Aircraft Braking Systems Market Size 2024-2028

The aircraft braking systems market size is forecast to increase by USD 1.96 billion at a CAGR of 8.09% between 2023 and 2028.

What will be the Size of the Aircraft Braking Systems Market During the Forecast Period?

How is this Aircraft Braking Systems Industry segmented and which is the largest segment?

The aircraft braking systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial aviation

- Military aviation

- General aviation

- Component

- Power brake

- Independent brake

- Boosted brake

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- North America

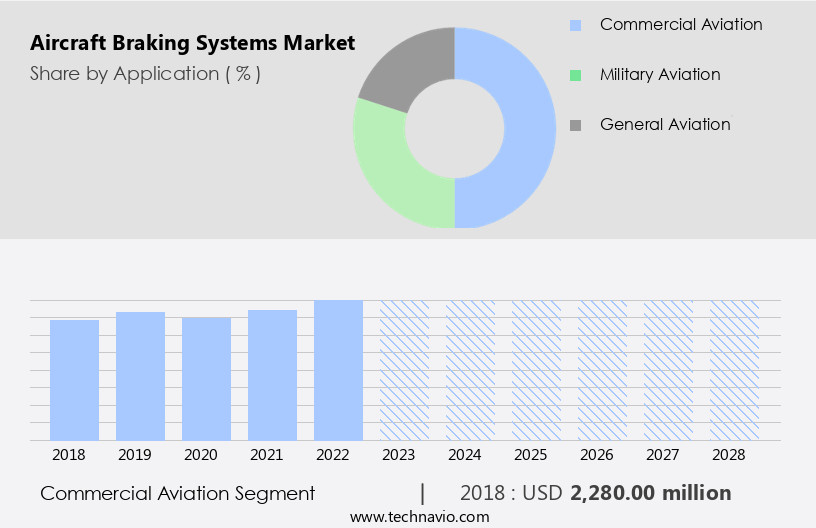

By Application Insights

- The commercial aviation segment is estimated to witness significant growth during the forecast period.

The commercial aviation sector, comprising narrow-body, wide-body, and regional aircraft, experiences continuous growth due to the increasing consumer preference for air travel. To meet stringent emission norms and improve operational efficiency, airlines are procuring new-generation aircraft with advanced engines and braking systems. These braking systems include hydraulic, pneumatic, and electric types, such as disc brakes, single-disc, double-disc, and multi-disc brakes, as well as rotor-disc brakes. The military sector also invests in advanced aircraft brake systems, utilizing carbon brakes and steel brakes, from leading manufacturers like Safran Landing Systems. The procurement of these aircraft and their components is influenced by factors like air traffic, new airports, and expenditure on procurement.

Labor shortages and safety concerns can disrupt the supply chain, necessitating safety improvement initiatives and reliability contracts. The market for aircraft brake systems is expected to grow significantly due to the increasing demand for new aircraft and the aging airplane fleet. The efficiency and durability of advanced brake discs, such as carbon fiber construction and electronics segment, are driving the market. The general aviation sector also utilizes various brake components and support systems, including anti-skid brakes, for different types of aircraft, from fixed-wing to rotary wing, and hydraulically or pneumatically operated.

Get a glance at the Aircraft Braking Systems Industry report of share of various segments Request Free Sample

The Commercial aviation segment was valued at USD 2.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

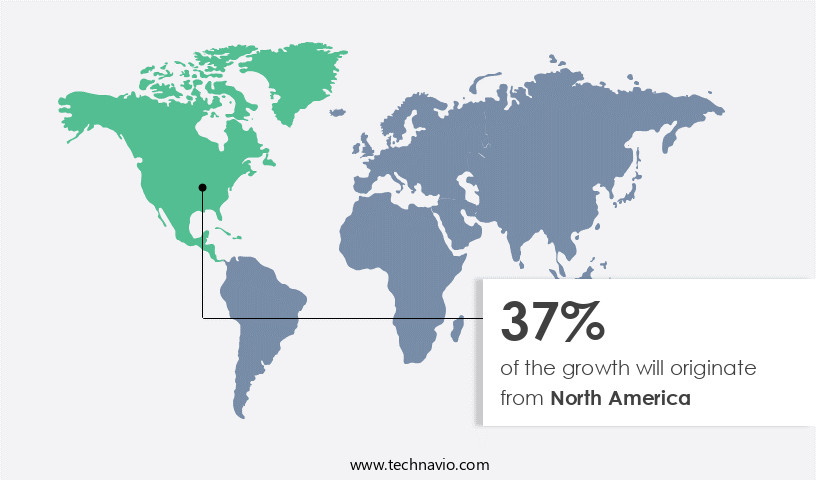

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is driven by advanced aviation infrastructure and a large consumer base. The region's mature markets, including the US and Canada, invest in technologically advanced braking systems, such as electric brakes and carbon brakes, which enhance safety and efficiency. These braking systems are integral to the aircraft's landing and takeoff processes. The global surge in demand for new aircraft necessitates significant investments in airframe parts and component manufacturing. Electric brakes, which are gaining popularity due to their reliability and reduced equipment failure risks, are a significant contributor to this trend. The market is further propelled by the military sector's demand for advanced braking systems, particularly for aircraft like the F-15EX.

The market encompasses various brake types, including disc brakes, hydraulic brakes, and pneumatic brakes, as well as single-disc, double-disc, and multi-disc brakes. The general aviation sector also utilizes brake components and support systems. Air traffic growth, new airport development, and increasing expenditure on procurement further fuel market expansion. Companies such as Safran Landing Systems and Crane Aerospace & Electronics are key players in this market. The market is subject to stringent regulations, flight cancellations, and e-commerce services, necessitating safety improvement initiatives and reliability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aircraft Braking Systems Industry?

Growing demand for commercial and general aircraft is the key driver of the market.

What are the market trends shaping the Aircraft Braking Systems Industry?

Development of electric brake systems is the upcoming market trend.

What challenges does the Aircraft Braking Systems Industry face during its growth?

Unexpected closure of aircraft maintenance facilities is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The aircraft braking systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft braking systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft braking systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advent Aircraft Systems Inc. - Aircraft braking systems are essential components for ensuring safe and efficient ground handling and deceleration of various aircraft models. The market caters to a range of aircraft types, including the Eclipse 500, Beechcraft King Air B200, and Pilatus PC-12. These systems are designed to meet the specific performance requirements of each aircraft, providing optimal stopping power and control during landing and taxiing. Manufacturers prioritize durability, reliability, and low maintenance to ensure optimal functionality and minimal downtime for operators. The market continues to evolve, driven by advancements in materials science, hydraulics, and electronics, offering enhanced safety and performance features.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advent Aircraft Systems Inc.

- Aviation Products Systems Inc.

- BERINGER AERO

- Crane Holdings Co.

- GOLDfren USA

- Grove Aircraft Landing Gear Systems Inc.

- Honeywell International Inc.

- Jay Em Aerospace Inc.

- Matco Aircraft Landing Systems

- McFarlane Aviation Inc.

- Meggitt Plc

- NMG Aerospace

- Moog Inc.

- Parker Hannifin Corp.

- RAPCO Inc.

- RTX Corp.

- Safran SA

- Sonex LLC

- Tactair Fluid Controls Inc.

- The Carlyle Johnson Machine Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aircraft braking systems play a crucial role in ensuring the safe and efficient stoppage of aircraft after landing. These systems are essential components of an aircraft's overall landing gear system and are available in various types, including hydraulic, pneumatic, and electric brakes. Hydraulic brakes are the most commonly used braking systems In the aviation industry. They operate by using hydraulic fluid to apply pressure to the brakes, generating friction and stopping the aircraft. These systems offer high stopping power and are suitable for large commercial aircraft. Pneumatic brakes, on the other hand, use compressed air to generate the necessary pressure to stop the aircraft.

They are commonly used in smaller aircraft and offer the advantage of being lighter than hydraulic brakes. Electric brakes are gaining popularity due to their efficiency and environmental benefits. They operate by passing an electric current through a resistance element, generating heat, and creating friction to stop the aircraft. These brakes offer the advantage of being more energy-efficient than hydraulic and pneumatic brakes and are suitable for both fixed-wing and rotary-wing aircraft. Advanced brake discs, such as carbon brakes and steel brakes, are being increasingly used In the aviation industry due to their durability and high performance. Carbon brakes offer the advantage of being lighter than steel brakes and offer improved stopping power and durability.

Steel brakes, on the other hand, offer high thermal capacity and are suitable for heavy-duty applications. The market is driven by several factors, including increased demand for air travel, the need for enhanced safety, and stringent regulations. The market is also influenced by factors such as supply chain disruptions, labor shortages, and employee safety concerns. The aviation industry is undergoing a significant transformation, with the adoption of advanced technologies such as fly-by-wire braking and computation-based braking systems. These systems offer improved reliability, reduced maintenance costs, and enhanced safety features. The market for aircraft braking systems is segmented into various categories based on aircraft type, actuation, and brake components.

The passenger aircraft segment is the largest market for aircraft braking systems due to the high number of aircraft in service. The cargo aircraft segment is expected to grow at a significant rate due to the increasing demand for cargo transportation. The market for aircraft braking systems is also influenced by factors such as air traffic, new airports, and expenditure on procurement. The military sector is another significant market for aircraft braking systems, with the demand driven by the need for high-performance brakes in military aircraft. The market for aircraft braking systems is highly competitive, with several players offering a range of products and services.

Some of the key players In the market include Safran Landing Systems, Crane Aerospace & Electronics, and General Electric. These companies are investing in product development, partnerships, and designs and technology to offer innovative solutions to their customers. In conclusion, the market is a dynamic and evolving industry, driven by factors such as increased demand for air travel, stringent regulations, and the adoption of advanced technologies. The market offers significant growth opportunities for companies offering innovative solutions and is expected to continue growing In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1957.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, France, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Braking Systems Market Research and Growth Report?

- CAGR of the Aircraft Braking Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft braking systems market growth of industry companies

We can help! Our analysts can customize this aircraft braking systems market research report to meet your requirements.