factors in reducing fuel consumption. The market is expected to witness strong growth in the coming years, driven by the increasing demand for reliable and efficient APUs in the aviation industry.

Market Analysis

The market is witnessing significant growth due to the increasing demand for commercial aviation and general aviation. APUs serve as essential aircraft systems, providing electrical power and air conditioning to the airplane during ground operations and in-flight. They act as an electrical power source and a backup for main engines, enabling passenger travel comfort and safety. APUs find extensive applications in various aircraft types, including fixed-wing aircraft like wide-body and narrow-body jets, as well as rotary-wing aircraft and unmanned aerial vehicles. Military aircraft deliveries and their subsequent backlog also contribute to the market growth.

Furthermore, the rise in passenger traffic and aircraft deliveries further boosts the demand for APUs. In the commercial aviation sector, the focus on reducing noise pollution has led to the development of low-noise APUs. High-performance APUs with improved fuel consumption are also gaining popularity. Ground support tools like ground power units and electric ground power are increasingly being used in conjunction with APUs for efficient aircraft handling. APUs are also finding applications in electric aircraft and military applications, further expanding their market potential. The ongoing trend of battery power in aviation systems is also expected to impact the APU market dynamics. Overall, the APU market is poised for growth in the coming years, driven by the increasing demand for efficient and reliable power sources in the aviation industry.

APUs are an integral part of aviation systems, and their importance is increasing as the industry moves towards more electric and sustainable aviation. The market for APUs is expected to grow as the demand for efficient and sustainable aviation solutions continues to rise. In conclusion, the APU market plays a vital role in powering the aviation industry, from commercial aviation and passenger travel to military applications and emerging electric aircraft. The market is driven by various factors, including passenger traffic, aircraft deliveries, and the need for efficient ground handling. APUs are essential for providing electrical power and other functions to aircraft during ground operations and in flight, and their importance is expected to grow as the industry moves towards more electric and sustainable aviation solutions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Military

- General aviation

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.In the dynamic aviation sector, the Aircraft Auxiliary Power Unit (APU) gearbox market experienced significant growth in 2023, primarily driven by the commercial aviation application segment. This segment encompasses aircraft used for passenger, cargo, and business purposes. The expansion of this segment can be attributed to the burgeoning air travel industry, fueled by the increasing number of air passengers and the rising volume of cargo shipments. The increasing number of air passengers and rising air cargo shipments have driven the demand for APUs in the commercial aviation sector. The commercial aviation industry's growth can be linked to technological advancements and consumer preference for air travel. Air travel has become increasingly affordable, leading to a wave in passenger traffic. Consequently, operators have been investing in new aircraft deliveries to meet the demands of the tourism industry.

Moreover, fuel efficiency requirements and environmental regulations have become crucial factors influencing market growth. To meet these regulations, there is a growing trend towards the adoption of electric aircraft systems, sustainable aviation solutions, and weight reduction techniques. Additionally, the integration of advanced avionics systems and connectivity solutions is transforming the aviation industry, offering enhanced passenger comfort and convenience. As the industry continues to evolve, the demand for APUs is expected to remain strong, with continued investments in new aircraft and upgrades to existing fleets.

Get a glance at the market share of various segments Request Free Sample

The commercial segment was valued at USD 881.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the aircraft auxiliary power unit (APU) market is fueled by the thriving aviation industry. The growth of this sector is driven by the rising demand for air travel and the need for fleet renewal among operators. To keep up with the industry's rapid expansion, engine original equipment manufacturers (OEMs) are investing significantly in expanding their production facilities. In a recent development, United Airlines announced a commercial agreement with Boom Supersonic in June 2023. Moreover, new aircraft orders and aviation fleet modernization are driving the market, with engine Original Equipment Manufacturers (OEMs) investing heavily in expanding their production facilities. This Denver-based aerospace company will provide United with new aircraft and collaborate on a sustainability initiative. The net-zero carbon aircraft, set to carry passengers in 2029, will run on 100% sustainable aviation fuel (SAF).

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing number of military aircraft is the key driver of the market. The Aircraft Auxiliary Power Unit (APU) market is experiencing significant growth due to the increasing demand for commercial aviation and general aviation. With the tide in passenger travel and military aircraft deliveries, the backlog for new aircraft orders continues to expand. Fuel efficiency, noise reduction, and carbon emissions are key concerns driving the adoption of advanced APU technologies, including electric APUs, which contribute to emissions reduction and passenger comfort. Aviation fleet modernization and defense expenditure are significant factors fueling the market's growth. Aircraft manufacturers, including those producing fixed-wing, wide body, narrow body, rotary-wing, UAVs, and electric aircraft, are integrating APUs into their designs to meet fuel efficiency requirements and environmental regulations.

APUs serve various applications, including commercial aircraft, military applications, ground support tools, and ground power units. Major players in the market, such as Airbus, Boeing, and Rolls-Royce, are investing in research and development to create high-performance, fuel-efficient, and low-noise APUs. Additionally, the integration of electrical power sources, such as batteries, into APUs and electric ground power systems, is a growing trend. The market for APUs is expected to continue its upward trajectory, driven by the increasing need for sustainable aviation solutions, connectivity, and advanced avionics systems. Weight reduction, aircraft deliveries, and the requirements of airlines, private owners, and military organizations further contribute to the market's growth. Overall, the market is a dynamic and evolving sector, poised for continued growth and innovation.

