Aircraft Engine Nacelle Market Size 2024-2028

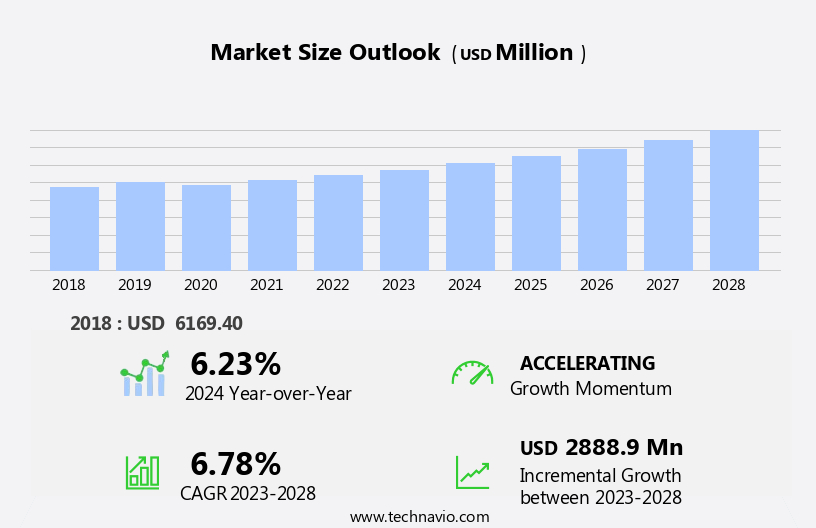

The aircraft engine nacelle market size is forecast to increase by USD 2.89 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth, driven by the ongoing advancements in engine and nacelle technology. These technological innovations include the adoption of additive manufacturing techniques for producing engine components, leading to lighter and more fuel-efficient designs. However, this market is not without its challenges. Maintenance and cost constraints continue to be major factors influencing the market's dynamics. Aircraft operators are seeking cost-effective solutions to minimize maintenance requirements and extend the life cycle of their engine nacelles. This trend is expected to create opportunities for market participants that can offer reliable, low-cost solutions while maintaining high performance standards.

- Companies that can successfully navigate these challenges and capitalize on the market's growth opportunities will be well-positioned to succeed in this competitive landscape.

What will be the Size of the Aircraft Engine Nacelle Market during the forecast period?

- The market in the United States is experiencing significant growth, driven by the increasing demand for fuel efficiency and weight reduction in commercial aviation. Nacelles, which house and protect aircraft engines, are critical components of modern aircraft, with applications ranging from pylons under the wing to clipped-wing designs. These structures are typically made of lightweight materials such as aluminum alloys, titanium alloys, stainless steel, nickel-chromium, and composites. Key market trends include the development of rear-mounted nacelles to improve aerodynamics and reduce drag, as well as the integration of advanced materials and technologies to improve engine performance and reduce weight.

- Additionally, the market is being driven by the need for improved exhaust nozzle designs to increase engine efficiency and reduce emissions. Despite the challenges posed by fan blade failure and other maintenance issues, the market is expected to continue growing due to the increasing demand for new engines and the ongoing modernization of existing fleets.

How is this Aircraft Engine Nacelle Industry segmented?

The aircraft engine nacelle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial aircraft

- Business aircraft

- Military aircraft

- End-user

- Original equipment manufacturer

- Aftermarket

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

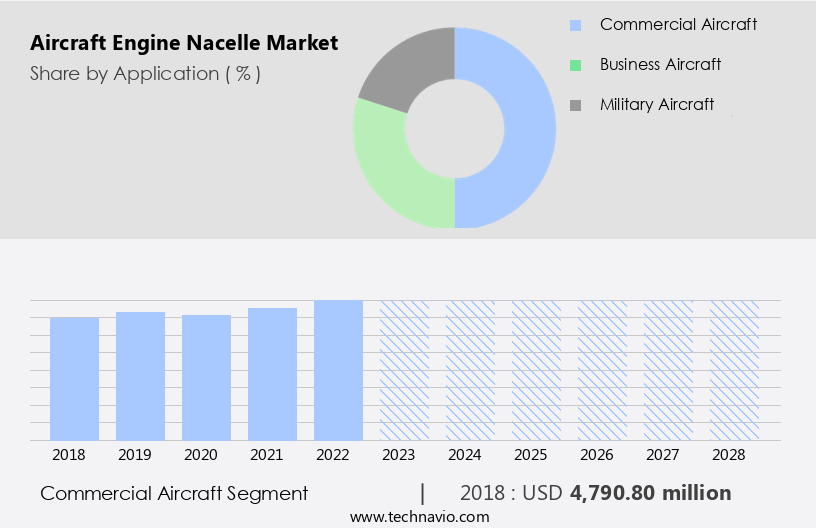

The commercial aircraft segment is estimated to witness significant growth during the forecast period.

Aircraft engine nacelles are vital components that encase and protect jet engines, enhancing their performance and efficiency. In the global market, commercial aircraft segment is a significant sub-segment, further categorized into narrow-body and wide-body aircraft. Nacelles for narrow-body aircraft, such as Boeing 737 and Airbus A320, accommodate engines with a thrust range of up to 35,000 lbs. On the other hand, wide-body aircraft, designed for long-haul flights with two aisles, require larger nacelles. Advancements in technology, like 3D printing using titanium alloys and composites, are revolutionizing the production process, leading to lighter, stronger, and more fuel-efficient engines. The military sector also demands high-performance, corrosion-resistant nacelles for Military jets and business jets, often made from nickel alloys and heat-processed forgings.

New aircraft, including the flagship supersonic airliner, are focusing on structural enhancements, such as noise-reducing nacelles, exhaust nozzles, and thrust reversers, to improve fuel efficiency and reduce weight. In the business jet segment, companies are collaborating with component providers to develop fuel-efficient engines and lighter nacelles. Aircraft OEMs are also investing in research and development to create new engines and nacelles that cater to the highest demand for fuel-efficient, quiet, and reliable engines. The commercial aircraft industry's growth is influenced by factors like air passenger traffic, fleet expansion, and the increasing demand for new engines. In , the market is a dynamic and evolving industry, driven by technological advancements, military requirements, and the commercial aviation sector's continuous pursuit of fuel efficiency, weight reduction, and noise reduction.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial aircraft segment was valued at USD 4.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

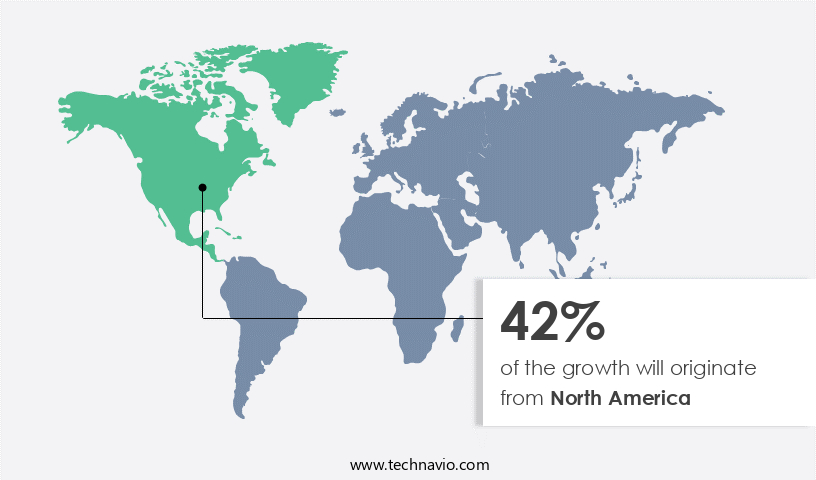

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Aircraft engine nacelles, a vital component of both military jets and business jets, are experiencing significant advancements due to technological innovations such as 3D printing technology. These structures, which house and protect the engines, are now being manufactured using materials like titanium alloys, aluminum alloys, composites, nickel alloys, and stainless steel for their strength and corrosion-resistant characteristics. Fuel efficiency is a major focus in the aviation industry, leading to the development of fuel-efficient engines. New aircraft, including business jets and commercial airliners, are being designed with lightweight materials and structural enhancements to reduce the weight of the aircraft and improve fuel efficiency.

Noise-reducing nacelles and thrust reversers are also being incorporated to minimize noise pollution and improve overall aircraft performance. The military sector is a significant contributor to the demand for aircraft engine nacelles, with military aircraft requiring and durable structures to withstand extreme conditions. Military jet engines are often larger and more powerful than those used in commercial aircraft, necessitating larger and more complex nacelles. Component providers and engine providers are collaborating to develop advanced nacelle designs that meet the evolving needs of the aviation industry. The demand for new engines and aircraft deliveries is driving the growth of the aircraft engine nacelles market.

The use of plain carbon steels, nickel-chromium alloys, and other materials in the production of exhaust nozzles and pylons under wing is also gaining popularity due to their high hardness and ability to withstand high temperatures. Reinforcements made of nickel alloys and other materials are being added to improve the overall strength and durability of the nacelles. In the business jet segment, smaller parts like fan blades and exhaust nozzles are being replaced with lightweight and more efficient alternatives to reduce fuel consumption and improve overall performance. The increasing air passenger traffic and the delivery of new engines are expected to further fuel the growth of the aircraft engine nacelles market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aircraft Engine Nacelle Industry?

- Technical advancements in existing engine and nacelle technology is the key driver of the market.

- The market is experiencing significant growth due to advancements in engine and nacelle technology. As aircraft engine efficiency, fuel consumption, and emissions continue to be key priorities, new materials, designs, and manufacturing processes are being developed to address these concerns. These technological innovations can also lead to reductions in engine noise and vibrations, enhancing passenger experience and minimizing the environmental impact of air travel.

- Nacelles, which encase the aircraft engines, are essential for optimal engine performance and efficiency. Technological advancements in nacelle design and materials can improve aerodynamics, reduce drag, and boost engine performance. The evolution of aircraft engine technology is a critical driver for the growth of the market.

What are the market trends shaping the Aircraft Engine Nacelle Industry?

- Additive manufacturing for engine components is the upcoming market trend.

- Additive manufacturing, or 3D printing, is revolutionizing The market with its ability to create complex geometries and unique shapes for engine components. This technology enables the production of parts that were previously difficult to manufacture using traditional methods. The adoption of additive manufacturing in engine component production presents several advantages, including enhanced performance, reduced weight, and increased durability. These benefits contribute to better fuel efficiency and lower emissions, making aircraft engines more eco-friendly. Moreover, the use of additive manufacturing in the production process offers cost savings.

- By leveraging this technology, aircraft engine manufacturers can produce high-quality, customized components with greater precision and flexibility. The market is expected to grow significantly due to the increasing demand for fuel efficiency and environmental sustainability in the aviation industry.

What challenges does the Aircraft Engine Nacelle Industry face during its growth?

- Maintenance and cost constraints associated with aircraft engine nacelles is a key challenge affecting the industry growth.

- Aircraft engine nacelles, a crucial component of an aircraft's engine system, undergo stringent safety regulations before being approved for use. The FAA and EASA, two leading aviation regulatory authorities, set the standards for airworthiness certificates, ensuring that engine components meet rigorous safety requirements. These certificates necessitate the absence of technical defects and regular maintenance. The cost of maintaining aircraft engines, including nacelles, is substantial for commercial airline operators.

- Regulations mandate that these components be in optimal condition to ensure safe and efficient aircraft operations.

Exclusive Customer Landscape

The aircraft engine nacelle market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft engine nacelle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft engine nacelle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adecco Group AG - Embraer's subsidiary provides aircraft engine nacelles tailored for the ERJ 135, 140, and 145 models. These nacelles enhance engine performance and fuel efficiency, contributing significantly to the overall aircraft productivity. Engineered with advanced materials and technology, they ensure optimal aerodynamic design and durability. By integrating these nacelles, operators can expect improved engine reliability and reduced maintenance costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adecco Group AG

- Aernnova Aerospace SA

- Arkwin Industries Inc.

- Aviagroup Industries

- Barnes Group Inc.

- Bombardier Inc.

- Cadence Aerospace LLC

- DRB HICOM Berhad

- FACC AG

- Kawak Aviation Technologies Inc.

- Leonardo Spa

- Magellan Aerospace Corp.

- Melrose Industries Plc

- MSM aerospace fabricators Ltd

- RTX Corp.

- Safran SA

- Singapore Technologies Engineering Ltd.

- Spirit AeroSystems Inc.

- The Nordam Group LLC

- Triumph Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aircraft engine nacelles play a crucial role in the aviation industry, serving as vital components that encase and protect engines while also contributing to overall aircraft performance. These structures are essential for both military and civilian applications, with the market for aircraft engine nacelles experiencing significant growth due to various market dynamics. The use of advanced materials, such as titanium alloys and composites, has been a key driver in the development of more fuel-efficient engines. These materials offer superior strength and corrosion-resistant characteristics, enabling the production of lighter and more durable nacelles. The military sector, in particular, has been at the forefront of adopting these advanced materials due to the high demands placed on military jets.

Fuel efficiency is a major concern for both military and civilian aircraft operators. The integration of fuel-efficient engines into new aircraft designs has led to increased demand for lightweight and aerodynamically efficient nacelles. Business jets, in particular, have been focusing on reducing their carbon footprint, leading to a higher demand for new, more efficient nacelles. The use of 3D printing technology has also emerged as a potential game-changer in the production of aircraft engine nacelles. This technology allows for the manufacture of complex geometries and shapes, enabling the production of lighter and more efficient nacelles. Additionally, the use of composites in the production of nacelles has led to significant weight reductions and improved fuel efficiency.

Thrust reversers are another important component of aircraft engine nacelles. These systems are essential for reducing the stopping distance of aircraft during landing and are particularly important for larger commercial jets. The development of more efficient and lightweight thrust reversers has led to increased demand for these components. The market for aircraft engine nacelles is highly competitive, with a variety of engine and component providers vying for market share. These companies are constantly innovating to meet the demands of their customers, whether it be for military aircraft requiring high-strength materials or business jets seeking fuel efficiency.

The highest demand for aircraft engine nacelles comes from the production of new aircraft. With the development of flagship supersonic airliners and new commercial jets, the demand for advanced and efficient nacelles is expected to remain strong. However, the market for smaller parts, such as exhaust nozzles and pylons, is also significant, with ongoing fleet maintenance and upgrades providing a steady stream of demand. In , the market for aircraft engine nacelles is driven by various factors, including the adoption of advanced materials, the demand for fuel efficiency, and the production of new aircraft. The use of 3D printing technology and composites is expected to continue driving innovation in the industry, while the military and business jet sectors will remain key markets for these vital components.

The market for aircraft engine nacelles is highly competitive, with a variety of engine and component providers vying for market share. The future of the industry looks bright, with ongoing advancements in materials, manufacturing technologies, and aircraft designs set to drive growth in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 2888.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Engine Nacelle Market Research and Growth Report?

- CAGR of the Aircraft Engine Nacelle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft engine nacelle market growth of industry companies

We can help! Our analysts can customize this aircraft engine nacelle market research report to meet your requirements.