Market Trends

The emergence of hydrazine-powered emergency power units is the upcoming trend in the market. Aircraft Auxiliary Power Units (APUs) play a crucial role in both commercial and general aviation by supplying electrical power and air conditioning to aircraft while on the ground, enhancing passenger comfort, and starting the main engines. The aviation industry's focus on fuel efficiency, noise reduction, and carbon emissions reduction has led to advancements in APU technologies. For instance, electric APUs and emissions reduction systems are gaining popularity. Honeywell International Inc. Recently announced the development of a power source for hybrid-electric aircraft, which will be integrated with their HGT1700 auxiliary power unit, forming a turbogenerator. This innovation aims to improve fuel consumption and reduce noise pollution.

Moreover, the commercial aviation and general aviation sectors, including passenger travel, regional carriers, and low-cost carriers, are driving the demand for new aircraft orders and aviation fleet modernization. Military aircraft deliveries also contribute significantly to the market's growth. The increasing defense expenditure and the need for military aircraft's electrical power and air conditioning systems further boost the market. APUs have various applications, including ground support tools like ground power units, and they are essential for various aircraft types, including fixed-wing, rotary wing, UAVs, and electric aircraft. Fuel efficiency requirements and environmental regulations are influencing the adoption of advanced APUs and sustainable aviation solutions.

Similarly, the connectivity and avionics systems, weight reduction, and energy storage systems, such as propulsion battery packs, are other factors driving the market's growth. APUs are integral to the aviation systems of commercial and military aircraft, providing electrical power and pneumatic systems. As the aviation industry evolves, APUs will continue to play a vital role in air travel and air transportation, ensuring the reliability and efficiency of aircraft and maintaining passenger comfort.

Market Challenge

The development of fuel cells for unmanned aerial vehicles (UAVs) is a key challenge affecting the market growth. The Aircraft Auxiliary Power Unit (APU) market encompasses various applications in commercial aviation and general aviation sectors. APUs provide electrical power and pneumatic systems for aircraft, acting as an essential component for passenger travel and military aircraft deliveries. With increasing passenger traffic and new aircraft orders, aviation fleet modernization continues to drive the demand for APUs. Fuel efficiency and noise reduction are key considerations in the development of APU technologies, including electric APUs and emissions reduction systems. Passenger comfort and connectivity are also crucial factors, as airlines and private owners seek sustainable aviation solutions. The market includes applications for fixed-wing aircraft, wide body and narrow body aircraft, rotary wing aircraft, and unmanned aerial vehicles (UAVs).

Furthermore, military organizations and defense expenditure contribute significantly to the market, with military aircraft applications and ground support tools such as ground power units. The market dynamics are influenced by fuel efficiency requirements, environmental regulations, and air transport networks, including regional carriers and low-cost carriers. Electric aircraft systems, avionics systems, weight reduction, and energy storage systems are emerging trends in the market. Propulsion battery packs and hybrid electric aircraft are also gaining traction as the industry focuses on reducing carbon emissions and improving fuel consumption.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aegis Power Systems Inc. - The company offers aircraft auxiliary power units that are used in commercial and military systems.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerosila

- General Electric Co.

- Honeywell International Inc.

- Liebherr International Deutschland GmbH

- Northstar Aerospace

- PBS Group AS

- Pratt and Whitney

- RTX Corp.

- Safran SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The aircraft auxiliary power unit (APU) market caters to the power needs of commercial aviation and general aviation, including passenger travel, military aircraft deliveries, and ground support tools. APUs provide electrical power for various aircraft systems, such as air conditioning, lighting, and communication equipment, during ground operations and in flight. New aircraft orders, fleet modernization, and aviation systems advancements drive market growth. APUs contribute to fuel efficiency, noise reduction, and emissions reduction, making them essential for sustainable aviation solutions. Technological innovations include electric APUs and hybrid electric aircraft. Passenger comfort, connectivity, and avionics systems also benefit from APUs. Military organizations and private owners rely on APUs for military aircraft, fixed-wing, rotary-wing, UAVs, and ground power units.

Moreover, fuel consumption and weight reduction are critical considerations in the aircraft industry, making high-performance APUs a priority. Environmental regulations and air transport networks, including regional carriers and low-cost carriers, further fuel the demand for APUs. APUs serve various applications, including ground power units, electric ground power, and main engines. Energy storage systems, propulsion battery packs, and pneumatic systems are integral components of APUs. The market's future lies in advancing technologies that meet fuel efficiency requirements and reduce noise pollution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 542.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aegis Power Systems Inc., Aerosila, General Electric Co., Honeywell International Inc., Liebherr International Deutschland GmbH, Northstar Aerospace, PBS Group AS, Pratt and Whitney, RTX Corp., and Safran SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch